Oregon Limited Liability Operating Agreement for Manager Managed Real Estate Development with Specification of Different Amounts of Capital Contributions by Members

Description

How to fill out Limited Liability Operating Agreement For Manager Managed Real Estate Development With Specification Of Different Amounts Of Capital Contributions By Members?

US Legal Forms - one of several largest libraries of lawful types in America - gives a wide range of lawful papers templates it is possible to acquire or printing. Making use of the web site, you can get thousands of types for enterprise and person purposes, sorted by categories, claims, or keywords and phrases.You will find the most recent versions of types such as the Oregon Limited Liability Operating Agreement for Manager Managed Real Estate Development with Specification of Different Amounts of Capital Contributions by Members within minutes.

If you already possess a membership, log in and acquire Oregon Limited Liability Operating Agreement for Manager Managed Real Estate Development with Specification of Different Amounts of Capital Contributions by Members in the US Legal Forms catalogue. The Obtain option can look on every kind you see. You have access to all previously downloaded types within the My Forms tab of your accounts.

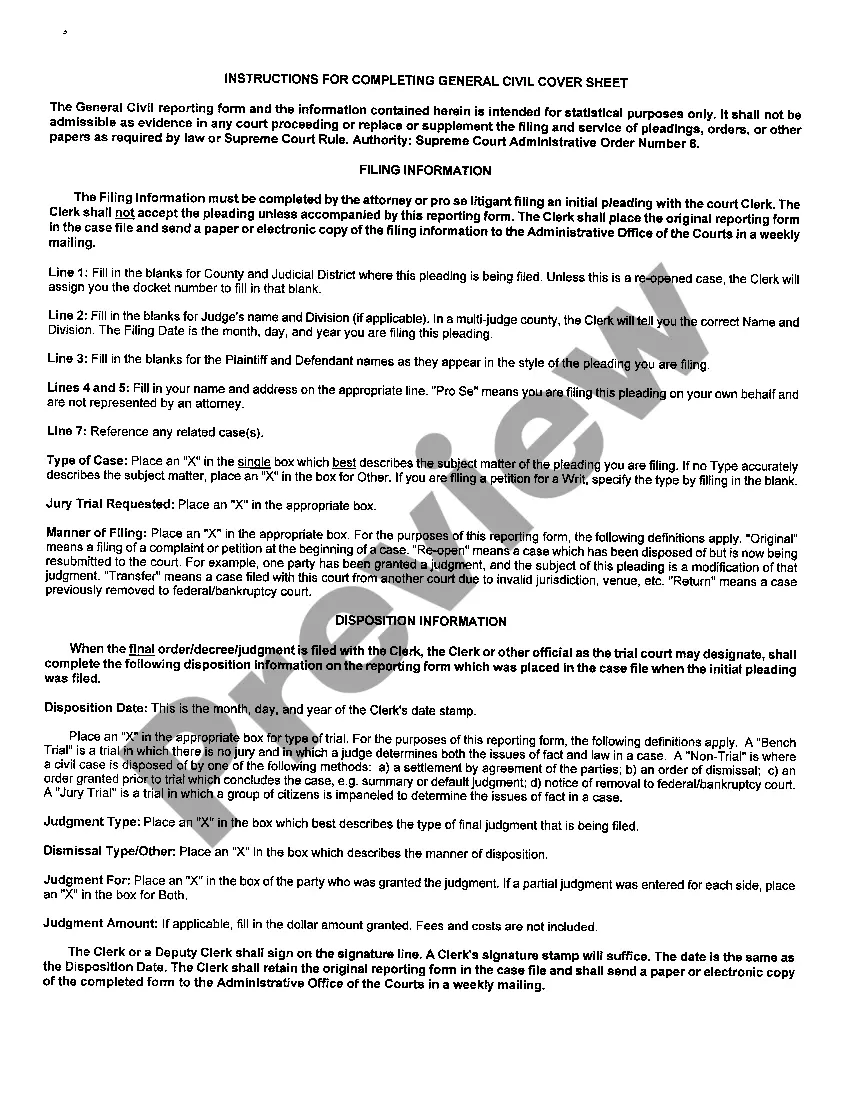

If you wish to use US Legal Forms for the first time, listed below are simple instructions to help you began:

- Ensure you have chosen the best kind to your metropolis/region. Click on the Review option to analyze the form`s content material. Read the kind outline to ensure that you have selected the right kind.

- In the event the kind doesn`t match your specifications, take advantage of the Search industry on top of the display to obtain the one that does.

- When you are pleased with the form, confirm your selection by visiting the Acquire now option. Then, select the prices strategy you favor and provide your credentials to sign up for the accounts.

- Method the purchase. Utilize your credit card or PayPal accounts to perform the purchase.

- Choose the formatting and acquire the form on your own gadget.

- Make adjustments. Load, change and printing and indicator the downloaded Oregon Limited Liability Operating Agreement for Manager Managed Real Estate Development with Specification of Different Amounts of Capital Contributions by Members.

Every single design you put into your money lacks an expiration time and is your own permanently. So, if you want to acquire or printing another backup, just check out the My Forms portion and click around the kind you need.

Obtain access to the Oregon Limited Liability Operating Agreement for Manager Managed Real Estate Development with Specification of Different Amounts of Capital Contributions by Members with US Legal Forms, probably the most extensive catalogue of lawful papers templates. Use thousands of skilled and condition-particular templates that satisfy your business or person requirements and specifications.

Form popularity

FAQ

How much does an LLC in Oregon cost per year? All Oregon LLCs need to pay $100 per year for the Oregon Annual Report fee. These state fees are paid to the Secretary of State. And this is the only state-required annual fee.

Contents Name your Oregon LLC. Choose your registered agent. Prepare and file articles of organization. Receive a certificate from the state. Create an operating agreement. Get an Employer Identification Number.

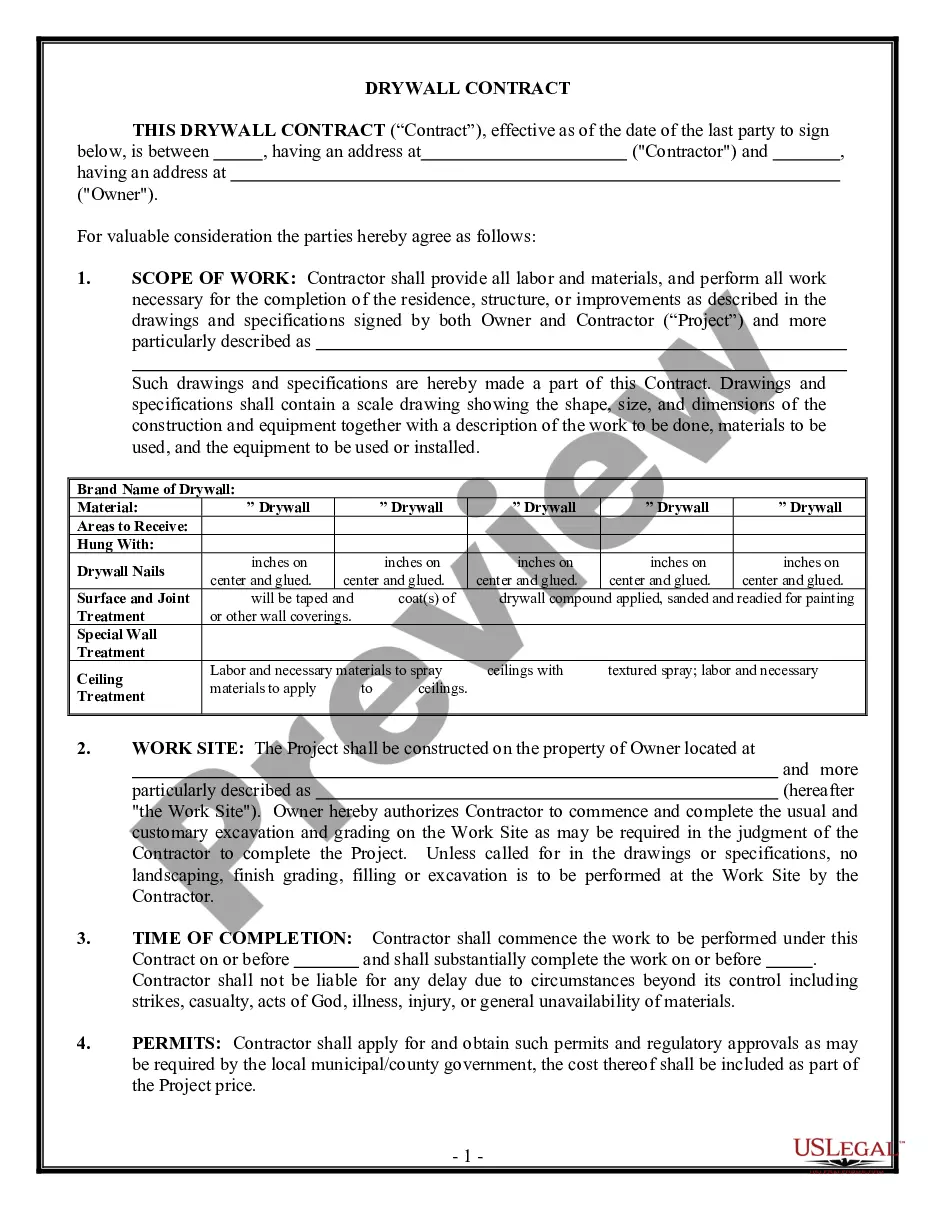

An LLC operating agreement should contain provisions to cover: Basic information about the LLC. ... A profit and loss allocation plan. ... The LLC's purpose. The management structure. ... Ownership percentages of each member. ... Voting rights and procedures. ... Meeting frequency. Procedures for bringing in new members. Sample LLC Operating Agreement - FindLaw findlaw.com ? starting-a-business ? sample-l... findlaw.com ? starting-a-business ? sample-l...

Filing your Articles of Organization is the primary Oregon single-member LLC filing requirement. You should submit your completed formation documents to the Oregon Secretary of State. Include the following information in your Articles: The official name of your company.

The state of Oregon does not require an LLC to have an operating agreement. Nonetheless, it is highly advisable that an LLC create this document because it can protect its members from being held personally liable if it is sued. Oregon LLC Operating Agreement | UpCounsel 2023 upcounsel.com ? oregon-llc-operating-agree... upcounsel.com ? oregon-llc-operating-agree...

Any contributions to capital should be documented. You'll want to be sure to include previous and new valuations and ownership percentages, signatures and more. Our LLC capital contribution agreement documents the following essential information: Name of each member making a contribution. LLC Capital Contribution Agreement ? FREE Template northwestregisteredagent.com ? legal-forms northwestregisteredagent.com ? legal-forms

Common pitfalls of a poorly drafted Operating Agreement include failing to: (i) specify what authority managers or members have; (ii) carve out key decisions that require a higher approval threshold (e.g., dissolution, sale of all or substantially all of the assets of the LLC, etc.); (iii) address how deadlocks in the ...

In a manager-managed limited liability company (LLC), certain important actions require voting by all members. These actions include setting the company's vision and dissolving the LLC. Hiring employees and obtaining a bank loan, on the other hand, do not typically require voting by all members. Which of the following actions requires voting on by all members ... - Brainly brainly.com ? question brainly.com ? question