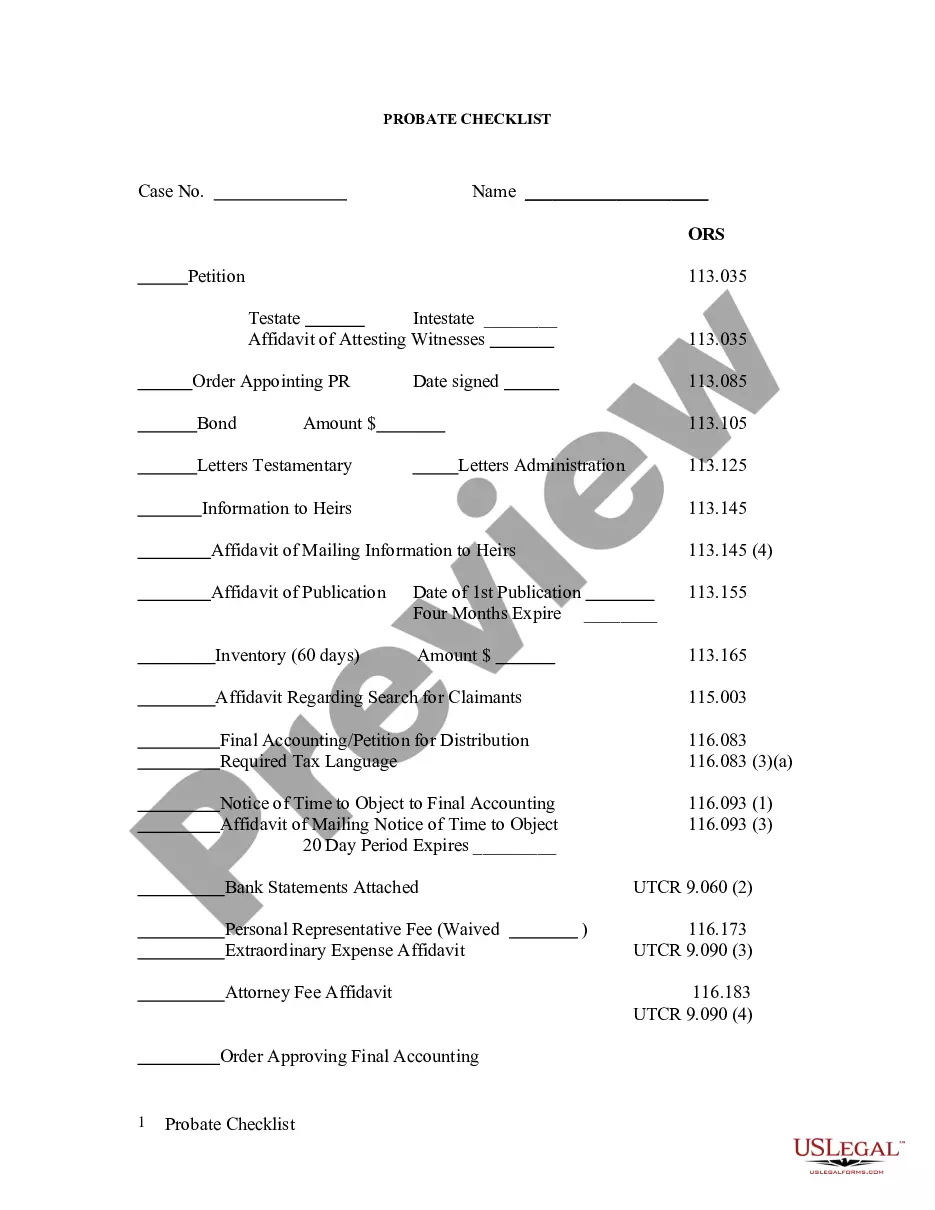

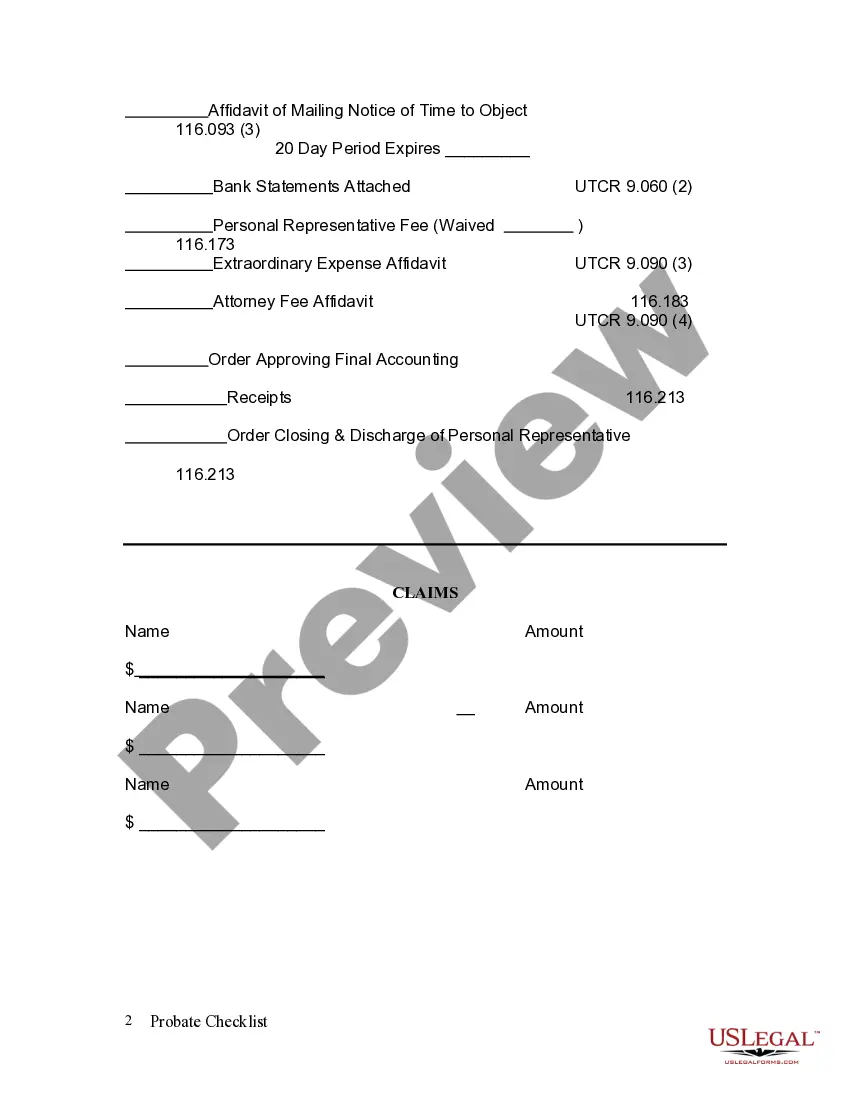

Oregon Probate Checklist

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

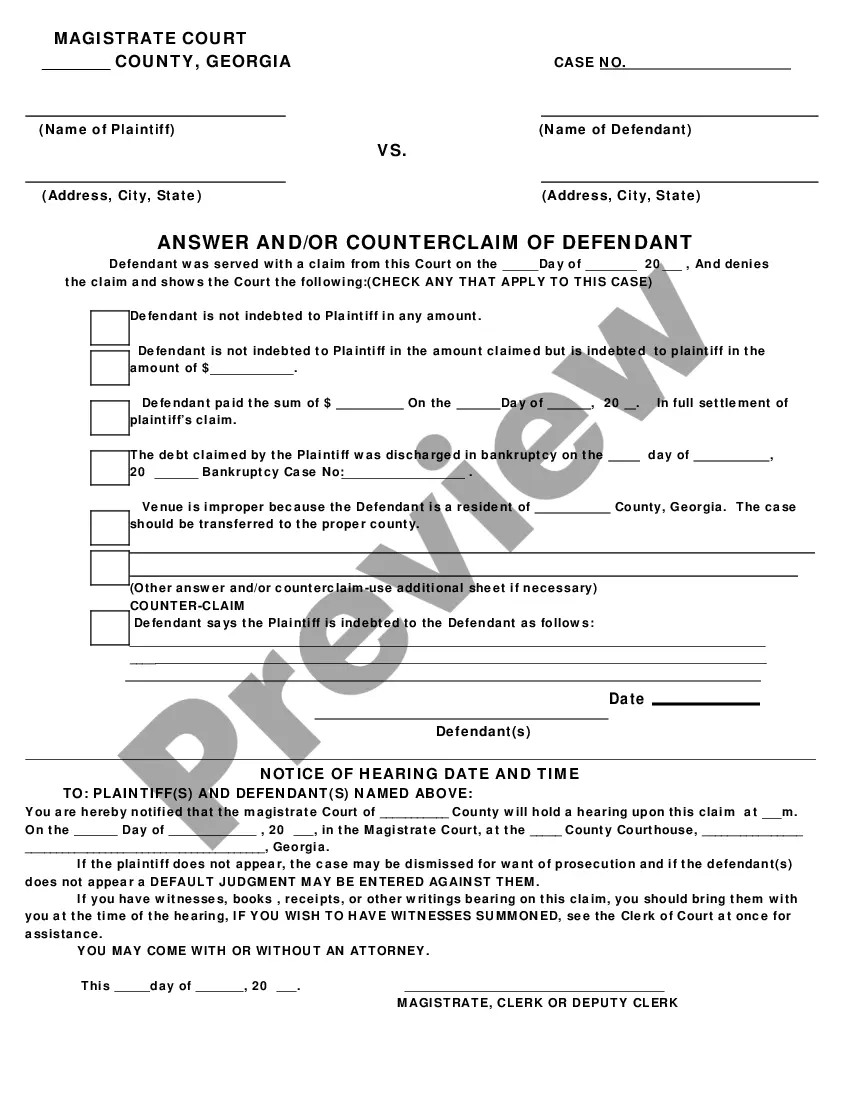

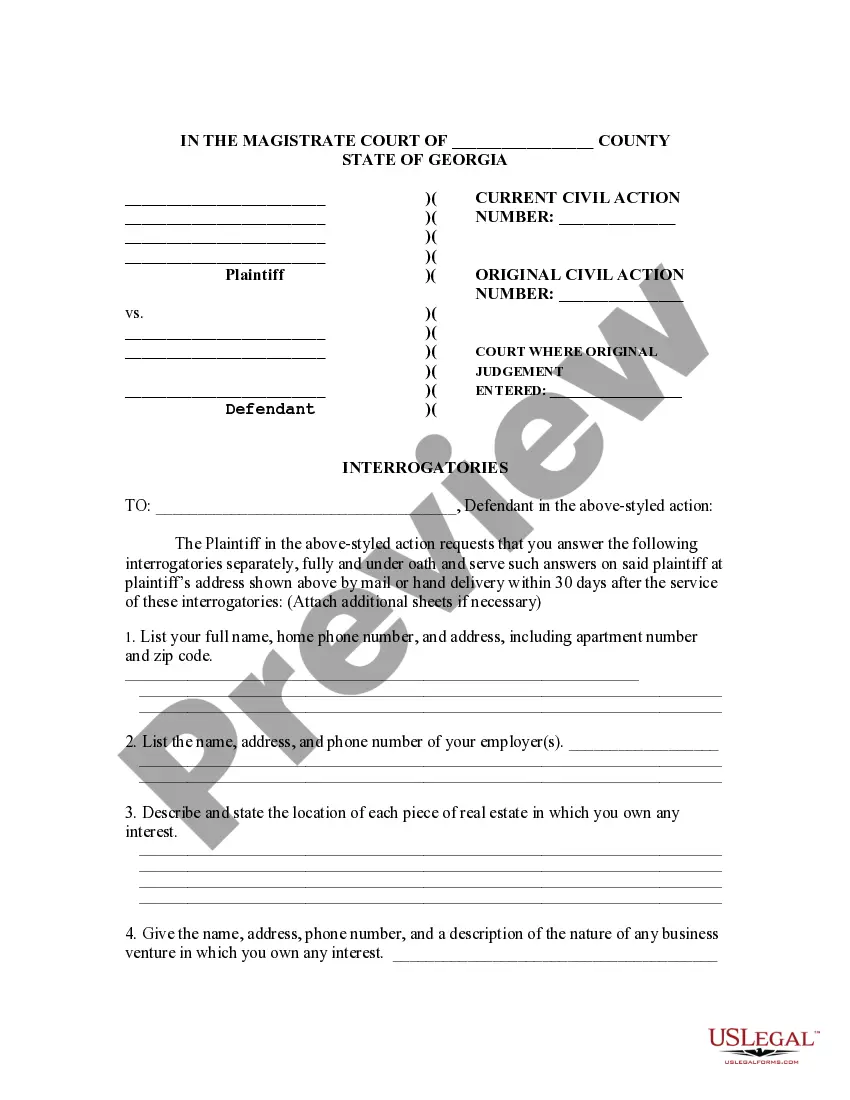

Looking for another form?

How to fill out Oregon Probate Checklist?

When it comes to filling out Oregon Probate Checklist, you most likely visualize an extensive process that consists of finding a appropriate form among hundreds of similar ones after which being forced to pay out a lawyer to fill it out for you. On the whole, that’s a slow and expensive choice. Use US Legal Forms and pick out the state-specific document within just clicks.

For those who have a subscription, just log in and then click Download to find the Oregon Probate Checklist sample.

If you don’t have an account yet but want one, stick to the step-by-step guide listed below:

- Be sure the document you’re downloading is valid in your state (or the state it’s needed in).

- Do it by looking at the form’s description and through clicking on the Preview function (if accessible) to see the form’s information.

- Click on Buy Now button.

- Find the proper plan for your budget.

- Join an account and choose how you want to pay out: by PayPal or by card.

- Download the document in .pdf or .docx format.

- Get the document on the device or in your My Forms folder.

Skilled lawyers draw up our templates to ensure after downloading, you don't need to worry about enhancing content material outside of your personal information or your business’s information. Sign up for US Legal Forms and receive your Oregon Probate Checklist example now.

Form popularity

FAQ

In California, estates valued over $150,000, and that don't qualify for any exemptions, must go to probate.If a person dies and owns real estate, regardless of value, either in his/her name alone or as a "tenant in common" with another, a probate proceeding is typically required to transfer the property.

In Oregon, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Under Oregon law, a small estate affidavit can be filed if the estate has no more than $75,000 in personal property and no more that $200,000 in real property. These limits may be subject to change. A larger estate may require probate.

Every financial institution will have a different threshold as to the amount they will transfer without a Grant of Probate. To provide you some guidance, a balance of somewhere in the vicinity of $20,000.00 $50,000.00 will not require a Grant of Probate.

Under Oregon law, a small estate affidavit can be filed if the estate has no more than $75,000 in personal property and no more that $200,000 in real property. These limits may be subject to change. A larger estate may require probate.

Probate is not always necessary. If the deceased person owned bank accounts or property with another person, the surviving co-owner often will then own that property automatically.Settle a dispute between people who claim they are entitled to assets of the deceased person.

Attorneys' fees in Oregon are based on the number of hours billed and the lawyer's hourly rate. For the simplest of probates, the fees can be around $2000. In general, probate legal fees will run between $3,000 and $5,000. If the estate is large, complex or has unusual assets, the costs can be much higher.

Probate is not always necessary. If the deceased person owned bank accounts or property with another person, the surviving co-owner often will then own that property automatically.

But generally if the total value of the Estate is less than £15,000 then usually Probate will not be required. But if the deceased owned assets worth more than the threshold, you'll need to go through the Probate process.