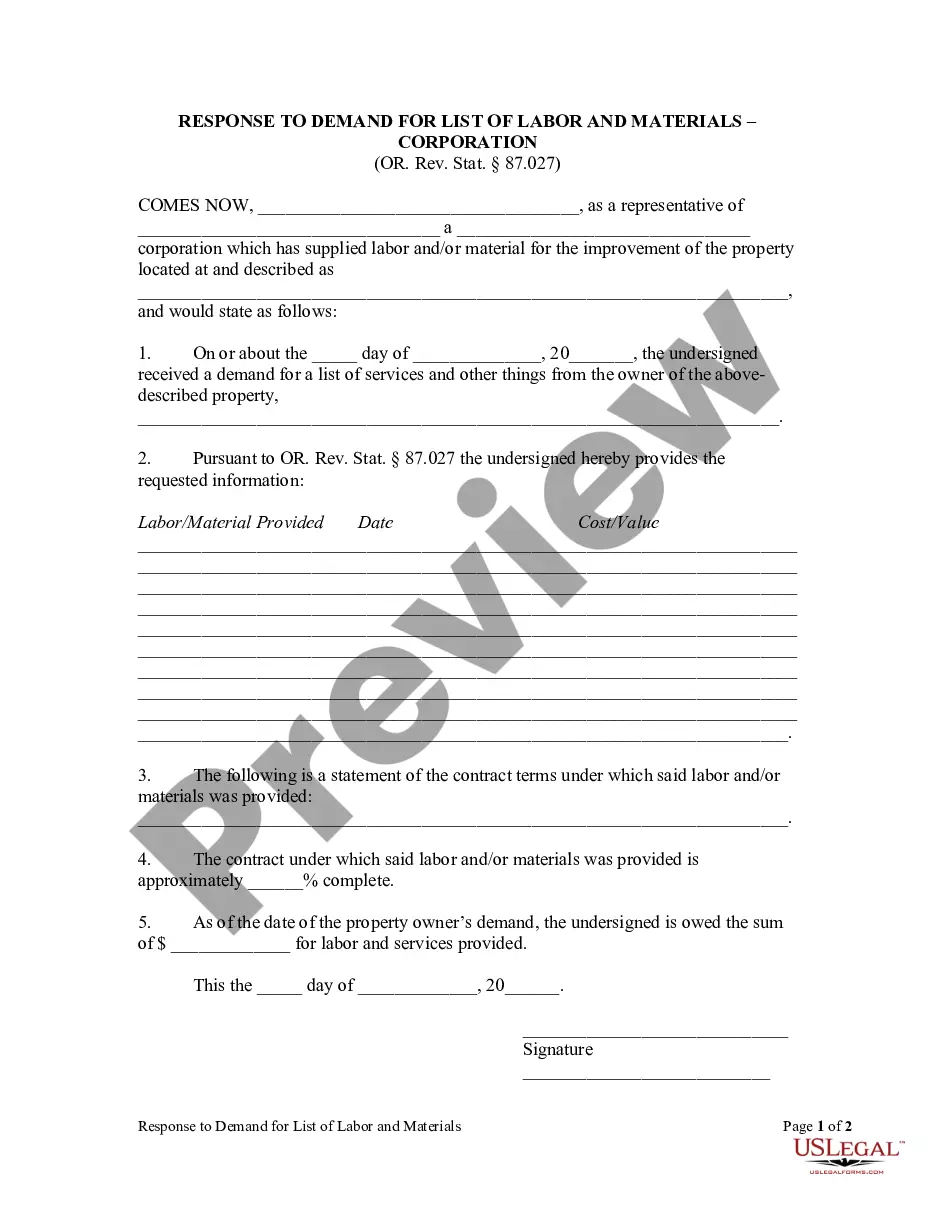

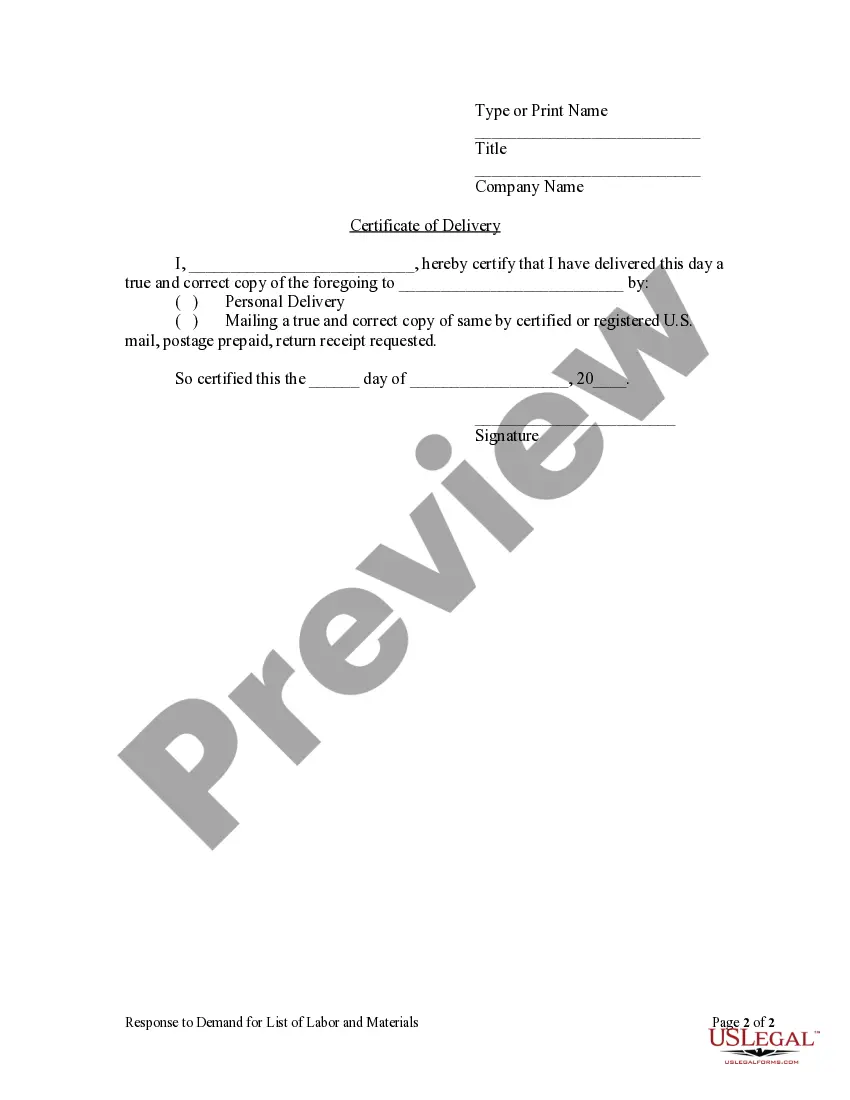

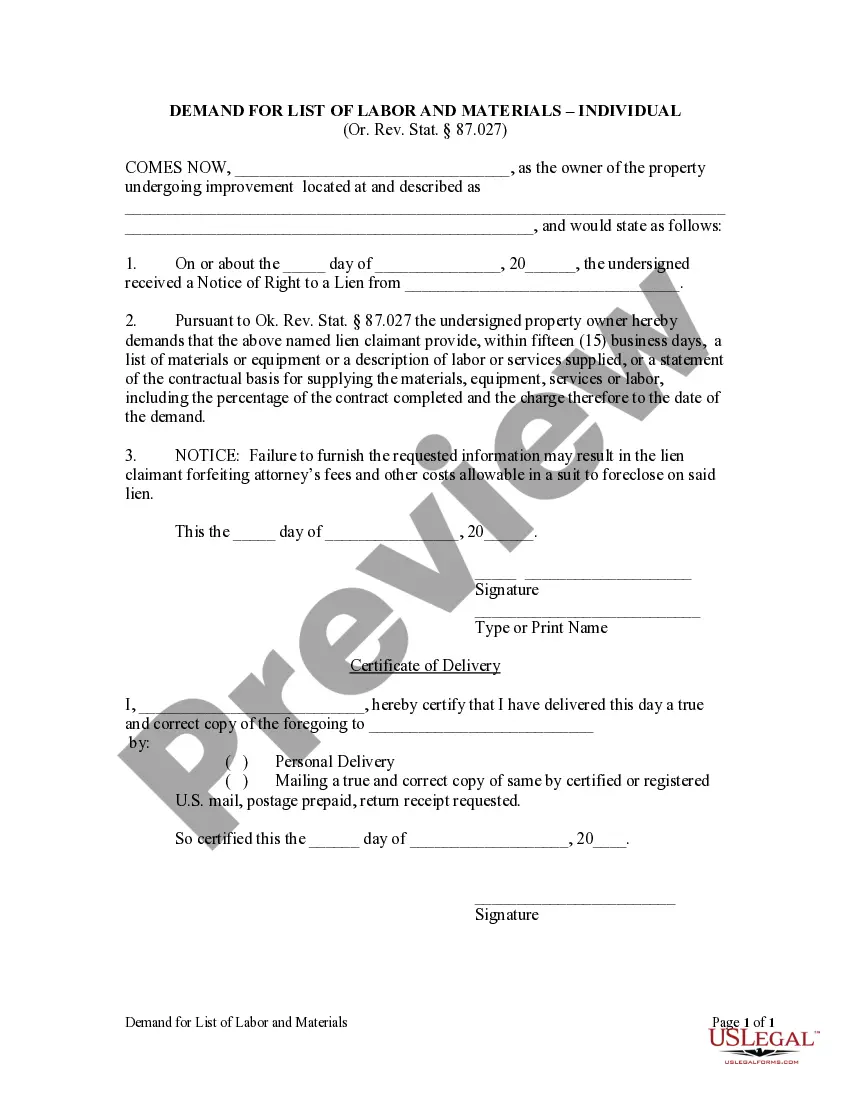

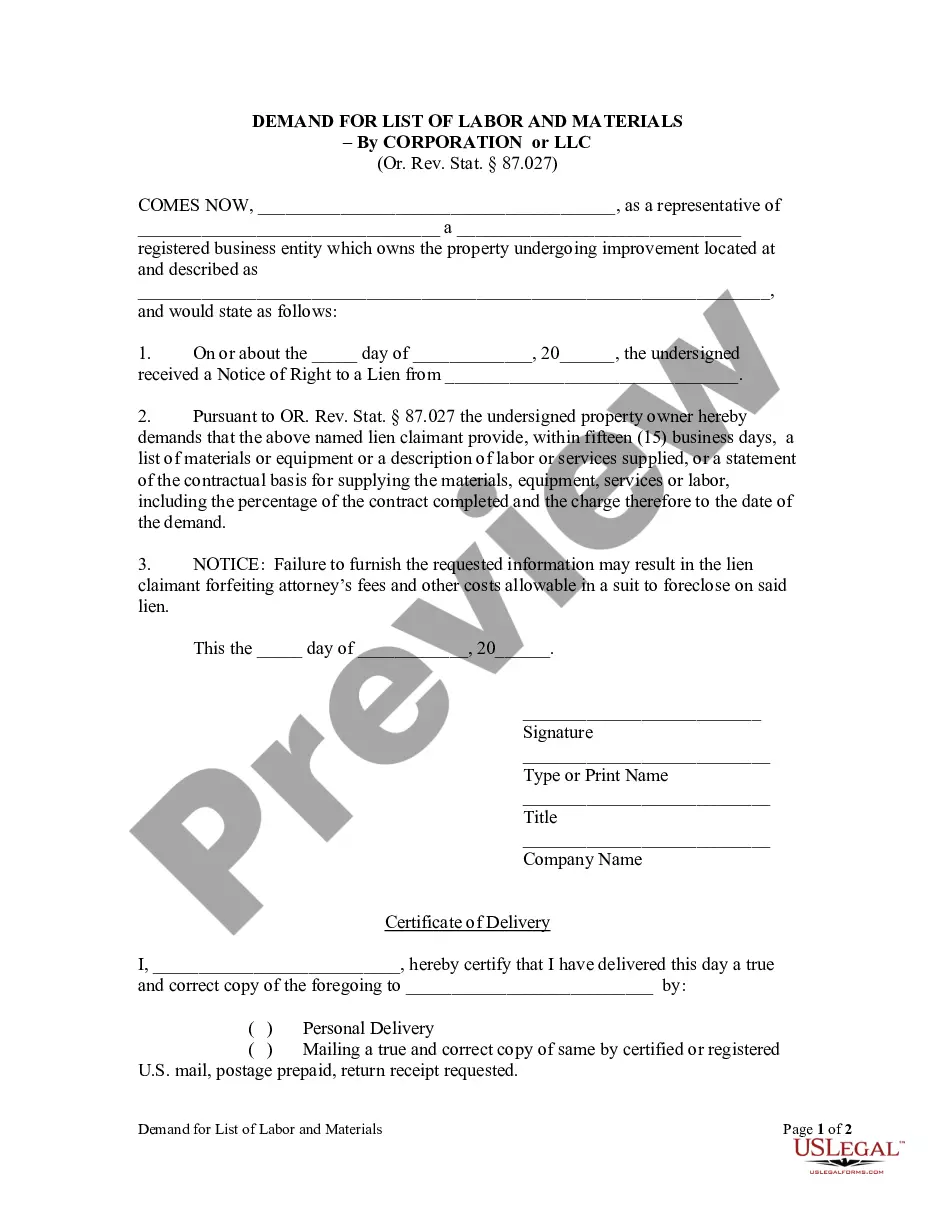

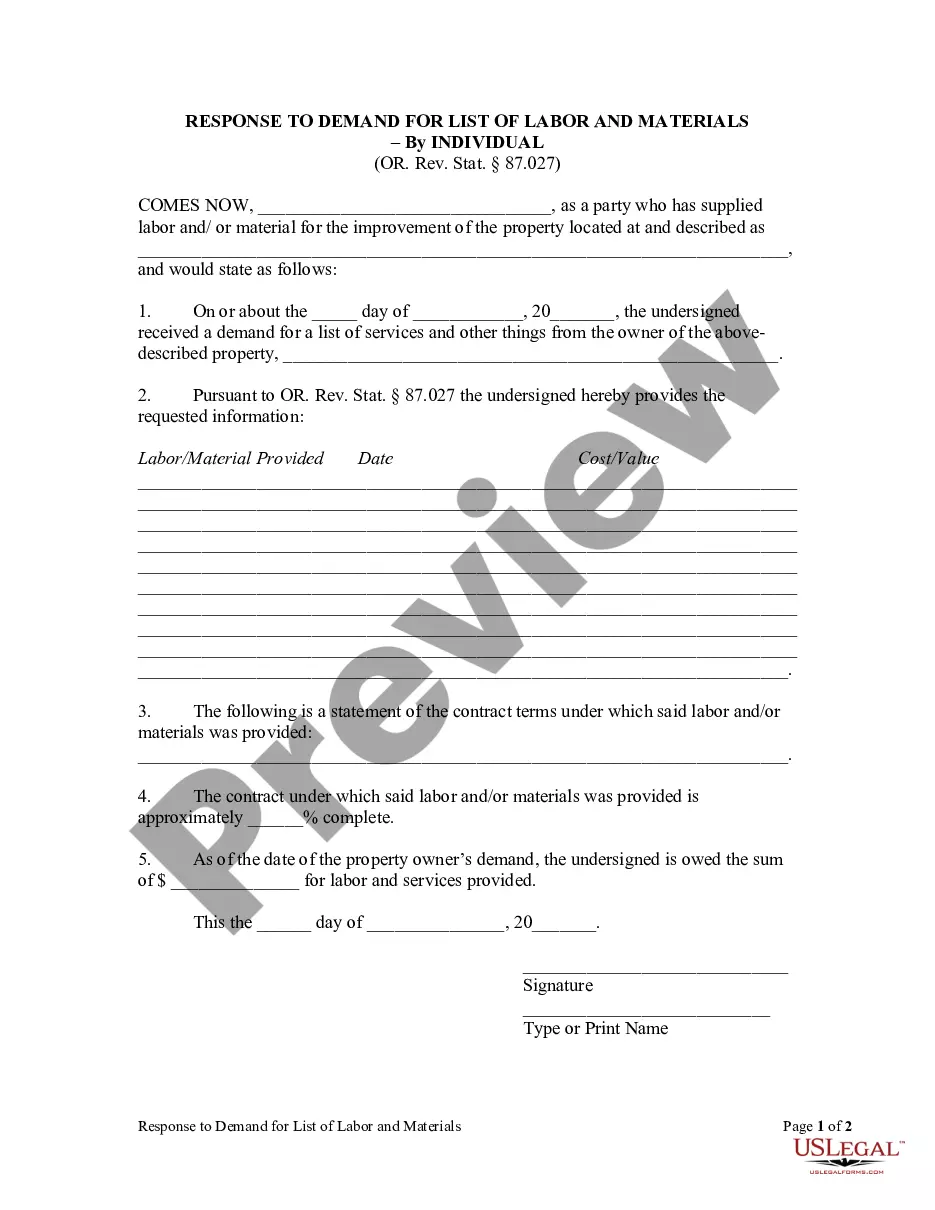

An owner who receives a notice of right to a lien in accordance with the provisions of ORS 87.021 may demand, in writing, from the person providing materials, equipment, services or labor a list of materials or equipment or description of labor or services supplied or a statement of the contractual basis for supplying the materials, equipment, services or labor, including the percentage of the contract completed, and the charge therefor to the date of the demand. The supplier's statement shall be delivered to the owner within 15 days, not including Saturdays, Sundays and other holidays as defined in ORS 187.010, of receipt of the owner's written demand, as evidenced by a receipt or a receipt of delivery of a certified or registered letter containing the demand. Failure of the supplier to furnish the information requested constitutes a loss of attorney fees and costs otherwise allowable in a suit to foreclose a lien.

Oregon Response to Demand for List of Services by Corporation

Description

How to fill out Oregon Response To Demand For List Of Services By Corporation?

When it comes to filling out Oregon Response to Demand for List of Services by Corporation or LLC, you probably imagine a long process that consists of finding a perfect form among a huge selection of very similar ones after which needing to pay a lawyer to fill it out for you. In general, that’s a slow and expensive option. Use US Legal Forms and select the state-specific template within just clicks.

If you have a subscription, just log in and click on Download button to have the Oregon Response to Demand for List of Services by Corporation or LLC template.

In the event you don’t have an account yet but want one, keep to the step-by-step guideline listed below:

- Make sure the file you’re downloading applies in your state (or the state it’s needed in).

- Do this by reading the form’s description and through clicking the Preview function (if available) to find out the form’s information.

- Click on Buy Now button.

- Choose the appropriate plan for your financial budget.

- Sign up for an account and select how you want to pay out: by PayPal or by card.

- Download the file in .pdf or .docx file format.

- Get the document on the device or in your My Forms folder.

Professional lawyers work on drawing up our samples to ensure after saving, you don't have to worry about editing content outside of your personal info or your business’s info. Sign up for US Legal Forms and get your Oregon Response to Demand for List of Services by Corporation or LLC example now.

Form popularity

FAQ

The different types of corporations and business structures. When it comes to types of corporations, there are typically four that are brought up: S corps, C corps, non-profit corporations, and LLCs.

A corporation makes your business a distinct entity. In other words, it separates your business assets from your personal assets.That is just fine; one person or multiple people can own a corporation. In most cases, if you are considering incorporating your small business, you will want to investigate S corporations.

Choose a Corporate Name. File Articles of Incorporation. Appoint a Registered Agent. Prepare Corporate Bylaws. Appoint Initial Directors and Hold First Board Meeting. File an Annual Report. Obtain an EIN.

C corporation (C corp) S corporation (S corp) Limited liability company (LLC)

Choose a corporate name. File your Articles of Incorporation. Appoint a registered agent. Start a corporate records book. Prepare corporate bylaws. Appoint initial directors. Hold first Board of Directors meeting. Issue stock to shareholders.

Tax Form 8832, Entity Classification Election, is a form certain businesses can use (which we will get to later) to elect or change how they are classified for federal tax purposes. Businesses receive a default tax classification, which can result in paying more business taxes than necessary.

Types of Corporations. Four main types of corporations are designated as C, S, limited liability companies, and nonprofit organizations.

Is an S Corp or LLC better? That is a bit of a misguided question. An LLC is a legal entity only and must choose to pay tax either as an S Corp, C Corp, Partnership, or Sole Proprietorship. Therefore, for tax purposes, an LLC can be an S Corp, so there is really no difference.

Choose a Business Name. Check Availability of Name. Register a DBA Name. Appoint Directors. File Your Articles of Incorporation. Write Your Corporate Bylaws. Draft a Shareholders' Agreement. Hold Initial Board of Directors Meeting.