Oregon Complaint - Judgment and Foreclosure of Agricultural Services Lien

Description

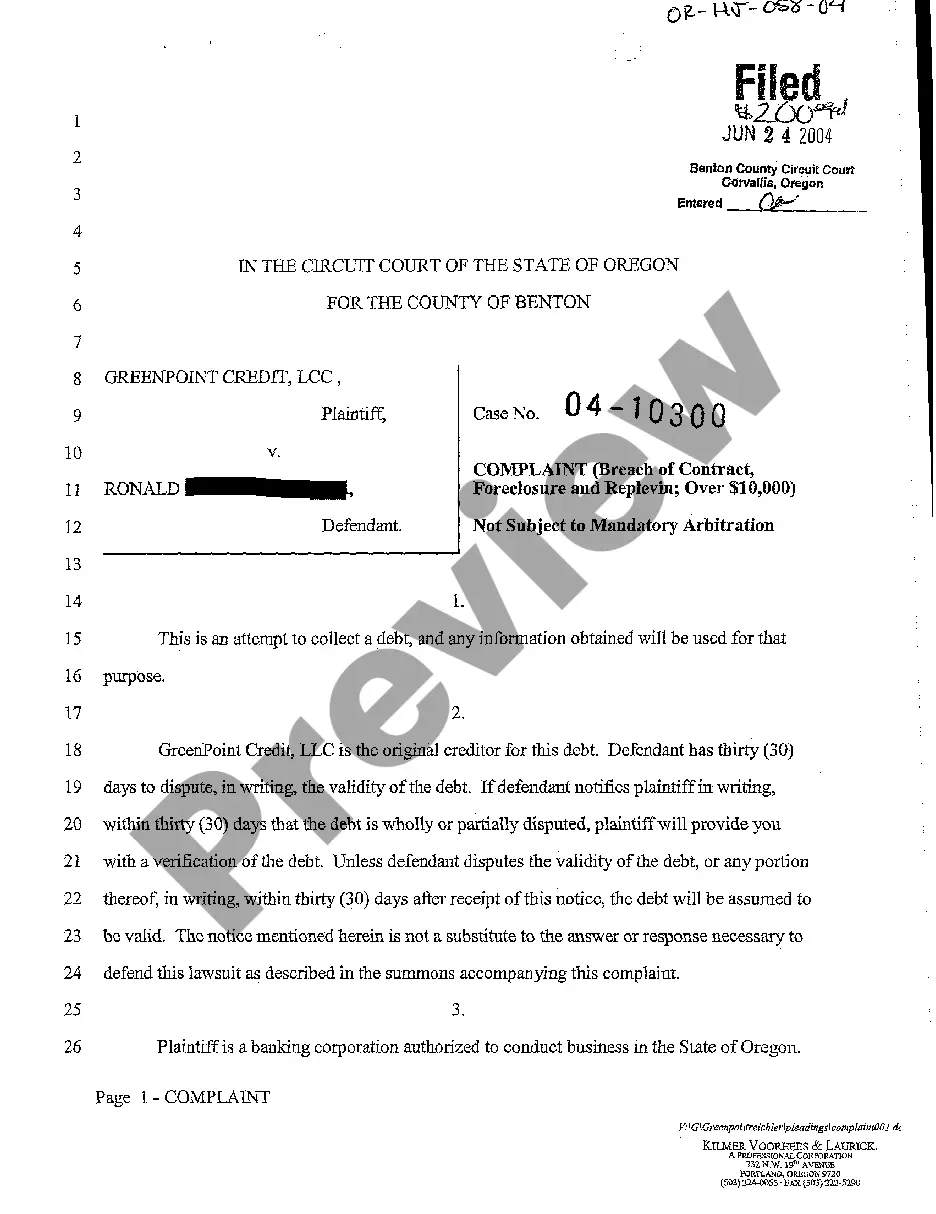

How to fill out Oregon Complaint - Judgment And Foreclosure Of Agricultural Services Lien?

Creating documents isn't the most simple job, especially for those who rarely deal with legal paperwork. That's why we recommend making use of correct Oregon Complaint - Judgment and Foreclosure of Agricultural Services Lien samples created by professional lawyers. It gives you the ability to avoid difficulties when in court or dealing with official organizations. Find the samples you want on our site for top-quality forms and exact information.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you are in, the Download button will immediately appear on the file webpage. Right after getting the sample, it will be saved in the My Forms menu.

Customers with no a subscription can easily create an account. Look at this brief step-by-step guide to get your Oregon Complaint - Judgment and Foreclosure of Agricultural Services Lien:

- Ensure that the document you found is eligible for use in the state it is needed in.

- Confirm the document. Utilize the Preview feature or read its description (if offered).

- Buy Now if this form is the thing you need or return to the Search field to get a different one.

- Select a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a required format.

After doing these easy steps, you can fill out the form in an appropriate editor. Double-check completed details and consider asking a lawyer to review your Oregon Complaint - Judgment and Foreclosure of Agricultural Services Lien for correctness. With US Legal Forms, everything becomes easier. Try it now!

Form popularity

FAQ

Foreclosure is the legal process that banks use to get back some of the money they loaned when a borrower can't repay the loan.So, banks would take all of the assets pledged to the loan. Families were often thrown off their farms and lost everything.

What contributed to the large number of foreclosures was a farm debt problem that began during the agricultural depression of the 1920s and grew more severe by 1929.

During the Great Depression, many farmers faced foreclosure because they had taken on large amounts of debt and mortgages to finance their operations. As prices continually fell after World War I, farmers found it harder and harder to pay their debts, and many were foreclosed on and evicted.

Can you purchase a foreclosure with a USDA loan? It is entirely possible to purchase a foreclosed home with a USDA loan, as long as the home is located in a qualified rural area. USDA loans do not require a down payment, making them an excellent choice for foreclosures.

What would happen if the family owed $10,000 on the property, but were only able to sell it for $6,000? They would be $4,000 in debt and have to pay it back somehow. Their property would be foreclosed upon and they would have to find another job place to live.

How did farmers fare during the Depression?Farmers worked hard to produce record crops and livestock. When prices fell they tried to produce even more to pay their debts, taxes and living expenses. In the early 1930s prices dropped so low that many farmers went bankrupt and lost their farms.

Many lost their farms when banks foreclosed and seized the property as payment for the debt. As farmers began to default on their loans, many rural banks began to fail.most farmers could grow food for their families. With falling prices and rising debt, though, thousands of farmers lost their land.

What contributed to the large number of foreclosures was a farm debt problem that began during the agricultural depression of the 1920s and grew more severe by 1929.Between 1929 and 1932, crop and livestock prices plummeted by almost 75 percent. The impact on farm earnings was staggering.