Oregon Sample Letter for Welcome Discount for New Enterprise

Description

How to fill out Sample Letter For Welcome Discount For New Enterprise?

You can spend hours online searching for the authentic document format that meets the state and federal requirements you need.

US Legal Forms provides thousands of valid templates that can be reviewed by experts.

You can easily download or print the Oregon Sample Letter for Welcome Discount for New Business from our platform.

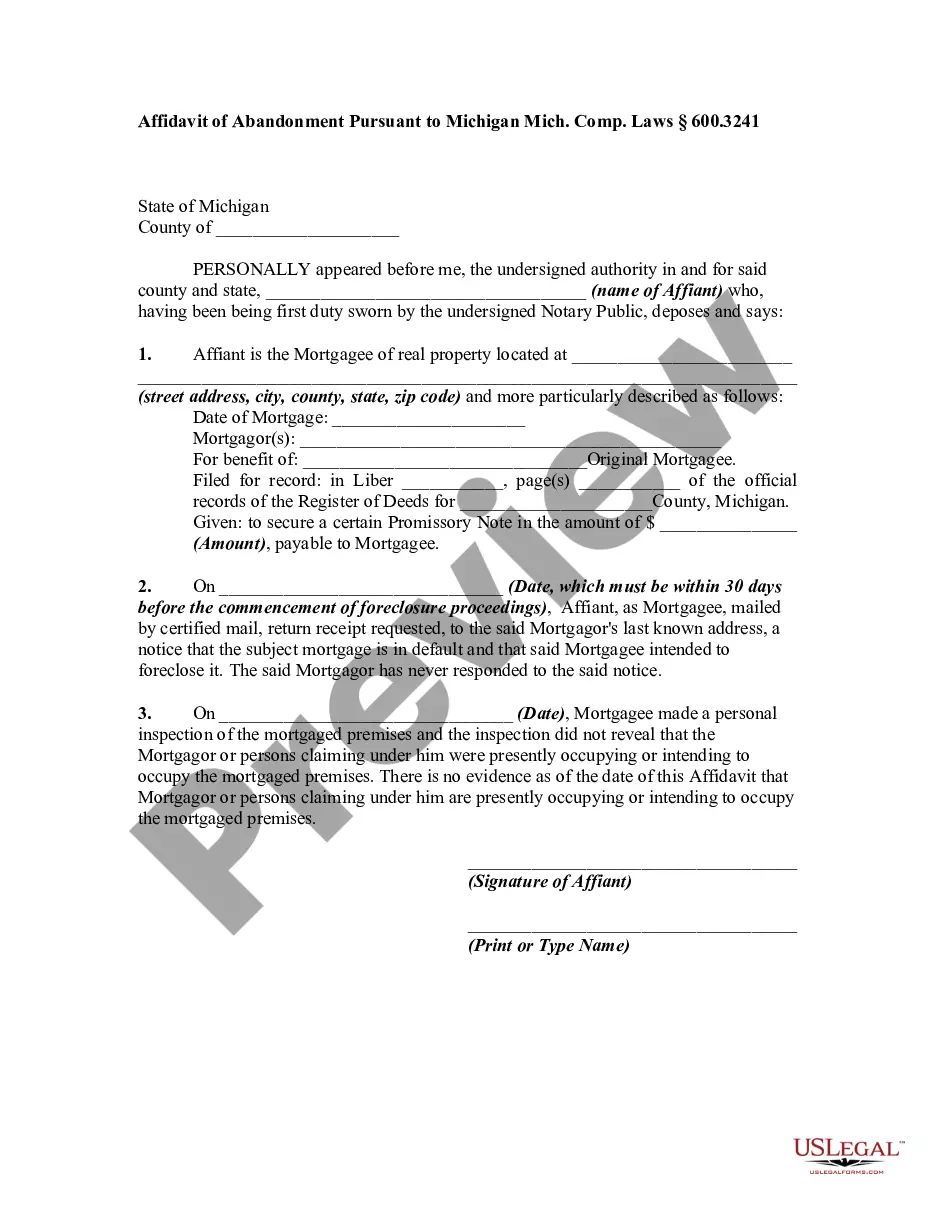

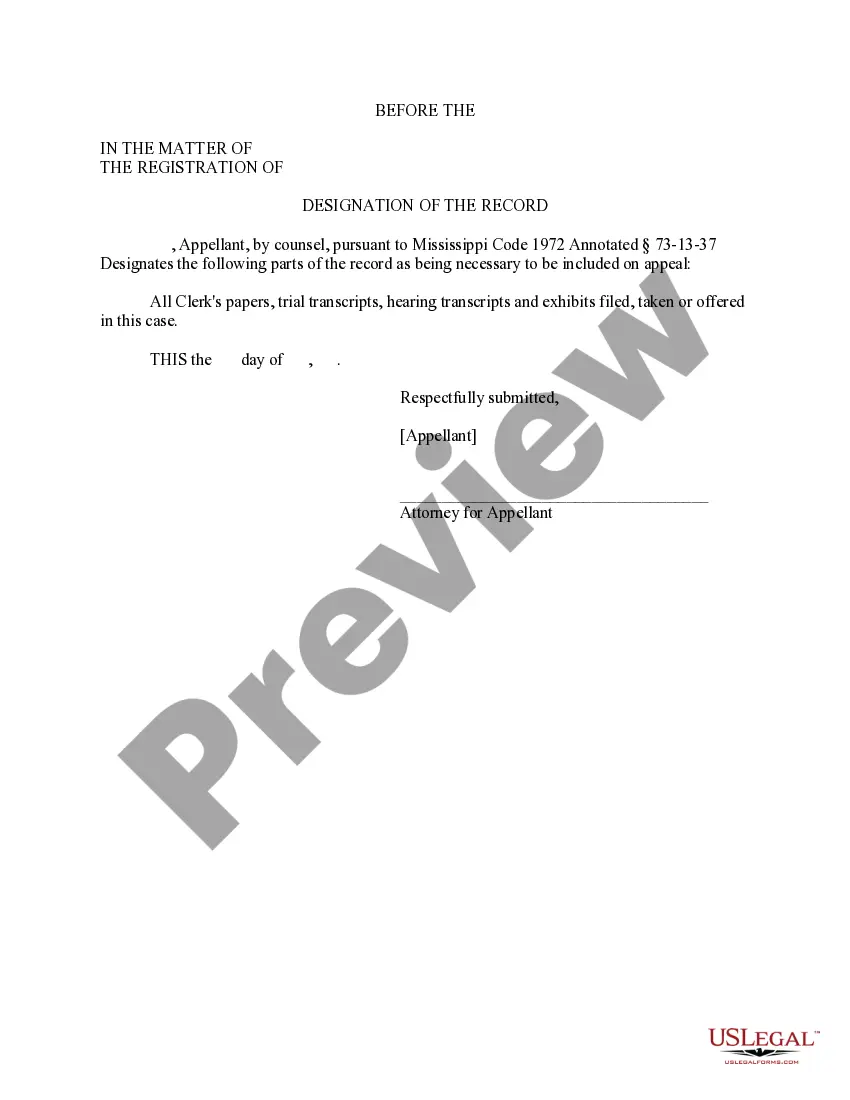

First, ensure you have selected the correct document format for the state/city of your choice. Read the form details to confirm you have picked the right template. If available, use the Preview button to review the document format as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you can complete, modify, print, or sign the Oregon Sample Letter for Welcome Discount for New Business.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of the purchased form, navigate to the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions provided below.

Form popularity

FAQ

Renewing your LLC in Oregon involves submitting a renewal application to the Secretary of State. You can complete this process online through the Oregon Secretary of State's website. Ensure you have your LLC's details on hand, including your registration number and other necessary information. This renewal keeps your Oregon Sample Letter for Welcome Discount for New Enterprise compliant and enhances your business reputation.

The Oregon Department of Revenue may send a certified letter to ensure you receive important tax-related information, such as notifications of owed taxes or potential audits. Certified letters provide proof of delivery, which is crucial for legal or compliance reasons. If you receive one of these letters, take immediate action to understand and address the contents. An Oregon Sample Letter for Welcome Discount for New Enterprise could then become a useful tool for your reply or inquiries.

Starting a business in Oregon requires several key steps, including selecting a business structure, registering your business name, and obtaining relevant licenses and permits. You must also set up tax accounts and apply for your Business Identification Number (BIN). Throughout the process, clear communication is crucial; using an Oregon Sample Letter for Welcome Discount for New Enterprise can help establish professional relationships with potential clients and state authorities.

The Department of Revenue may send you a letter for several reasons, including tax assessments, notices of unpaid tax bills, or changes to your account. These letters aim to inform you about your tax obligations and ensure compliance with state laws. Receiving such correspondence is common, and it’s essential to take it seriously and act accordingly. An Oregon Sample Letter for Welcome Discount for New Enterprise can guide you in drafting your response effectively.

Responding to a letter from the Oregon Department of Revenue involves reviewing the details provided and preparing the necessary information or documentation requested. Make sure to address any questions or issues raised clearly and comprehensively. Generally, it's wise to respond promptly to avoid any penalties or complications. You might find that using an Oregon Sample Letter for Welcome Discount for New Enterprise enhances your correspondence, making it more effective.

The Oregon Department of Revenue can garnish wages or bank accounts if you owe unpaid taxes. Typically, they may take a portion of your earnings or funds directly from your bank account until the owed amount is settled. The exact amount garnished can depend on your income and other financial circumstances. If you're facing garnishment issues, utilizing an Oregon Sample Letter for Welcome Discount for New Enterprise can help you craft a response and negotiate with the state.

To apply for a Business Identification Number (BIN) in Oregon, you need to complete the online application available on the Oregon Secretary of State's website. This process requires basic information about your business, such as its name and address. After you submit your application, the state will process it and issue your BIN. For businesses just starting, using an Oregon Sample Letter for Welcome Discount for New Enterprise can also help in your communications with state officials.

Receiving a letter from the Oregon Department of Revenue can indicate various issues, such as tax obligations, updates on your account, or requests for additional information. The letter may also inform you of any discrepancies related to your tax filings. It is essential to read the letter carefully and respond promptly to avoid potential penalties. Notably, businesses can benefit from an Oregon Sample Letter for Welcome Discount for New Enterprise to maintain clear communication with the department.

To check if a brand name is available, you should conduct a search using the trademark database from the U.S. Patent and Trademark Office. This step confirms that your brand name is not already trademarked. After confirming availability, you can draft your marketing materials, including your Oregon Sample Letter for Welcome Discount for New Enterprise.

You can check for business name availability by utilizing the search function on the Oregon Secretary of State's website. This ensures that your desired name isn't already in use, which is crucial for establishing your brand. Making use of the Oregon Sample Letter for Welcome Discount for New Enterprise can help you solidify your branding efforts.