Oregon Sample Letter for Assets and Liabilities of Decedent's Estate

Description

How to fill out Sample Letter For Assets And Liabilities Of Decedent's Estate?

You may devote several hours online trying to find the legitimate document format that suits the federal and state specifications you want. US Legal Forms provides a large number of legitimate varieties which are evaluated by professionals. It is simple to obtain or print the Oregon Sample Letter for Assets and Liabilities of Decedent's Estate from our service.

If you already have a US Legal Forms profile, you may log in and click the Down load switch. Following that, you may full, modify, print, or signal the Oregon Sample Letter for Assets and Liabilities of Decedent's Estate. Each legitimate document format you buy is the one you have eternally. To obtain an additional backup for any obtained type, proceed to the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms site the first time, adhere to the simple instructions under:

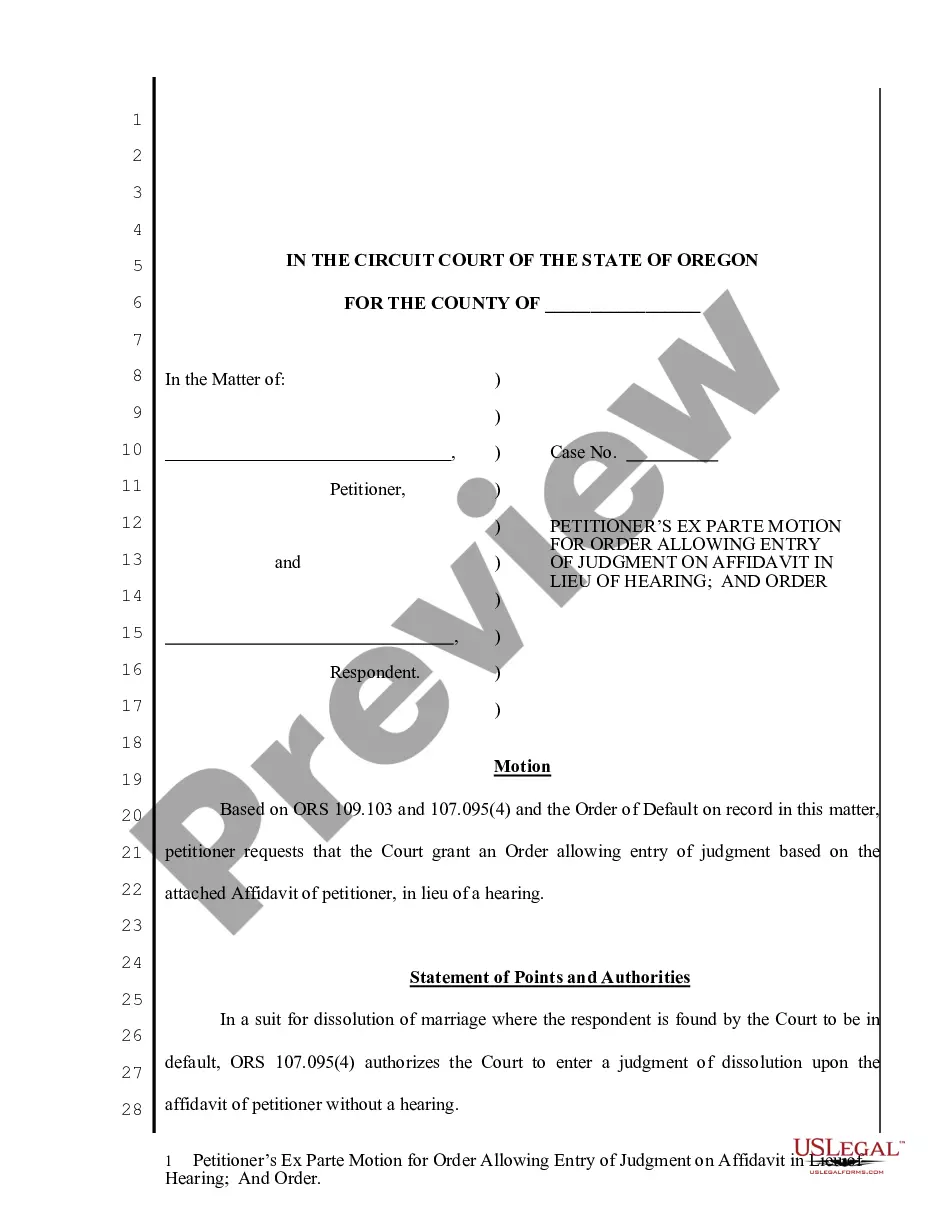

- Very first, be sure that you have selected the correct document format for that region/town of your liking. Browse the type explanation to make sure you have picked the appropriate type. If available, take advantage of the Review switch to check through the document format also.

- In order to find an additional variation from the type, take advantage of the Look for industry to find the format that meets your requirements and specifications.

- Upon having located the format you would like, click Purchase now to carry on.

- Choose the pricing plan you would like, type in your accreditations, and sign up for your account on US Legal Forms.

- Total the purchase. You can utilize your bank card or PayPal profile to purchase the legitimate type.

- Choose the format from the document and obtain it for your gadget.

- Make adjustments for your document if needed. You may full, modify and signal and print Oregon Sample Letter for Assets and Liabilities of Decedent's Estate.

Down load and print a large number of document web templates utilizing the US Legal Forms site, which offers the greatest variety of legitimate varieties. Use specialist and status-certain web templates to tackle your small business or individual requires.

Form popularity

FAQ

Do I Have to List All Bank Accounts on the Inventory? Yes. Any and all bank accounts that the decedent owned must be listed on the inventory. This is true even if the bank accounts were held with payable-on-death (POD) designations or if the bank accounts were jointly held with the right of survivorship.

Here are some things to consider when drafting a letter to your executor or trustee. Your thoughts about wealth. Share your story about how you came to the assets that you are leaving in your will. How was your wealth created, what do you value and what are your long-term goals for your wealth?

This inventory must include all of the decedent's (i) personal estate under your supervision and control, (ii) interest in any multiple party account (which is defined in Part 2) in any financial institution, (iii) real estate over which you have a power of sale, and (iv) other real estate that is an asset of the ...

What's Included in A Small Estate Affidavit? Provide the name of the person who died and the date of the death. State that the value of the assets in the estate is less than $50,000. State that at least 60 days have passed since the death. State that no application to appoint a personal representative has been granted.

A Deed of Estate Inventory (?Deed?) is a summary of all the deceased's assets and liabilities and list of the heirs. In addition, it acts as a tax notification on the basis of which inheritance tax is imposed on the heirs.

Assets should be clearly identified, listed in reasonable detail, and valued as of the decedent's date of death (not the date the inventory is prepared).