Oregon Line of Credit Promissory Note

Description

How to fill out Line Of Credit Promissory Note?

Have you been in a placement in which you need to have papers for possibly company or person functions nearly every time? There are a lot of legal record templates available online, but getting kinds you can rely on is not straightforward. US Legal Forms provides a huge number of type templates, just like the Oregon Line of Credit Promissory Note, which are written to fulfill federal and state needs.

In case you are currently acquainted with US Legal Forms internet site and possess an account, just log in. Next, you are able to acquire the Oregon Line of Credit Promissory Note format.

Should you not come with an account and need to begin using US Legal Forms, follow these steps:

- Get the type you want and ensure it is for that correct town/county.

- Utilize the Preview key to review the shape.

- Browse the outline to actually have selected the right type.

- If the type is not what you are looking for, utilize the Search area to discover the type that suits you and needs.

- Whenever you discover the correct type, click on Get now.

- Select the pricing program you desire, fill in the specified info to produce your bank account, and buy your order utilizing your PayPal or Visa or Mastercard.

- Pick a practical document file format and acquire your duplicate.

Find all of the record templates you might have purchased in the My Forms food selection. You may get a further duplicate of Oregon Line of Credit Promissory Note at any time, if required. Just click on the required type to acquire or print the record format.

Use US Legal Forms, probably the most substantial variety of legal forms, in order to save time and stay away from mistakes. The service provides expertly created legal record templates which you can use for a range of functions. Create an account on US Legal Forms and begin creating your life easier.

Form popularity

FAQ

Promissory Notes Are Legal Contracts In order for a contract to be enforceable, it must contain certain legal conditions such as an offer and an acceptance of that offer. Contracts indicate the type and amount of payment for services or goods rendered.

It must include all the mandatory elements such as the legal names of the payee and maker's name, amount being loaned / to be repaid, full terms of the agreement and the full amount of liability, beside other elements. The note must clearly mention only the promise of making the repayment and no other conditions.

Additionally, although those selling them might not know or admit it, promissory notes are usually securities and must be registered with the SEC or the state in which they're sold?or they must have a specific exemption from registration under the law.

In Oregon, promissory notes require the signature of both the lender and the sender for the contract to be valid. Without both signatures, the deal is not legal. If one of the parties voids the agreement, the matter cannot be taken to court for judgment. The case will be thrown out.

What is a HELOC note? It's a promissory note, which creates a legal agreement obligating a borrower to repay a debt to a lender. Signing off on a HELOC promissory note conveys responsibilities to you as the borrower and extends rights to the lender. Both are important if you're considering a home equity line of credit.

?Residential line of credit instrument? means any line of credit instrument creating a lien on real property upon which are situated or will be constructed four or fewer residential units, one of which, at the time the credit agreement is entered into, is the borrower's residence or is intended, following construction, ...

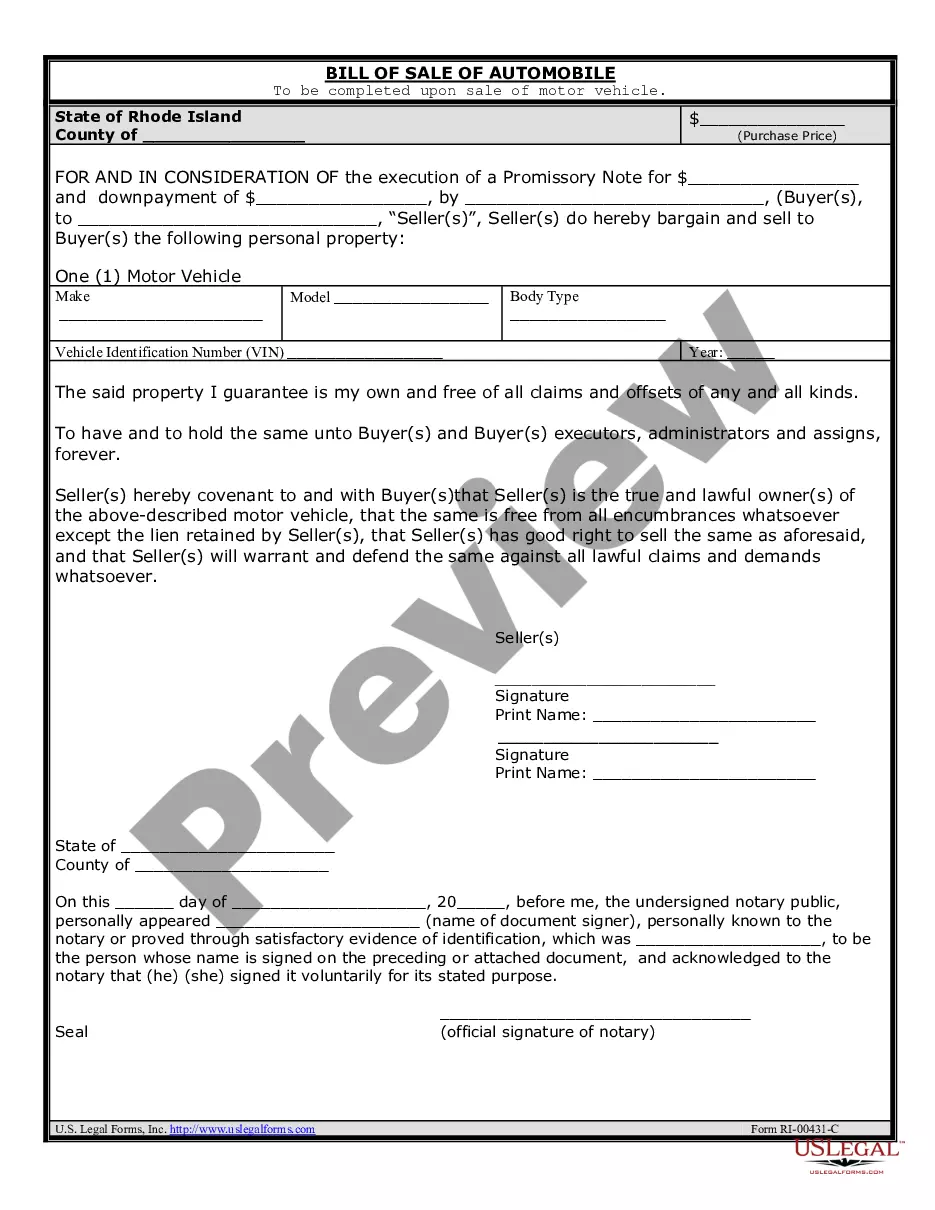

A form of promissory note to be used to evidence advances under an uncommitted line of credit when the lender uses a line of credit confirmation letter instead of a separate line of credit agreement and the parties are not contemplating a negotiable instrument.

Promissory notes are quite simple and can be prepared by anyone. They do not need to be prepared by a lawyer or be notarized. It isn't even particularly significant whether a promissory note is handwritten or typed and printed.