Oregon Revocable Trust for Estate Planning

Description

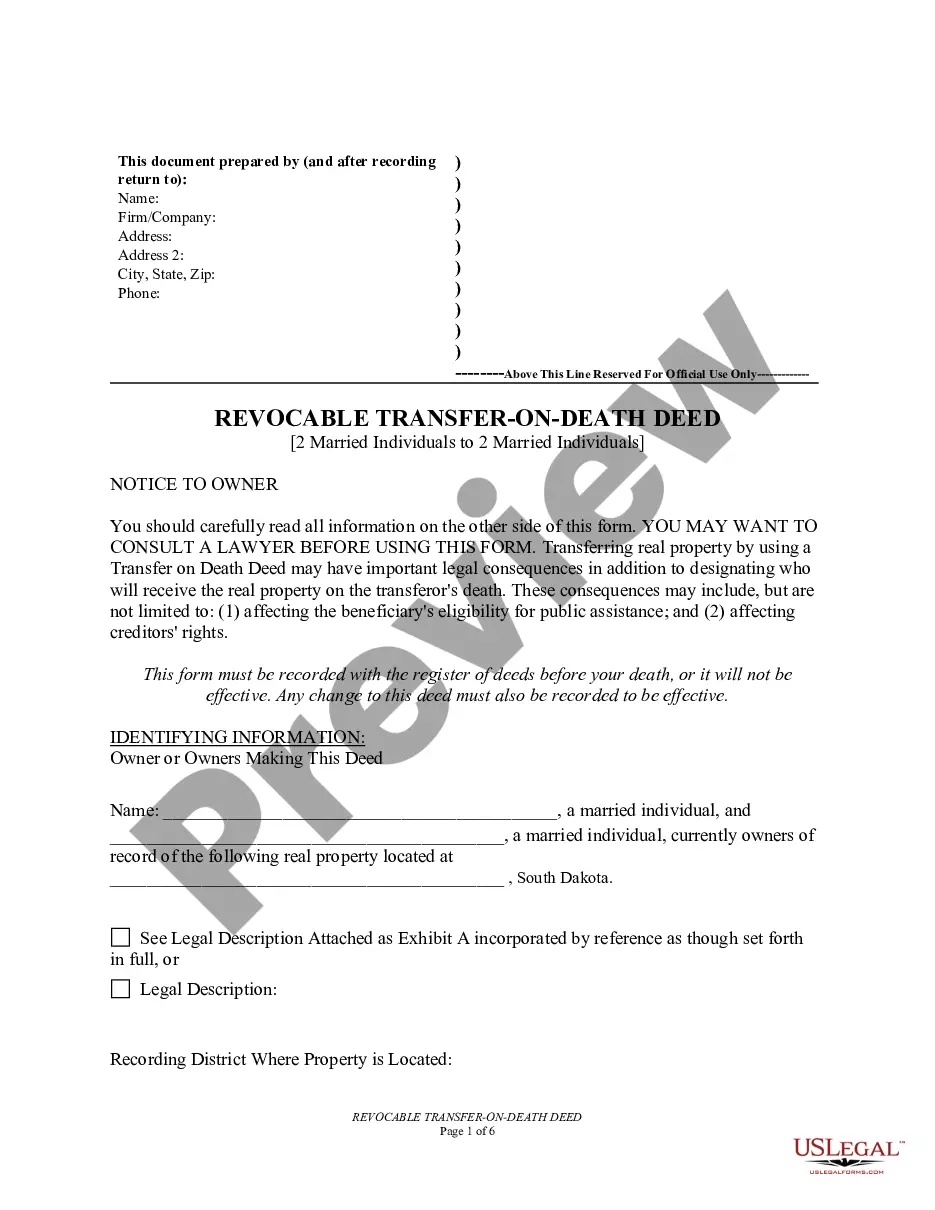

How to fill out Revocable Trust For Estate Planning?

US Legal Forms - one of the largest compilations of legal documents in the United States - offers a variety of legal document templates you can download or print.

By utilizing the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can obtain the most recent versions of forms such as the Oregon Revocable Trust for Estate Planning in seconds.

If you already have an account, Log In and download the Oregon Revocable Trust for Estate Planning from your US Legal Forms library. The Download button will appear on every document you view. You can access all previously saved forms in the My documents section of your profile.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the document to your device. Edit the form. Fill in, modify, print, and sign the saved Oregon Revocable Trust for Estate Planning.

Every template you've added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the document you need.

Access the Oregon Revocable Trust for Estate Planning with US Legal Forms, the most extensive repository of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Ensure you have selected the correct form for your area/state.

- Click the Review button to examine the details of the form.

- Check the form description to confirm you have chosen the right document.

- If the form does not meet your requirements, use the Search field at the top of the screen to locate the one that fits.

- Once you are satisfied with the document, confirm your selection by clicking the Buy now button.

- Then, select the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

The choice between a will and a trust often depends on your individual needs. An Oregon Revocable Trust for Estate Planning provides unique advantages such as avoiding probate and facilitating management of your assets in the event of incapacity. On the other hand, a will can be simpler but may lead your estate through probate, adding complexity and time. Ultimately, you should consider your specific circumstances to choose the best option for your estate planning.

Yes, an Oregon Revocable Trust for Estate Planning can effectively avoid probate. When you transfer your assets into the trust, those assets do not go through the probate process upon your passing. This means that your loved ones can access those assets quickly and without the extra costs and delays associated with probate. Therefore, utilizing a trust offers a smoother transition of your estate.

A trust may help in estate planning, but it does not necessarily avoid Oregon estate tax. It's essential to consider how the assets within the trust are valued at the time of your death. Utilizing an Oregon Revocable Trust for Estate Planning can help you strategize your estate efficiently. Consulting a professional is key to understanding tax implications clearly.

Setting up a trust can come with pitfalls such as inadequate funding and unclear instructions. If you do not transfer your assets or miscommunicate your wishes, the trust may not work as intended. An Oregon Revocable Trust for Estate Planning helps you avoid these issues by guiding you through the steps. Keeping everything transparent and organized is essential.

A major mistake parents make in the UK, similar to other countries, is neglecting tax implications associated with the trust. They may not understand how certain assets are taxed or the impact on their beneficiaries. An Oregon Revocable Trust for Estate Planning can help families navigate these issues more effectively. Being well-informed is key to ensuring your estate plan benefits your heirs.

Setting up an Oregon Revocable Trust for Estate Planning involves several steps. First, you define the trust's purpose and select a trustee, usually yourself. Next, you draft the trust document, which outlines the terms and conditions. Finally, remember to transfer your assets into the trust to ensure everything is organized and ready for distribution later.

While a family trust can provide numerous benefits, one disadvantage is the potential complexity in managing the trust. If not handled properly, it can lead to confusion among family members, especially regarding roles and responsibilities. An Oregon Revocable Trust for Estate Planning simplifies this process, making sure family members understand their duties. Clear communication is essential to avoid misunderstandings.

One common mistake parents make when setting up a trust fund is failing to properly fund the trust. It's crucial to transfer assets into the trust; otherwise, it won't serve its purpose. With an Oregon Revocable Trust for Estate Planning, you can easily manage your assets and ensure they are distributed according to your wishes. Always consult with an expert to make the process smoother.