This form involves the sale of a small business where the real estate on which the Business is located is leased from a third party. This form assumes that the Seller has received the right to assign the lease from the lessor/owner.

Oregon Agreement for Sale of Business by Sole Proprietorship with Leased Premises

Description

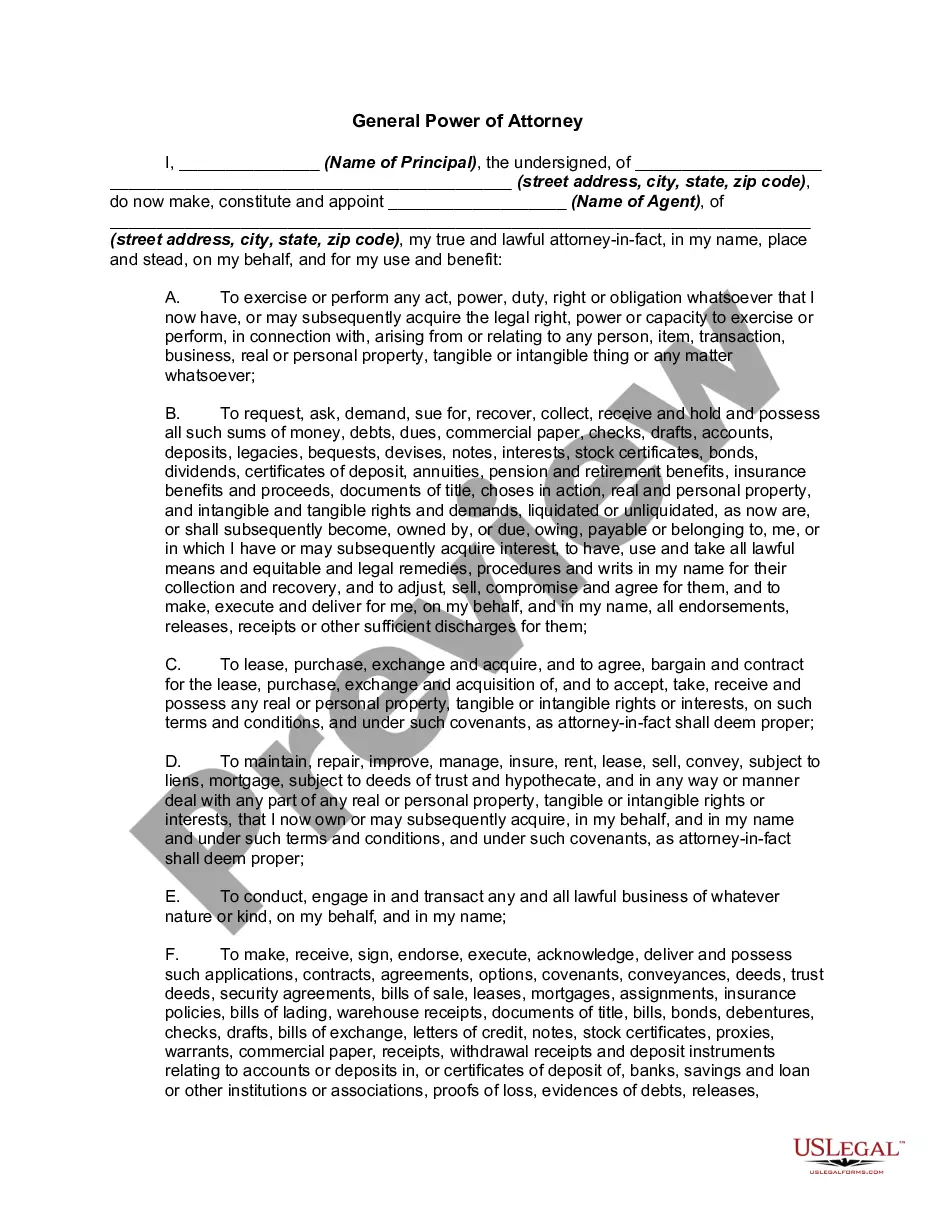

How to fill out Agreement For Sale Of Business By Sole Proprietorship With Leased Premises?

Choosing the best authorized record template can be quite a have a problem. Of course, there are a variety of themes accessible on the Internet, but how will you get the authorized develop you require? Use the US Legal Forms website. The services delivers a huge number of themes, such as the Oregon Agreement for Sale of Business by Sole Proprietorship with Leased Premises, which can be used for business and private needs. Every one of the kinds are checked by experts and meet up with state and federal needs.

If you are already authorized, log in in your accounts and click the Download key to get the Oregon Agreement for Sale of Business by Sole Proprietorship with Leased Premises. Make use of your accounts to search from the authorized kinds you might have bought previously. Go to the My Forms tab of your respective accounts and get an additional version from the record you require.

If you are a whole new consumer of US Legal Forms, listed below are simple instructions for you to follow:

- Initial, make sure you have selected the correct develop for the area/region. You may examine the form making use of the Review key and study the form description to guarantee it will be the right one for you.

- If the develop will not meet up with your needs, utilize the Seach area to discover the appropriate develop.

- Once you are positive that the form is suitable, go through the Purchase now key to get the develop.

- Opt for the rates plan you need and type in the needed information. Create your accounts and purchase an order making use of your PayPal accounts or credit card.

- Select the submit file format and download the authorized record template in your system.

- Total, change and printing and indication the attained Oregon Agreement for Sale of Business by Sole Proprietorship with Leased Premises.

US Legal Forms is definitely the biggest collection of authorized kinds where you will find various record themes. Use the service to download professionally-made paperwork that follow status needs.

Form popularity

FAQ

A sole proprietorship is an unincorporated business that is owned by one person. It is the simplest form of business organization to start and maintain. The business has no existence apart from you, the owner.

Asset Sale ? Capital Gains Tax Capital gains tax is the proceeds of your asset sale minus the original cost. You'll pay tax on the capital gain or loss on the assets sold. Here's a quick equation: Sale price ? purchase price = net proceeds.

Sole proprietorship has the following advantage: Ease of starting a business, being your own boss, a pride of ownership, quick decision, direct incentive, confidentiality of information.

employed individual simply means the person works for him or herself. It's just a business term. A sole proprietor refers to someone who owns a business by themselves. A sole proprietor does not work for a company like a traditional employee.

A sole proprietor is someone who owns an unincorporated business by himself or herself.

A sole proprietorship cannot be sold as a single entity like a corporation. Instead, when a sole proprietor sells the business, the sale is treated as the sale of the separate and identifiable assets of the business.

Overview. A sole proprietorship cannot be sold as a single entity like a corporation. Instead, when a sole proprietor sells the business, the sale is treated as the sale of the separate and identifiable assets of the business. The sale of a disregarded entity is also treated as the sale of the entity's assets.

Sole proprietors and partners pay themselves simply by withdrawing cash from the business. Those personal withdrawals are counted as profit and are taxed at the end of the year.