Oregon Contract with Independent Contractor - Contractor has Employees

Description

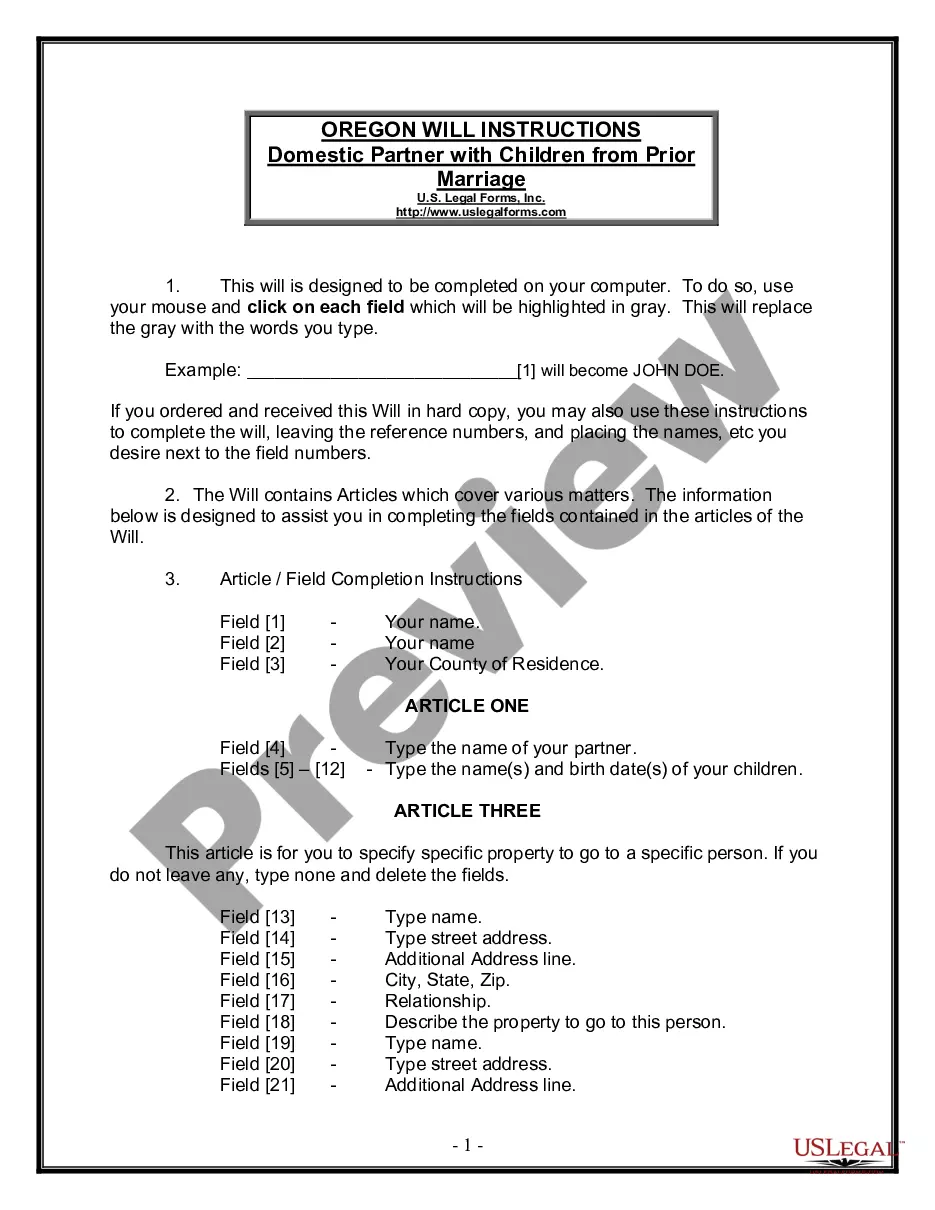

How to fill out Contract With Independent Contractor - Contractor Has Employees?

Are you at the location where you need documents for both business or personal purposes every day? There are numerous legal document templates accessible online, but locating ones you can trust isn’t straightforward. US Legal Forms offers a wide variety of form templates, including the Oregon Contract with Independent Contractor - Contractor has Employees, which can be used to meet federal and state regulations.

If you are already familiar with the US Legal Forms website and have your account, simply Log In. After that, you can download the Oregon Contract with Independent Contractor - Contractor has Employees template.

If you do not possess an account and wish to start utilizing US Legal Forms, follow these steps.

You can find all the document templates you have purchased in the My documents section. You may obtain an additional copy of the Oregon Contract with Independent Contractor - Contractor has Employees at any time, if necessary. Just select the required document to download or print the document template.

Make use of US Legal Forms, one of the most comprehensive collections of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start simplifying your life.

- Obtain the document you need and ensure it is for the correct city/state.

- Use the Preview button to review the document.

- Examine the description to confirm you have selected the right document.

- If the document is not what you're looking for, use the Research field to find the document that meets your needs and requirements.

- Once you find the correct document, click Purchase now.

- Select the pricing plan you want, fill out the required information to create your account, and pay for your order using your PayPal or Visa or Mastercard.

- Choose a convenient document format and download your copy.

Form popularity

FAQ

An employee is on a company's payroll and receives wages and benefits in exchange for following the organization's guidelines and remaining loyal. A contractor is an independent worker who has autonomy and flexibility but does not receive benefits such as health insurance and paid time off.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

A worker who provides services for remuneration generally will be considered an employee by the courts and state regulatory agencies, unless that worker meets the criteria required of an independent contractor (or other exception) with the emphasis falling on the word independent.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

In Oregon, independent contractors are not considered employees of businesses and are not subject to employment laws, rules or protections provided to actual employees.

In Oregon, independent contractors are not considered employees of businesses and are not subject to employment laws, rules or protections provided to actual employees.

In short, someone who sets their wage, hours, and chooses the jobs they take on is a subcontractor, while someone whose employer specifies their wage, hours, and work tasks is an employee.

Under Oregon law, a small business is defined as having 50 or fewer employees. A full-time employee (FTE), under the Employer Responsibility section of the federal Affordable Care Act, works 30 hours or more per week.

What is an independent contractor? Under Oregon law, an independent contractor must be: free from direction and control over the means and manner of providing the services, subject only to the right to specify the desired results; is customarily engaged in an independently established business; and.

An employee is hired for a specific job or to provide labor in the service of someone else (the employer). When an individual begins a long-term working relationship with a business, that person usually becomes an employee, though there are exceptions.