Oregon Articles of Incorporation, Not for Profit Organization, with Tax Provisions

Description

The proper form and necessary content of articles or certificates of incorporation for a nonprofit corporation depend largely on the requirements of the state nonprofit corporation act in the state of incorporation. Typically nonprofit corporations have no capital stock and therefore have members, not stockholders. Because federal tax-exempt status will be sought for most nonprofit corporations, the articles or certificate of incorporation must be carefully drafted to include specific language designed to ensure qualification for tax-exempt status.

How to fill out Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

Discovering the right legitimate record template could be a battle. Naturally, there are a variety of layouts available on the net, but how can you get the legitimate type you want? Utilize the US Legal Forms internet site. The service delivers thousands of layouts, like the Oregon Articles of Incorporation, Not for Profit Organization, with Tax Provisions, that you can use for company and private requires. Each of the types are checked out by pros and satisfy federal and state requirements.

If you are currently listed, log in in your account and click the Obtain button to obtain the Oregon Articles of Incorporation, Not for Profit Organization, with Tax Provisions. Make use of your account to search with the legitimate types you possess bought earlier. Check out the My Forms tab of the account and get yet another version of your record you want.

If you are a new user of US Legal Forms, here are easy guidelines that you can adhere to:

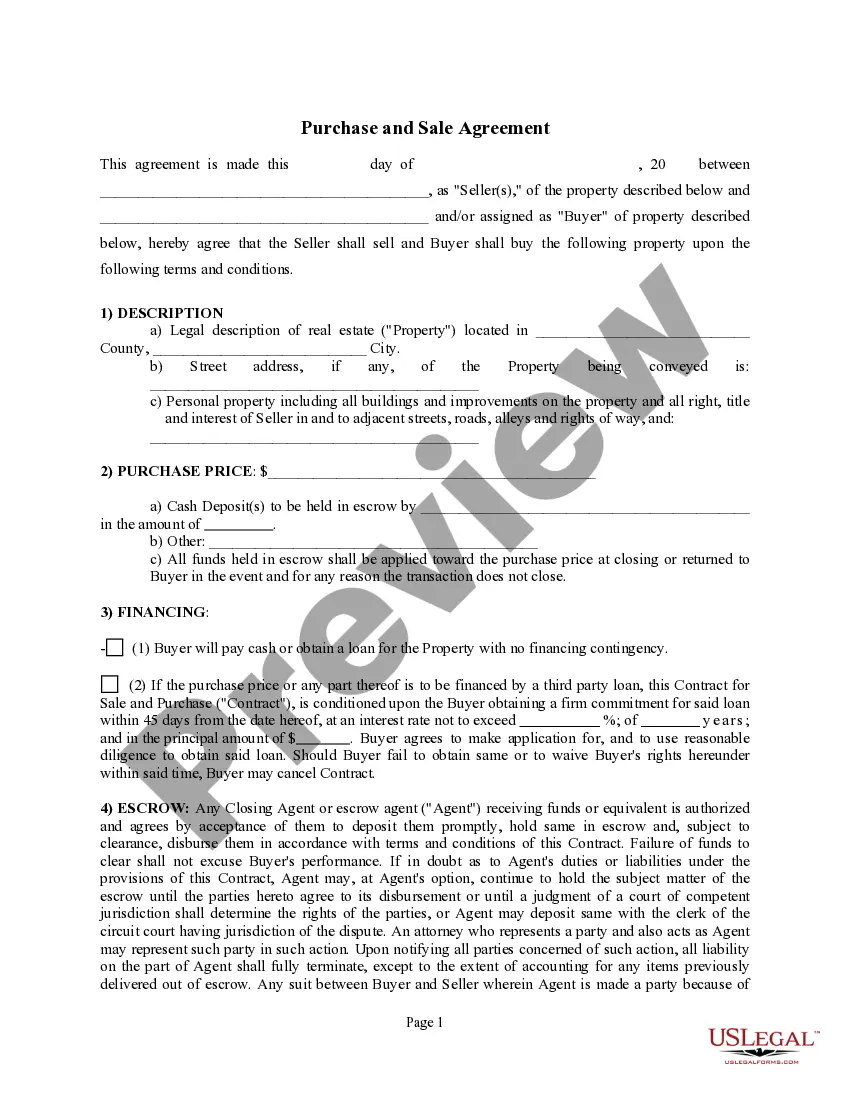

- Initially, be sure you have selected the right type for the area/area. You may look through the shape while using Review button and read the shape information to ensure this is the right one for you.

- In the event the type fails to satisfy your expectations, make use of the Seach industry to discover the proper type.

- When you are sure that the shape is proper, go through the Get now button to obtain the type.

- Select the prices strategy you want and enter the needed details. Design your account and pay for the transaction utilizing your PayPal account or charge card.

- Pick the document formatting and download the legitimate record template in your system.

- Full, modify and print and sign the attained Oregon Articles of Incorporation, Not for Profit Organization, with Tax Provisions.

US Legal Forms will be the biggest catalogue of legitimate types in which you will find numerous record layouts. Utilize the service to download skillfully-manufactured files that adhere to status requirements.

Form popularity

FAQ

HOW CAN A NONPROFIT LOSE ITS 501(c)(3) STATUS? Failing to file a Form 990 with the IRS. ... Engaging in private benefit or private inurement. ... Lobbying. ... Political campaigning. ... Generating too much Unrelated Business Income. ... Failing to operate in ance with its purpose.

Nonprofit organizations must apply to the Internal Revenue Service for tax-exempt status. See your tax advisor to determine whether to apply for tax-exempt status and type to pursue.

The exempt purposes set forth in section 501(c)(3) are charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, and preventing cruelty to children or animals.

Actually, no! These terms are often used interchangeably, but they all mean different things. Nonprofit means the entity, usually a corporation, is organized for a nonprofit purpose. 501(c)(3) means a nonprofit organization that has been recognized by the IRS as being tax-exempt by virtue of its charitable programs.

The IRS maintains an ?Exempt Organizations Select Check Tool? (available at ), which enables a user to search for organizations to determine their eligibility to receive tax-deductible charitable contributions.

The final cost of starting a nonprofit in Oregon can vary, depending on the forms you're eligible to file. It costs $50 to incorporate in the state, then filing for 501(c) status costs either $275 or $600, depending on the form. So, starting a nonprofit in Oregon can cost between $325 and $650.

These nonprofits may be considered public charities, private foundations, or private operating foundations, which we'll explain in more detail later.

Are Nonprofits Taxed? Nonprofit organizations are exempt from federal income taxes under subsection 501(c) of the Internal Revenue Service (IRS) tax code. A nonprofit organization is an entity that engages in activities for both public and private interest without pursuing the goal of commercial or monetary profit.