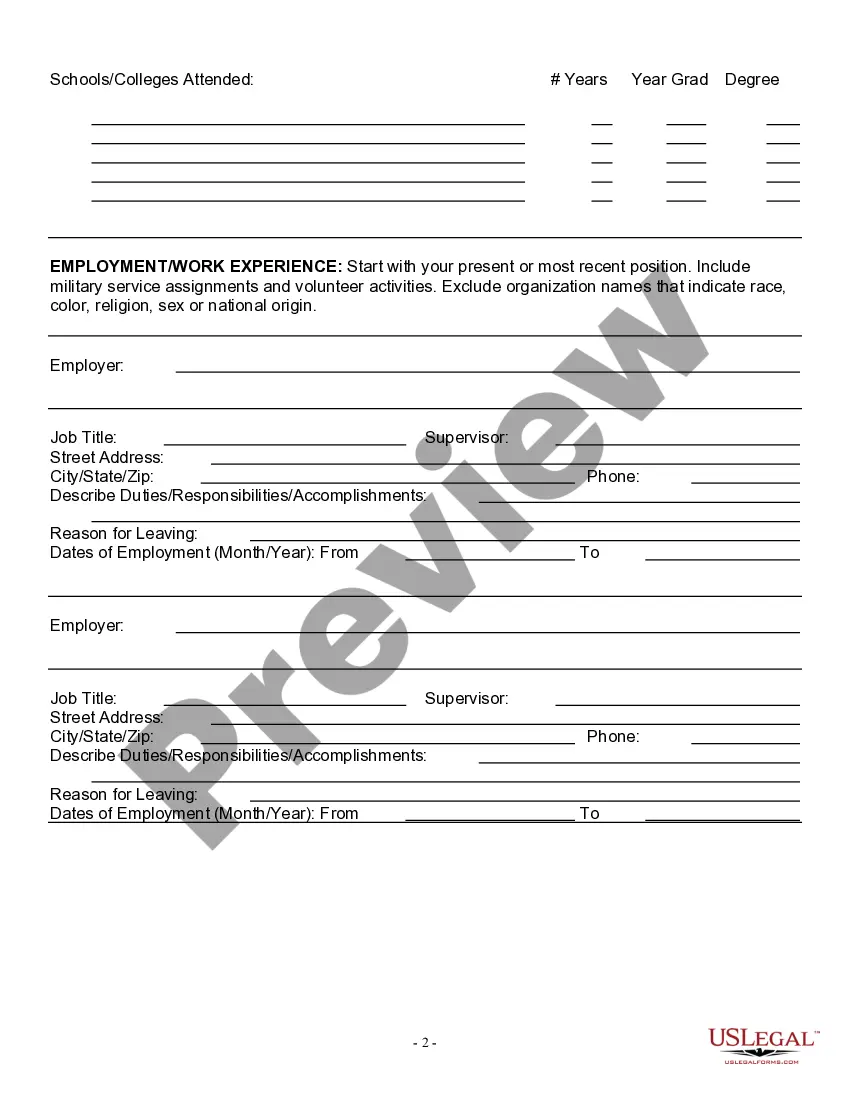

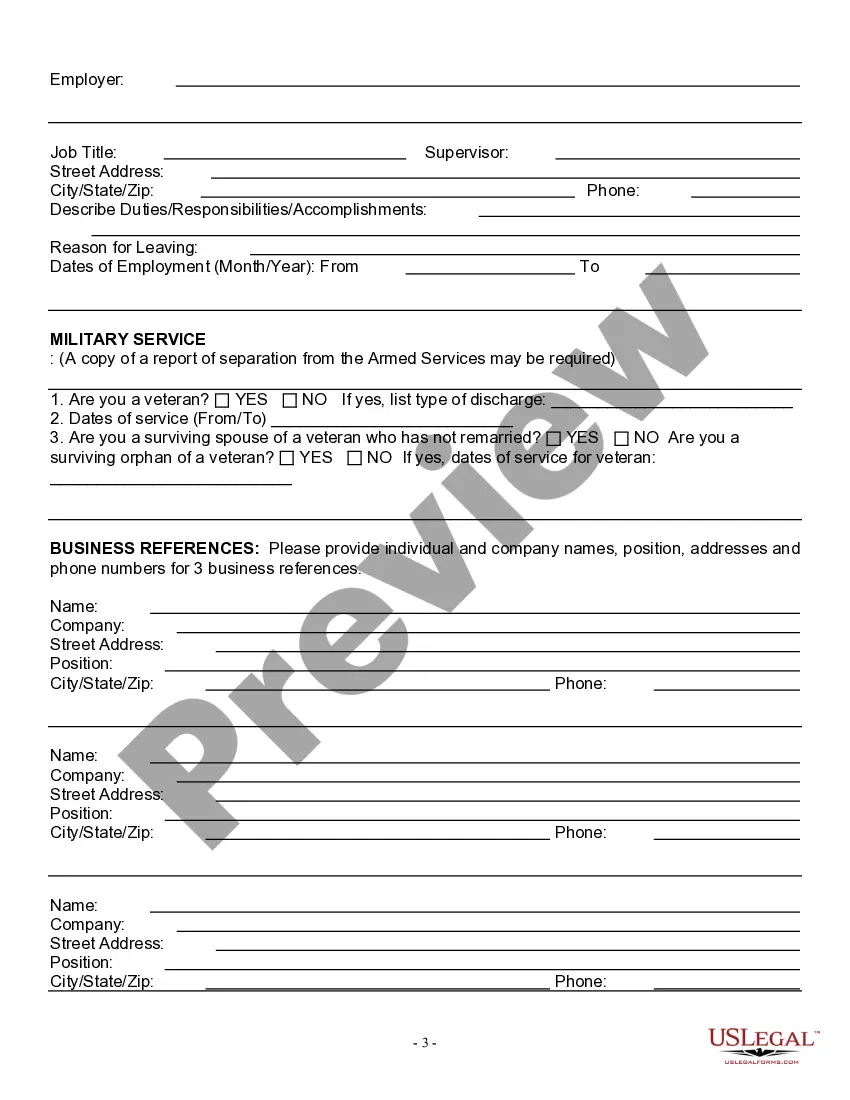

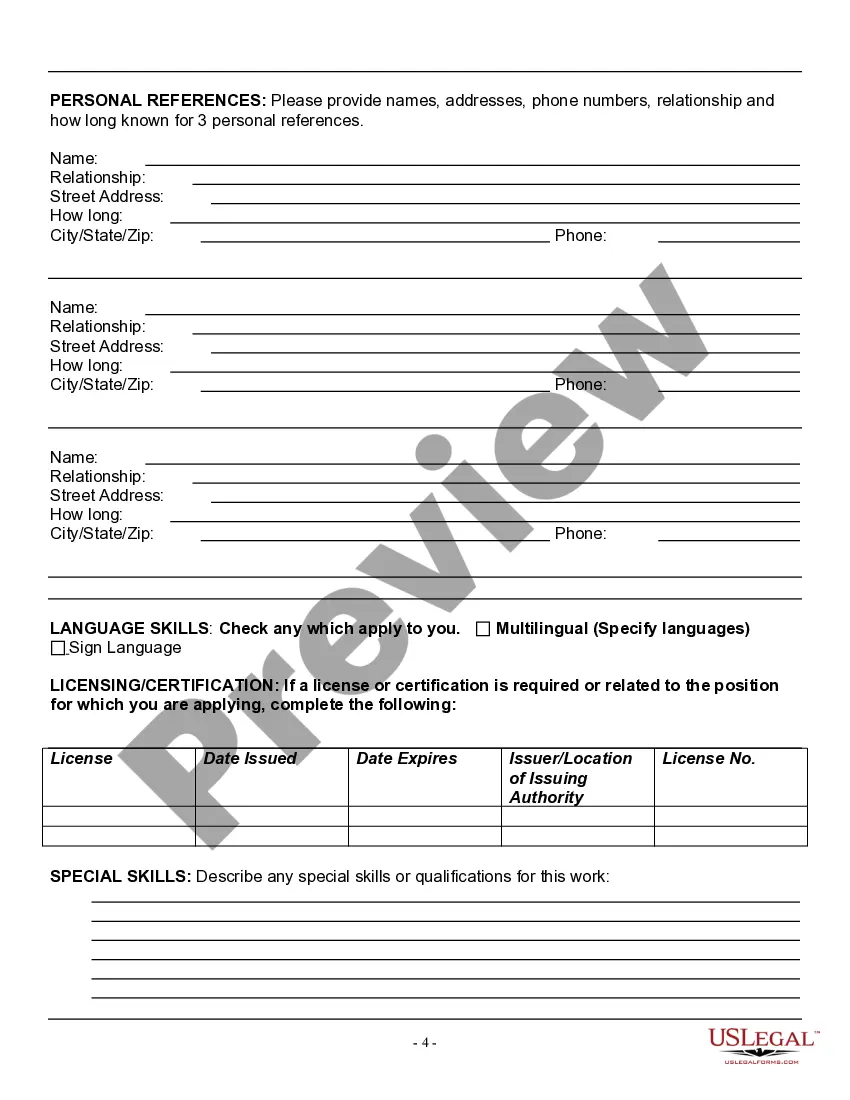

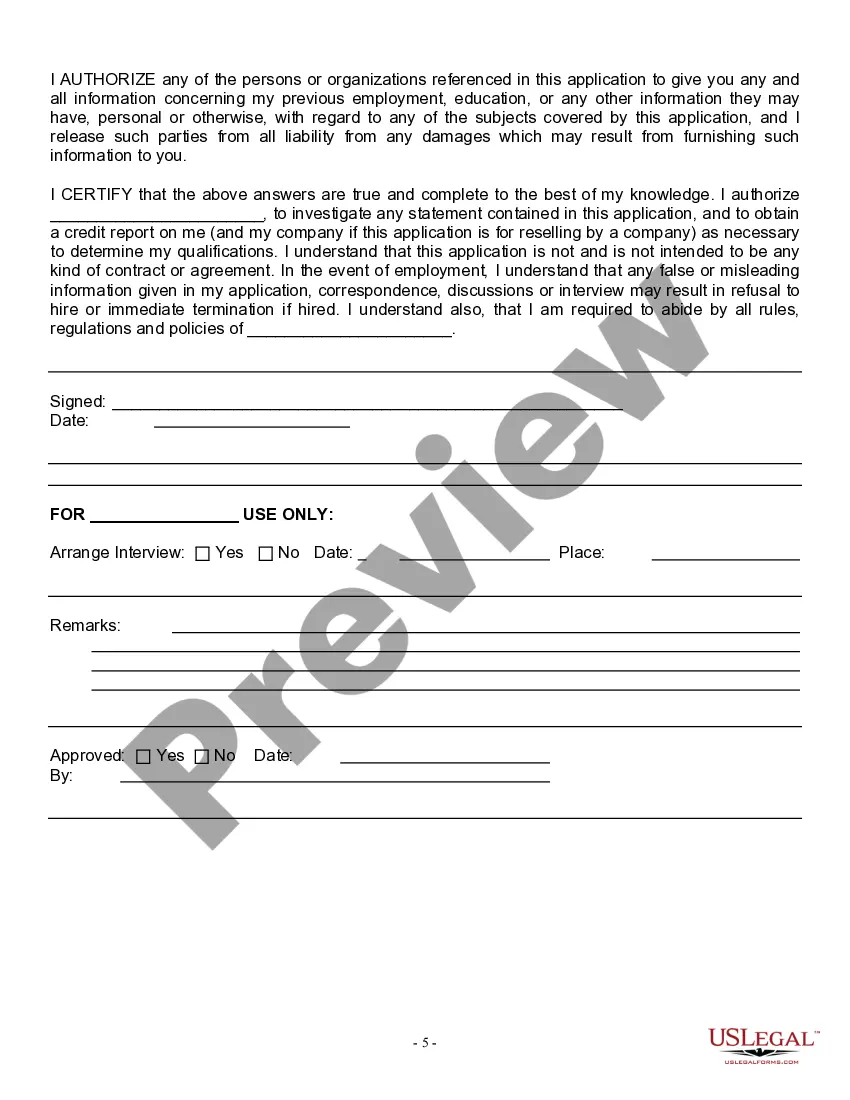

Oregon Employment Application for Labourer

Description

How to fill out Employment Application For Labourer?

Are you currently in a situation where you require documents for both business or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding ones that you can rely on is not easy.

US Legal Forms offers a vast collection of form templates, such as the Oregon Employment Application for Laborer, that are designed to comply with state and federal regulations.

Once you find the correct form, click Get now.

Choose the pricing plan you want, fill out the requested information to create your account, and pay for your order using PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Oregon Employment Application for Laborer template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and make sure it is for your specific city/state.

- Utilize the Preview button to inspect the form.

- Examine the details to ensure you have selected the correct form.

- If the form is not what you are seeking, use the Search field to find the form that fits your needs.

Form popularity

FAQ

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Newly hired employees must complete and sign Section 1 of Form I-9 no later than the first day of employment. Generally, only unexpired, original documentation is acceptable (i.e., driver license or passport). The only exception is that an employee may present a certified copy of a birth certification.

They could determine the size and delivery of your paycheck, for example.5 forms to complete when starting a new job. You might be wondering why you need to be prepared for your new-hire paperwork.I-9 documents.W-4 form.Direct deposit form.Benefits enrollment.Company-specific paperwork.

Required Employment Forms in OregonSigned Job Offer Letter.W2 Tax Form.I-9 Form and Supporting Documents.Direct Deposit Authorization Form (Template)Federal W-4 Form.Employee Personal Data Form (Template)Company Worker's Compensation Insurance Policy Forms.Company Health Insurance Policy Forms.More items...?

If you have more than one job a W-2 payroll job for an employer and a 1099 self-employed job apply for unemployment benefits if you earned more than $1,000 or worked more than 500 hours at your W-2 job in the last 18 months.

Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

There are two ways to apply:Online. The fastest way to apply is through our Online Claim System200b. For regular unemployment insurance (UI) benefits, you will fill out an online form.By phone. You can also apply over the phone. Right now a lot of people are calling, so you may have to wait on hold.

Independent contractors cannot use the wages they earn to qualify for unemployment insurance benefits when they are unemployed. 6. Independent contractors are generally not eligible for other employment benefits, such as health insurance and pension plans.

File an unemployment claim 200bUse the Contact Us form or visit unemployment.oregon.gov. Looking for work? WorkSource Oregon can help you find a job, training and other free resources. 200b200b200b200b200bWe have helped more than 1500 Oregonians receiving unemployment insurance (UI) benefits successfully start their own business.

Please visit our website at: to submit your weekly claim report through the Online Claim System. From the homepage, select Use the Online Claim System. From the Online Claim System menu, please select Pandemic Unemployment Assistance.