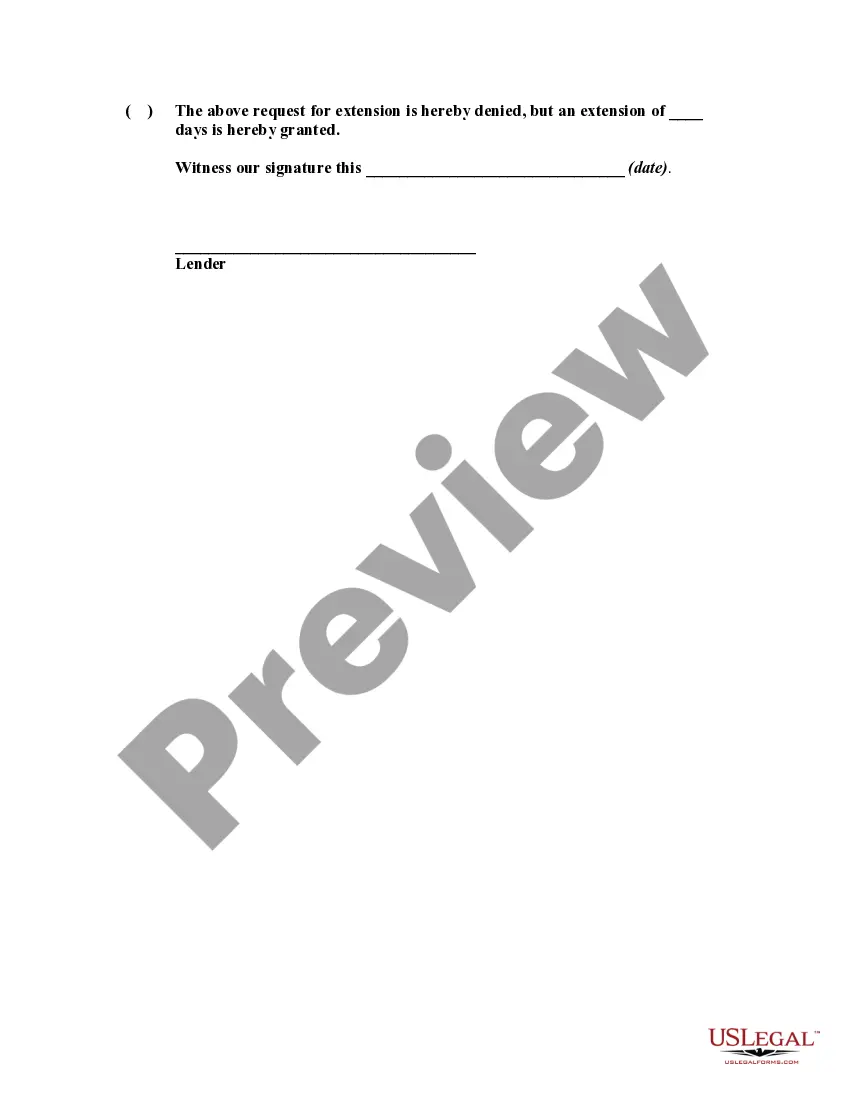

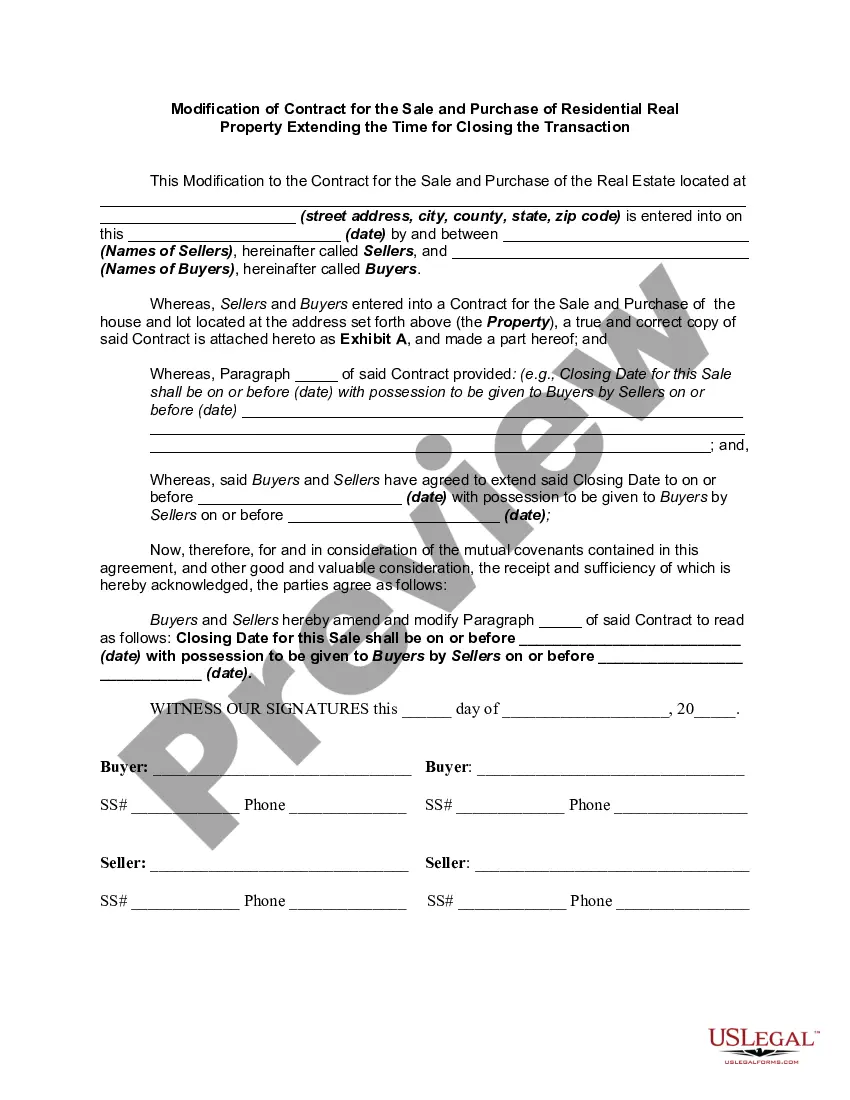

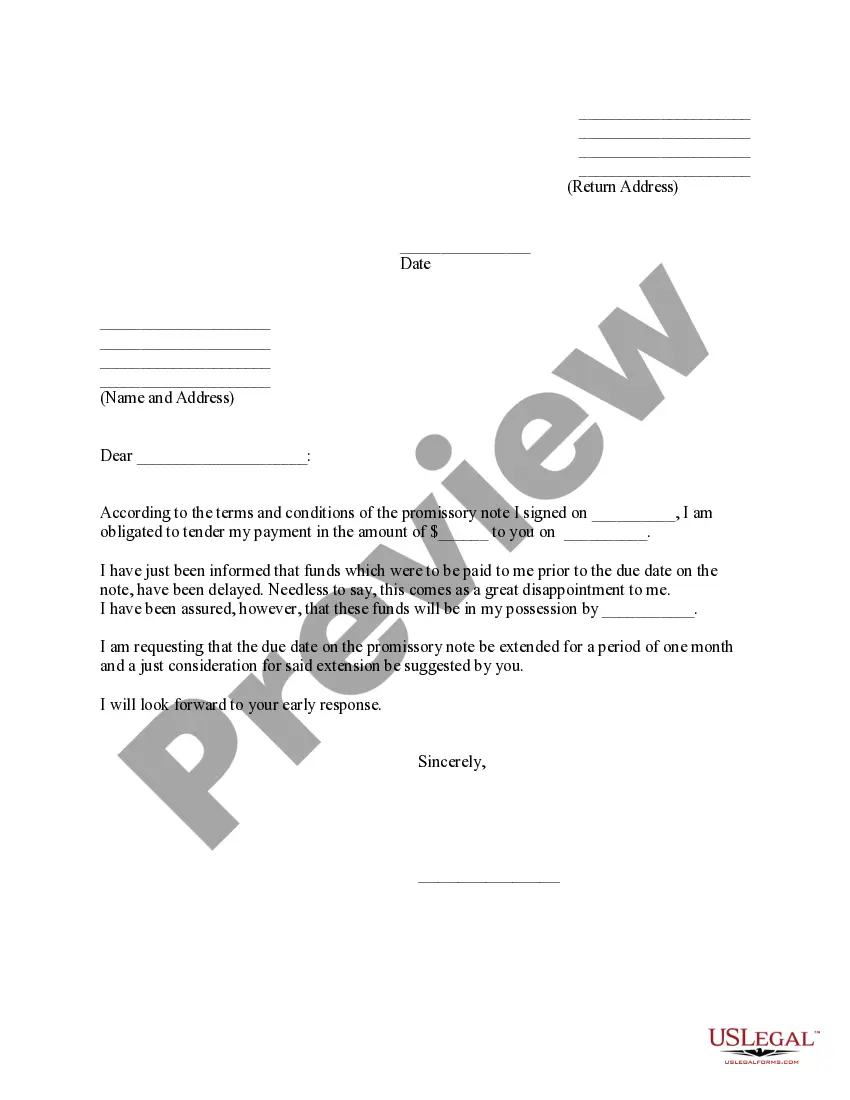

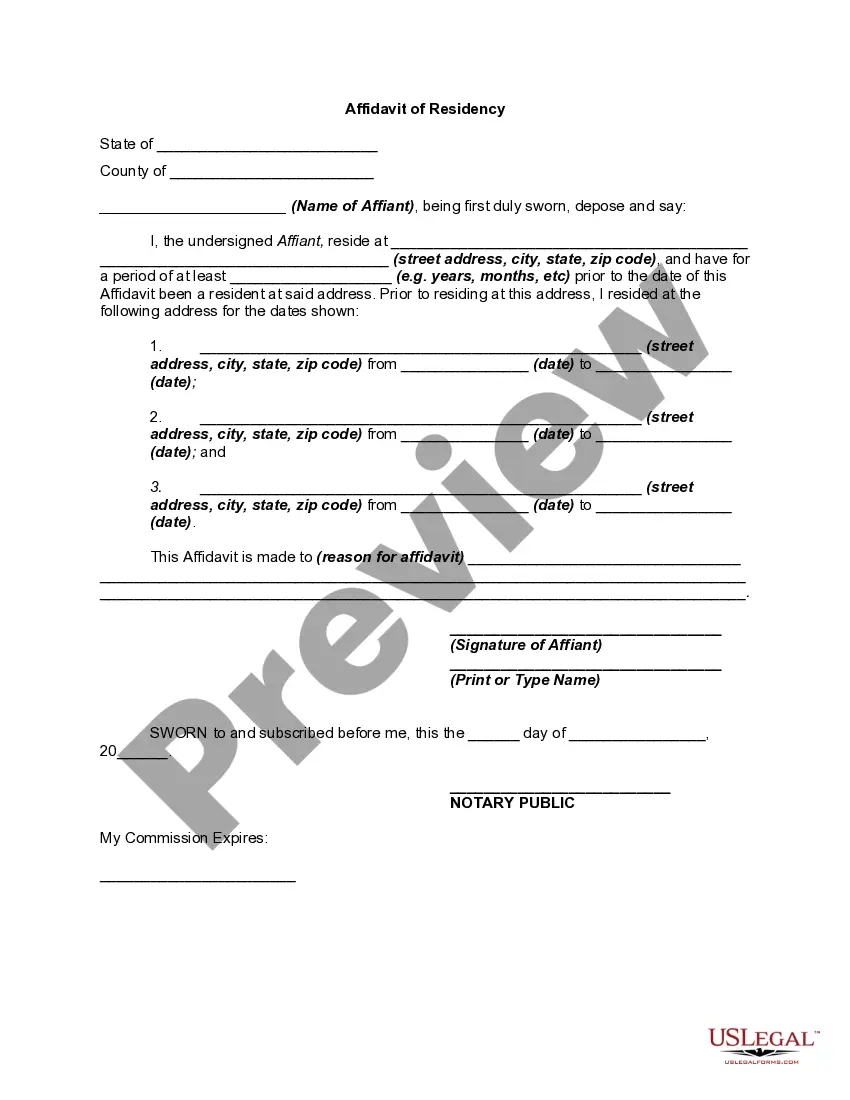

This form is a sample of a request for an extension of time in order to consummate a purchase of real property which will be security for a loan. In effect the loan applicants are asking for an extension of the date of closing set forth in their loan commitment or application.

Oregon Request for Extension of Loan Closing Date

Description

How to fill out Request For Extension Of Loan Closing Date?

US Legal Forms - among the largest libraries of authorized varieties in the States - delivers a wide array of authorized record web templates it is possible to down load or printing. Utilizing the web site, you may get a large number of varieties for organization and person uses, categorized by categories, claims, or keywords and phrases.You will find the latest models of varieties such as the Oregon Request for Extension of Loan Closing Date in seconds.

If you already have a registration, log in and down load Oregon Request for Extension of Loan Closing Date from the US Legal Forms library. The Acquire key will appear on every develop you see. You gain access to all earlier saved varieties from the My Forms tab of the profile.

If you wish to use US Legal Forms for the first time, allow me to share simple instructions to obtain started out:

- Be sure to have picked out the correct develop for your personal area/county. Go through the Preview key to analyze the form`s content. Look at the develop information to ensure that you have chosen the correct develop.

- When the develop doesn`t match your demands, use the Lookup field on top of the screen to discover the the one that does.

- Should you be pleased with the form, confirm your option by simply clicking the Buy now key. Then, pick the pricing prepare you favor and offer your qualifications to register on an profile.

- Process the transaction. Make use of your charge card or PayPal profile to accomplish the transaction.

- Pick the format and down load the form on the device.

- Make changes. Fill up, modify and printing and sign the saved Oregon Request for Extension of Loan Closing Date.

Every single design you included with your bank account does not have an expiry day and is also your own permanently. So, if you want to down load or printing an additional duplicate, just visit the My Forms segment and then click around the develop you need.

Gain access to the Oregon Request for Extension of Loan Closing Date with US Legal Forms, one of the most comprehensive library of authorized record web templates. Use a large number of professional and express-certain web templates that fulfill your small business or person needs and demands.

Form popularity

FAQ

Personal income tax penalties You will owe a 5 percent late-payment penalty on any Oregon tax not paid by the original due date of the return, even if you have filed an extension. If you file more than three months after the due date (including extensions), a 20 percent late-filing penalty will be added.

Personal income tax penalties You will owe a 5 percent late-payment penalty on any Oregon tax not paid by the original due date of the return, even if you have filed an extension. If you file more than three months after the due date (including extensions), a 20 percent late-filing penalty will be added.

The deadline to submit tax returns for 2022, and pay any taxes owed, will be Tuesday, April 18, 2023. The deadline to file Oregon state income tax returns will also move to April 18. The usual deadline of April 15 falls on a Saturday.

Breaking news: Due date for California state tax returns and payments moved to November 16, 2023. Sacramento -- The California Franchise Tax Board today confirmed that most Californians have until November 16, 2023, to file and pay their tax year 2022 taxes to avoid penalties.

Use Publication OR-40-EXT to determine if you need to file for an automatic extension of time for filing an Oregon individual income tax return. Oregon honors all federal automatic six-month extensions of time to file individual income tax returns (federal Form 4868) as valid Oregon extensions.

Note: You don't need to request an Oregon extension unless you owe Oregon tax. If you need an Oregon filing extension, request the extension based upon your extension payment method: Electronic payments. Submit your payment prior to the return due date, selecting the ?Return payment? type.

If you have an approved Federal tax extension (IRS Form 4868), you will automatically receive an Oregon tax extension.

Your 2022 return is due October 16, 2023. An extension of time to file your return is not an extension of time to pay your tax. If you need an extension of time to file and expect to owe Oregon tax, download Publication OR-40-EXT from our forms and publications page for instructions.