Oregon Agreement to Incorporate by Partners Incorporating Existing Partnership

Description

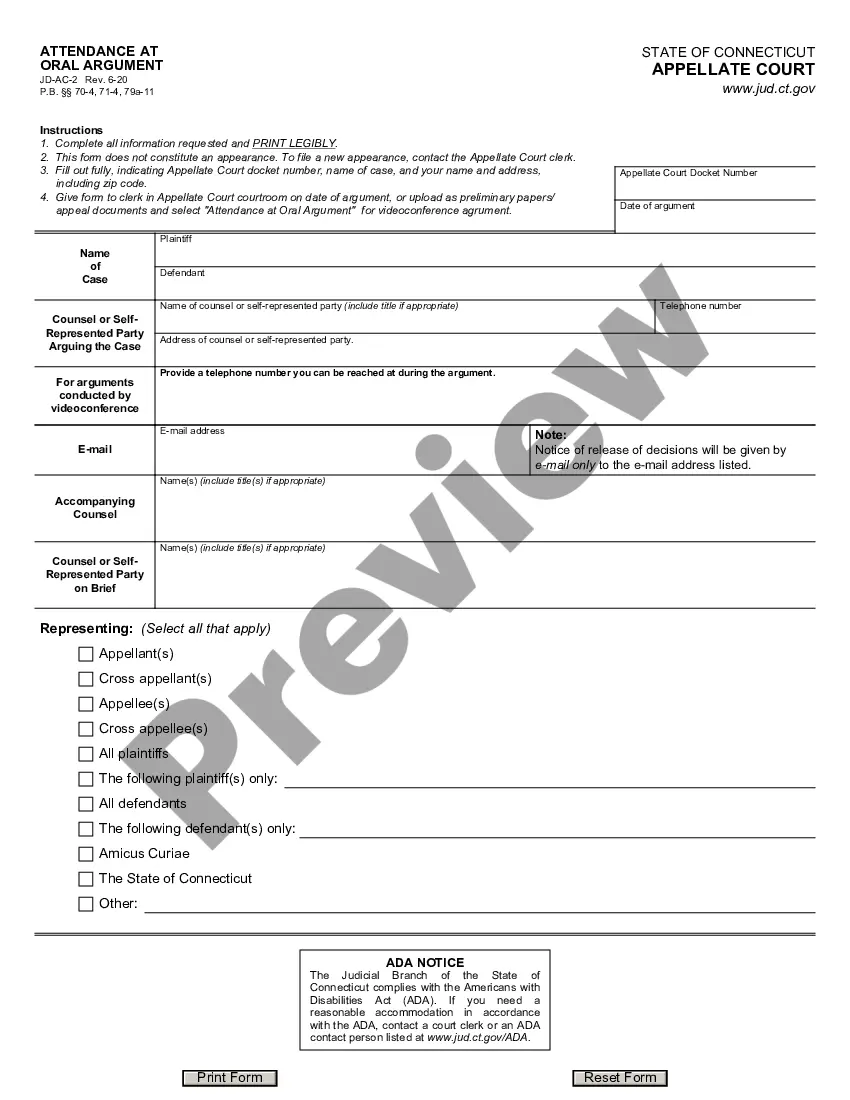

How to fill out Agreement To Incorporate By Partners Incorporating Existing Partnership?

US Legal Forms - one of the largest collections of legal documents in the country - offers a variety of legal document templates that you can obtain or print. Using the website, you can find thousands of forms for business and personal use, organized by categories, states, or keywords.

You can access the latest versions of forms such as the Oregon Agreement to Incorporate by Partners Incorporating Existing Partnership in just a few minutes. If you already have a subscription, Log In and obtain the Oregon Agreement to Incorporate by Partners Incorporating Existing Partnership from the US Legal Forms library. The Download button will appear on every document you view. You have access to all previously downloaded forms within the My documents section of your account.

If you are new to US Legal Forms, here are simple steps to get started: Ensure you have selected the correct form for your area/state. Click on the Preview button to review the form's details. Check the form description to confirm you have chosen the right one. If the form does not meet your needs, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Download now button. Then, choose your preferred pricing plan and provide your details to register for an account. Process the purchase. Use your credit card or PayPal account to complete the transaction. Select the file format and download the form to your device. Edit. Complete, modify, and print and sign the downloaded Oregon Agreement to Incorporate by Partners Incorporating Existing Partnership.

Never modify or delete any HTML tags. Only synonymize plain text outside of the HTML tags.

- Every document you added to your account has no expiration date and is yours indefinitely.

- If you wish to obtain or print another copy, simply navigate to the My documents section and click on the form you need.

- Access the Oregon Agreement to Incorporate by Partners Incorporating Existing Partnership with US Legal Forms, the most extensive library of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

Whether to start a partnership or an LLC depends on your specific needs. A partnership is simpler and less costly to establish, but may expose partners to personal liability. An LLC offers personal liability protection and may have tax advantages. When considering your options, weigh these factors and think about how an Oregon Agreement to Incorporate by Partners Incorporating Existing Partnership can fit your business strategy.

To form a partnership with an existing business, consult with all stakeholders to ensure alignment on shared vision and objectives. Draft a formal partnership agreement that specifies each partner's roles, duties, and financial contributions. This document is essential for clarity and legal protection as you merge operations. Specifically, consider an Oregon Agreement to Incorporate by Partners Incorporating Existing Partnership for structured assistance.

Forming a partnership with an existing business involves thorough discussions about shared goals and how resources will be combined. Start by drafting a partnership agreement that outlines contributions, responsibilities, profit sharing, and decision-making processes. This agreement is key to successfully merging operations and ensuring a smooth collaboration. Utilizing an Oregon Agreement to Incorporate by Partners Incorporating Existing Partnership can simplify this process.

To add partners to a partnership firm, review the existing partnership agreement for any specific procedures. Typically, existing partners must agree to the addition, and the new partner should understand their obligations. Amend the partnership agreement to reflect the new partner's contributions and responsibilities. This process is critical when drafting an Oregon Agreement to Incorporate by Partners Incorporating Existing Partnership.

The 80% rule refers to the requirement that at least 80% of the assets or income of a partnership must be derived from eligible sources for tax benefits. This rule is important for partnerships that seek favorable tax treatment. To maintain compliance, partners should monitor their income sources regularly. Understanding this rule is essential when forming an Oregon Agreement to Incorporate by Partners Incorporating Existing Partnership.

To fill out a partnership agreement, start by defining the terms of the partnership, including the business name and purpose. Next, list each partner’s contributions, roles, and responsibilities. Clearly outline how profits and losses will be shared among partners. Finally, ensure that all partners sign and date the agreement for legal validity, especially when planning to utilize an Oregon Agreement to Incorporate by Partners Incorporating Existing Partnership.

To terminate a domestic partnership in Oregon, you must file a Notice of Termination with the Secretary of State. This legal document concludes the partnership officially. If you have an Oregon Agreement to Incorporate by Partners Incorporating Existing Partnership, review it to ensure compliance with any specific requirements outlined in your agreement.

A partnership does not need articles of incorporation since those are typically required for corporations. However, having a formal partnership agreement is essential. This document can serve as an Oregon Agreement to Incorporate by Partners Incorporating Existing Partnership, outlining each partner's rights and responsibilities, ensuring smoother operations.

Yes, a corporation can be a partner in a general partnership. This arrangement allows for greater flexibility and resource pooling, fostering business growth. However, if you are operating under an Oregon Agreement to Incorporate by Partners Incorporating Existing Partnership, ensure that the agreement reflects any corporations involved to avoid misunderstandings.

Dissolving a partnership requires several important steps, starting with notifying all partners of the decision. Next, settle any outstanding debts and obligations, and then formally file a dissolution plan with necessary paperwork. If your partnership has an Oregon Agreement to Incorporate by Partners Incorporating Existing Partnership, ensure you follow that agreement's guidelines during this process.