Oregon Stock Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Stock Dividend - Resolution Form - Corporate Resolutions?

If you need to finalize, obtain, or print legal document templates, utilize US Legal Forms, the premier collection of legal documents available online.

Leverage the site’s straightforward and convenient search feature to find the documents you seek.

A range of templates for business and personal purposes is organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other versions of the legal document template.

Step 4. Once you have located the form you desire, click the Purchase now button. Select your preferred payment plan and enter your information to register for the account.

- Utilize US Legal Forms to locate the Oregon Stock Dividend - Resolution Form - Corporate Resolutions in just a few clicks.

- If you are an existing US Legal Forms user, sign in to your account and then click the Download button to obtain the Oregon Stock Dividend - Resolution Form - Corporate Resolutions.

- You can also access forms you previously acquired within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions listed below.

- Step 1. Ensure you have selected the form for the correct city/state.

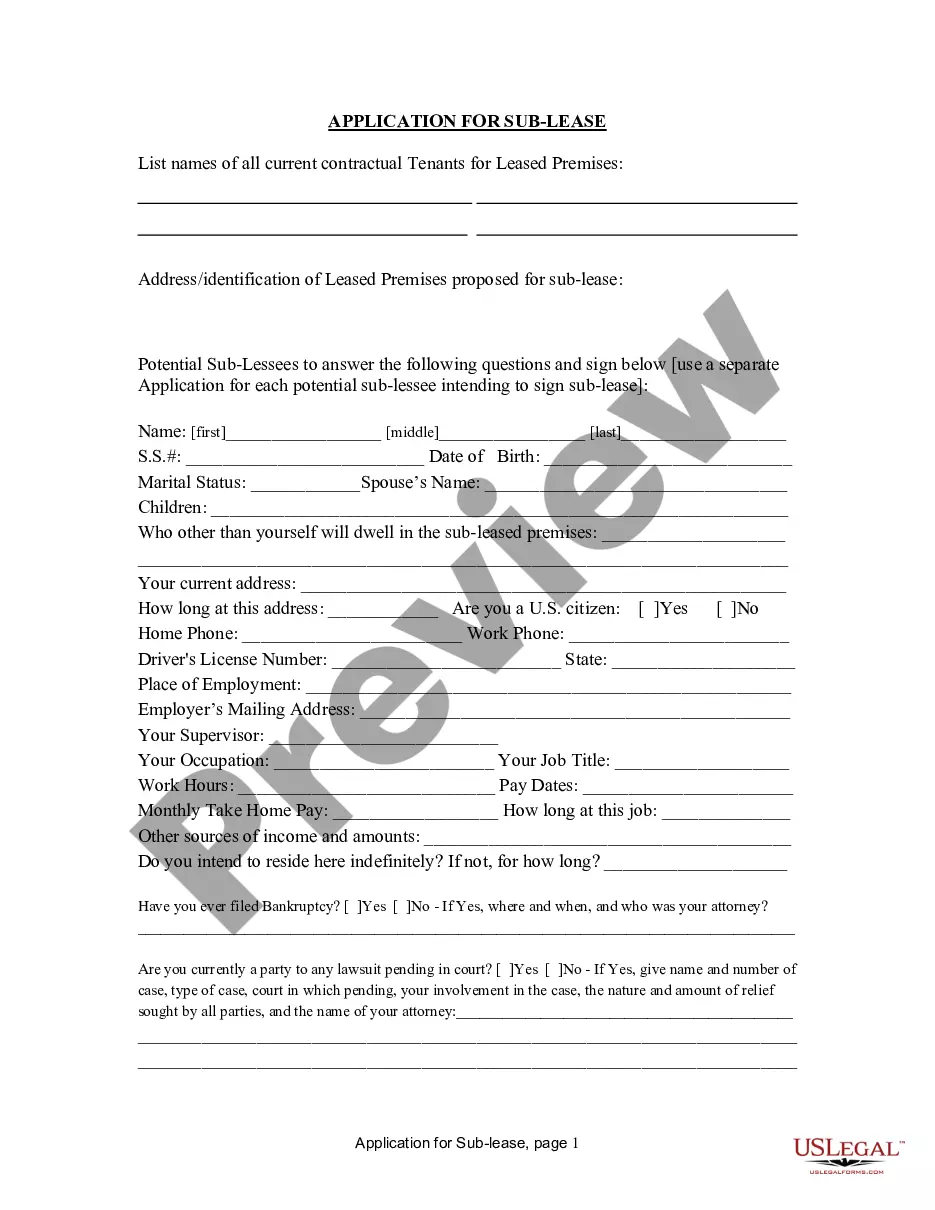

- Step 2. Use the Review option to examine the form’s content. Make sure to read the summary.

Form popularity

FAQ

A resolution form is a document that outlines decisions made by a corporation’s board or shareholders and officially signifies their agreements. This form not only provides clarity but also serves as a legal record of the decisions taken. Utilizing the Oregon Stock Dividend - Resolution Form - Corporate Resolutions ensures that these decisions are captured correctly and comply with Oregon law.

A corporate resolution to authorize signature is a document that grants specific individuals the power to sign documents on behalf of the corporation. This could pertain to financial transactions, contracts, or other business affairs. The Oregon Stock Dividend - Resolution Form - Corporate Resolutions can effectively capture these important authorizations for your records.

Yes, Oregon has established laws that govern various aspects of business operations, including corporate structures and regulations. These laws ensure that businesses operate fairly and responsibly within the state. Understanding these regulations can be simplified by using tools like the Oregon Stock Dividend - Resolution Form - Corporate Resolutions.

To register as an S Corp in Oregon, you must first file your Articles of Incorporation with the Oregon Secretary of State. After incorporation, you need to submit IRS Form 2553 to elect S Corporation status. Utilizing resources such as the Oregon Stock Dividend - Resolution Form - Corporate Resolutions can assist in managing your corporate governance and compliance as an S Corp.

Another name for a corporate resolution is a corporate action. This term describes the official decision or action taken by a corporation's board or shareholders. The Oregon Stock Dividend - Resolution Form - Corporate Resolutions serves as an essential tool in documenting these corporate actions clearly and effectively.

Yes, Oregon requires most businesses to obtain a business license. This applies to a variety of entities, including corporations and nonprofits. For your convenience, understanding obligations through resources like the Oregon Stock Dividend - Resolution Form - Corporate Resolutions can aid in the process of compliance.

In Oregon, a nonprofit corporation must have at least three board members who are not related to each other. This requirement ensures diverse perspectives and governance within the organization. When drafting necessary documents, such as resolutions, using the Oregon Stock Dividend - Resolution Form - Corporate Resolutions makes compliance easier.

A shareholder resolution document is a formal proposal put forth by shareholders intended to direct the company’s board to take specific actions or implement changes. Such resolutions are crucial for promoting shareholder engagement and accountability. Utilizing the Oregon Stock Dividend - Resolution Form - Corporate Resolutions helps facilitate these important decisions effectively.

A corporate resolution serves to document decisions made by a corporation’s board of directors or shareholders. This formal documentation often outlines the intentions regarding business actions, such as the issuance of stock dividends. Using the Oregon Stock Dividend - Resolution Form - Corporate Resolutions can streamline this process, ensuring legality and clarity.

A corporate resolution form is an official document that records the decisions and actions taken by a corporation's board. This form is crucial for various corporate activities, such as approving the Oregon Stock Dividend - Resolution Form - Corporate Resolutions. By using this form, businesses ensure adherence to legal requirements and clarity in their operations, providing a reliable reference for future decisions and actions.