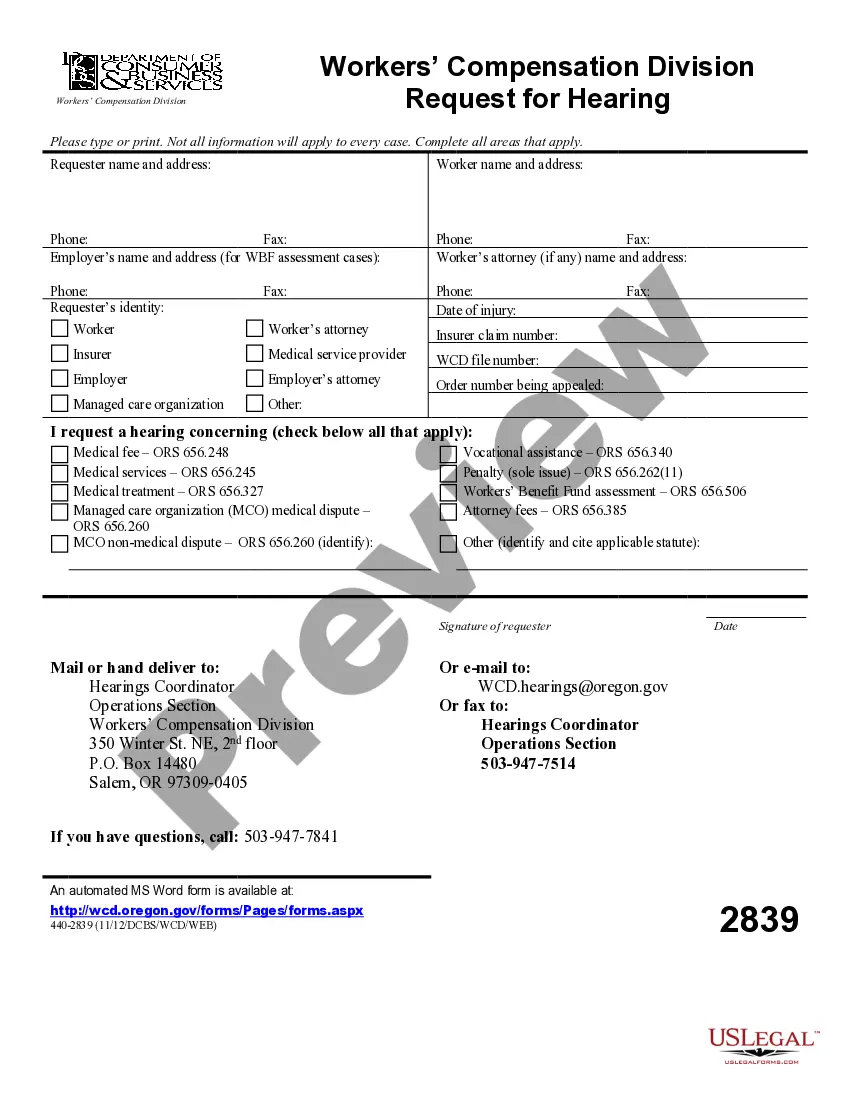

Oregon Request for Workers Compensation Division Claim File Information

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Oregon Request For Workers Compensation Division Claim File Information?

In terms of submitting Oregon Request for Workers Compensation Division Claim File Information, you most likely imagine an extensive procedure that involves finding a ideal sample among hundreds of very similar ones and then having to pay out a lawyer to fill it out to suit your needs. On the whole, that’s a slow and expensive choice. Use US Legal Forms and select the state-specific template in just clicks.

For those who have a subscription, just log in and then click Download to get the Oregon Request for Workers Compensation Division Claim File Information sample.

In the event you don’t have an account yet but need one, stick to the point-by-point guideline below:

- Be sure the file you’re getting applies in your state (or the state it’s required in).

- Do so by reading through the form’s description and through clicking the Preview function (if offered) to find out the form’s information.

- Click on Buy Now button.

- Pick the suitable plan for your financial budget.

- Sign up to an account and choose how you would like to pay: by PayPal or by card.

- Download the document in .pdf or .docx file format.

- Get the record on your device or in your My Forms folder.

Skilled legal professionals draw up our samples to ensure that after saving, you don't have to bother about editing content material outside of your individual information or your business’s information. Join US Legal Forms and receive your Oregon Request for Workers Compensation Division Claim File Information document now.

Form popularity

FAQ

State your name, date of birth, social security number, and date of injury at the very beginning of your letter. Explicitly state that you were on-the-job and that you were injured while performing your duties. Elaborate on the tasks you were performing at the time of your injury. Include as many details as you can.

When should an employee file a workers' comp claim? An employee should file a workers' compensation claim if injuries were sustained on the job or within the scope of employment. This includes occupational accidents, diseases, trauma injuries, or illness caused by exposure to work activities or chemicals.

Reporting an injury and filing a claim 200bTell your employer about your work-related injury or illness right away. Fill out Form 801 Report of Job Injury or Illness and turn it in to your employer. Your employer should send it to its workers' compensation insurance carrier within five days of your notice.

The insurance company may use your rating to come up with a starting settlement amount, but you may want to ask for a moderately higher amount for permanent disability compensation, plus the cost of future medical treatment and any past-due temporary disability benefits.

Report these payments as wages on Line 7 of Form 1040 or Form 1040A, or on Line 1 of Form 1040EZ. If your disability pension is paid under a statute that provides benefits only to employees with service-connected disabilities, part of it may be workers' compensation. That part is exempt from tax.

Workers' compensation insurance pays for workers' medical treatment and lost wages on accepted claims when workers suffer work- related injuries and illnesses. By law, Oregon employers that have one or more employees, full or part time, must carry workers' compensation insurance or be self-insured.

Get your weekly disability check started, if you're not receiving it already. Maximize your weekly benefit check. Report all super-added injuries. Seek psychological care, when appropriate. Seek pain management care, when appropriate. Don't refuse medical procedures. Be very careful what you tell the doctor.

A workers' comp trial to determine a fair settlement is usually called a workers' comp hearing or lawsuit.The judge evaluates the case and will decide on an appropriate settlement amount. The insurance company must follow the judge's order to pay the claim, and the settlement is complete.

Report these payments as wages on Line 7 of Form 1040 or Form 1040A, or on Line 1 of Form 1040EZ. If your disability pension is paid under a statute that provides benefits only to employees with service-connected disabilities, part of it may be workers' compensation. That part is exempt from tax.