Oregon Instructions are the official guidelines for processing and managing cases within the state of Oregon. They provide the framework and procedures for case management in the state of Oregon, such as filing forms, collecting evidence, conducting investigations, preparing reports, and making court decisions. The main types of Oregon Instructions are: 1. Oregon Administrative Rules (Oars): Oars are the legal basis for the Oregon Instructions and provide the general rules for case management. 2. Oregon Manual of Procedures (MOP): The MOP provides detailed instructions on how to process and manage cases in Oregon. It includes instructions on filing forms, collecting evidence, conducting investigations, preparing reports, and making court decisions. 3. Oregon Practice Book: The Oregon Practice Book provides guidance on how to apply the Oregon Instructions in practice. It contains sample forms, templates, and practice tips for case management. 4. Oregon Jurisprudence Manual (OEM): The OEM provides an overview of Oregon law and provides guidance on how to interpret the Oregon Instructions. It also contains sample forms and practice tips for case management. 5. Oregon Criminal Law Manual (CLM): The CLM provides an overview of Oregon criminal law and provides guidance on how to apply the Oregon Instructions in criminal cases. It also contains sample forms and practice tips for case management.

Oregon Instructions

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Oregon Instructions?

If you’re searching for a way to appropriately prepare the Oregon Instructions without hiring a legal professional, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every private and business scenario. Every piece of paperwork you find on our web service is drafted in accordance with nationwide and state regulations, so you can be certain that your documents are in order.

Adhere to these straightforward instructions on how to get the ready-to-use Oregon Instructions:

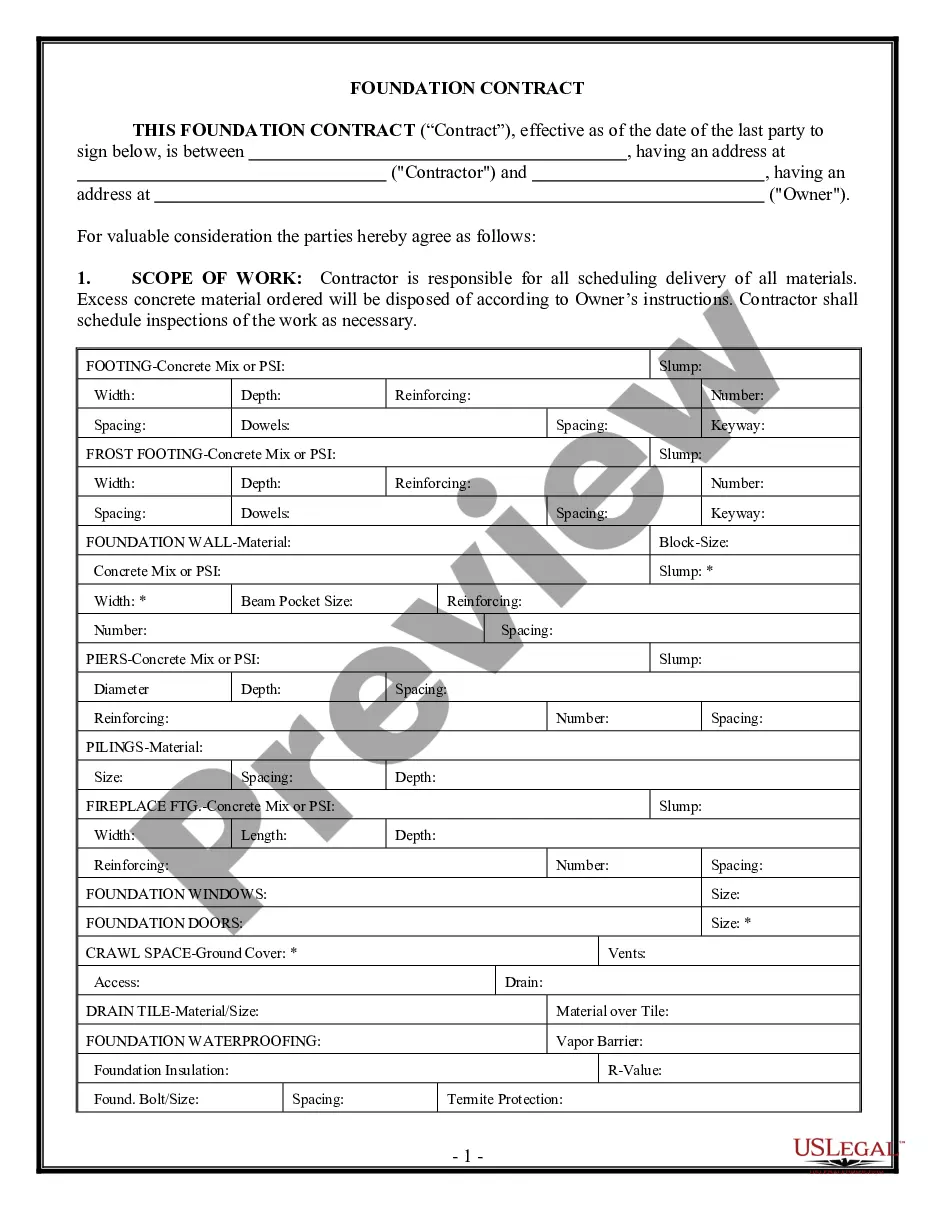

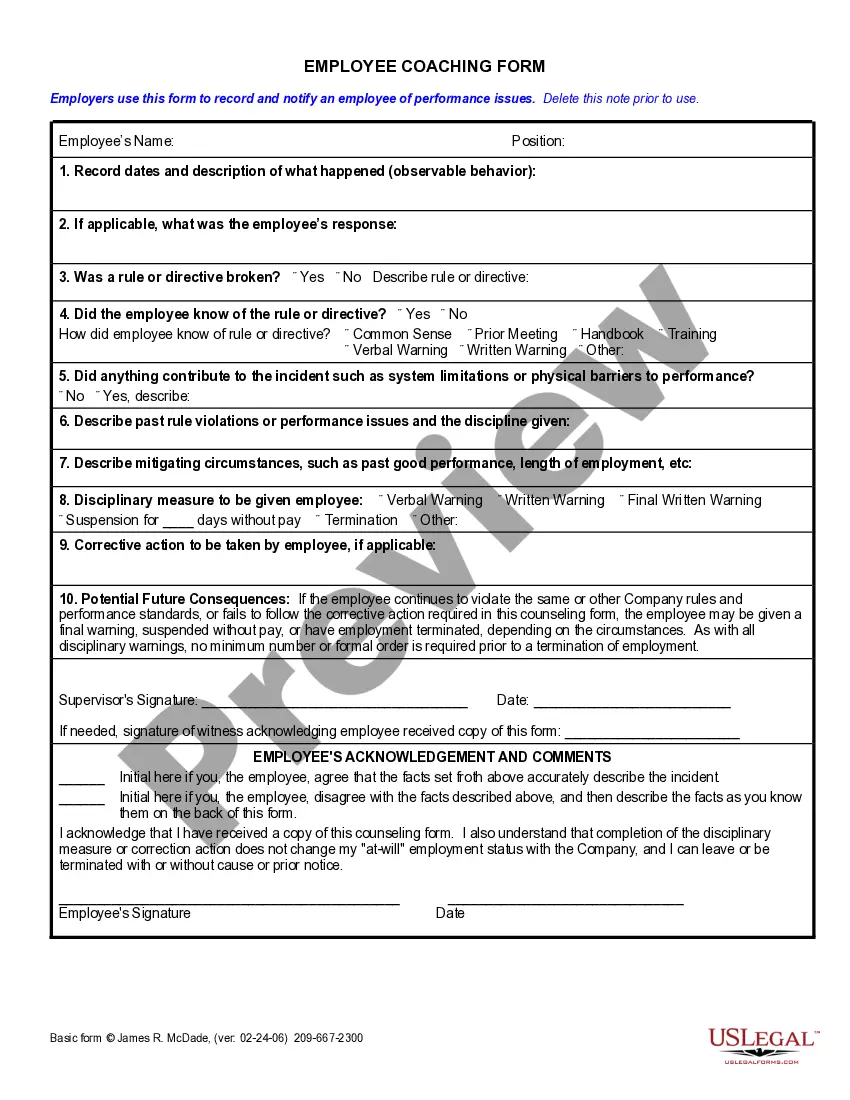

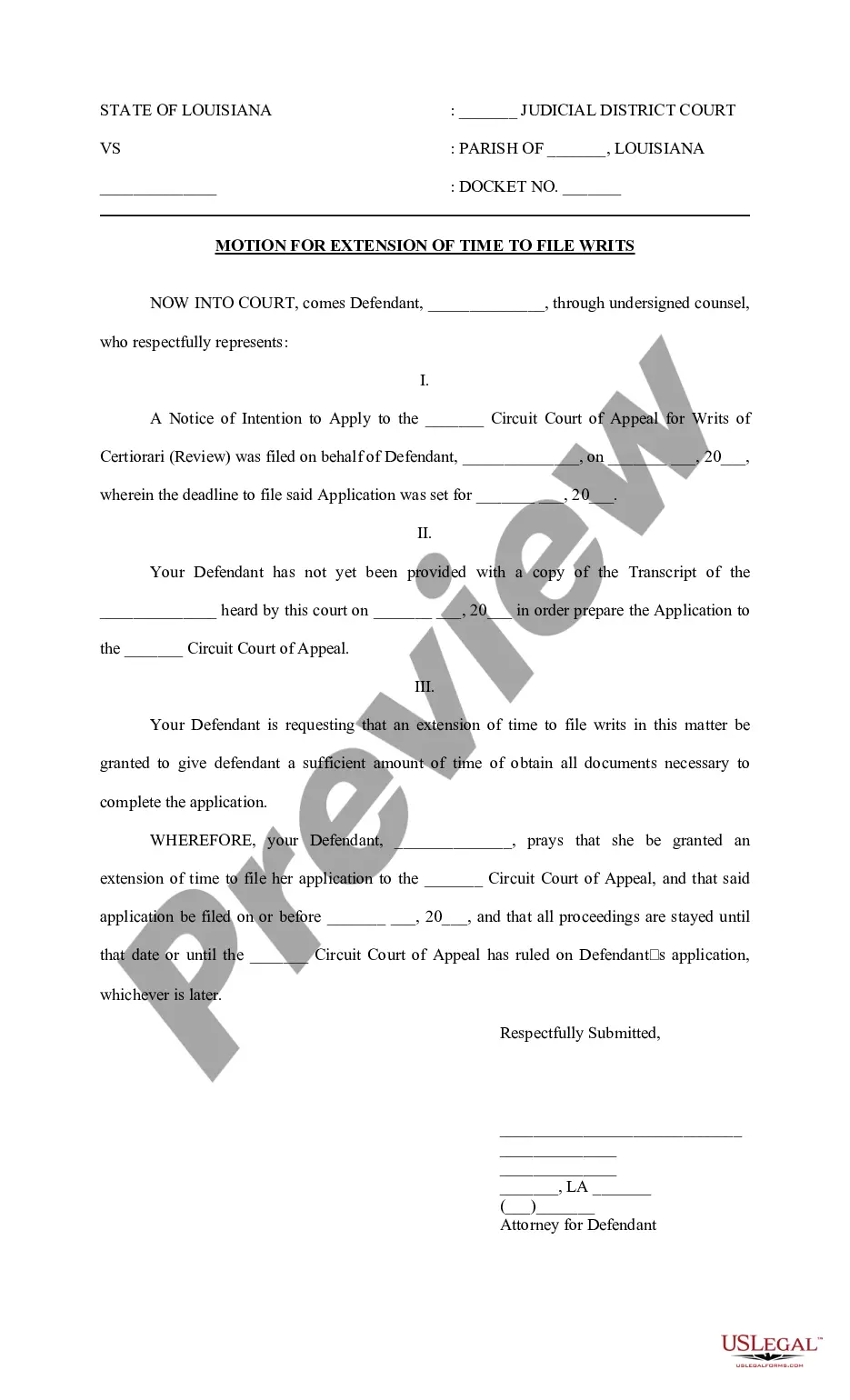

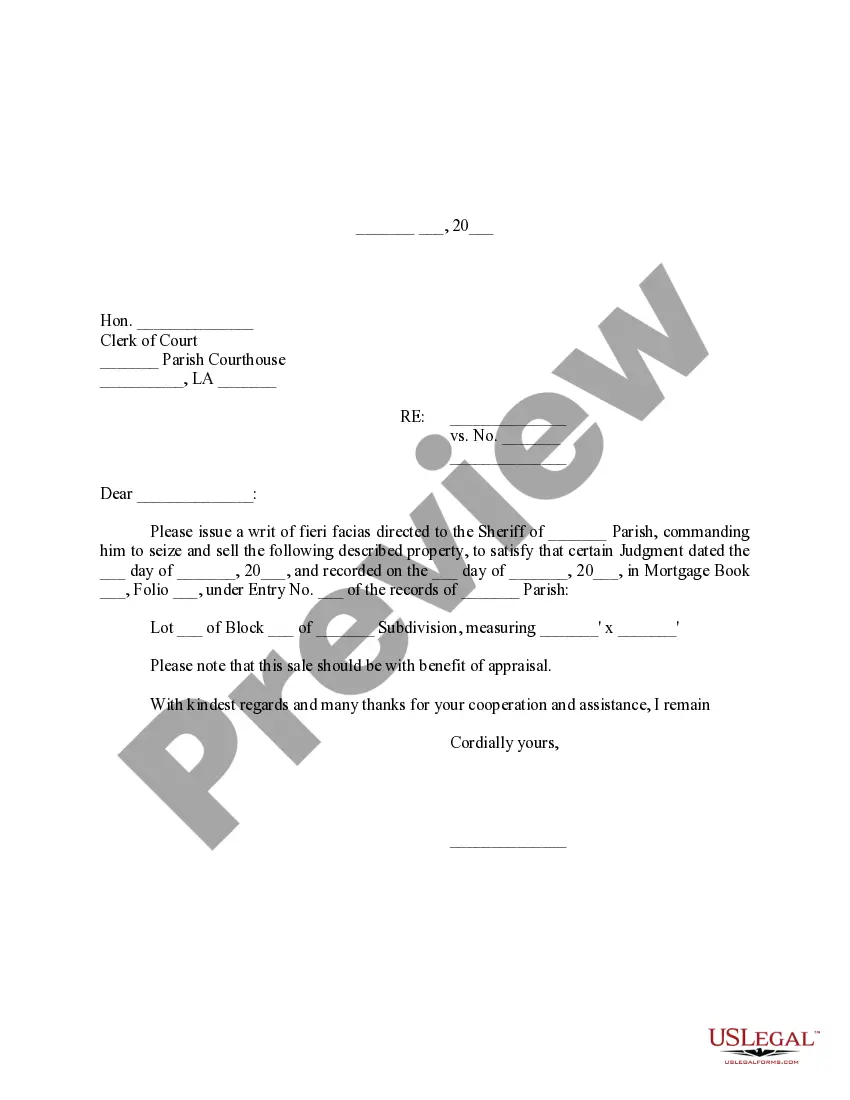

- Ensure the document you see on the page corresponds with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Type in the form title in the Search tab on the top of the page and select your state from the list to locate another template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Create an account with the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your Oregon Instructions and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it quickly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

Waiver of Penalty In 2021 or 2022, you retired after reaching age 62 or became disabled, and your underpayment was due to reasonable cause (and not willful neglect); or. The underpayment was due to a casualty, disaster, or other unusual circumstance, and it would be inequitable to impose the penalty.

Form OR-40N Instructions requires you to list multiple forms of income, such as wages, interest, or alimony . We last updated the Individual Income Tax Return Instructions for Nonresident / Part-year Resident in January 2023, so this is the latest version of Form OR-40N Instructions, fully updated for tax year 2022.

So, you will owe a total penalty of 25 percent of any tax not paid.

For the 2021 tax year, Oregon's standard deduction allows taxpayers to reduce their taxable income by $2,350 for single filers, $4,700 for those married filing jointly, $3,780 for heads of household, and $4,700 for qualifying widowers.

Use Form OR-40 if you're a full-year Oregon resident. Use Form OR-40-P if any ONE of the following is true: You're a part-year resident. You're filing jointly and one of you is a full-year Ore- gon resident and the other is a part-year resident.

Substantial Understatement Penalty (SUP) The penalty is equal to 20 percent of the amount of any underpayment of net tax attributable to the understatement.

How to Avoid an Underpayment Penalty Your tax return shows you owe less than $1,000. You paid 90% or more of the tax that you owed for the taxable year or 100% of the tax that you owed for the year prior, whichever amount is less8.

Underpayment interest won't be charged if: During 2021 or 2022, you retired at age 62 or older or became disabled; and ? There was reasonable cause for underpaying your esti- mated tax. Reasonable cause is determined on a case-by-case basis.