A receipt is a written acknowledgment by the recipient of payment for goods, payment of a debt or receiving property from another. An acknowledgment receipt is a recipient's confirmation that the items were received by the recipient.

Oregon Receipt for Money Paid or Expenses Incurred on Behalf of Payor's Children

Description

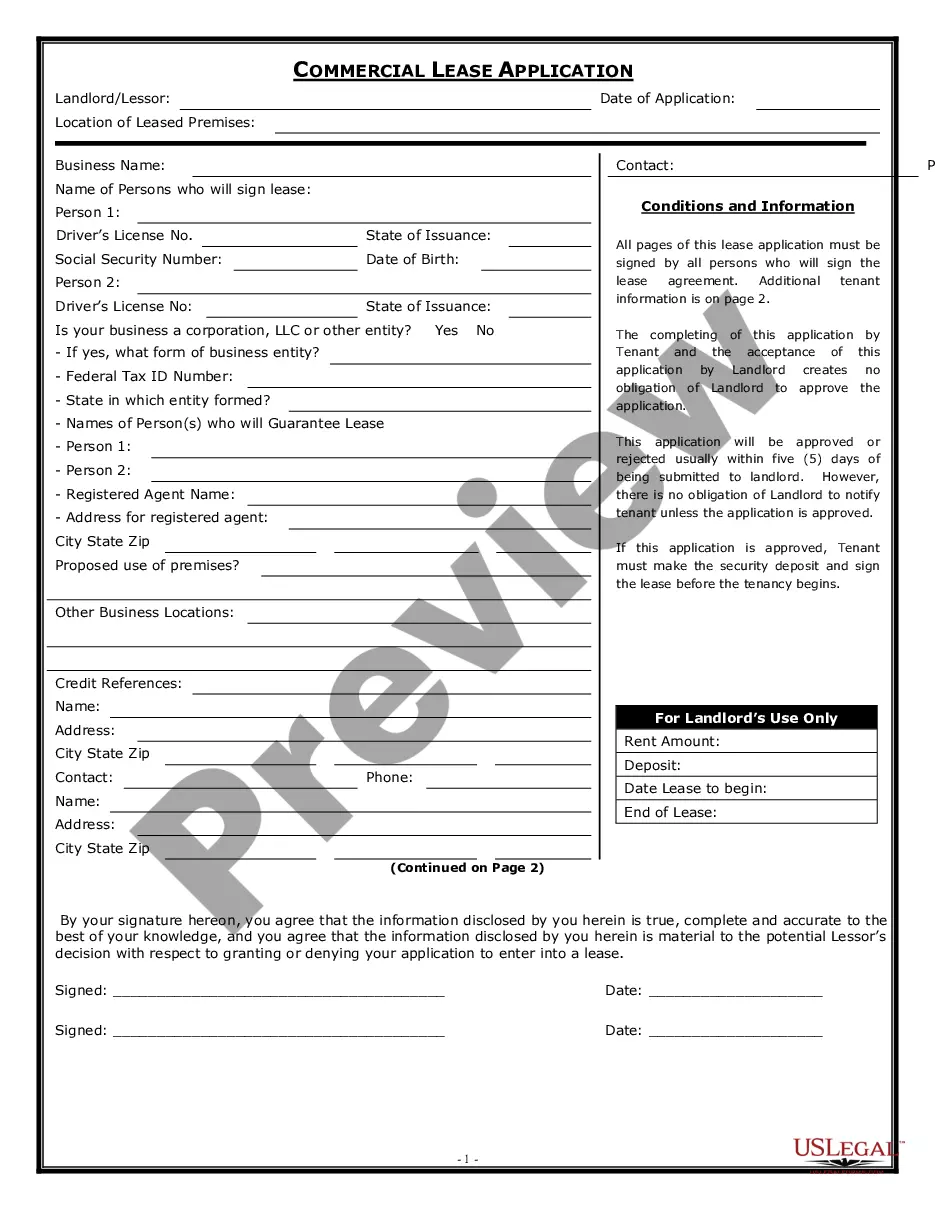

How to fill out Receipt For Money Paid Or Expenses Incurred On Behalf Of Payor's Children?

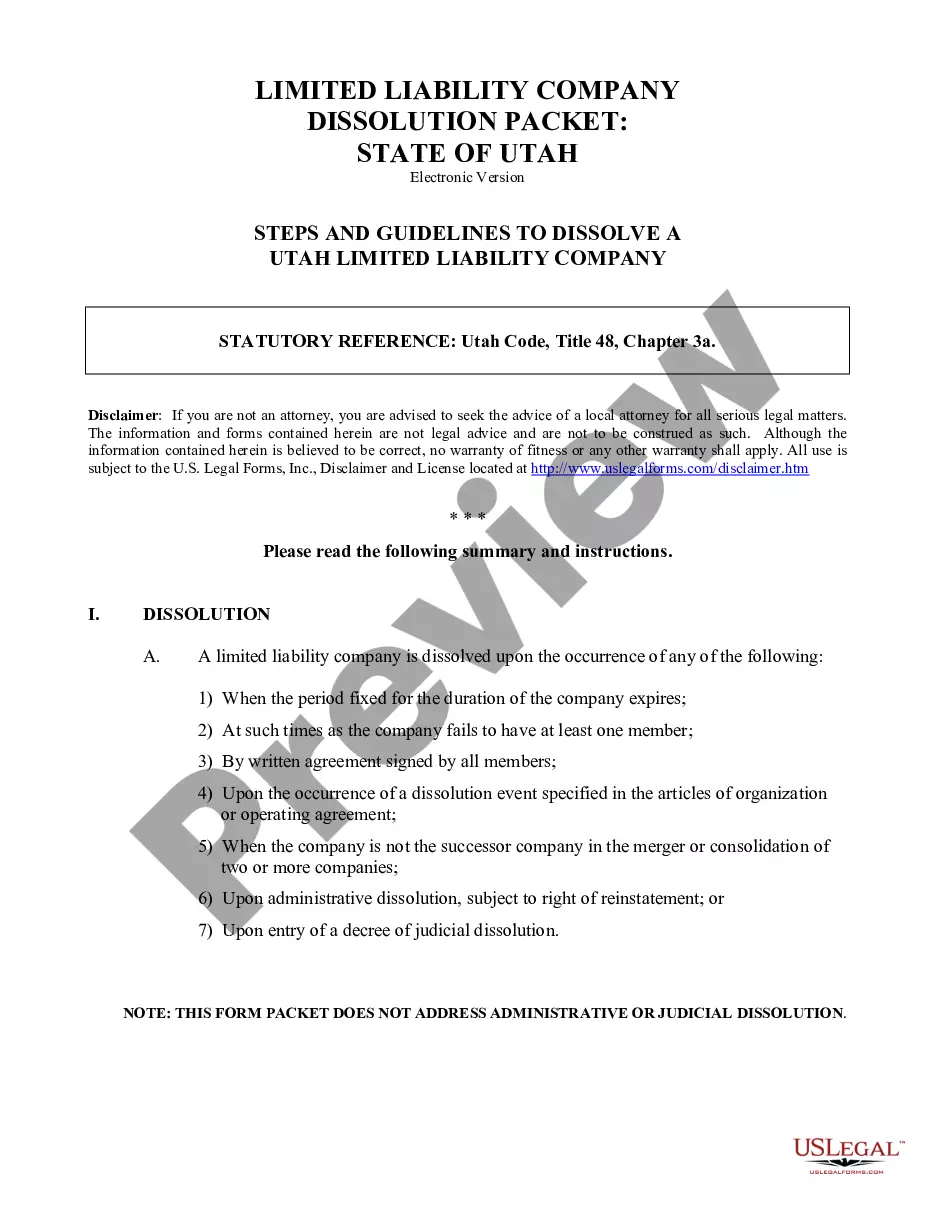

Finding the right lawful document design might be a struggle. Obviously, there are plenty of layouts available online, but how can you find the lawful type you will need? Take advantage of the US Legal Forms internet site. The service delivers 1000s of layouts, like the Oregon Receipt for Money Paid or Expenses Incurred on Behalf of Payor's Children, that can be used for business and private demands. Every one of the types are checked by professionals and meet up with federal and state demands.

Should you be already authorized, log in to the profile and then click the Obtain option to obtain the Oregon Receipt for Money Paid or Expenses Incurred on Behalf of Payor's Children. Utilize your profile to appear from the lawful types you might have bought earlier. Go to the My Forms tab of the profile and obtain another copy of the document you will need.

Should you be a new customer of US Legal Forms, listed here are simple directions for you to comply with:

- First, make sure you have selected the proper type for the town/county. You may check out the form utilizing the Preview option and browse the form outline to guarantee it is the right one for you.

- If the type fails to meet up with your needs, utilize the Seach industry to get the right type.

- When you are positive that the form is suitable, go through the Get now option to obtain the type.

- Select the pricing prepare you need and type in the required details. Make your profile and pay money for the order making use of your PayPal profile or charge card.

- Pick the submit structure and acquire the lawful document design to the system.

- Total, revise and print out and indication the received Oregon Receipt for Money Paid or Expenses Incurred on Behalf of Payor's Children.

US Legal Forms is definitely the most significant local library of lawful types in which you can find various document layouts. Take advantage of the company to acquire skillfully-manufactured paperwork that comply with condition demands.

Form popularity

FAQ

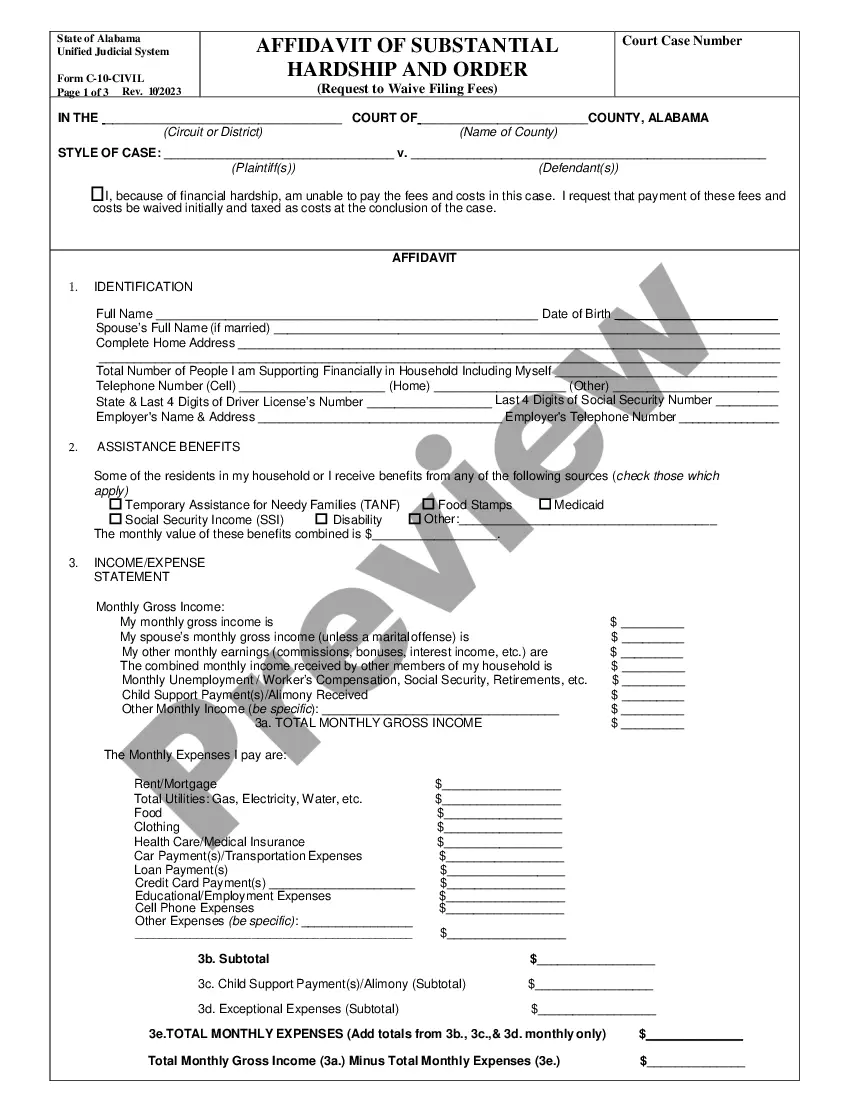

A2. For tax year 2021, the Child Tax Credit is increased from $2,000 per qualifying child to: $3,600 for each qualifying child who has not reached age 6 by the end of 2021, or. $3,000 for each qualifying child age 6 through 17 at the end of 2021.

Oregon has three kinds of credits: standard, carryforward, and refundable. Standard credits can be claimed up to the amount of your tax liability for the year, but any extra amount can't be refunded.

The Oregon Office of Economic Analysis (OEA) has confirmed a surplus for the 2021-2023 biennium, triggering a record $5.61 billion ?kicker? for the 2023 tax year. The $5.61 million kicker is the largest in Oregon history. It's nearly three times larger than the previous record kicker of $1.9 billion two years ago.

Oregon 529 College Savings Network account contributions Your AGI determines the percentage of your contribution made during the year you may claim as a credit. For more information about this credit, see Publication OR-17. Claim this credit on Schedule OR-ASC or Schedule OR-ASC-NP using code 896.

Oregon has joined at least eight other states in implementing a new or expanded state child tax credit (CTC) since the expanded federal child tax credit expired in 2022. The new Oregon child tax credit, known as the "Oregon Kid's Credit," is worth up to $1,000 and is completely refundable.

More States Adopting and Expanding Child Tax Credits In 2023, three states ? Minnesota, Oregon, and Vermont ? passed bills to explore providing advanced payments throughout the year, rather than as a once-a-year lump sum, to help families with their normal bills and other expenses.

What is the Oregon Kids' Credit? An annual refundable tax credit of $1,000 per eligible child aged 0-5 to help Oregon families struggling with the rising costs of raising kids. All Oregon families who meet the income requirements and file taxes are eligible.

ORS Chapter 809 ? Refusal, Suspension, Cancellation and Revocation of Registration, Title, Driving Privileges and Identification Card.