Oregon Collection Report

Description

How to fill out Collection Report?

You are capable of dedicating hours online attempting to locate the valid document format that meets the federal and state requirements you require.

US Legal Forms offers numerous valid templates that have been evaluated by specialists.

You can either download or print the Oregon Collection Report from my service.

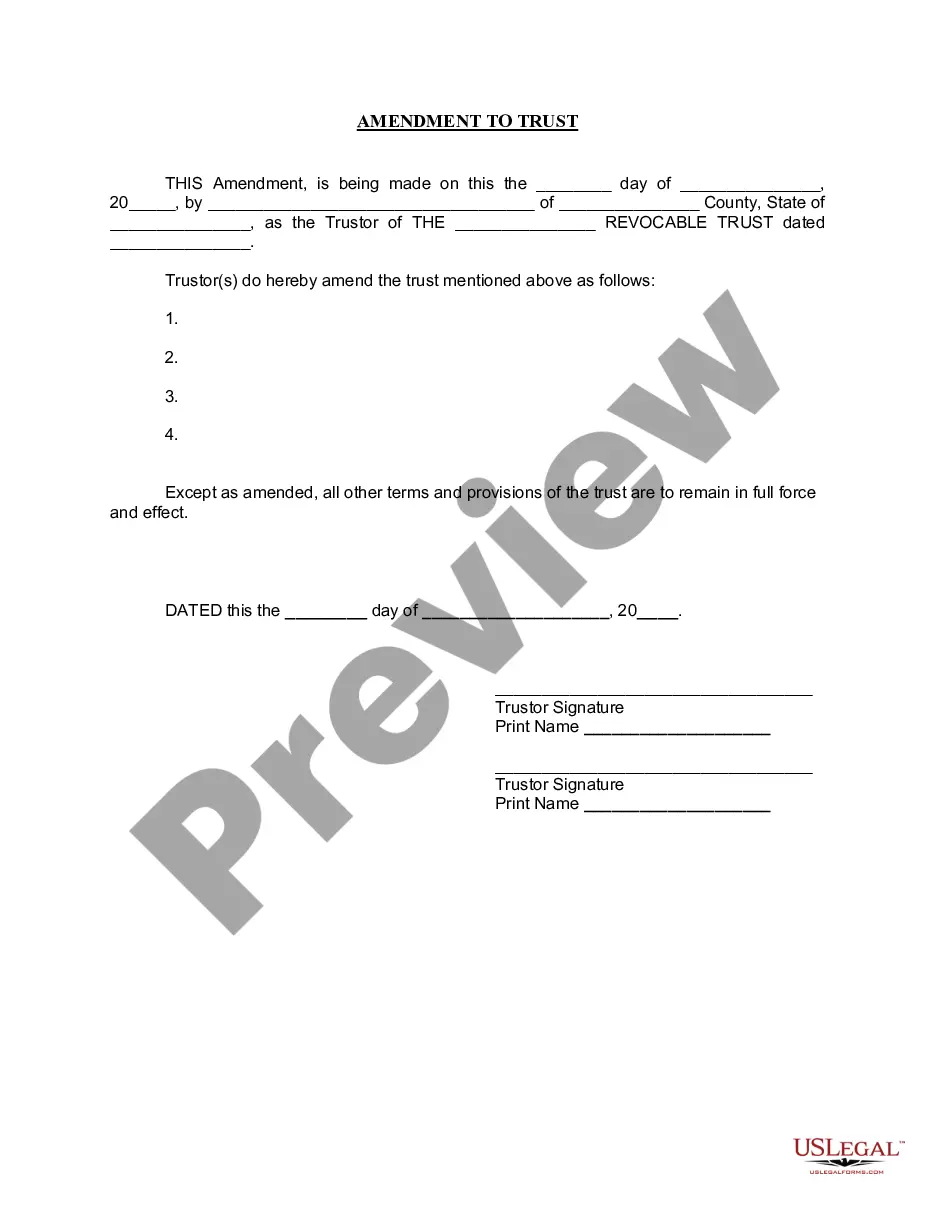

If available, utilize the Preview option to review the document format as well.

- If you possess a US Legal Forms account, you can Log In and select the Acquire option.

- After that, you are able to complete, modify, print, or sign the Oregon Collection Report.

- Every valid document format you purchase is yours permanently.

- To obtain another version of a purchased document, navigate to the My documents tab and select the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions outlined below.

- First, ensure that you have chosen the correct document format for the state/city of your choice.

- Review the document description to confirm that you have selected the appropriate form.

Form popularity

FAQ

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.

In Oregon, the statute of limitations for debt is six years. This means a creditor has up to six years to file a lawsuit to collect on the debt. The six-year statute of limitations applies to medical debt, credit card debt, auto loan debt, etc.

Collection accounts stay on the credit report for seven years from the original delinquency date of the original debt, or the date of the first missed payment after which the account was no longer brought current.

To find out what you have in collections, you will need to check your latest credit reports from each of the 3 credit bureaus. Collection agencies are not required to report their account information to all three of the national credit reporting agencies.

Each state has a statute of limitations about how long a debt collector can pursue old debt. For most states, this ranges between four and six years. These statutes govern the amount of time that a debt collector can sue you, but there is no limit to how long a collector has to try and collect on a debt.

In Oregon, the statute of limitations for debt is six years. This means a creditor has up to six years to file a lawsuit to collect on the debt. The six-year statute of limitations applies to medical debt, credit card debt, auto loan debt, etc.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that. Under state laws, if you are sued about a debt, and the debt is too old, you may have a defense to the lawsuit.

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising.

A collection account will be automatically removed from your credit report seven years after the original account went delinquent. The original delinquency date is when your account first became 30 days past due, kicking off the series of missed payments that ended with your account going to collections.