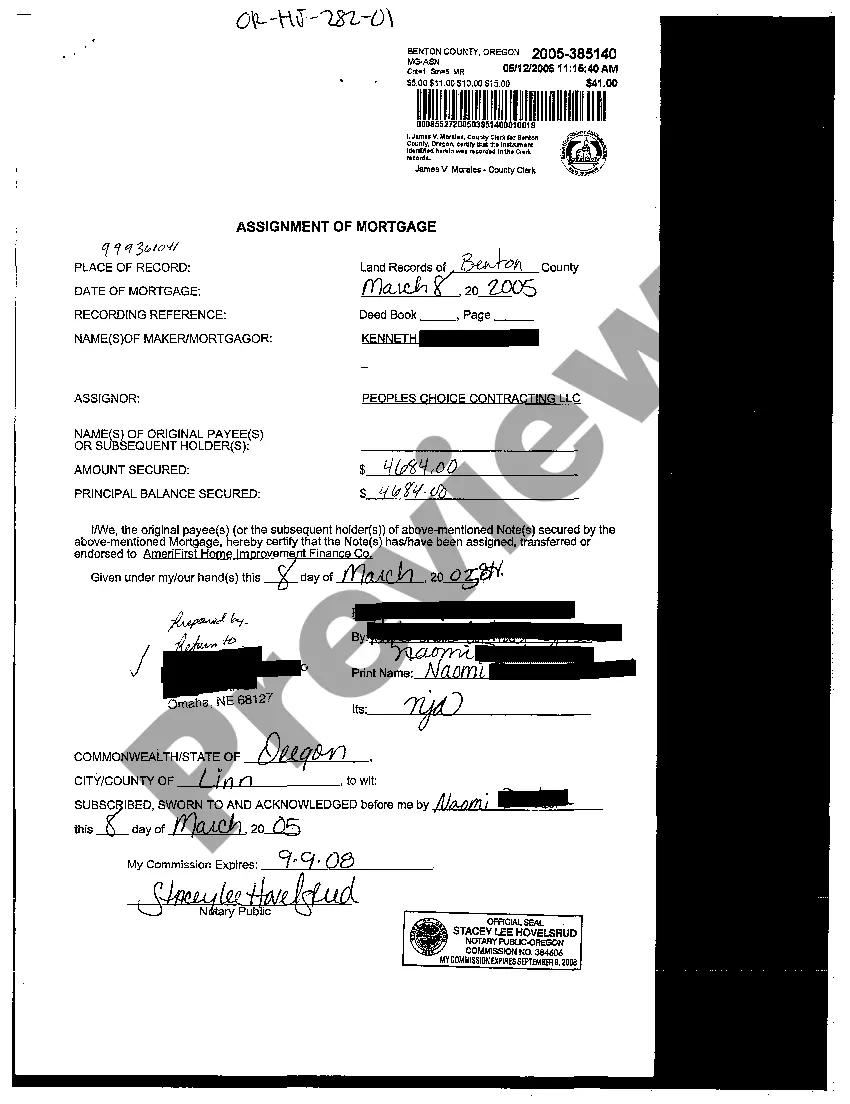

Oregon Assignment of Mortgage

Description

How to fill out Oregon Assignment Of Mortgage?

The work with papers isn't the most straightforward task, especially for those who rarely work with legal papers. That's why we recommend utilizing correct Oregon Assignment of Mortgage templates created by skilled attorneys. It allows you to eliminate problems when in court or dealing with official institutions. Find the files you need on our site for top-quality forms and accurate explanations.

If you’re a user having a US Legal Forms subscription, simply log in your account. As soon as you’re in, the Download button will immediately appear on the template webpage. Right after accessing the sample, it’ll be saved in the My Forms menu.

Customers with no an active subscription can easily create an account. Utilize this brief step-by-step help guide to get your Oregon Assignment of Mortgage:

- Make certain that file you found is eligible for use in the state it is needed in.

- Confirm the document. Make use of the Preview option or read its description (if offered).

- Buy Now if this form is the thing you need or go back to the Search field to get another one.

- Choose a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

After completing these easy steps, you are able to complete the sample in your favorite editor. Check the filled in information and consider requesting a legal representative to review your Oregon Assignment of Mortgage for correctness. With US Legal Forms, everything gets much easier. Try it now!

Form popularity

FAQ

You may contact us at (407) 836-5115 to request a search of your Satisfaction of Mortgage. You may also utilize our web site (www.occompt.com) to see if your Satisfaction has been recorded. Your Satisfaction is recorded under the names of the borrower/mortgagor on the original loan.

(2) Beneficiary means a person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or the person's successor in interest, and who is not the trustee unless the beneficiary is qualified to be a trustee under ORS 86.713 (Qualifications of trustee) (1)(b)(D).

Banks often sell and buy mortgages from each other as a way to liquidate assets and improve their credit ratings. When the original lender sells the debt to another bank or an investor, a mortgage assignment is created and recorded in the public record and the promissory note is endorsed.

A Satisfaction of Mortgage is issued by the lender after they have received the final mortgage payment from the borrower. It's signed by the mortgagee (in the presence of a witness in some states and counties) and then notarized by a registered notary public.

An assignment transfers all of the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it and, if the mortgage is subsequently transferred, each assignment is to be recorded in the county land records.

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.

Key Takeaways. A satisfaction of mortgage is a signed document confirming that the borrower has paid off the mortgage in full and that the mortgage is no longer a lien on the property.

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.

If a lender takes longer than 90 days to record it, they can be charged up to $1,500 in penalties. So, in theory, a satisfaction should be recorded within 30-90 days of payoff regardless of what state you work in.