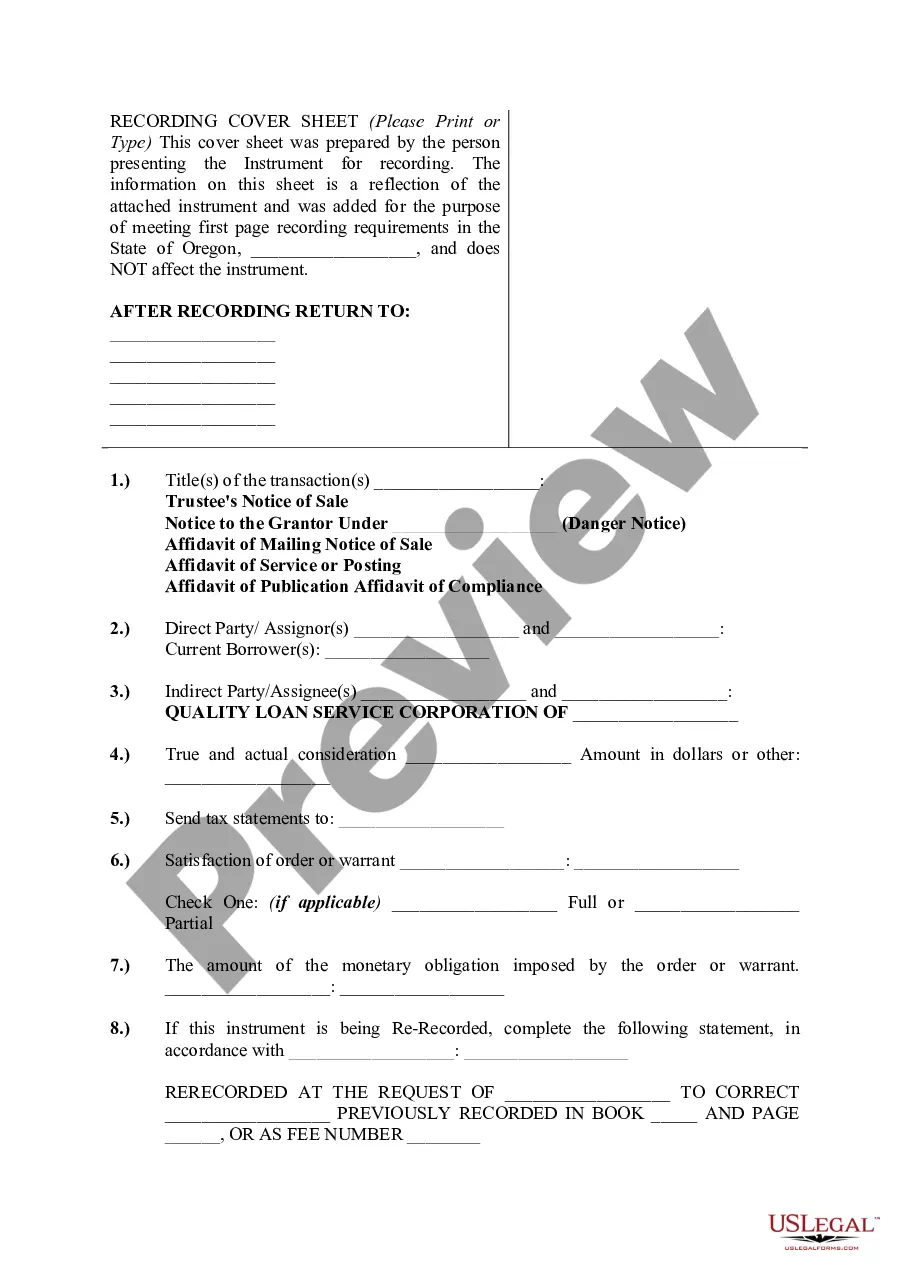

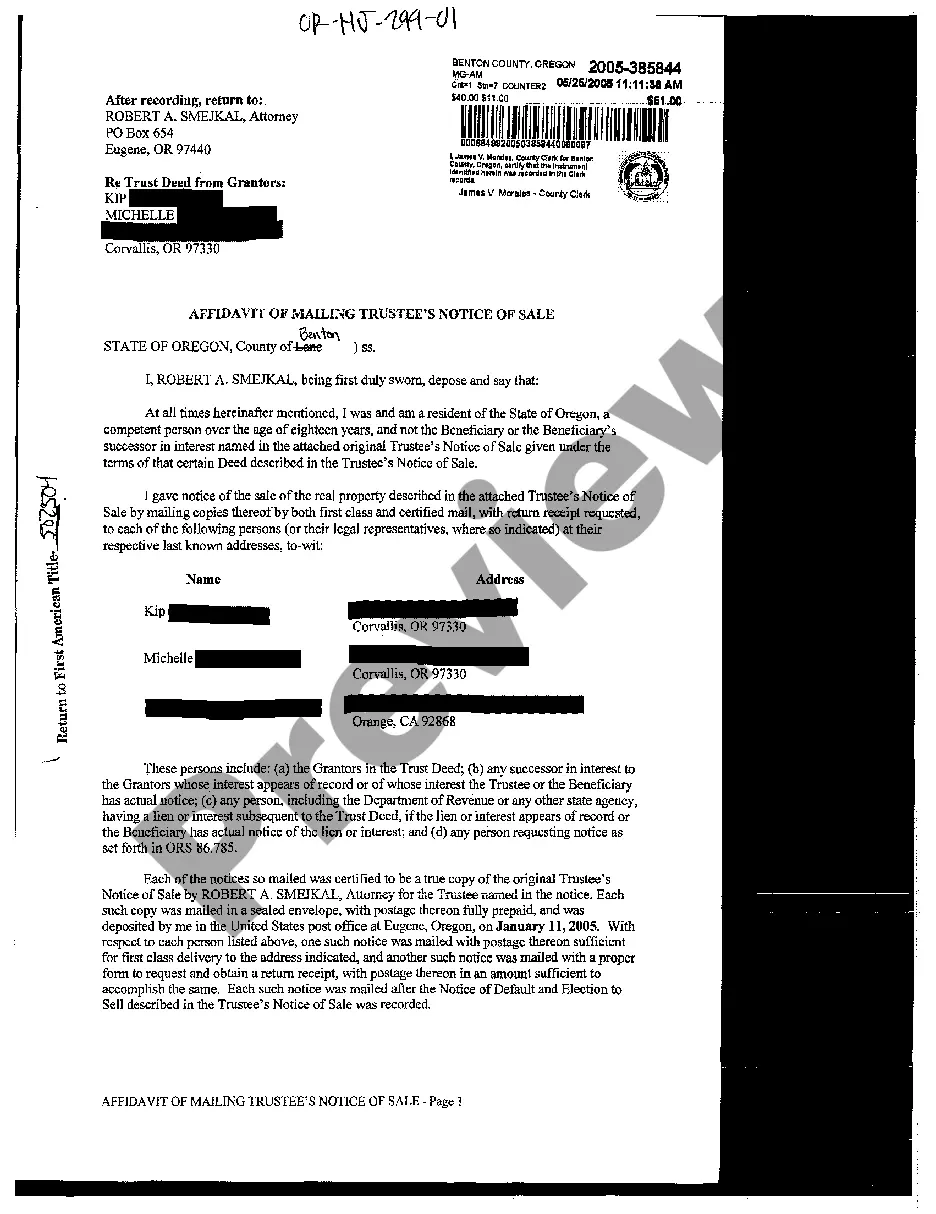

Oregon Trustee's Notice of Sale

Description

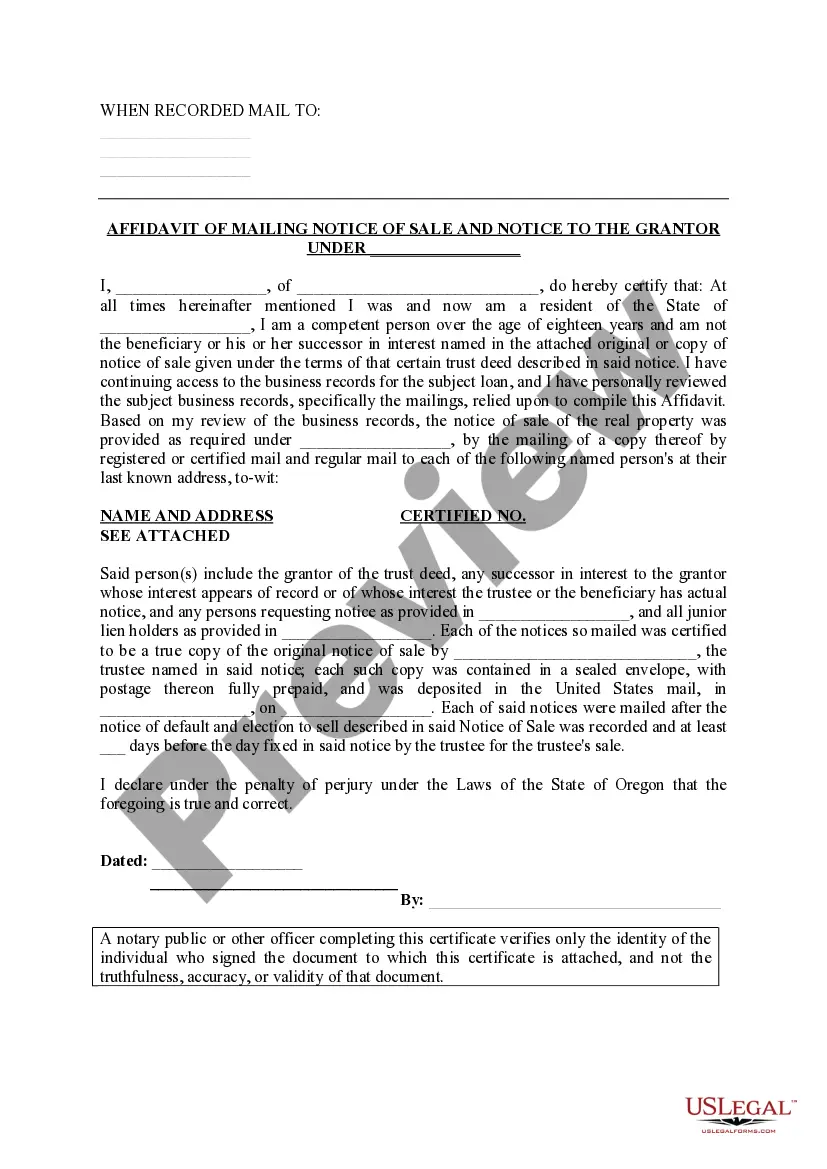

How to fill out Oregon Trustee's Notice Of Sale?

The work with papers isn't the most uncomplicated job, especially for those who almost never deal with legal paperwork. That's why we advise making use of accurate Oregon Trustee’s Notice of Sale samples created by skilled attorneys. It gives you the ability to eliminate troubles when in court or dealing with formal institutions. Find the templates you want on our website for high-quality forms and accurate explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. When you’re in, the Download button will immediately appear on the template webpage. Soon after accessing the sample, it will be saved in the My Forms menu.

Customers with no an active subscription can easily get an account. Utilize this simple step-by-step guide to get the Oregon Trustee’s Notice of Sale:

- Make certain that the document you found is eligible for use in the state it is necessary in.

- Verify the document. Make use of the Preview feature or read its description (if available).

- Click Buy Now if this form is the thing you need or go back to the Search field to find a different one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after finishing these easy steps, you can complete the form in your favorite editor. Check the filled in details and consider asking an attorney to examine your Oregon Trustee’s Notice of Sale for correctness. With US Legal Forms, everything gets much easier. Try it now!

Form popularity

FAQ

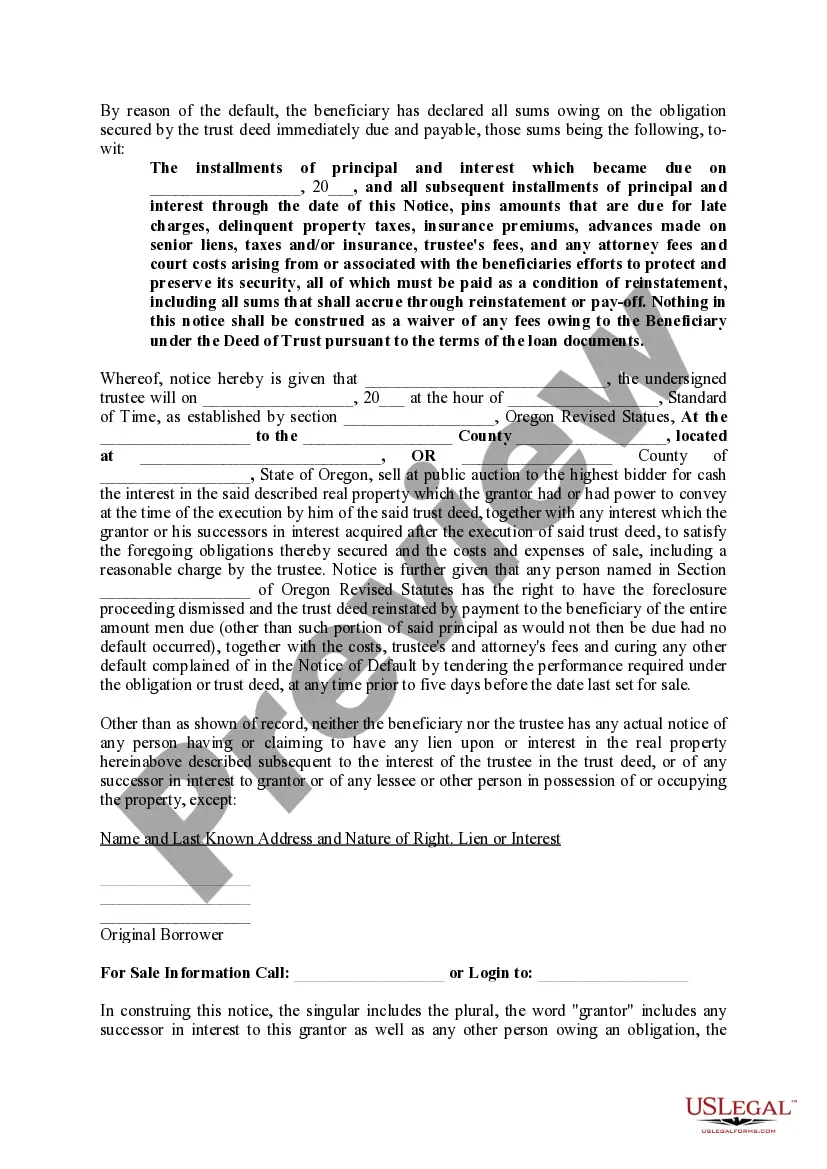

After the Sale Once the trustee sale is complete, the property deed is recorded in the new owner's name. The winning bidder can take immediate possession of the property. If the previous owner or rental tenants are present, they must vacate the property and remove all personal belongings.

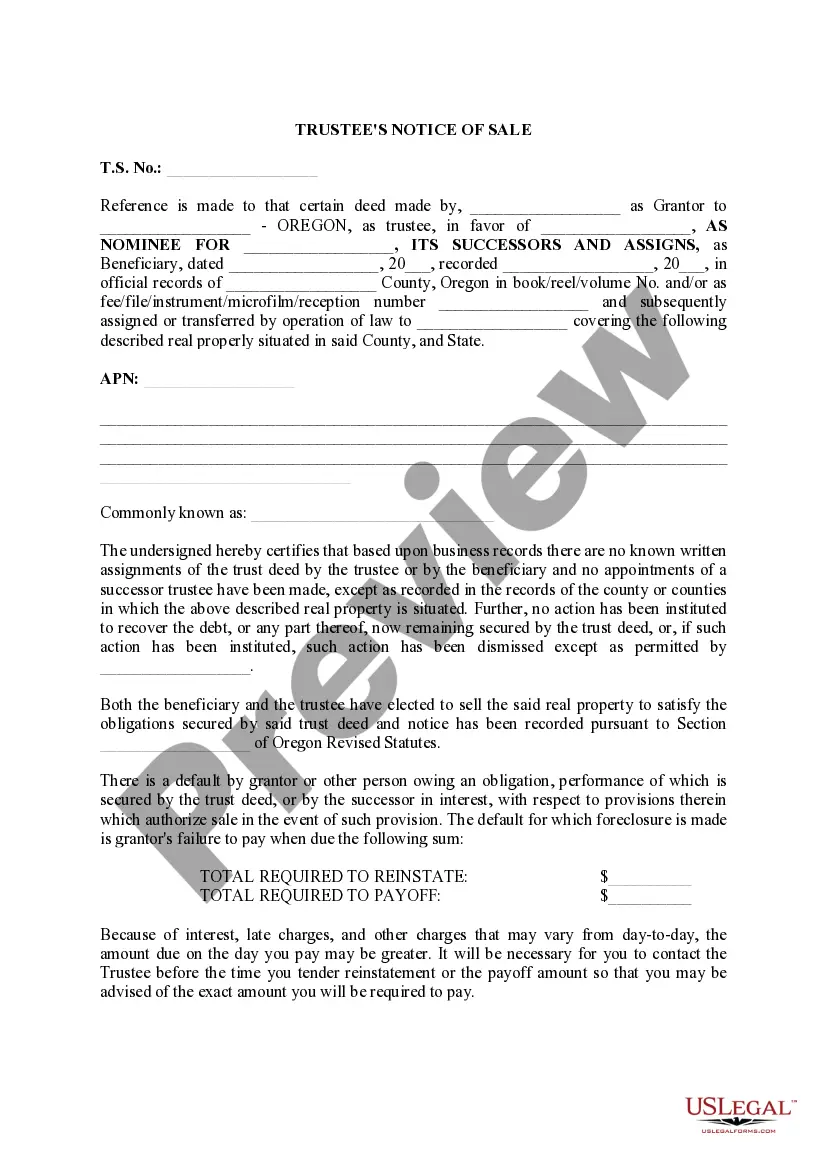

The trustee is a neutral third-party who holds the legal title to a property until the borrower pays off the loan in full. They're called a trustee because they hold the property in trust for the lender.

Oregon borrowers can expect that the foreclosure process will take approximately six months to complete if everything goes smoothly during the foreclosure. Court delays, borrower objects or a borrower's filing for bankruptcy can delay the process.

In Oregon, lenders may foreclose on deeds of trusts or mortgages in default using either a judicial or non-judicial foreclosure process. The judicial process of foreclosure, which involves filing a lawsuit to obtain a court order to foreclose, is used when no power of sale is present in the mortgage or deed of trust.

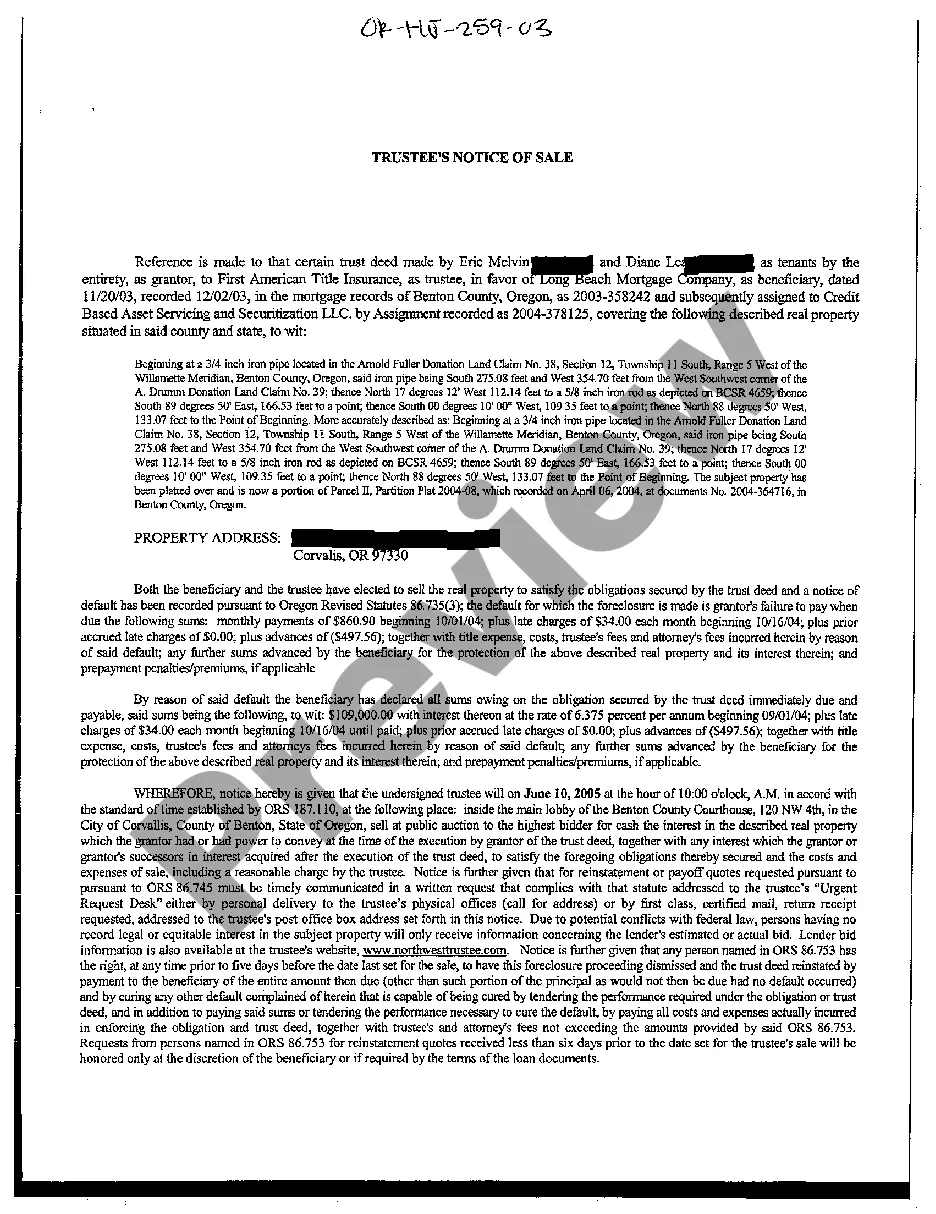

A Notice of Trustee's Sale informs homeowners and mortgage borrowers of record that their home will be sold at a trustee's sale on a specific date and at a specific location. The actual sale typically completes a non-judicial foreclosure in states allowing this type of foreclosure process.

In a nonjudicial foreclosure, the third party who normally handles the foreclosure process is called a "trustee." In theory, a foreclosure trustee is a neutral party, but the lender or loan servicer usually chooses the trustee, who is often affiliated with the lender or the lender's attorney.

The OTDA provides that a nonjudicial foreclosure may not be initiated unless "the trust deed, any assignments of the trust deed by the trustee or the beneficiary and any appointment of a successor trustee are recorded in the mortgage records in the counties in which the property described in the deed is situated."

Banks and other lenders typically use a trust deed. A trust deed can be foreclosed by a lawsuit in the circuit court of the county where the property is located. This type of foreclosure is referred to as a judicial foreclosure and is now common for residential loans in Oregon.

In real estate, a trustee sale means the sale of real property through public auction. A trustee sale usually occurs when the homeowner is in default on their mortgage, resulting in a foreclosure.A trustee sale is typically the second-to-last step in the foreclosure process in a nonjudicial foreclosure state.