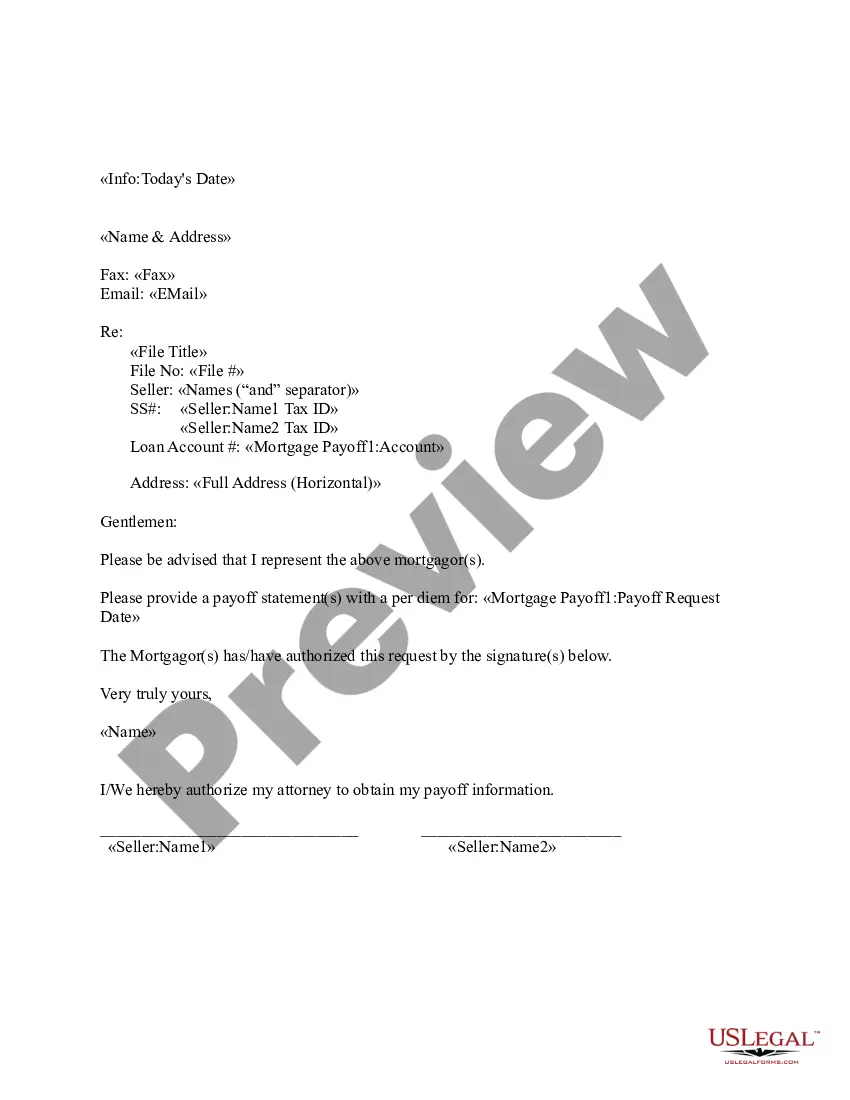

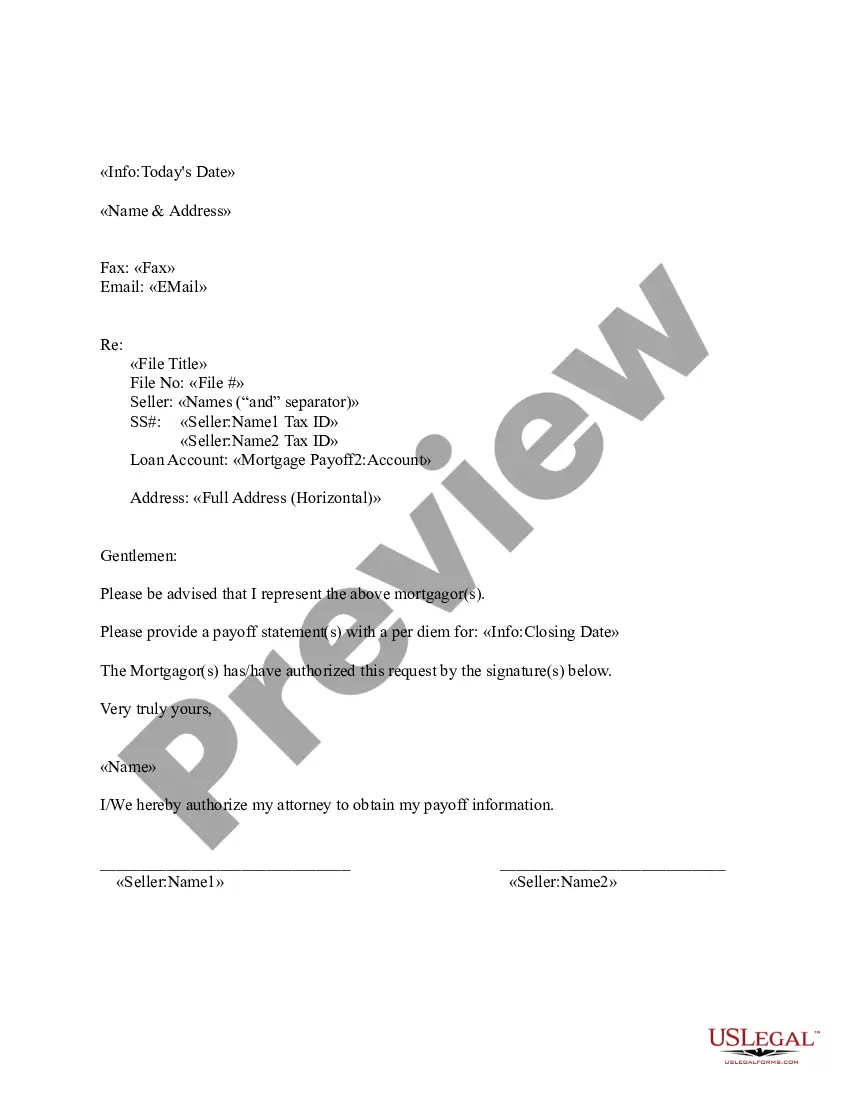

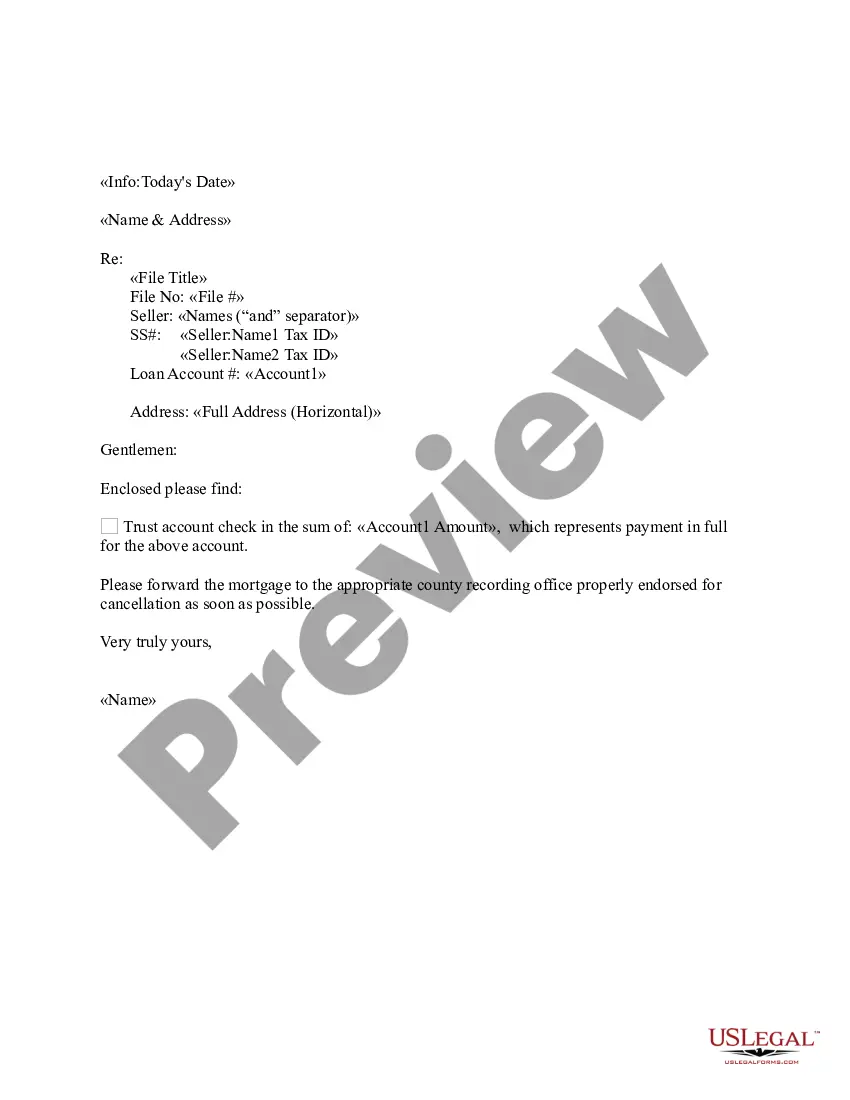

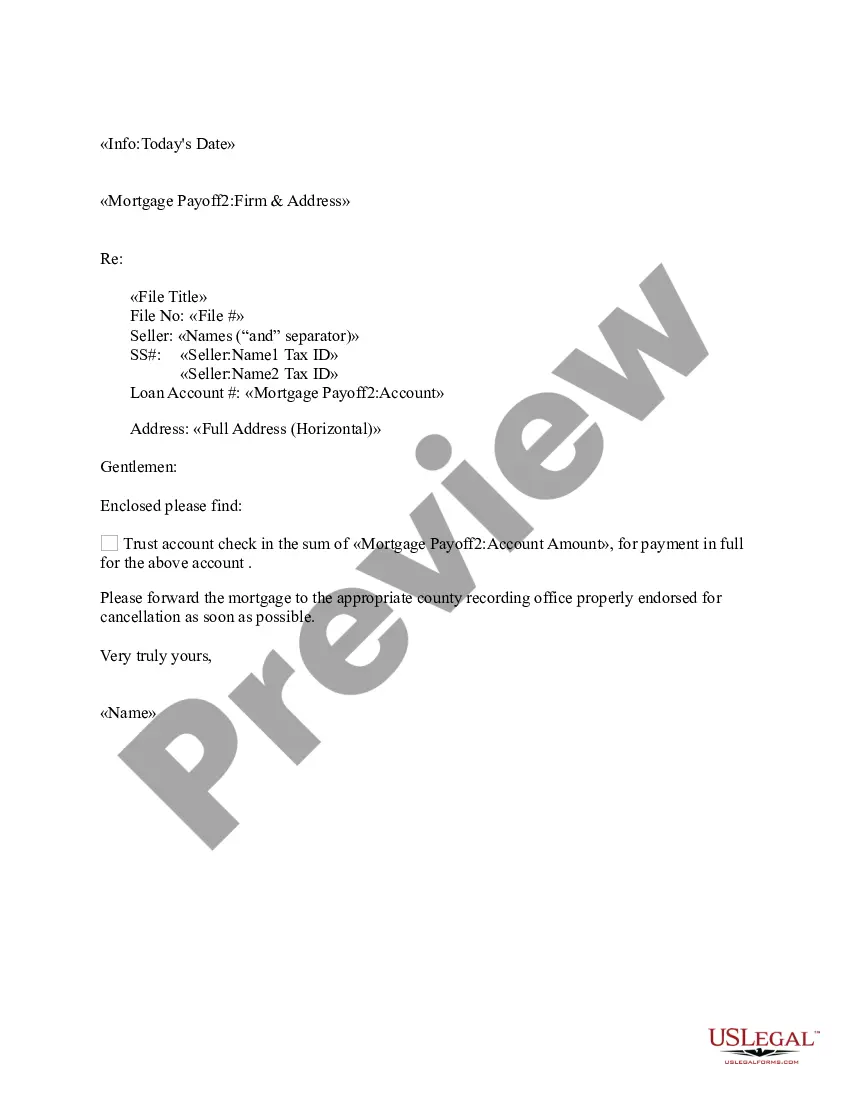

Oregon Sample Letter Requesting Payoff Balance of Mortgage

Description

How to fill out Sample Letter Requesting Payoff Balance Of Mortgage?

Finding the right legitimate papers template can be quite a have difficulties. Obviously, there are plenty of templates available on the Internet, but how can you discover the legitimate form you want? Take advantage of the US Legal Forms website. The support offers a large number of templates, such as the Oregon Sample Letter Requesting Payoff Balance of Mortgage, that you can use for organization and personal requirements. Each of the kinds are inspected by pros and meet up with federal and state specifications.

In case you are presently signed up, log in to the bank account and then click the Download option to have the Oregon Sample Letter Requesting Payoff Balance of Mortgage. Make use of bank account to appear through the legitimate kinds you may have acquired formerly. Visit the My Forms tab of your respective bank account and acquire another version from the papers you want.

In case you are a brand new user of US Legal Forms, listed below are basic instructions for you to stick to:

- Initially, make sure you have chosen the proper form for your personal town/region. You are able to look through the shape utilizing the Review option and browse the shape description to ensure it will be the right one for you.

- In case the form is not going to meet up with your needs, use the Seach field to obtain the proper form.

- When you are sure that the shape would work, click on the Buy now option to have the form.

- Pick the rates strategy you desire and enter the necessary details. Make your bank account and pay for your order utilizing your PayPal bank account or bank card.

- Opt for the document formatting and obtain the legitimate papers template to the device.

- Total, revise and produce and sign the acquired Oregon Sample Letter Requesting Payoff Balance of Mortgage.

US Legal Forms is the most significant local library of legitimate kinds for which you can discover a variety of papers templates. Take advantage of the company to obtain professionally-made documents that stick to status specifications.

Form popularity

FAQ

A payoff quote shows the remaining balance on your mortgage loan, which includes your outstanding principal balance, accrued interest, late charges/fees and any other amounts. You'll need to request your free payoff quote as you think about paying off your mortgage.

Essentially, a loan payoff letter is a representation by the existing lender regarding the outstanding amounts owed on the loan, including principal, interest, fees and other charges required to pay the loan in full and release any collateral.

Lenders can also send you a payoff letter after you have finished paying off a loan. This letter serves as confirmation that your loan has been repaid in full, and your account has been closed. It's most often requested so that customers can prove to other lenders that they have no other outstanding debts.

How to get your 10-day payoff letter. You'll need to request a 10-day payoff letter from your current loan servicer, which you may be able to do online. Not all lenders offer an online request option, however, so you may need to call or email your loan servicer directly to get this information.

Lenders can also send you a payoff letter after you have finished paying off a loan. This letter serves as confirmation that your loan has been repaid in full, and your account has been closed. It's most often requested so that customers can prove to other lenders that they have no other outstanding debts.

Include all relevant information in the payoff letter, including: Include the name of the loan or mortgage holder. Include the loan or mortgage number. Include the payment amount. Include the date you plan to make the payment. Include your name and address. Include your contact information.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions.