Oregon Resignation Letter from Accounting Firm to Client as Auditors for Client

Description

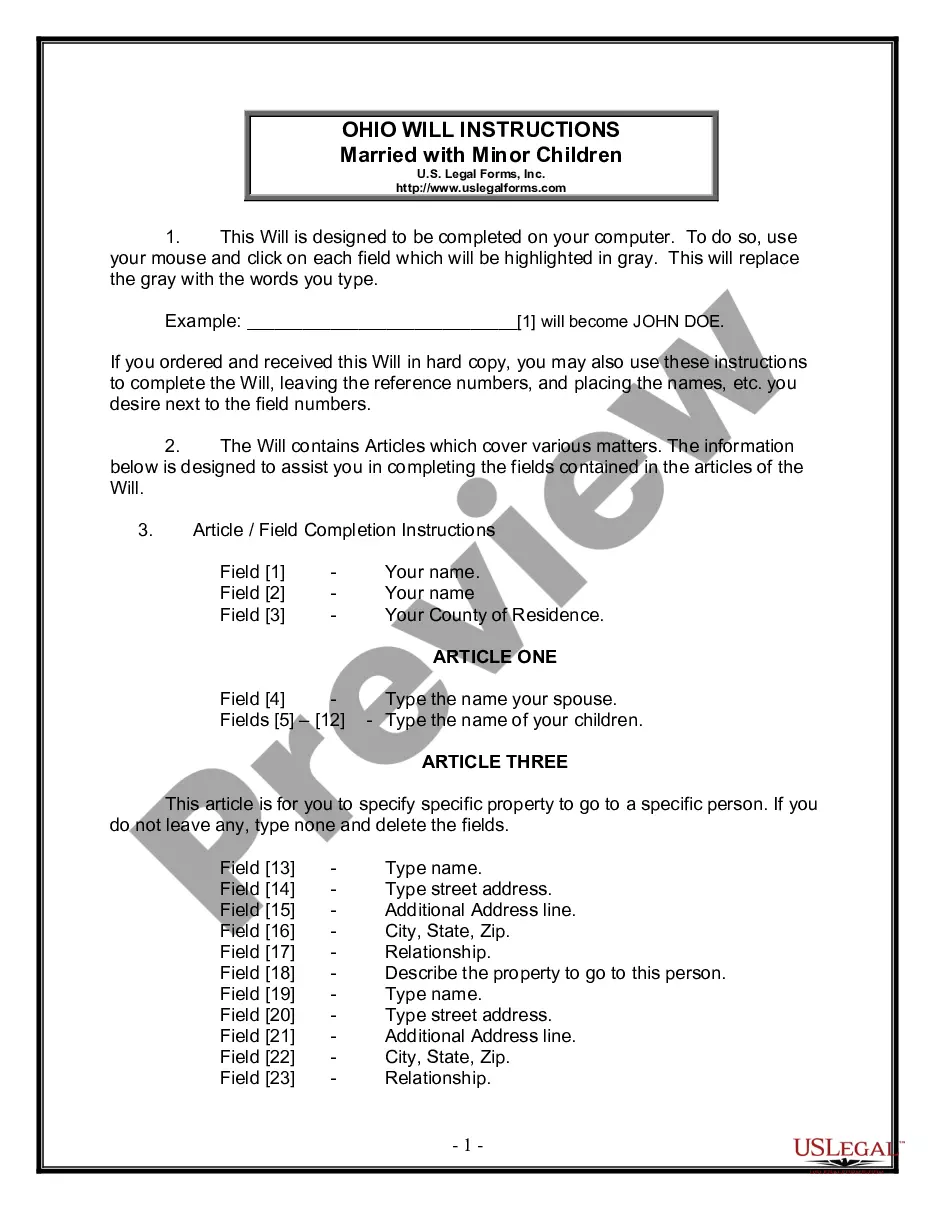

How to fill out Resignation Letter From Accounting Firm To Client As Auditors For Client?

If you seek to obtain extensive, download, or print valid document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click on the Purchase now button. Select the payment plan you prefer and input your information to create an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the transaction. Step 6. Choose the format of the legal form and download it to your device.

- Use US Legal Forms to acquire the Oregon Resignation Letter from Accounting Firm to Client as Auditors for Client in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Download option to obtain the Oregon Resignation Letter from Accounting Firm to Client as Auditors for Client.

- You can also access forms you previously saved from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the guidance provided below.

- Step 1. Make sure you have chosen the form for the correct city/state.

- Step 2. Use the Review feature to examine the form's details. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternate types of the legal form template.

Form popularity

FAQ

Resigning as an accountant requires clear communication and professionalism. Start by drafting an Oregon Resignation Letter from Accounting Firm to Client as Auditors for Client, which formally notifies your client of your decision to resign. In this letter, include the reason for your resignation and the effective date. It’s important to ensure a smooth transition, so offer assistance with the handover process, making it easier for your client to find new auditors.

To effectively part ways with an accounting client, establish clear communication about your intentions. Begin by drafting an Oregon Resignation Letter from Accounting Firm to Client as Auditors for Client to formally notify them of your decision. Ensure you outline the reasons behind this action and remind them of any final accounting duties you will complete. This approach maintains professionalism while allowing both parties to transition smoothly.

When writing a letter to terminate a client relationship, start by clearly stating your intention and the effective date. Include any actions you will take to assist the client during the transition period, along with a note of appreciation for the partnership. Using an Oregon Resignation Letter from Accounting Firm to Client as Auditors for Client as a template can ensure you deliver a thoughtful and clear message. This fosters goodwill and maintains professionalism in your correspondence.

Firing an accounting client should be handled delicately. Begin with an honest conversation about the reasons for your decision and the challenges that led to it. Afterward, follow up with a formal letter, such as an Oregon Resignation Letter from Accounting Firm to Client as Auditors for Client, that outlines the final steps and responsibilities. This way, you can ensure a professional closure to your business relationship.

Polite termination of a contract with a client involves clear communication that respects the relationship. Detail the reasons for termination and provide a sincere thank you for their partnership, while ensuring you comply with the terms of the contract. Use an Oregon Resignation Letter from Accounting Firm to Client as Auditors for Client to formalize your message in a respectful and professional manner. This maintains your integrity while parting ways.

To politely disengage a client, communicate openly about your need to discontinue services. Offer a clear explanation, and if appropriate, suggest alternatives that can help them transition. Close your communication with gratitude for the time you worked together. An Oregon Resignation Letter from Accounting Firm to Client as Auditors for Client can effectively encapsulate your message in a considerate way.

To terminate a contract with an accountant, first review the terms of the contract to comply with any stipulations. Follow up by drafting a formal termination notice that cites the reasons for your decision and includes an effective termination date. A well-written document, such as an Oregon Resignation Letter from Accounting Firm to Client as Auditors for Client, helps facilitate this process smoothly. Ensure that all communications remain professional and respectful.

When writing a client termination letter, start by stating your intention to terminate the services clearly. Include the effective date and any pending responsibilities you might have. Be courteous and express appreciation for the past collaboration to maintain goodwill. An Oregon Resignation Letter from Accounting Firm to Client as Auditors for Client can serve as a solid template to ensure you cover all necessary details.

To resign from a client, initiate a conversation to explain your decision clearly and professionally. Following that discussion, provide a formal resignation letter, such as an Oregon Resignation Letter from Accounting Firm to Client as Auditors for Client, to document your decision. This approach helps in maintaining professionalism and leaves the door open for future interactions. Make sure to finish any outstanding tasks before you formally resign.

A disengagement letter from accountants to clients serves as an official notice that an accountant will no longer provide services. This document outlines the reasons for the disengagement, details about the work completed, and any outstanding matters. It is important to follow the professional protocols in such letters to maintain a positive relationship. Utilizing an Oregon Resignation Letter from Accounting Firm to Client as Auditors for Client ensures clarity and professionalism.