Indiana Obtain S Corporation Status - Corporate Resolutions Forms

Description

How to fill out Obtain S Corporation Status - Corporate Resolutions Forms?

Have you ever encountered a scenario where you require documents for either business or personal purposes on a daily basis.

There are numerous legal document templates available online, but locating those that are trustworthy is challenging.

US Legal Forms offers a vast array of template options, including the Indiana Obtain S Corporation Status - Corporate Resolutions Forms, designed to comply with federal and state regulations.

Once you find the correct template, click Get now.

Select the pricing plan you wish to use, complete the necessary information to create your account, and make your purchase using PayPal or a credit card. Choose a convenient file format and download your copy. You can find all the templates you have purchased in the My documents section. You can download an additional copy of the Indiana Obtain S Corporation Status - Corporate Resolutions Forms at any time if needed. Simply select the required template to download or print the document format. Use US Legal Forms, the most extensive collection of legal documents, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Indiana Obtain S Corporation Status - Corporate Resolutions Forms template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the template you require and ensure it is for the correct city/state.

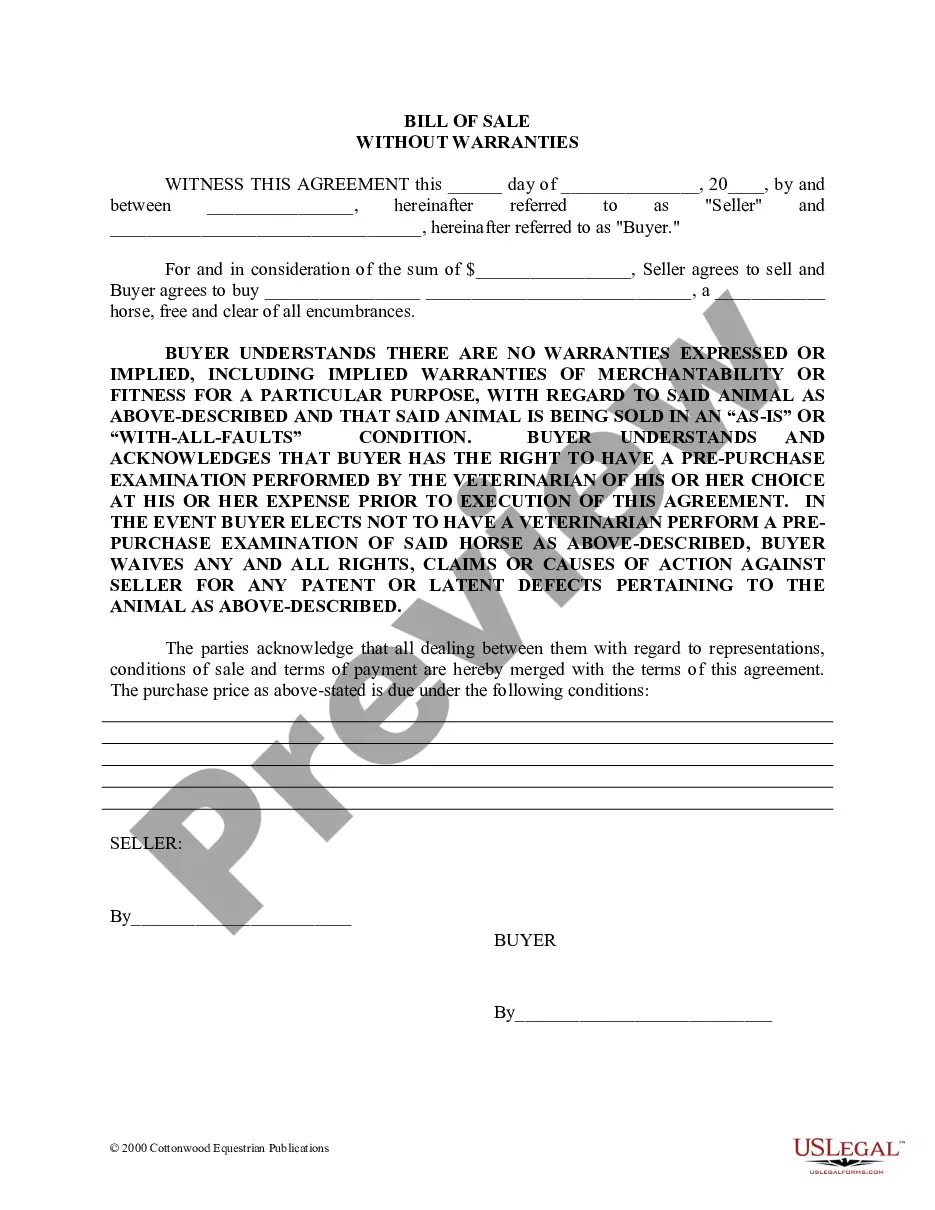

- Use the Preview button to review the form.

- Examine the details to confirm you have chosen the appropriate template.

- If the template does not meet your needs, utilize the Search function to find the one that fits you and your requirements.

Form popularity

FAQ

The W-9 form for a corporation must be signed by an authorized representative, such as an officer of the corporation. This person is responsible for ensuring the accuracy of the information supplied on the form. It's important to use someone with appropriate authority to sign to avoid compliance issues. If you need help with forms and signatures, uslegalforms can simplify the process of managing your corporate resolutions in Indiana.

When completing a W-9 for an S corporation, include your corporation's legal name and the appropriate taxpayer identification number. It is crucial to check the box indicating the entity type as an S Corporation. Make sure the information provided is accurate to avoid any delays or issues with the IRS. If you need detailed instructions or templates, uslegalforms can provide helpful resources for Indiana Obtain S Corporation Status - Corporate Resolutions Forms.

Yes, S Corporations are generally exempt from backup withholding; however, certain conditions must be met. As long as your S Corp has provided the correct information on forms like the W-9, withholding should not apply. Nevertheless, you must remain compliant with IRS requirements to maintain this exemption. For further assistance, uslegalforms can guide you through the process and requirements of S Corporation status in Indiana.

When you have an S Corporation, you file taxes using Form 1120S. This form reports your corporation's income, deductions, and credits. Furthermore, your income passes through to your personal tax returns, so you must report it there. Using resources from uslegalforms can help you understand the tax filing process and provide necessary forms for your Indiana Obtain S Corporation Status - Corporate Resolutions Forms.

Filling out a W-9 form for your small business is straightforward. You need to provide your business name, address, and taxpayer identification number. Additionally, indicate your entity type, such as S Corporation, by selecting the appropriate box. If you are unsure about the specifics, uslegalforms can offer templates and instructions to ensure accuracy in completing your W-9 for your Indiana Obtain S Corporation Status - Corporate Resolutions Forms.

To form an S Corp in Indiana, begin by registering your business with the Indiana Secretary of State. Next, file Articles of Incorporation, and once your corporation is established, submit Form 2553 to the IRS to elect S Corporation status. Ensure you stay within the application deadlines to benefit from the S Corp tax advantages. Uslegalforms provides templates to make forming your S Corporation easier and more efficient.

To achieve S Corp status, first, ensure your business meets the eligibility requirements. After that, you will need to file Form 2553 with the IRS, indicating your election for S Corporation treatment. It is essential to complete this step within a specified timeframe following incorporation. Uslegalforms offers resources that can help streamline the process of obtaining S Corporation status and completing corporate resolutions forms in Indiana.

To obtain S Corporation status, you will need to file Form 2553 with the IRS. This form allows your corporation to elect S Corporation status. Additionally, you may need to file Articles of Incorporation in Indiana when establishing your corporation. Remember, using uslegalforms can simplify this process by providing the necessary templates and guidance for Indiana Obtain S Corporation Status - Corporate Resolutions Forms.

To fill out a corporate resolution form, start by clearly stating the purpose of the resolution, which is often to obtain S Corporation status. Include the name of your corporation, the date, and details about the meeting during which the resolution is adopted. You can find templates tailored for Indiana Obtain S Corporation Status - Corporate Resolutions Forms through platforms like uslegalforms, which simplify the process by providing guidance and ensuring compliance with relevant laws.

An S-Corp is required to file Form 1120S annually and provide Schedule K-1 to shareholders. Additionally, state-specific forms may apply depending on Indiana regulations. Implementing solid Corporate Resolutions Forms is crucial to ensure every aspect of your S-Corp's decisions is documented correctly.