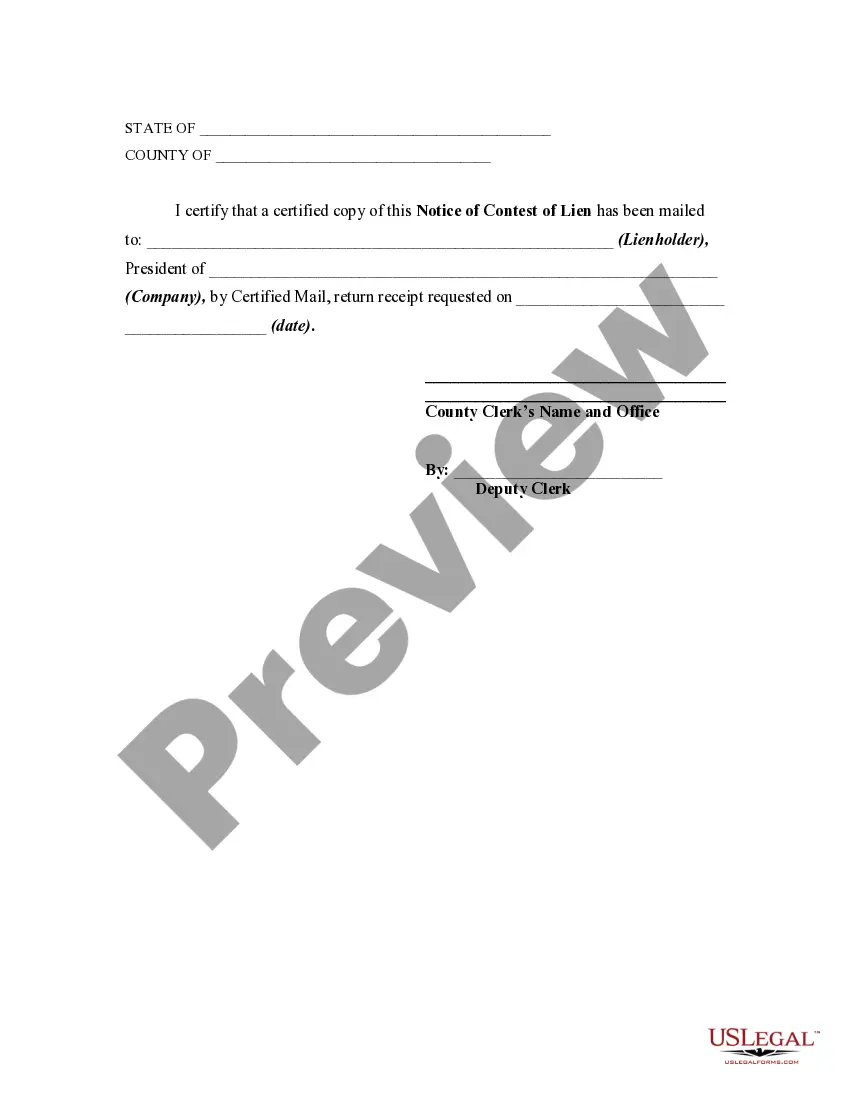

This form is a sample of a notice contesting a lien that has been recorded in the office of the appropriate county official.This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oregon Notice of Contest of Lien

Description

How to fill out Notice Of Contest Of Lien?

Are you presently in a placement the place you need to have paperwork for sometimes company or person uses almost every time? There are tons of legitimate file templates available on the net, but locating versions you can trust is not straightforward. US Legal Forms offers thousands of kind templates, just like the Oregon Notice of Contest of Lien, that are composed to satisfy federal and state requirements.

If you are previously informed about US Legal Forms web site and have your account, merely log in. Next, you are able to down load the Oregon Notice of Contest of Lien format.

If you do not provide an accounts and would like to start using US Legal Forms, adopt these measures:

- Find the kind you will need and make sure it is to the appropriate metropolis/county.

- Take advantage of the Review button to review the form.

- See the explanation to actually have selected the proper kind.

- In case the kind is not what you`re trying to find, utilize the Search discipline to discover the kind that meets your needs and requirements.

- If you discover the appropriate kind, just click Acquire now.

- Choose the pricing program you desire, fill in the specified details to generate your account, and buy an order with your PayPal or Visa or Mastercard.

- Select a hassle-free data file file format and down load your backup.

Discover all of the file templates you have purchased in the My Forms menu. You can obtain a extra backup of Oregon Notice of Contest of Lien any time, if needed. Just click on the essential kind to down load or printing the file format.

Use US Legal Forms, the most comprehensive variety of legitimate varieties, to save lots of some time and prevent errors. The assistance offers appropriately manufactured legitimate file templates which you can use for a range of uses. Create your account on US Legal Forms and begin creating your way of life easier.

Form popularity

FAQ

In Oregon, construction liens generally need to be recorded within 75 days from the date the project was substantially completed, or 75 days from the date that the lien claimant stopped providing labor, material, equipment, or services, whichever hap- pened first.

In Oregon, construction liens generally need to be recorded within 75 days from the date the project was substantially completed, or 75 days from the date that the lien claimant stopped providing labor, material, equipment, or services, whichever hap- pened first.

How long does a judgment lien last in Oregon? A judgment lien in Oregon will remain attached to the debtor's property (even if the property changes hands) for ten years.

A right to lien notice, also known as a preliminary notice, is a notification of services, equipment, or other labor that you're providing to a property without having a direct contract with the property's owner (i.e., being a subcontractor).

Statute of Limitation on Tax Collection However, the statute of 10 years limitation on judgment liens begins to run on a tax lien as soon as the tax warrant is filed pursuant to ORS 314.430. Such lien may be renewed by court order without loss of priority.

Under Oregon's laws, those who work on your property or provide labor, equipment, services or materials and are not paid have a right to enforce their claim for payment against your property. This claim is known as a construction lien.

The notice of right to a lien may be given at any time during the progress of the improvement, but the notice only protects the right to perfect a lien for materials, equipment and labor or services provided after a date which is eight days, not including Saturdays, Sundays and other holidays as defined in ORS 187.010, ...

Either the property owner pays the amount you are owed, or you may file a lawsuit to foreclose the lien. Within 120 days of the date you recorded the lien, you must bring a lawsuit to foreclose on the lien. The lien will become invalid after 120 days if a court action is not filed.