Oregon Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises

Description

How to fill out Letter Tendering Payment In Order To Obtain Release Of Mortgaged Premises?

Are you presently within a position that you need to have papers for possibly company or person purposes virtually every day time? There are a lot of lawful record layouts accessible on the Internet, but getting versions you can depend on isn`t easy. US Legal Forms offers 1000s of develop layouts, much like the Oregon Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises, which are created in order to meet state and federal needs.

If you are presently knowledgeable about US Legal Forms website and have a free account, merely log in. Following that, it is possible to download the Oregon Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises design.

Should you not have an profile and would like to begin using US Legal Forms, abide by these steps:

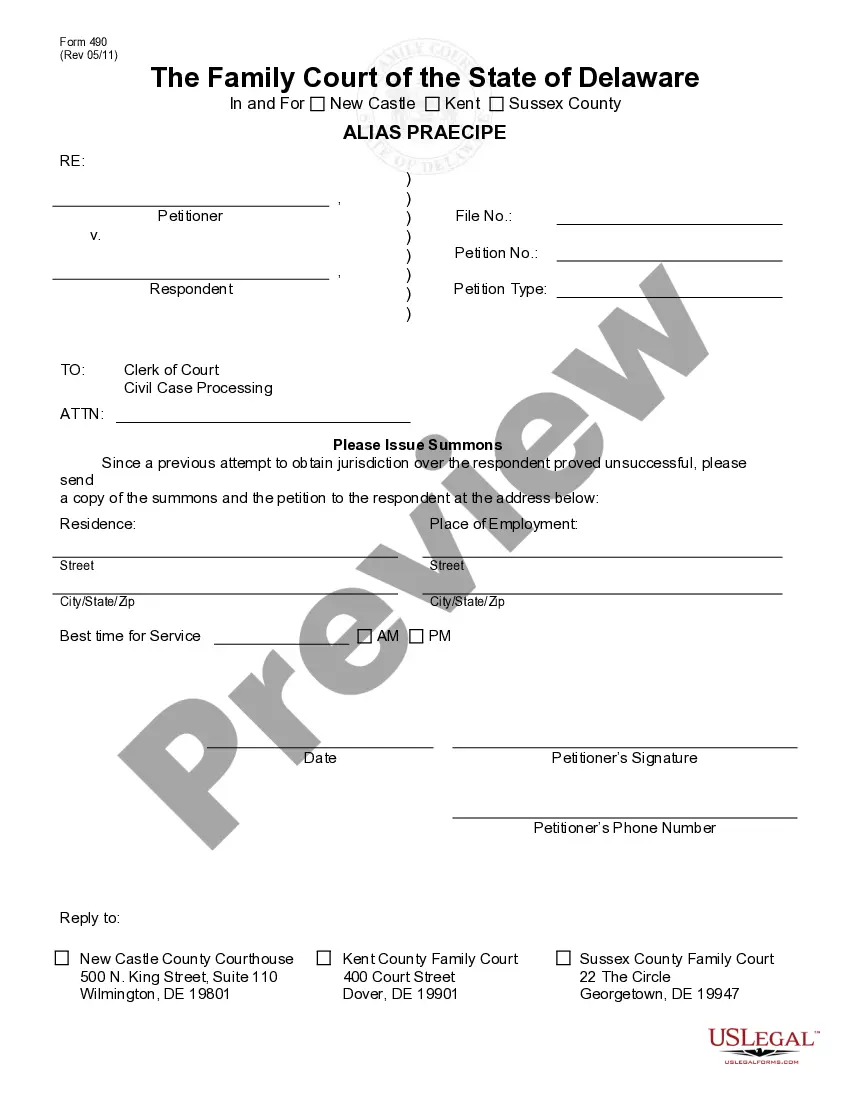

- Obtain the develop you need and ensure it is to the right metropolis/county.

- Use the Preview key to examine the shape.

- Read the information to ensure that you have chosen the correct develop.

- In case the develop isn`t what you`re searching for, take advantage of the Research field to get the develop that meets your needs and needs.

- If you obtain the right develop, just click Get now.

- Choose the prices prepare you would like, fill out the desired information to produce your account, and pay for an order utilizing your PayPal or Visa or Mastercard.

- Select a convenient data file formatting and download your version.

Locate all the record layouts you possess bought in the My Forms food selection. You can get a additional version of Oregon Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises at any time, if needed. Just click on the essential develop to download or produce the record design.

Use US Legal Forms, the most extensive assortment of lawful forms, to save lots of efforts and avoid mistakes. The assistance offers skillfully made lawful record layouts which you can use for a variety of purposes. Produce a free account on US Legal Forms and commence creating your way of life easier.

Form popularity

FAQ

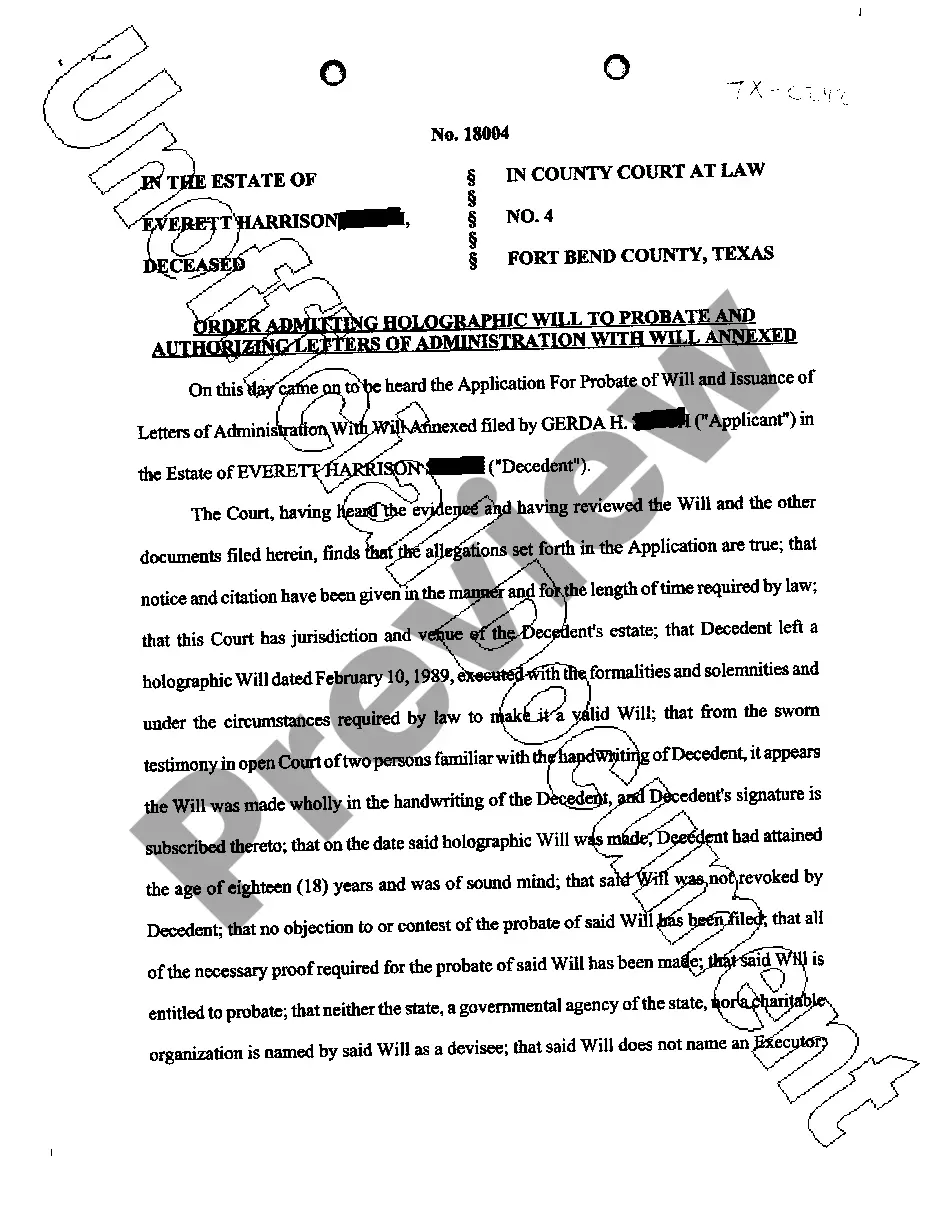

A deed of reconveyance is issued to borrowers once a mortgage loan has been paid in full. The document is created by the lender, is notarized, includes a legal description of the property, and is recorded in the county where the property is located.

A deed of reconveyance, also known as a satisfaction of mortgage, is a document that proves you've paid off your mortgage. The deed of reconveyance releases the lien the mortgage lender placed on your property.

A Satisfaction of Mortgage and a Deed of Reconveyance are essentially the same thing.

A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.

?This document is called a mortgage satisfaction or deed of reconveyance depending on the state,? says Megan Hernandez, director of Marketing and Public Relations at the American Land Title Association. In California, the deed of reconveyance is known as a full reconveyance form.

Once you've repaid your loan in full, your lender contacts the title company to issue a deed of reconveyance in its proper form ing to state law. This generally occurs within 3 ? 4 weeks of your final payment.

Receive mortgage documents: The mortgage company will send you a canceled promissory note, updated deed of trust and certificate of satisfaction. These documents prove that your mortgage is paid off. Save them in a secure location.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.