US Legal Forms - one of the biggest libraries of legitimate varieties in the United States - offers a wide array of legitimate file templates you can download or produce. Using the site, you will get a huge number of varieties for business and person functions, sorted by classes, says, or search phrases.You can get the latest variations of varieties much like the Oregon Plan of Liquidation and Dissolution of a Corporation within minutes.

If you currently have a registration, log in and download Oregon Plan of Liquidation and Dissolution of a Corporation through the US Legal Forms local library. The Download option will show up on every single develop you see. You have access to all earlier delivered electronically varieties within the My Forms tab of the account.

In order to use US Legal Forms the first time, here are simple instructions to help you began:

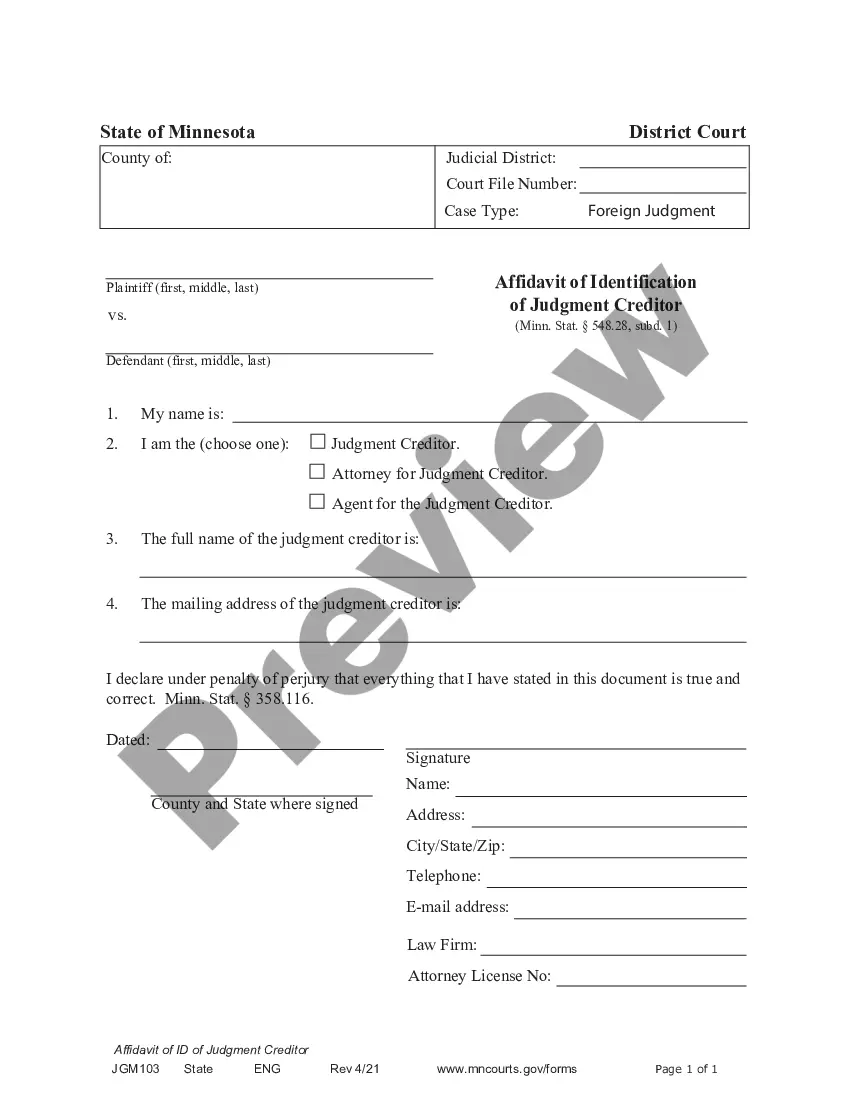

- Make sure you have selected the proper develop for the area/state. Click the Review option to analyze the form`s content. Look at the develop explanation to actually have selected the correct develop.

- When the develop doesn`t satisfy your specifications, take advantage of the Research discipline on top of the monitor to discover the one that does.

- If you are satisfied with the form, validate your choice by clicking on the Purchase now option. Then, pick the prices plan you prefer and offer your credentials to register for an account.

- Method the transaction. Use your bank card or PayPal account to complete the transaction.

- Pick the structure and download the form on your own system.

- Make adjustments. Fill up, edit and produce and sign the delivered electronically Oregon Plan of Liquidation and Dissolution of a Corporation.

Every web template you included with your bank account lacks an expiry time which is yours forever. So, if you would like download or produce yet another backup, just go to the My Forms segment and click about the develop you will need.

Gain access to the Oregon Plan of Liquidation and Dissolution of a Corporation with US Legal Forms, the most comprehensive local library of legitimate file templates. Use a huge number of specialist and condition-particular templates that fulfill your organization or person requires and specifications.