Oregon General Form of Agreement to Incorporate

Description

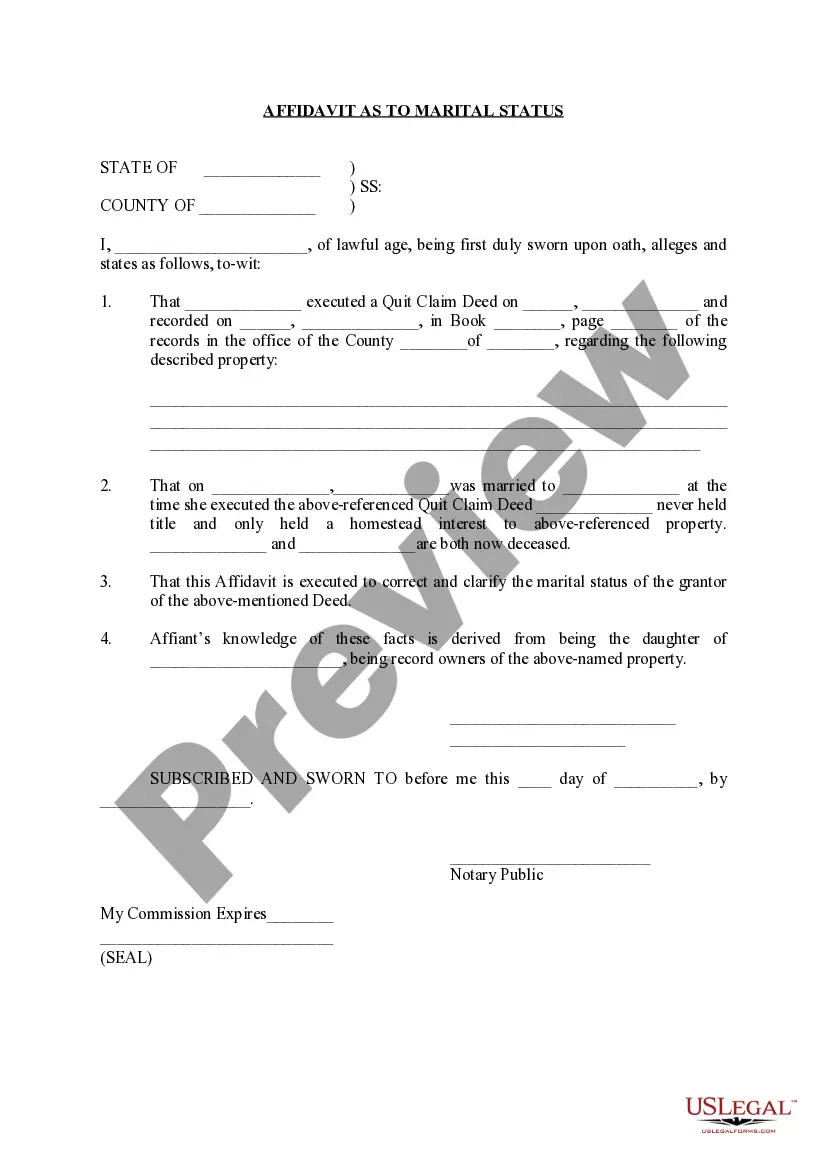

How to fill out General Form Of Agreement To Incorporate?

It is feasible to dedicate time online trying to locate the sanctioned document template that meets the federal and state requirements you desire.

US Legal Forms provides an extensive collection of legal templates that have been reviewed by experts.

You can easily obtain or print the Oregon General Form of Agreement to Incorporate from my support.

If available, utilize the Preview button to browse through the document template as well.

- If you already possess a US Legal Forms account, you may Log In and then click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Oregon General Form of Agreement to Incorporate.

- Each legal document template you acquire is yours forever.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/region that you choose.

- Check the form description to make sure you have chosen the right form.

Form popularity

FAQ

If your LLC does not have an operating agreement, state default laws will govern its operation, which may not align with your specific needs or preferences. This can lead to misunderstandings among members regarding decision-making and profit distribution. Furthermore, lacking an agreement may limit your ability to resolve conflicts effectively. To avoid these issues, consider utilizing the Oregon General Form of Agreement to Incorporate to draft an operating agreement that suits your business.

In Oregon, while it is not legally required to have an operating agreement for your LLC, it is highly recommended. An operating agreement outlines the management structure, responsibilities, and operational procedures of your business. It serves to establish clear expectations among members and can help prevent disputes down the road. Using the Oregon General Form of Agreement to Incorporate can simplify the creation of this essential document.

An entity of record in Oregon refers to the official designation of a business that is recognized and registered with the state. This includes corporations, LLCs, and partnerships that have filed required documents, such as the Oregon General Form of Agreement to Incorporate. Maintaining accurate entity records can help protect your legal standing and ensure compliance with state regulations.

A C Corporation, or C Corp, is a type of business entity that is separate from its owners. This entity type offers limited liability protection to shareholders, meaning their personal assets are protected from business debts. Choosing to operate as a C Corp through the Oregon General Form of Agreement to Incorporate can provide advantages like unlimited growth potential and tax benefits, making it a popular choice for many entrepreneurs.

To incorporate in Oregon, you must file the Oregon General Form of Agreement to Incorporate with the Secretary of State. Additionally, you should provide a unique company name, designate a registered agent, and outline your business's purpose. Ensuring these requirements are met can simplify your incorporation process and lay a solid foundation for your new business.

In Oregon, the entity type refers to the specific classification of your business, such as a corporation, limited liability company (LLC), or partnership. The choice of entity type affects your legal obligations, tax implications, and management structure. When using the Oregon General Form of Agreement to Incorporate, you can clearly define your entity type and comply with state requirements.

An LLC in Oregon provides flexible management options, limited liability protection, and potential tax advantages. Members enjoy personal asset protection while benefiting from pass-through taxation, which avoids double taxation. Moreover, utilizing the Oregon General Form of Agreement to Incorporate simplifies the formation process, making it accessible for entrepreneurs seeking to establish their business.

A domestic business corporation in Oregon is a corporation that is formed under Oregon state law. This type of corporation operates primarily within the state and must comply with Oregon regulations regarding incorporation. When filing the Oregon General Form of Agreement to Incorporate, you establish your business's identity and obligations within this framework.

While Oregon does not legally require an operating agreement for an LLC, it is highly recommended to have one. This document outlines the management structure and operational procedures of your business, helping to prevent disputes. Utilizing the Oregon General Form of Agreement to Incorporate alongside an operating agreement can strengthen your business's foundation.

A DLLC, or Domestic Limited Liability Company, is essentially the same as an LLC in Oregon. Both structures provide liability protection to their owners while allowing for flexibility in management and tax treatment. When you consider the Oregon General Form of Agreement to Incorporate, both terms refer to the formation of the same legal entity within the state.