Oregon Lease Purchase Agreement for Equipment

Description

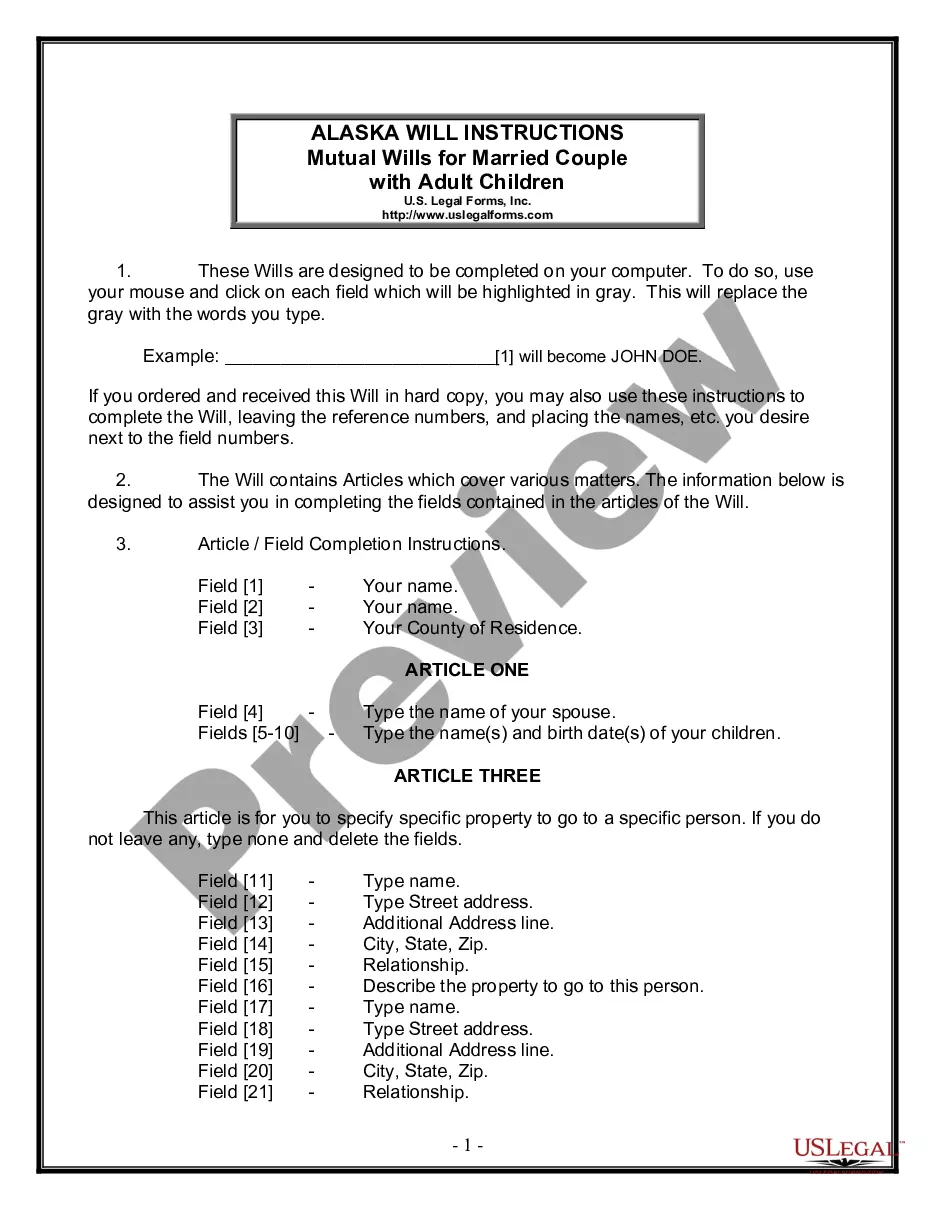

How to fill out Lease Purchase Agreement For Equipment?

Locating the appropriate legal document template can be a challenge.

Of course, there are numerous templates accessible online, but how can you find the legal form that you need.

Utilize the US Legal Forms website. The service offers a vast array of templates, including the Oregon Lease Purchase Agreement for Equipment, that can be utilized for both business and personal purposes.

You can preview the form using the Preview button and review the form details to confirm it is the right one for you.

- All of the forms are verified by professionals and meet federal and state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the Oregon Lease Purchase Agreement for Equipment.

- Use your account to review the legal forms you have previously purchased.

- Visit the My documents tab in your account to acquire another copy of the document you need.

- If you are a new customer of US Legal Forms, here are straightforward instructions that you should follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

A Capital Lease is treated like a purchase for tax and depreciation purposes. The leased equipment is shown as an asset and/or a liability on the lessee's balance sheet, and the tax benefits of ownership may be realized, including Section 179 deductions.

How to Record "Lease to Own" Computer assetCreate Other Current Liability account for the loan/lease payable.Create Fixed Asset account for Computer Equipment.You must use a General Journal Entry, as taxes cannot be entered from the register.

The three main types of leasing are finance leasing, operating leasing and contract hire.

Because they are both a form of lease, they have one thing in common. That is, the owner of the equipment (the lessor) provides to the user (the lessee) the authority to use the equipment and then returns it at the end of a set period.

Learn more about Equipment Leasing!Sale/Leaseback: (allows you to use your equipment to get working capital)True Lease or Operating Equipment Leases: (Also known as fair market value leases)The P.U.T. Option Lease (Purchase upon Termination)TRAC Equipment Leases.More items...

An operating lease is an agreement to use and operate an asset without the transfer of ownership. Common assets. Examples include property, plant, and equipment. Tangible assets are that are leased include real estate, automobiles, aircraft, or heavy equipment.

A lease will always have at least two parties: the lessor and the lessee. The lessor is the person or business that owns the equipment. The lessee is the person or business renting the equipment. The lessee will make payments to the lessor throughout the contract.

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

It is retained by the lessor during and after the lease term and cannot contain a bargain purchase option. The term is less than 75% of the asset's estimated economic life and the present value (PV) of lease payments is less than 90% of the asset's fair market value.

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.