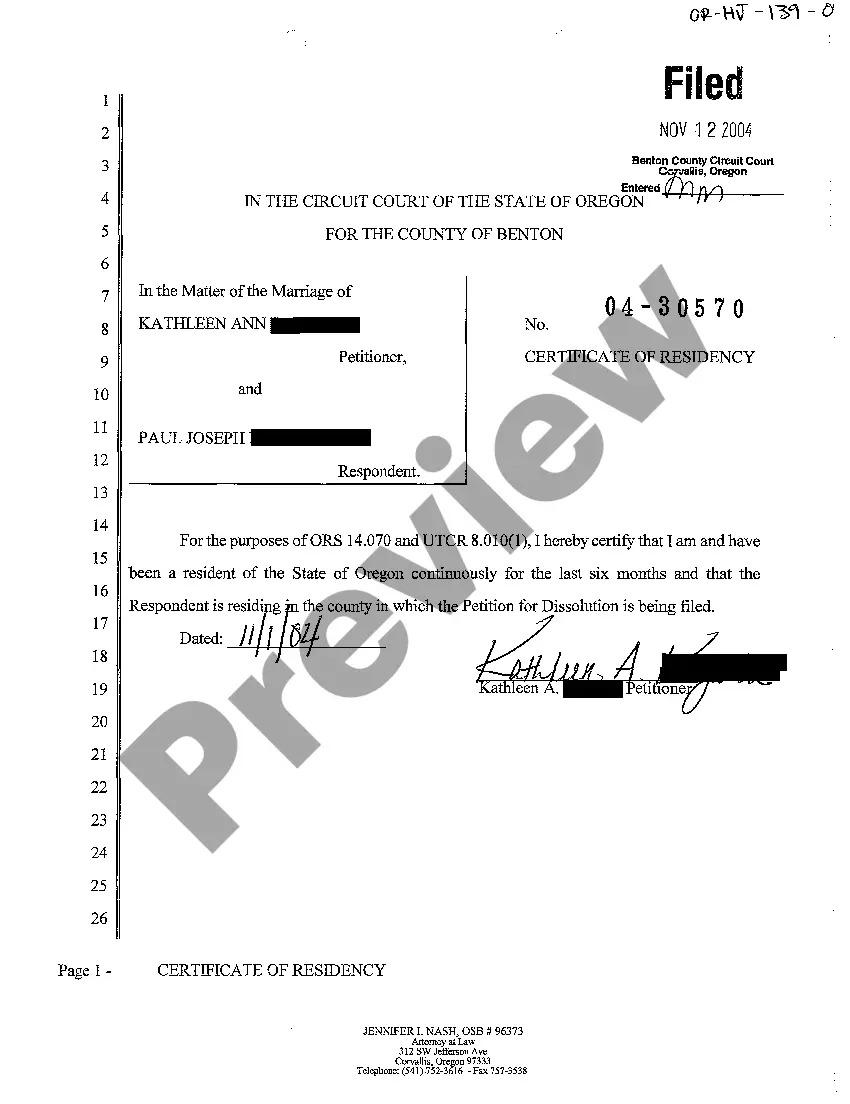

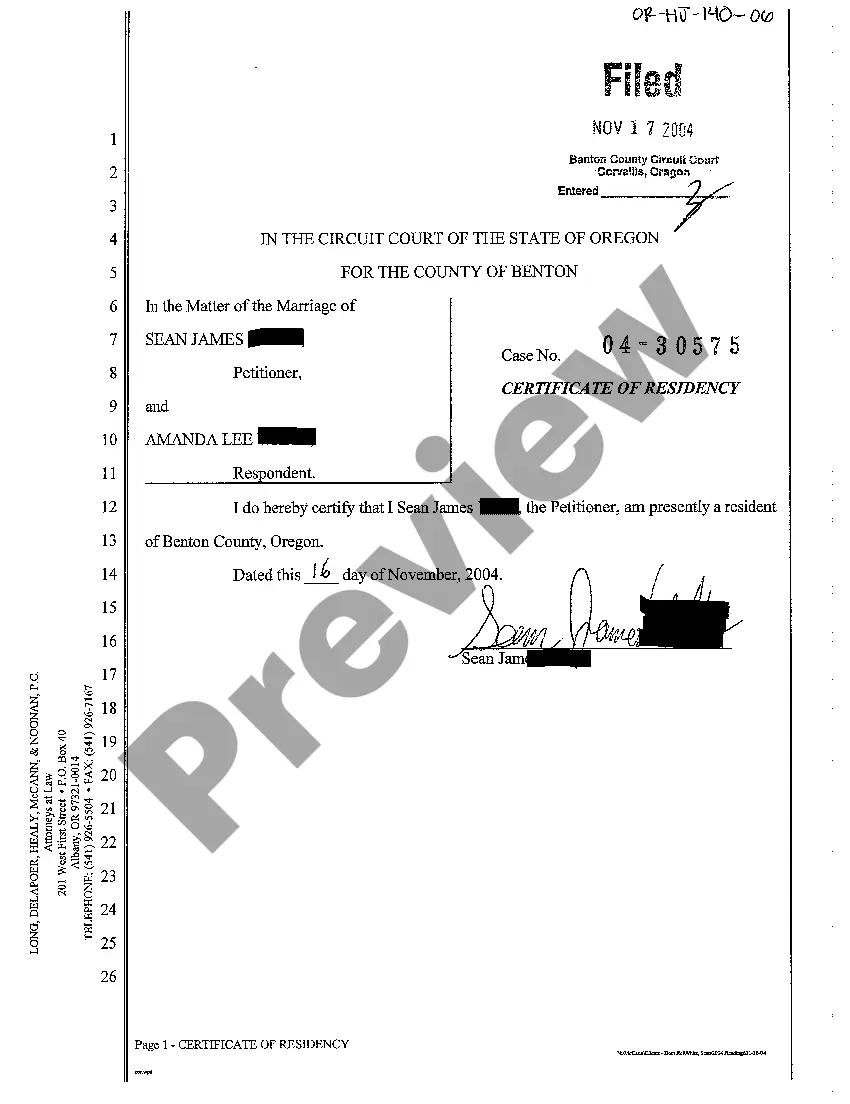

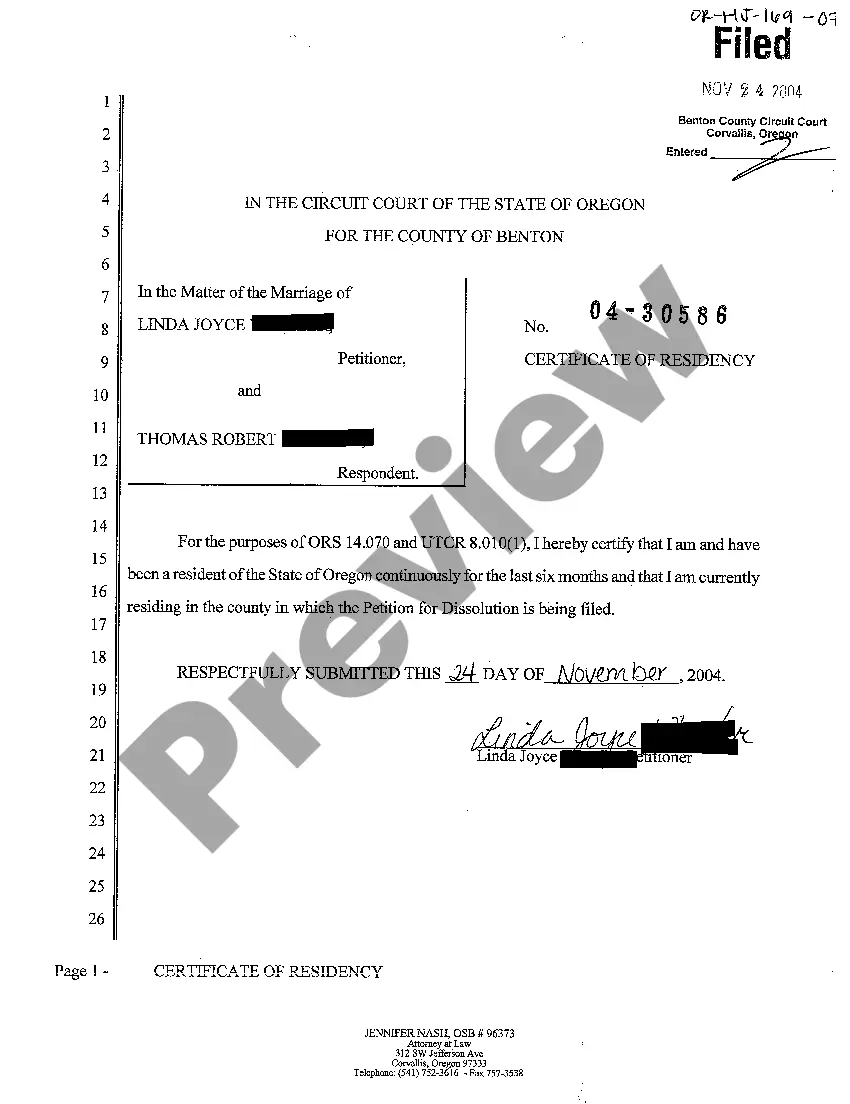

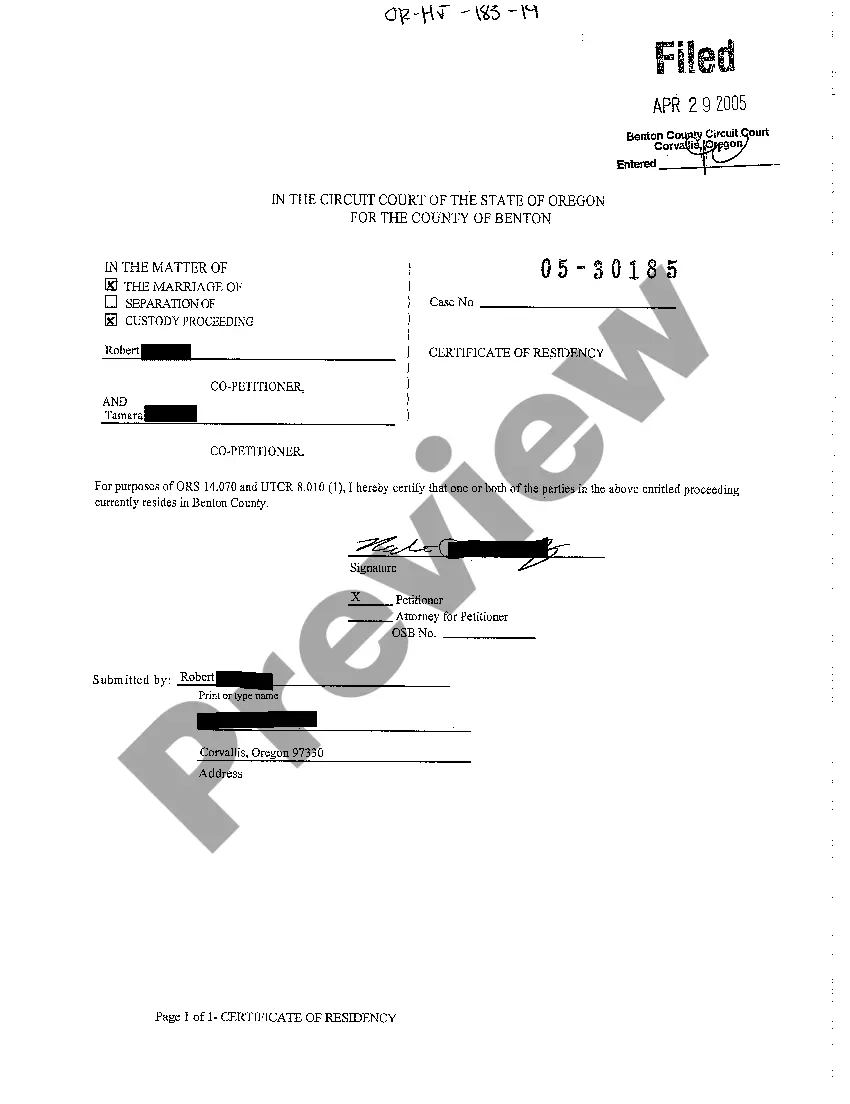

Oregon Certificate of Residency

Description

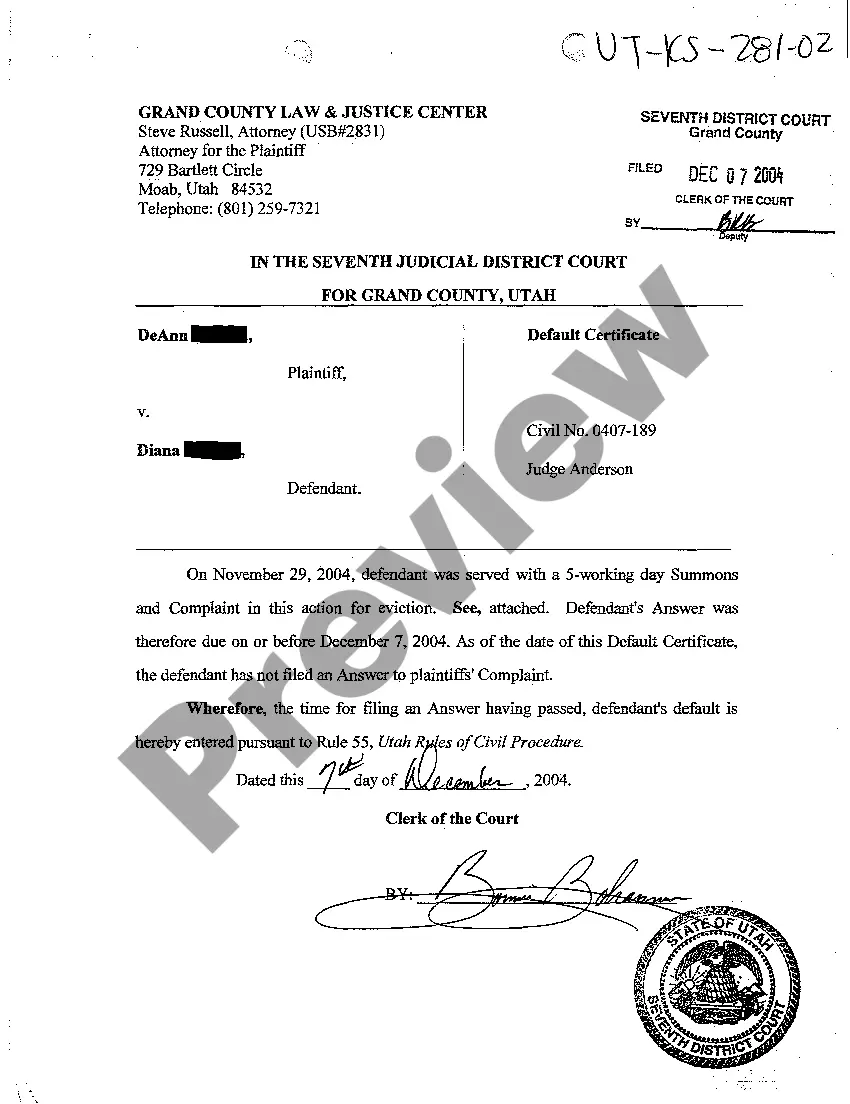

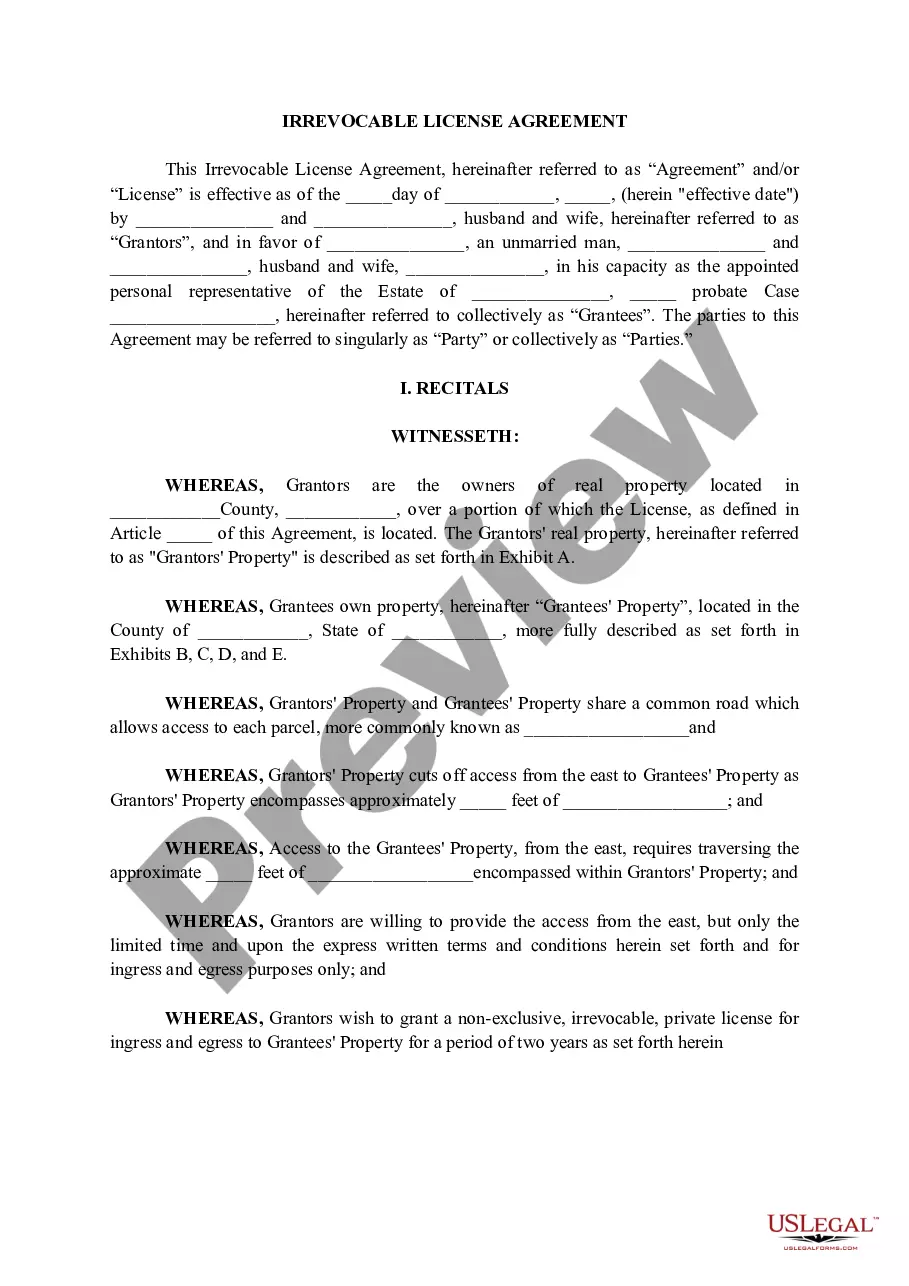

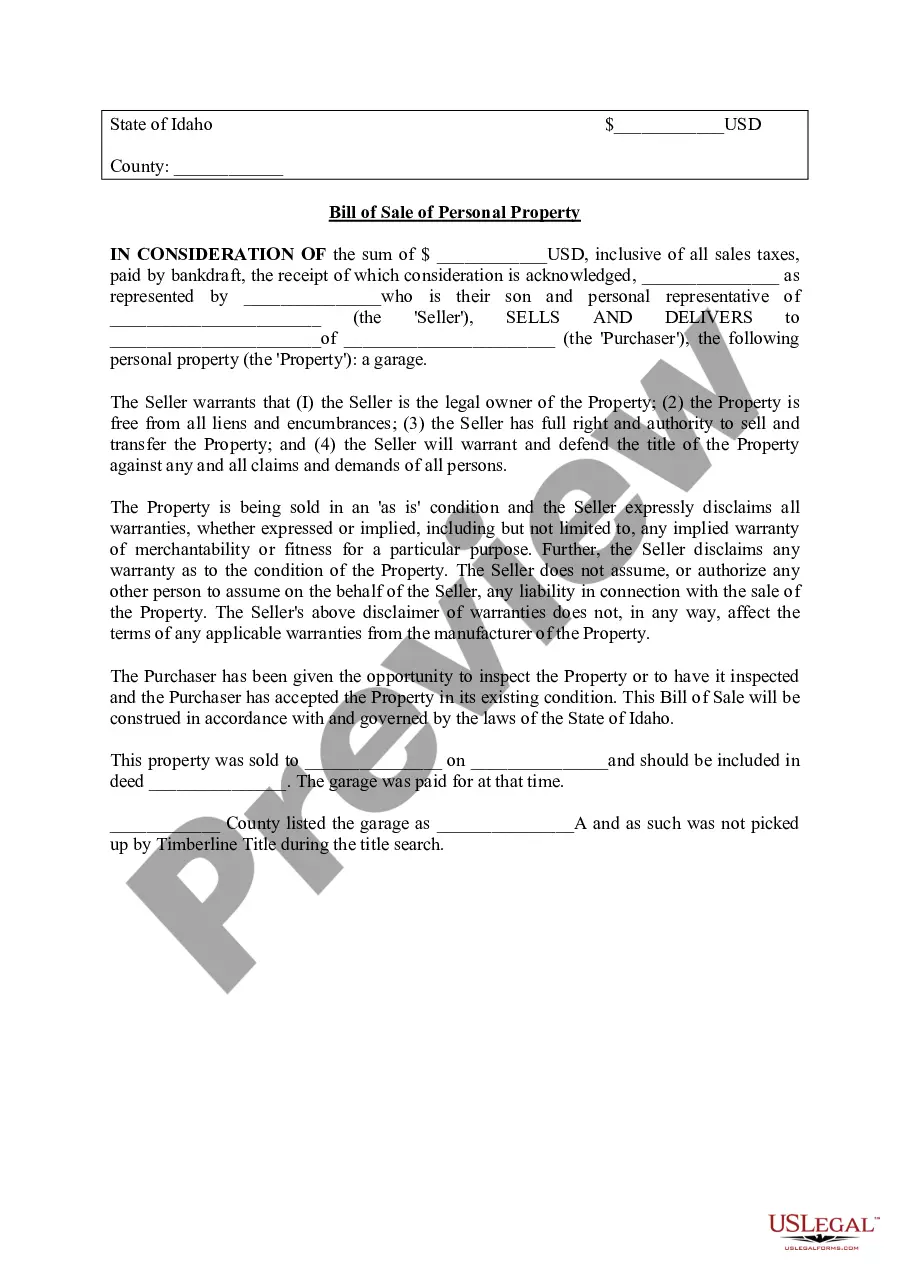

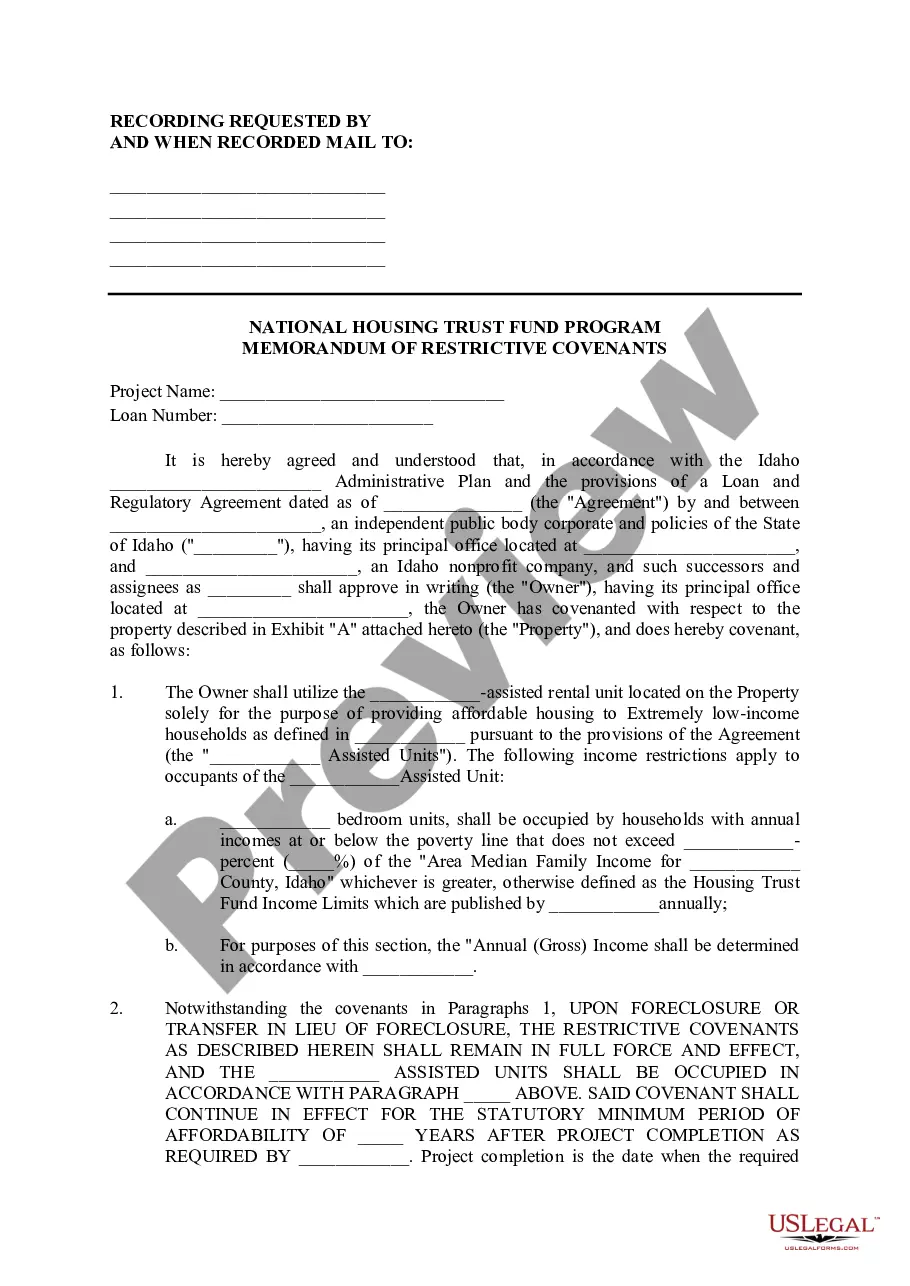

How to fill out Oregon Certificate Of Residency?

The work with papers isn't the most uncomplicated task, especially for people who almost never work with legal papers. That's why we recommend making use of accurate Oregon Certificate of Residency templates created by skilled lawyers. It gives you the ability to eliminate problems when in court or handling formal organizations. Find the documents you require on our website for top-quality forms and correct descriptions.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you’re in, the Download button will automatically appear on the file page. After accessing the sample, it will be saved in the My Forms menu.

Users without a subscription can easily get an account. Use this short step-by-step help guide to get the Oregon Certificate of Residency:

- Make sure that the sample you found is eligible for use in the state it is needed in.

- Confirm the document. Use the Preview option or read its description (if offered).

- Buy Now if this form is the thing you need or return to the Search field to get a different one.

- Select a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

Right after completing these straightforward actions, it is possible to complete the form in your favorite editor. Check the filled in information and consider asking a lawyer to review your Oregon Certificate of Residency for correctness. With US Legal Forms, everything becomes much simpler. Test it now!

Form popularity

FAQ

Generally, you need to establish a physical presence in the state, an intent to stay there and financial independence. Then you need to prove those things to your college or university. Physical presence: Most states require you to live in the state for at least a full year before establishing residency.

Find a new place to live in the new state. Establish domicile. Change your mailing address and forward your mail. Change your address with utility providers. Change IRS address. Register to vote. Get a new driver's license. File taxes in your new state.

Government-issued photo ID.Residential lease/property deed.Utility bill.Letter from the government/court (marriage license, divorce, government aid)Bank statement.Driver's license/learner's permit.Car registration.Notarized affidavit of residency.

Typical factors states use to determine residency. Often, a major determinant of an individual's status as a resident for income tax purposes is whether he or she is domiciled or maintains an abode in the state and are present" in the state for 183 days or more (one-half of the tax year).

By statute, an individual is a resident of Oregon under two scenarios. A. An individual who is domiciled in Oregon, unless he a) does not have a permanent place of abode in Oregon; b) maintains a permanent place of abode in a place other than Oregon, and c) spends less than 31 days of a taxable year in Oregon.

To qualify as an Oregon resident (for tuition purposes), one must live in Oregon for 12 consecutive months while taking eight credits or fewer per term while demonstrating that they are in the state for a primary purpose other than education (such as working, volunteering, or other purposes).

If you reside in Oregon, and need to provide proof that you are a resident of or domiciled in Oregon, a true copy of your Oregon permanent or part-year income tax return filed with the Oregon Department of Revenue for the previous tax year is acceptable proof with this form.

An individual can at any one time have but one domicile. If an individual has acquired a domicile at one place (i.e. California), he retains that domicile until he acquires another elsewhere.