Oregon Conveyance of Deed to Lender in Lieu of Foreclosure

Description

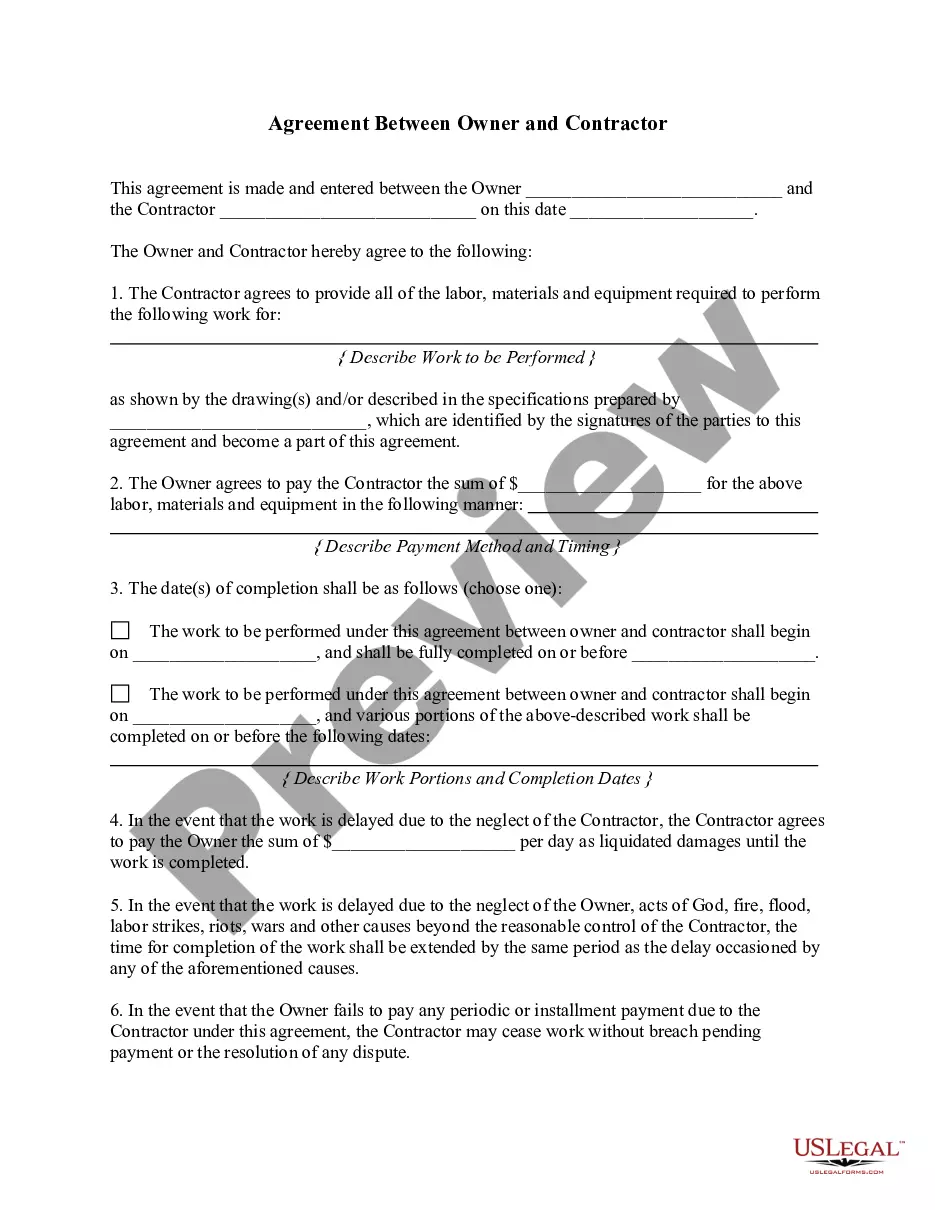

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

US Legal Forms - one of several greatest libraries of legal varieties in America - delivers a wide range of legal file web templates you can obtain or produce. Utilizing the web site, you can find a large number of varieties for company and personal functions, categorized by classes, states, or search phrases.You can get the newest versions of varieties just like the Oregon Conveyance of Deed to Lender in Lieu of Foreclosure within minutes.

If you currently have a monthly subscription, log in and obtain Oregon Conveyance of Deed to Lender in Lieu of Foreclosure from your US Legal Forms catalogue. The Download key will appear on every single develop you view. You get access to all in the past saved varieties in the My Forms tab of your own profile.

If you want to use US Legal Forms for the first time, listed here are simple instructions to obtain started out:

- Be sure to have picked the best develop for your personal area/region. Go through the Preview key to examine the form`s articles. Browse the develop information to ensure that you have chosen the proper develop.

- When the develop doesn`t match your specifications, use the Research area near the top of the monitor to find the the one that does.

- Should you be satisfied with the shape, verify your selection by clicking the Acquire now key. Then, opt for the rates strategy you prefer and give your credentials to sign up on an profile.

- Procedure the deal. Use your bank card or PayPal profile to accomplish the deal.

- Choose the format and obtain the shape in your gadget.

- Make adjustments. Fill up, revise and produce and sign the saved Oregon Conveyance of Deed to Lender in Lieu of Foreclosure.

Every single design you put into your bank account lacks an expiration date and is the one you have forever. So, in order to obtain or produce an additional version, just check out the My Forms portion and click about the develop you want.

Obtain access to the Oregon Conveyance of Deed to Lender in Lieu of Foreclosure with US Legal Forms, one of the most considerable catalogue of legal file web templates. Use a large number of professional and state-distinct web templates that satisfy your business or personal needs and specifications.

Form popularity

FAQ

A deed in lieu of foreclosure is exactly what the name implies. That is, instead of resorting to a costly and time-consuming foreclosure, an owner simply deeds the property to the lender in exchange for the forgiveness or payment of some or all of the debt owed by the borrower.

Generally, homeowners using short sales or deeds in lieu are required to pay tax on the amount of the forgiven debt?but not if they qualify for the Qualified Principal Residence Indebtedness (QPRI) exclusion. The QPRI exclusion was set to expire on January 1, 2021, but was extended to January 1, 2026.

A Deed in Lieu does not clear second (or even third) mortgages, and therefore will not allow the lender to take clear title to the property. (These are sometimes referred to as junior liens.) And if the Deed in Lieu is accepted, the secondary lender may come after you for the deficiency.

A Deed in Lieu does not clear second (or even third) mortgages, and therefore will not allow the lender to take clear title to the property. (These are sometimes referred to as junior liens.) And if the Deed in Lieu is accepted, the secondary lender may come after you for the deficiency.

A deed in lieu of foreclosure is a document that transfers the title of a property from the property owner to their lender in exchange for relief from the mortgage debt. Choosing a deed in lieu of foreclosure can be less damaging financially than going through a full foreclosure proceeding.

Advantages to a borrower in offering a lieu deed include, first, the release of the borrower and all other persons who may owe payment or the performance of other obligations secured by the mortgage. However, such persons remain liable if they agree to do so contemporaneously with the lieu deed transaction.

Drawbacks Of A Deed In Lieu No guarantee of acceptance: Your lender isn't obligated to accept your deed in lieu of foreclosure. Your credit will still take a hit: While a deed in lieu arrangement won't harm your credit as drastically as a foreclosure, you can still expect your score to drop.