Oregon Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years

Description

How to fill out Grantor Retained Income Trust With Division Into Trusts For Issue After Term Of Years?

Are you in a situation where you regularly need to obtain documents for either business or personal purposes.

There are numerous legitimate document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides a wide array of form templates, such as the Oregon Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years, that comply with both state and federal regulations.

Retrieve all the document templates you've purchased in the My documents section.

You can download an additional copy of the Oregon Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years at any time if needed. Just click on the desired form to download or print the document template.

Utilize US Legal Forms, one of the largest collections of legal forms, to save time and avoid errors. The service offers expertly crafted legal document templates for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Oregon Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Select the form you need and ensure it is for the correct city/county.

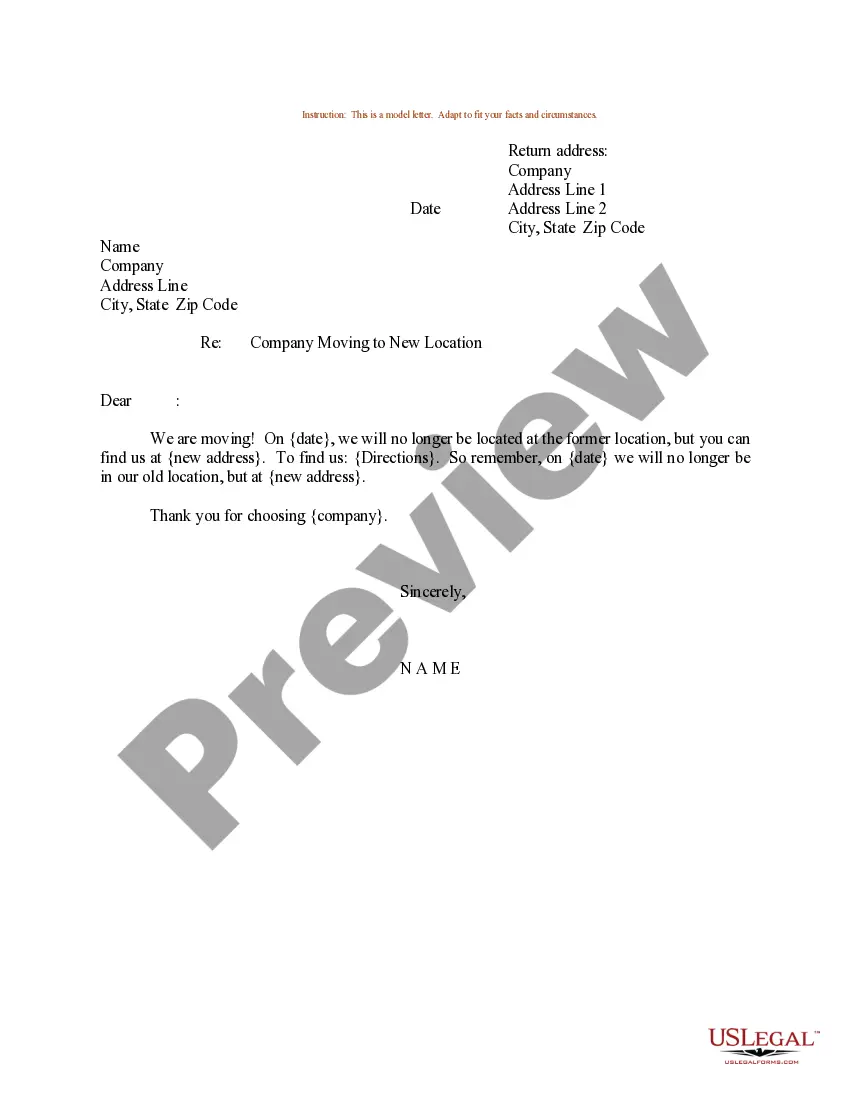

- Use the Preview button to examine the form.

- Review the details to confirm you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs.

- Once you find the right form, click on Buy now.

- Select the pricing plan you want, fill out the necessary information to create your account, and pay for your order using your PayPal or credit card.

- Choose a convenient document format and download your version.

Form popularity

FAQ

Breaking an irrevocable trust can be quite challenging, as these trusts are designed to be permanent. However, under certain circumstances, such as consent from all beneficiaries or significant changes in circumstances, it may be possible to modify the Oregon Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years. Seeking legal counsel is vital for understanding your options.

Key Takeaways. A 5 by 5 Power in Trust is a clause that lets the beneficiary make withdrawals from the trust on a yearly basis. The beneficiary can cash out $5,000 or 5% of the trust's fair market value each year, whichever is a higher amount.

Year Trust, also known as a Legacy Trust or Medicaid Asset Protection Trust, can be established to protect assets from being spent down on long term care in a nursing home. The assets you place in the Legacy Trust will become exempt from the Medicaid spend down requirements after a 5 year look back period.

The trustee must provide the notice of the right to a trustee's report required by subsection (2)(c) of this section at the end of the six-month period if the beneficiary has not received distribution of the specific item of property or specific amount of money before the end of the period.

But assets in an irrevocable trust generally don't get a step up in basis. Instead, the grantor's taxable gains are passed on to heirs when the assets are sold. Revocable trusts, like assets held outside a trust, do get a step up in basis so that any gains are based on the asset's value when the grantor dies.

At the end of the initial term retained by the Grantor, if the Grantor is still living, the remainder beneficiaries (or a trust to be administered for the benefit of the remainder beneficiaries) receive $100,0000 plus all capital growth (which is the amount over and above the net income that was paid to the Grantor).

Under Section 663(b) of the Internal Revenue Code, any distribution by an estate or trust within the first 65 days of the tax year can be treated as having been made on the last day of the preceding tax year.

You cannot receive your inheritance until the estate has been properly administered. This generally takes between nine and 12 months, although it can take longer in complex estates.

In the case of a good Trustee, the Trust should be fully distributed within twelve to eighteen months after the Trust administration begins. But that presumes there are no problems, such as a lawsuit or inheritance fights.

When a trust is irrevocable but some or all of the trust can be disbursed to or for the benefit of the individual, the look-back period applying to disbursements which could be made to or for the individual but are made to another person or persons is 36 months.