Oregon Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner

Description

How to fill out Agreement To Devise Or Bequeath Property Of A Business Transferred To Business Partner?

Locating the appropriate authorized document template can be challenging.

Of course, there are plenty of templates available online, but how do you find the legal document you require? Use the US Legal Forms website.

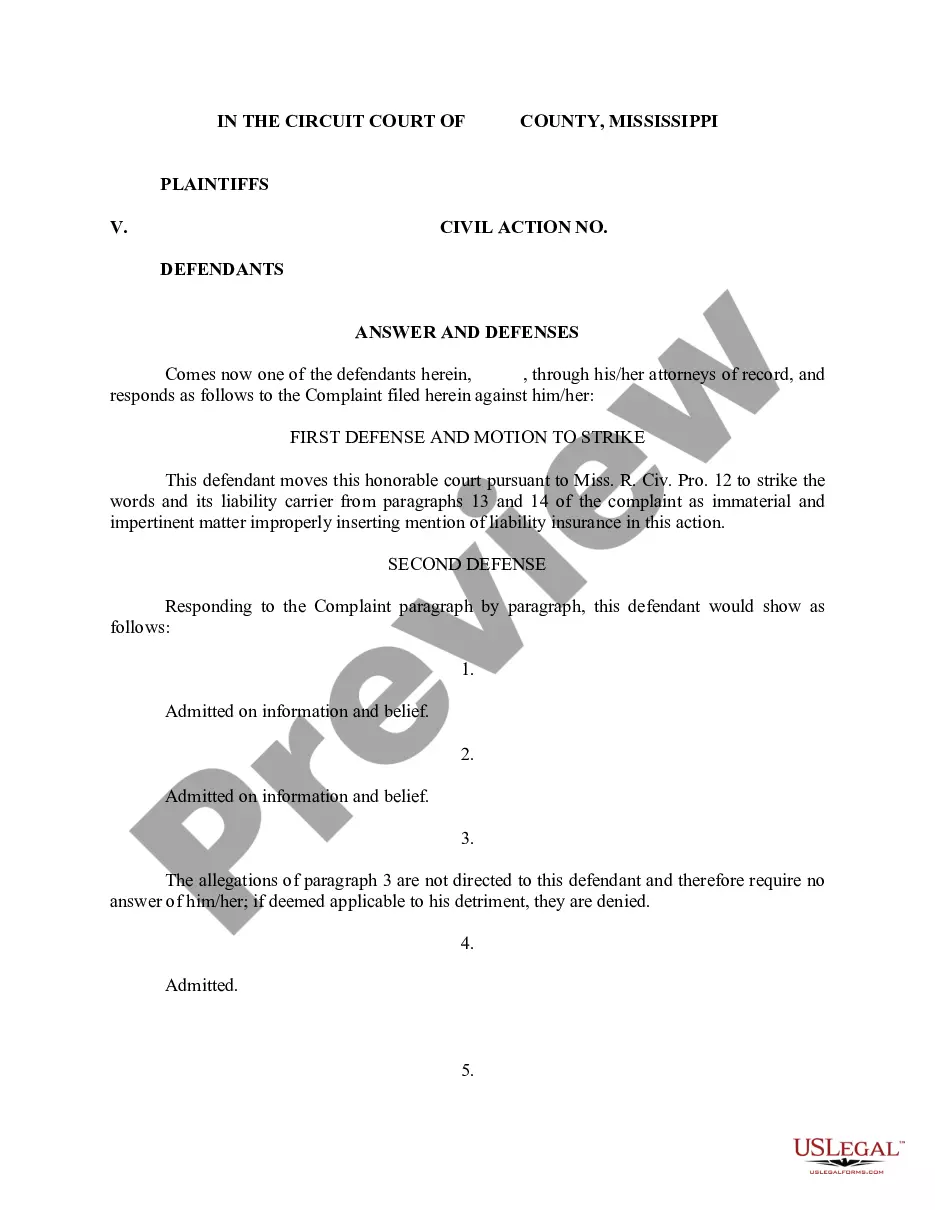

The service offers a vast number of templates, including the Oregon Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner, which you can utilize for both business and personal purposes.

You can examine the document using the Review button and read the description to confirm it is the right one for you. If the document does not meet your requirements, utilize the Search feature to find the appropriate form.

- All of the documents are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to acquire the Oregon Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner.

- Use your account to review the legal documents you have obtained previously.

- Navigate to the My documents section of your account and download an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward instructions to follow.

- First, ensure you have selected the correct form for your locality/region.

Form popularity

FAQ

Real estate investors, for example, might use a limited partnership. Another common use of a limited partnership is in a family business, called a family limited partnership. Members of a family may pool their money, designate a general partner, and watch their investments grow.

A partnership has no separate legal personality and it cannot therefore own property and it will be owned by the individual property owning partners. The Land Registry will allow up to four property owning partners to be named at the Land Registry as legal owners.

In a limited partnership, limited partners can invest in the business and share the profits and losses, but cannot actively manage the daily operations of the LP. However, in an LLC, the members can in fact oversee the daily operations of the business so long as the LLC is member-managed and not manager-managed.

In a general partnership: all partners (called general partners) are personally liable for all business debts, including court judgments. each individual partner can be sued for the full amount of any business debt (though that partner can in turn sue the other partners for their share of the debt), and.

The main difference between a partnership and a corporation is the separation between the owners and the business. Corporations are separate from their owners, but in partnerships, owners share the business's risks and benefits. In a partnership, two or more individuals who wish to do business together form a company.

A general partnership is an unincorporated business with two or more owners who share business responsibilities. Each general partner has unlimited personal liability for the debts and obligations of the business. Each partner reports their share of business profits and losses on their personal tax return.

A limited partnership (LP) exists when two or more partners go into business together, but the limited partners are only liable up to the amount of their investment. An LP is defined as having limited partners and a general partner, which has unlimited liability.

The limited partnership is a specialized form of partnership. The purpose of the limited partnership is to allow individuals to organize into an entity form that allows the flexibility of a general partnership while allowing for special rights, duties, and protections for limited partners.

Because a partnership is not a legal person, it cannot acquire or hold a registered interest in real property. In order to acquire and hold real property, the partnership requires an individual or corporation to become a registered owner.

Thus, the partnership, as a separate person can acquire its own property, bring actions in court in its own name and incur its own liabilities and obligations.