Oregon Sample Letter for Explanation of Bankruptcy

Description

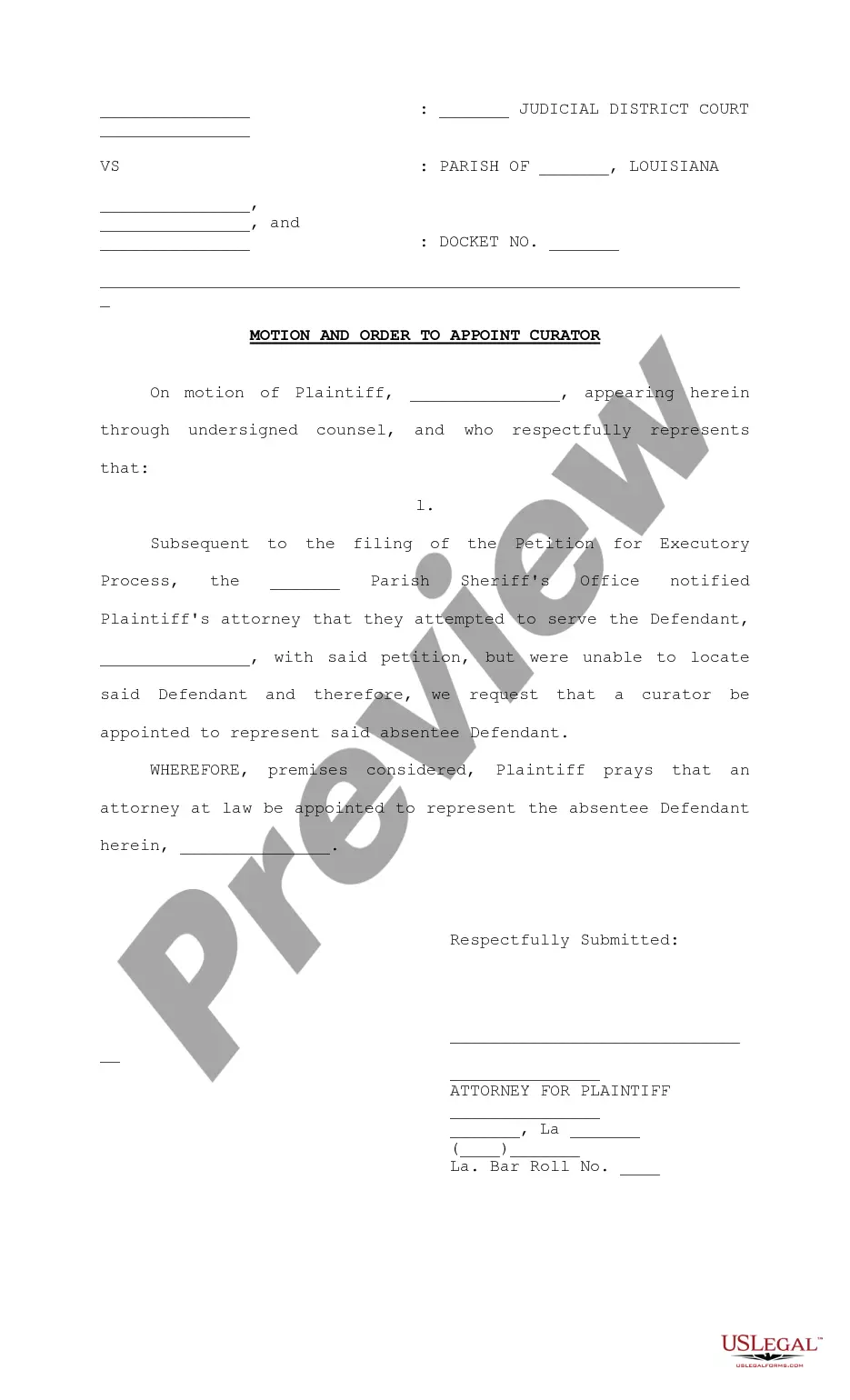

How to fill out Sample Letter For Explanation Of Bankruptcy?

You can dedicate hours on the web searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that have been reviewed by experts.

You can download or print the Oregon Sample Letter for Explanation of Bankruptcy from our service.

First, ensure that you have chosen the correct document template for the state/city of your choice. Review the document summary to confirm that you have selected the right document. If available, utilize the Preview button to examine the document template as well. If you wish to find another version of your document, use the Search field to locate the template that fits your needs and requirements.

- If you already have a US Legal Forms account, you may Log In and click the Download button.

- Next, you can complete, edit, print, or sign the Oregon Sample Letter for Explanation of Bankruptcy.

- Every legal document template you obtain is yours indefinitely.

- To obtain another copy of the purchased form, visit the My documents tab and click the appropriate button.

- If you are navigating the US Legal Forms site for the first time, follow the simple instructions below.

Form popularity

FAQ

To begin writing this type of letter, you might explain the situation or circumstance and any contributing factors....2. Explain the situationWhat happened?How did it happen?Were there contributing factors?What is the current situation?

In other words, a letter of explanation is exactly what it sounds like. The lender and their underwriter are asking the borrower to explain something. That could be a change in jobs, a gap in employment, a large deposit into their bank account, a source of self-employed income, or just about anything else.

How to write a letter of explanationThe lender's name and address.Your name and your application number.The date you're submitting the letter and expected closing date (if you know it)A short statement that helps an underwriter fully understand your situation in regards to the reason for concern.More items...?

The key to writing a great letter of explanation is to keep it short, simple and informative. Be clear and write with as much detail as you can since someone else will need to understand your situation. Avoid including irrelevant information or answers to questions the underwriter didn't ask.

The key to writing a great letter of explanation is to keep it short, simple and informative. Be clear and write with as much detail as you can since someone else will need to understand your situation. Avoid including irrelevant information or answers to questions the underwriter didn't ask.

Make sure you state you are exercising your rights under the Fair Debt Collection Practices Act. Include a sentence or two describing why you are judgment-proof For example: I am judgment proof because I am living only on Social Security benefits, own limited exempt property, and cannot meet current expenses.

Give your name, address and court number (to be taken from the latest correspondence about your bankruptcy). The court may check with the Official Receiver that you are entitled to an automatic discharge. You should receive a certificate confirming your discharge within about four weeks.

An explanatory letter is a document that gives the owner of the will, the testator, the chance to explain, in as much detail as desired, how and why they wish to distribute their property as they have laid out.

How to write a letter of explanationFacts. Include all the details with correct dates and dollar amounts.Resolution. Explain how and when the situation was resolved.Acknowledge. It's important that the letter outline why the problem won't arise again. Recognize if and how you could have avoided this mistake.

When drafting a Letter of Explanation for Bankruptcy, you need to state the reason you are submitting this explanation, record the type of bankruptcy you filed for, the timeline of the bankruptcy proceedings, and a brief description of the circumstances that led to the bankruptcy.