This form assumes that the Beneficiary has the right to make such an assignment, which is not always the case. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oregon Notice to Trustee of Assignment by Beneficiary of Interest in Trust

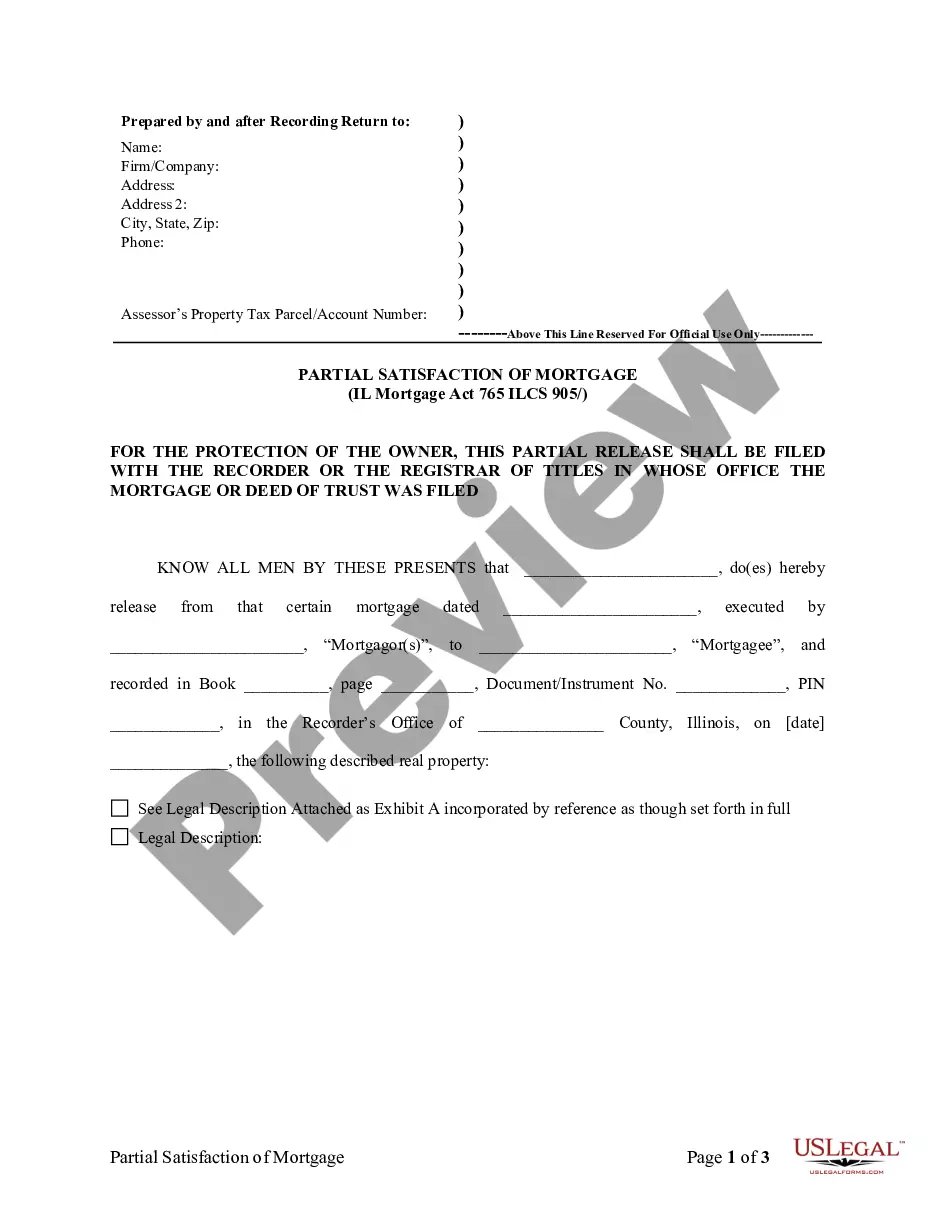

Description

How to fill out Notice To Trustee Of Assignment By Beneficiary Of Interest In Trust?

If you want to compile, retrieve, or create authentic document templates, utilize US Legal Forms, the largest collection of lawful documents available online.

Make use of the site's straightforward and user-friendly search function to find the forms you require.

Various templates for corporate and personal uses are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click on the Buy now button. Choose your preferred payment plan and enter your credentials to register for an account.

Step 5. Complete the transaction. You can utilize your credit card or PayPal account to finish the payment.

- Employ US Legal Forms to obtain the Oregon Notice to Trustee of Assignment by Beneficiary of Interest in Trust in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Obtain button to download the Oregon Notice to Trustee of Assignment by Beneficiary of Interest in Trust.

- You can also access forms you've previously saved in the My documents section of your account.

- If you're using US Legal Forms for the first time, adhere to the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the content of the form. Don’t forget to read the description.

- Step 3. If you're not satisfied with the form, utilize the Search field at the top of the screen to find different models in the legal form database.

Form popularity

FAQ

An assignment to a trust involves transferring benefits or rights from a beneficiary to a trustee. In the context of an Oregon Notice to Trustee of Assignment by Beneficiary of Interest in Trust, this process allows the beneficiary to notify the trustee of the assignment. It is crucial for maintaining clear communication about the rights connected to the trust. Understanding this concept helps ensure that all parties are aware of their roles and responsibilities.

Transferring property to a trust in Oregon involves formally changing the title of the property to reflect the trust's name. This process may include filling out a deed, which must then be recorded with the local county. It's advisable to reference the Oregon Notice to Trustee of Assignment by Beneficiary of Interest in Trust for guidance and to ensure a smooth transfer process.

Yes, beneficiaries in Oregon typically have the right to see the trust document. This access allows them to understand their rights and interests based on the terms set forth within the trust. The Oregon Notice to Trustee of Assignment by Beneficiary of Interest in Trust plays a key role in ensuring beneficiaries receive the necessary information about the trust.

To assign a trustee, you need to create a trust document that clearly states the individual or entity designated as the trustee. Ensure to follow the legal requirements under Oregon law, including the proper execution of the document. Utilizing the Oregon Notice to Trustee of Assignment by Beneficiary of Interest in Trust can help facilitate this assignment efficiently and legally.

In Oregon, a trustee must notify beneficiaries within a reasonable time after the trust is established or after the trustee has received notice of their appointment. This notification is guided by the Oregon Notice to Trustee of Assignment by Beneficiary of Interest in Trust. It is important for beneficiaries to receive timely communication to understand their rights and interests in the trust.

While trusts can provide certain tax benefits, they do not automatically avoid Oregon estate tax. It is crucial to understand the specific provisions within your trust agreement to determine tax implications. Filing an Oregon Notice to Trustee of Assignment by Beneficiary of Interest in Trust can help clarify the relationship between your estate and the trust's assets. Consulting with a tax advisor can help you navigate these complexities effectively.

To place your property into a trust in Oregon, start by drafting the trust document that outlines the terms of the trust. Next, you need to execute a deed transferring the title of your property to the trust. Filing the Oregon Notice to Trustee of Assignment by Beneficiary of Interest in Trust with the appropriate authorities can help formalize this transfer. Seeking guidance from a legal professional can simplify this process and provide clarity.

One significant mistake parents often make when setting up a trust fund is neglecting to keep their beneficiaries informed. Failing to communicate the terms and intentions behind the trust can lead to confusion or disputes later. Additionally, not filing an Oregon Notice to Trustee of Assignment by Beneficiary of Interest in Trust might result in complications regarding asset distributions. Being proactive in this process can prevent misunderstandings and ensure smooth management.