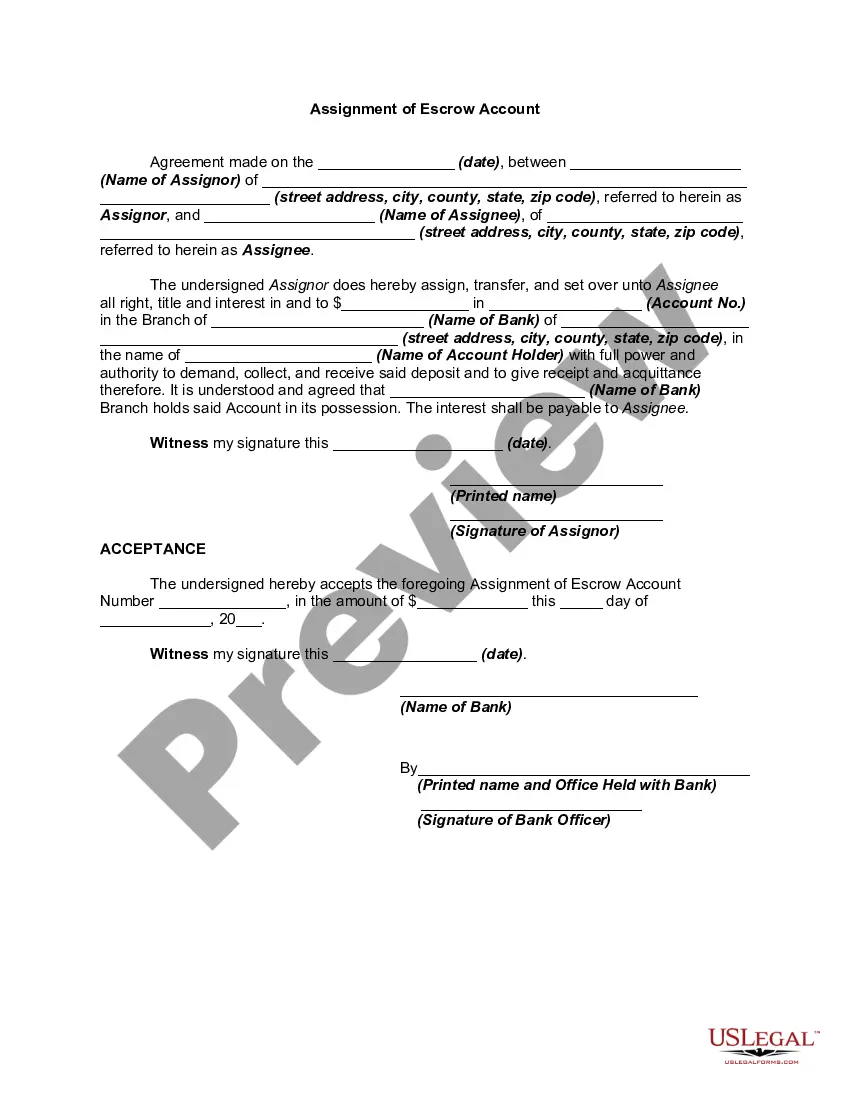

Oregon Assignment of Bank Account

Description

How to fill out Assignment Of Bank Account?

Discovering the right authorized document web template can be quite a have difficulties. Needless to say, there are tons of layouts available on the Internet, but how do you obtain the authorized develop you need? Utilize the US Legal Forms site. The services gives thousands of layouts, such as the Oregon Assignment of Bank Account, that you can use for business and personal requires. Each of the varieties are inspected by pros and satisfy federal and state needs.

Should you be currently listed, log in for your bank account and then click the Download button to get the Oregon Assignment of Bank Account. Make use of bank account to search throughout the authorized varieties you may have purchased in the past. Check out the My Forms tab of your respective bank account and have another version in the document you need.

Should you be a brand new end user of US Legal Forms, here are simple instructions so that you can comply with:

- Initially, make sure you have chosen the right develop for your city/county. You are able to check out the form using the Review button and look at the form description to make sure it will be the right one for you.

- In case the develop does not satisfy your requirements, utilize the Seach field to obtain the correct develop.

- When you are certain the form would work, click the Buy now button to get the develop.

- Choose the costs plan you desire and enter the needed information. Build your bank account and purchase the order making use of your PayPal bank account or bank card.

- Select the data file file format and obtain the authorized document web template for your product.

- Full, modify and print and sign the attained Oregon Assignment of Bank Account.

US Legal Forms is the most significant library of authorized varieties where you will find numerous document layouts. Utilize the company to obtain skillfully-manufactured files that comply with status needs.

Form popularity

FAQ

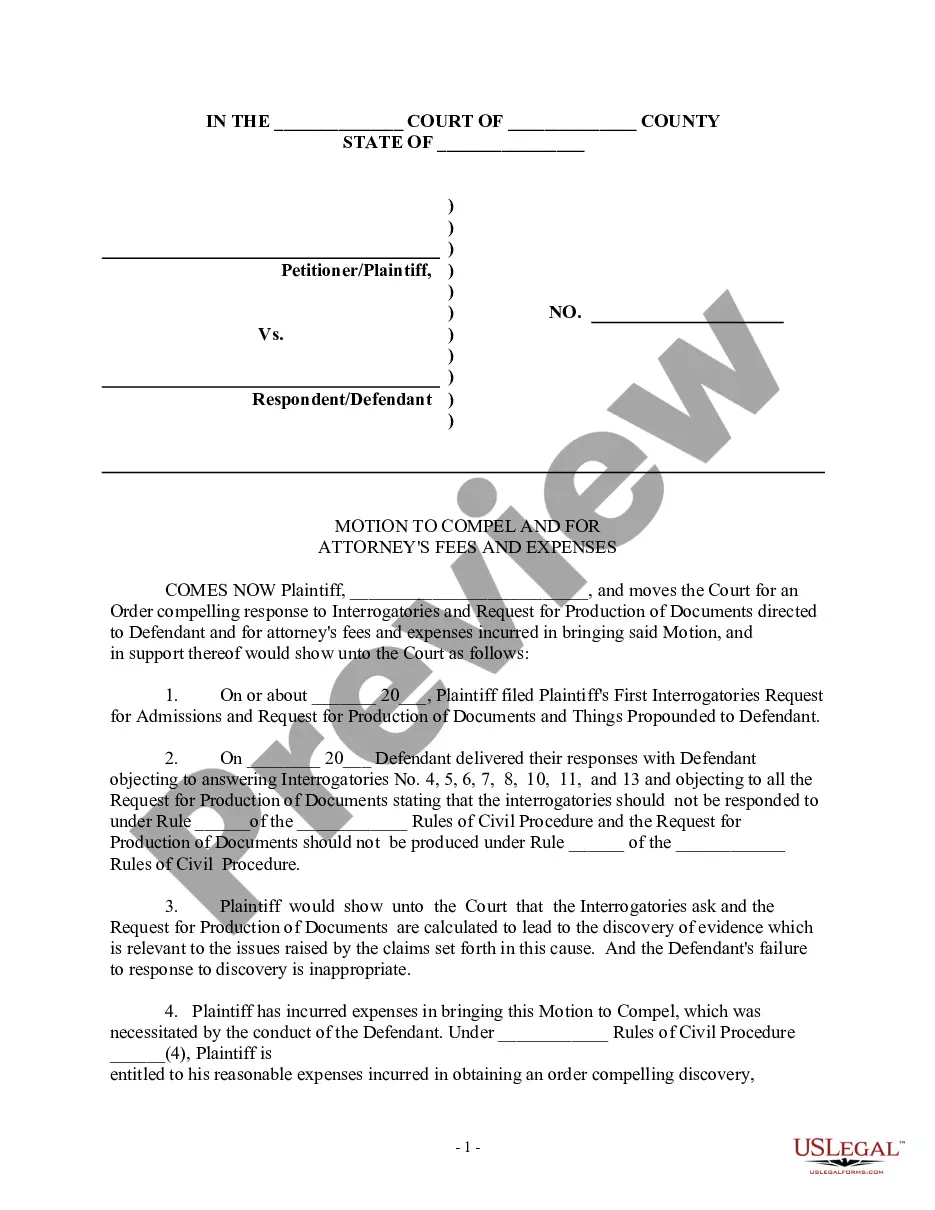

The following are the most commonly used statutes of limitations, but be sure to check Chapter 12 to make sure the limitation period has not changed: 1 year Garnishments (1 year from delivery of writ) 2 years Negligence for injury to person or damage to property.

Statute of limitations on debt for all states StateWrittenOralCalifornia4 years2Colorado6 years6Connecticut6 years3Delaware3 years346 more rows ?

In Oregon, the deadline is six years for a mortgage, medical or credit card debt, auto loans, and other contract debts. Unfortunately, state tax debt doesn't have a statute of limitation. Note that the statute of limitations doesn't start when you were last billed but starts with your last payment on your debt.

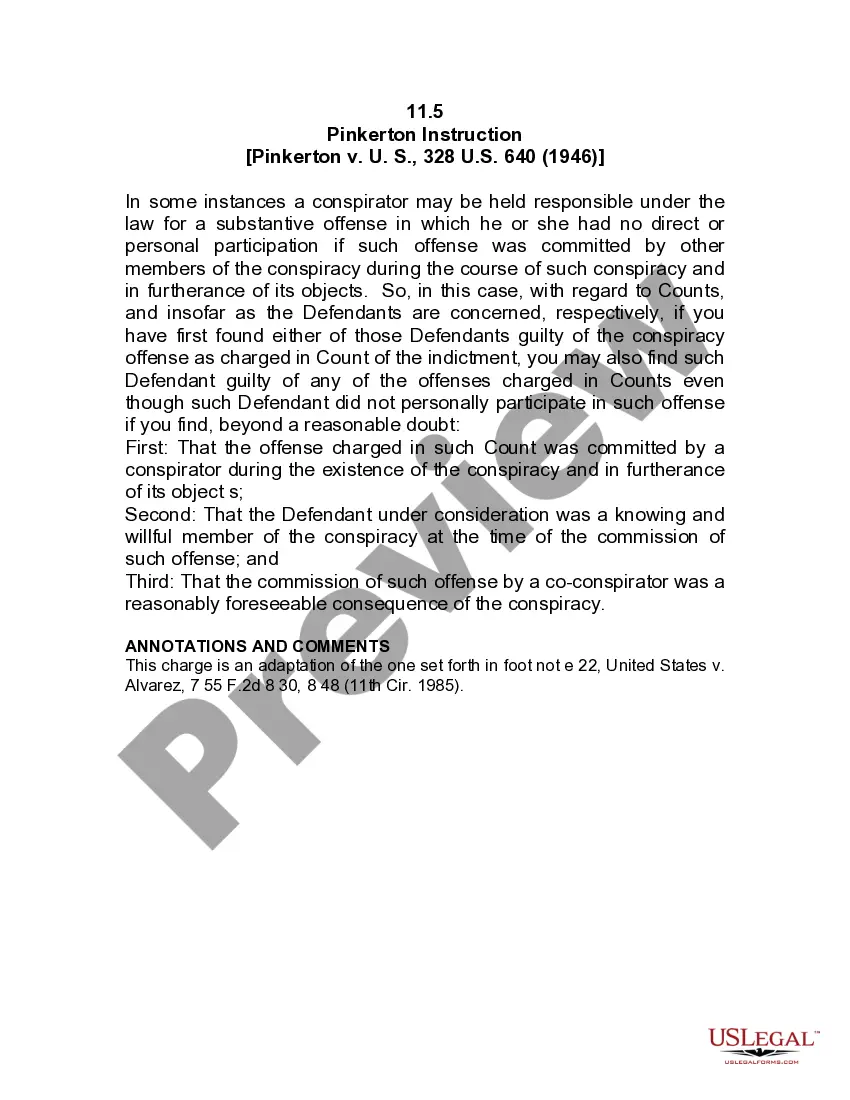

(1) A joint account belongs, during the lifetime of all parties, to the parties in proportion to the net contributions by each to the sums on deposit, unless there is clear and convincing evidence of a different intent.

In Oregon, a sale of assets in an assignment for the benefit of creditors does not require court authority. The assignee must instead liquidate the assets in whatever manner reasonably generates the highest sale price.

Oregon has a law called the Unlawful Debt Collection Practices Act. It controls how a creditor may try to collect a debt, whether by letter or phone call. Unlawful debt collection practices include the use of obscene or abusive language.

Oregon has a six-year statute of limitations for debt In Oregon, the statute of limitations for debt is six years. This means a creditor has up to six years to file a lawsuit to collect on the debt. The six-year statute of limitations applies to medical debt, credit card debt, and auto loan debt.

Oregon's Criminal Statute of Limitations at a Glance There is a six-year statute of limitations for sexual felonies or crimes in which the victim is under 18 at the time of the offense. There is a three-year limit for all other felonies and a two-year limit for most misdemeanors in the state.