Oregon Assignment of Property in Attached Schedule

Description

How to fill out Assignment Of Property In Attached Schedule?

If you require to complete, obtain, or create official document templates, utilize US Legal Forms, the largest collection of legal forms that are accessible online.

Employ the website's straightforward and user-friendly search function to locate the documents you require.

A variety of templates for business and personal purposes are organized by category and jurisdiction, or keywords.

Step 5. Complete the transaction. You may use your Visa or MasterCard or PayPal account to finalize the purchase.

Step 6. Retrieve the format of the legal document and download it to your device. Step 7. Complete, customize, and print or sign the Oregon Assignment of Property in Attached Schedule.

- Utilize US Legal Forms to retrieve the Oregon Assignment of Property in Attached Schedule with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to access the Oregon Assignment of Property in Attached Schedule.

- You can also find forms you have previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form relevant to the specific town/land.

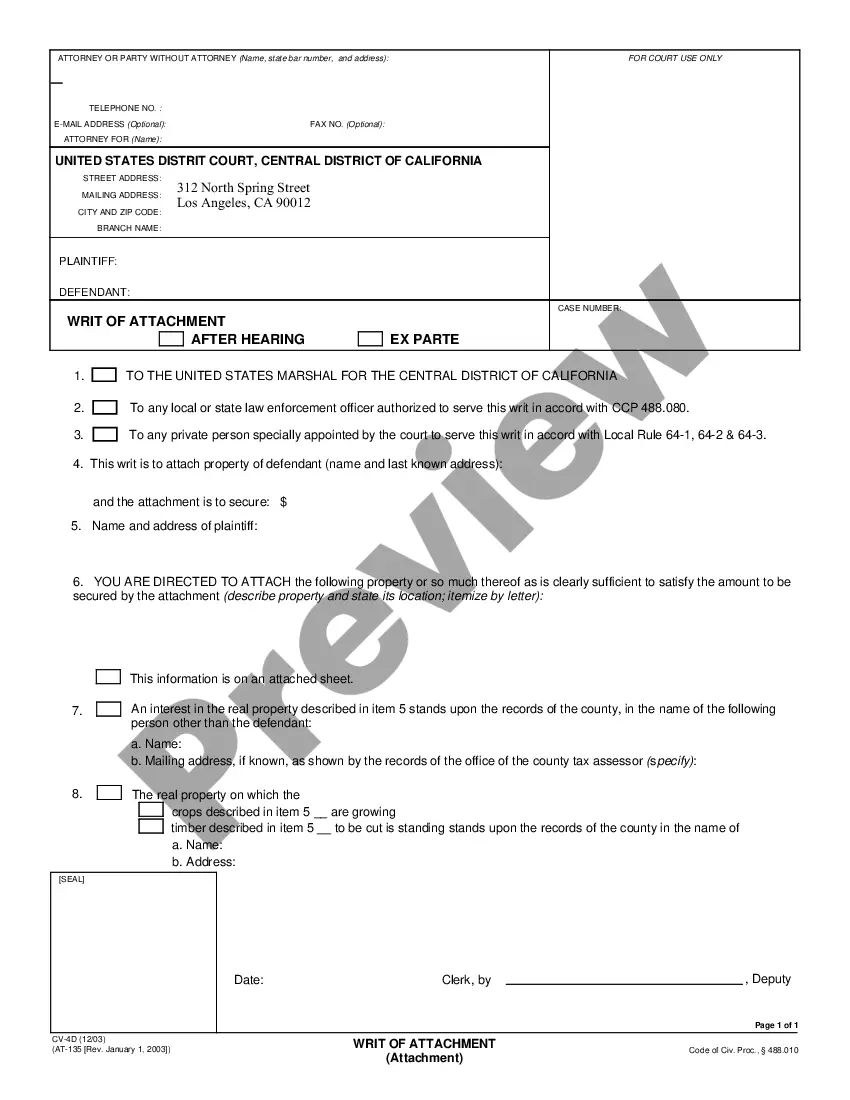

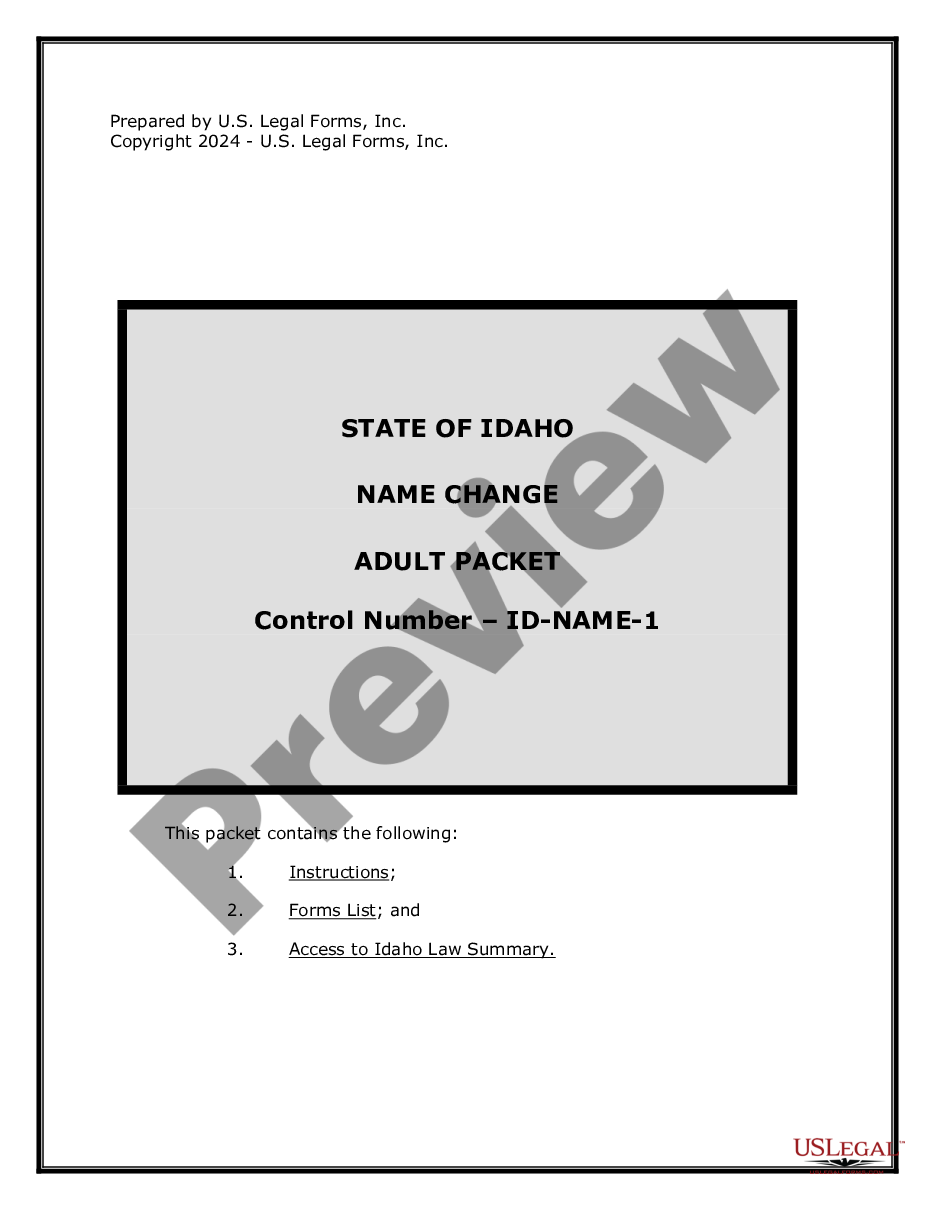

- Step 2. Use the Preview option to examine the content of the form. Don’t forget to review the description.

- Step 3. If you are not happy with the form, utilize the Search feature at the top of the screen to find other versions from the legal form template.

- Step 4. Once you have located the form you need, click the Get now button. Select the payment plan you prefer and provide your details to create an account.

Form popularity

FAQ

In Oregon, any real property or personal assets valued above the state’s exemption limit may be subject to estate tax. This includes all forms of real estate, financial accounts, and personal belongings that exceed $1 million in total value. Managing these assets through the Oregon Assignment of Property in Attached Schedule can help you plan strategically for tax obligations.

Certain assets are exempt from estate tax in Oregon, including life insurance proceeds, retirement accounts, and assets held in a qualified personal residence trust. By knowing what assets qualify for these exemptions, you can plan better for your heirs. Utilizing the Oregon Assignment of Property in Attached Schedule can further enhance your estate planning to maximize these exemptions.

An irrevocable trust is one effective way to avoid Oregon estate tax. By transferring assets into this type of trust, you can effectively remove them from your taxable estate. The Oregon Assignment of Property in Attached Schedule can assist you in structuring these trusts efficiently and ensuring compliance with state regulations.

In Oregon, assets that are subject to probate typically include real estate, bank accounts, stocks, and personal property that the deceased owned solely. However, properties held in a trust or jointly owned with rights of survivorship generally bypass probate. This makes the Oregon Assignment of Property in Attached Schedule an important tool to manage these assets effectively.

The easiest way to transfer ownership of a house often involves using a quitclaim deed. This option allows the current owner to transfer their interest quickly, with less formalities involved. However, incorporating the Oregon Assignment of Property in Attached Schedule can enhance this process by documenting the necessary details and ensuring that all parties are aware of the transaction terms, ultimately making the transfer more straightforward.

Transferring a property title to a family member in Oregon generally involves filling out a deed that specifies the change in ownership. It’s crucial to have this deed properly executed and notarized before submitting it to the county clerk’s office. The Oregon Assignment of Property in Attached Schedule can streamline this process by clearly stating the conditions of the transfer, simplifying the legal requirements involved.

To transfer ownership of a property in Oregon, you typically need to execute a deed, such as a warranty deed or quitclaim deed. It is important to follow state regulations and file the deed with the county records office. Incorporating the Oregon Assignment of Property in Attached Schedule ensures that the process is smooth, as it clearly outlines the terms of the transfer, thus avoiding potential legal issues.

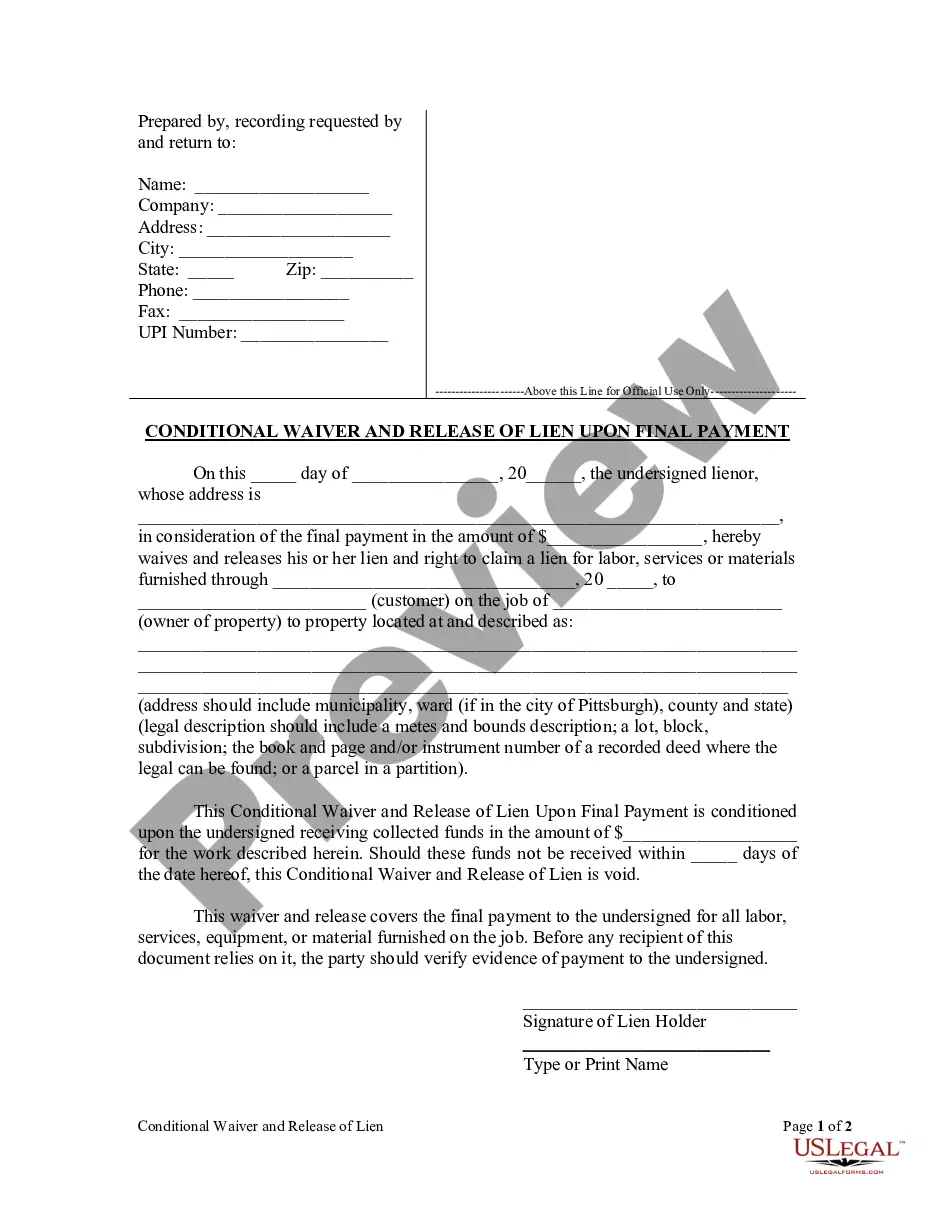

A property assignment form is a legal document that facilitates the transfer of ownership rights from one party to another. This form allows for clarity and assurance in property transactions, ensuring all parties understand their rights. For those looking to understand the Oregon Assignment of Property in Attached Schedule, this form is crucial as it helps in detailing the specific terms of the property transfer.

Transferring real property to children can be achieved through various methods, including a gift deed or a trust. The Oregon Assignment of Property in Attached Schedule is a useful tool that allows parents to clearly outline their wishes regarding property transfer. Utilizing this method ensures that the process is clear and legally binding, helping to avoid disputes among family members later.

Employers in Oregon must generally honor wage assignments if they are legally valid and properly executed. However, employers also have the right to refuse assignments that do not comply with legal requirements or that are ambiguous. For clarity on this process, exploring the Oregon Assignment of Property in Attached Schedule through US Legal Forms can provide valuable insights.