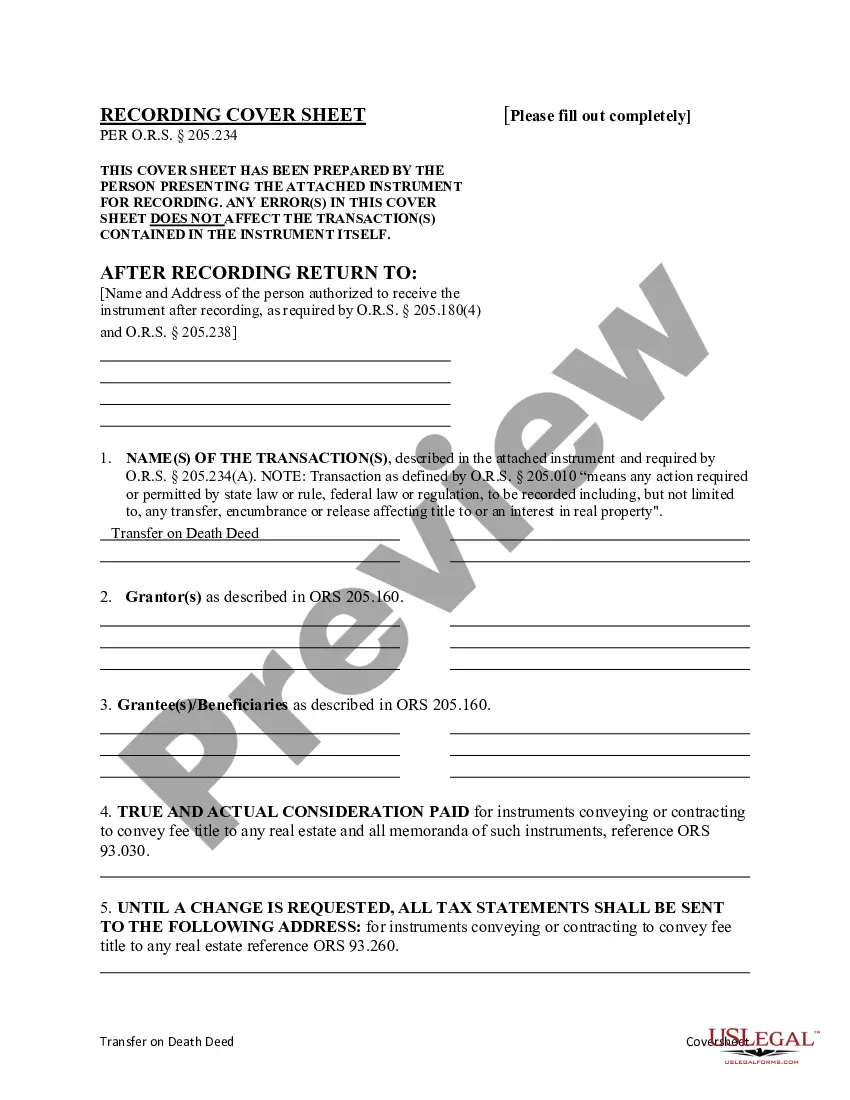

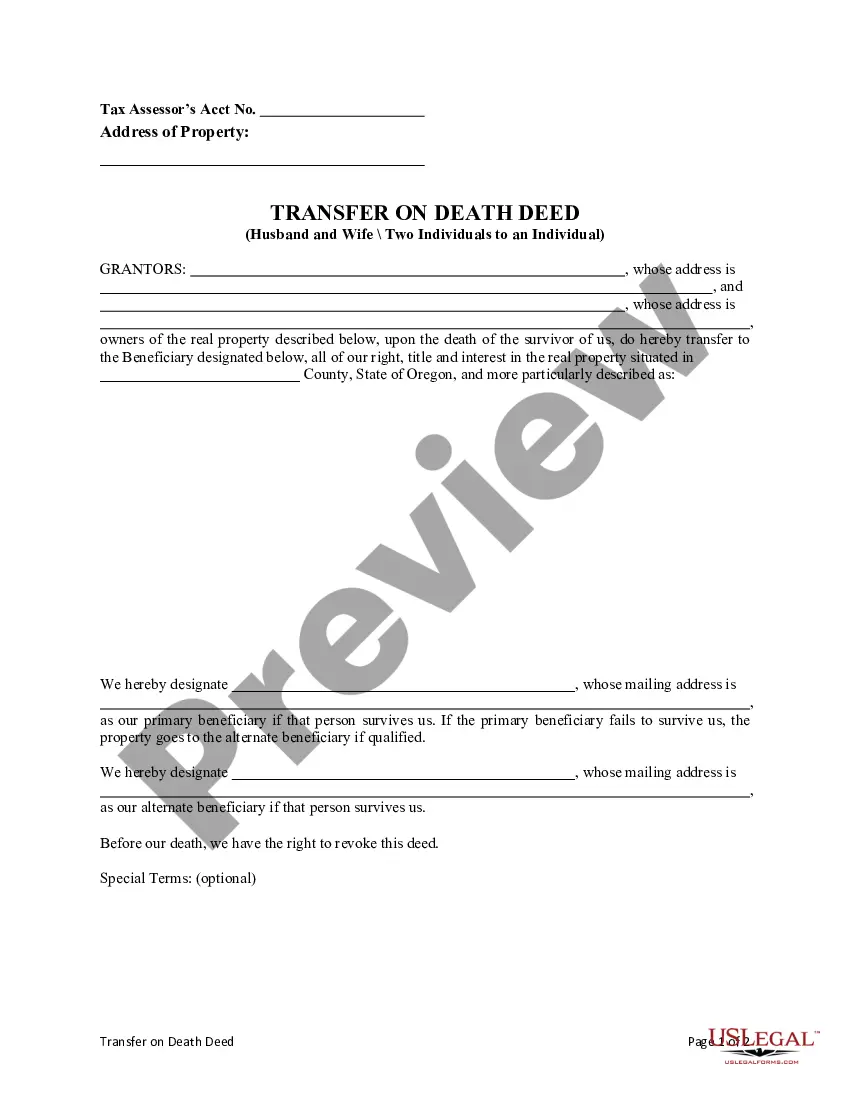

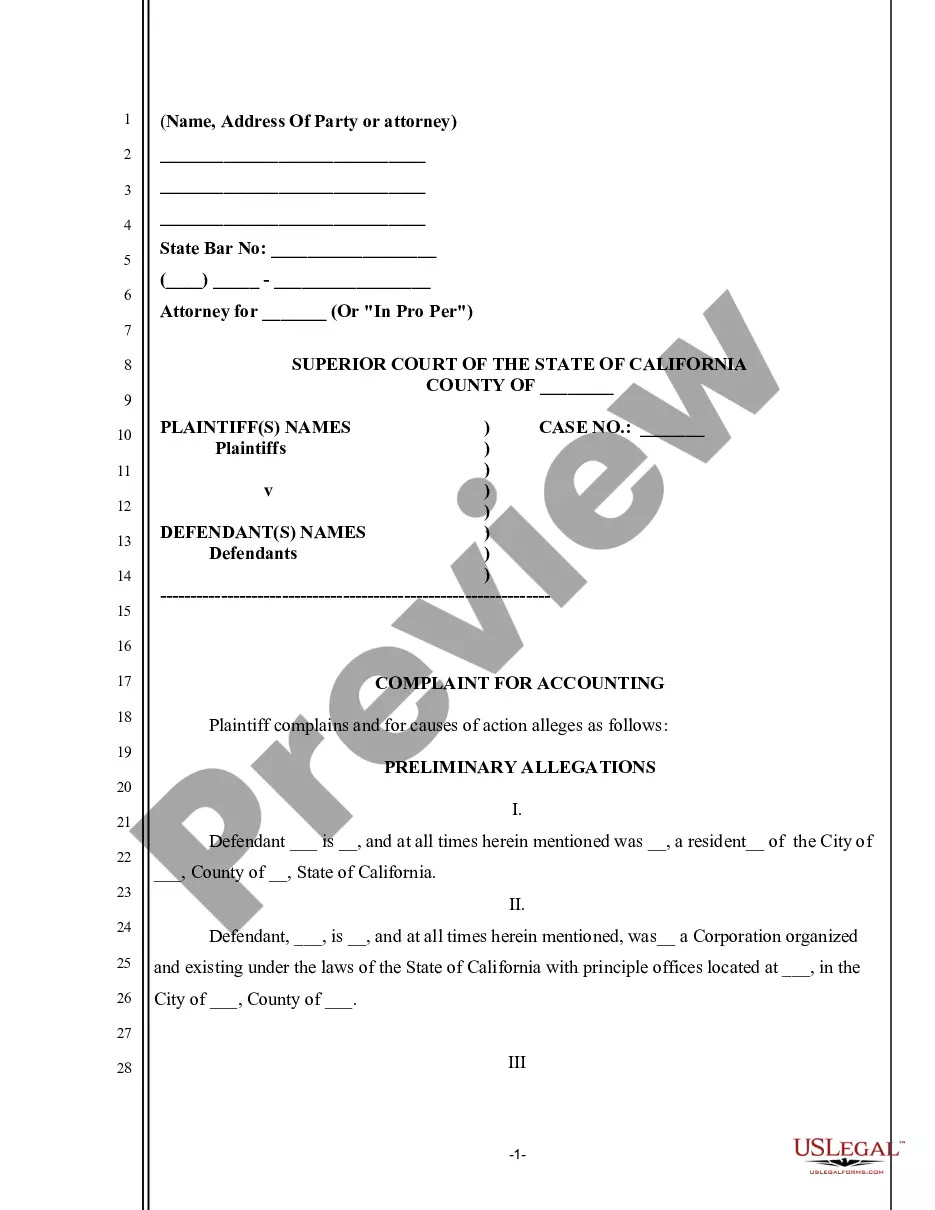

This form is a Transfer on Death Deed where the Grantors are husband and wife and the Grantee / Beneficiary is an individual. This transfer is revocable until Grantor's death and effective only upon the death of the last surviving Grantor. The primary beneficiary / Grantee takes the property if the primary beneficiary survives the Grantors. If the primary beneficiary fails to survive Grantors, the property would go to the secondary beneficiary if qualified. This deed complies with all state statutory laws.

Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary.

Description

Key Concepts & Definitions

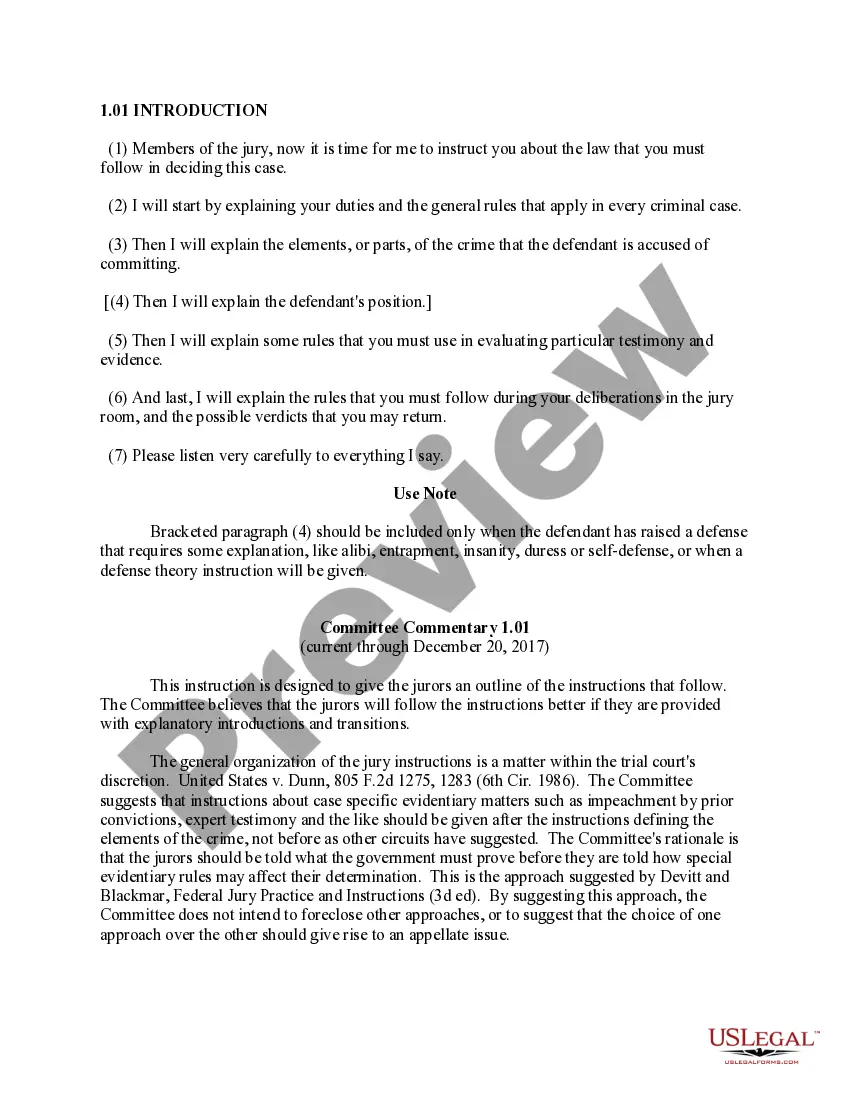

Transfer on Death Deed (TOD Deed): A legal document that allows property owners to name a beneficiary who will receive the property upon the owner's death without the need for probate. Probate Process: A legal process where after death, a court oversees the distribution of the deceased's assets. It can be lengthy and costly. Quitclaim: A deed that transfers any ownership interest the grantor has in the property, without warranties or guarantees that the grantor owns the property at all.

Step-by-Step Guide to Creating a Transfer on Death Deed from Two Individuals

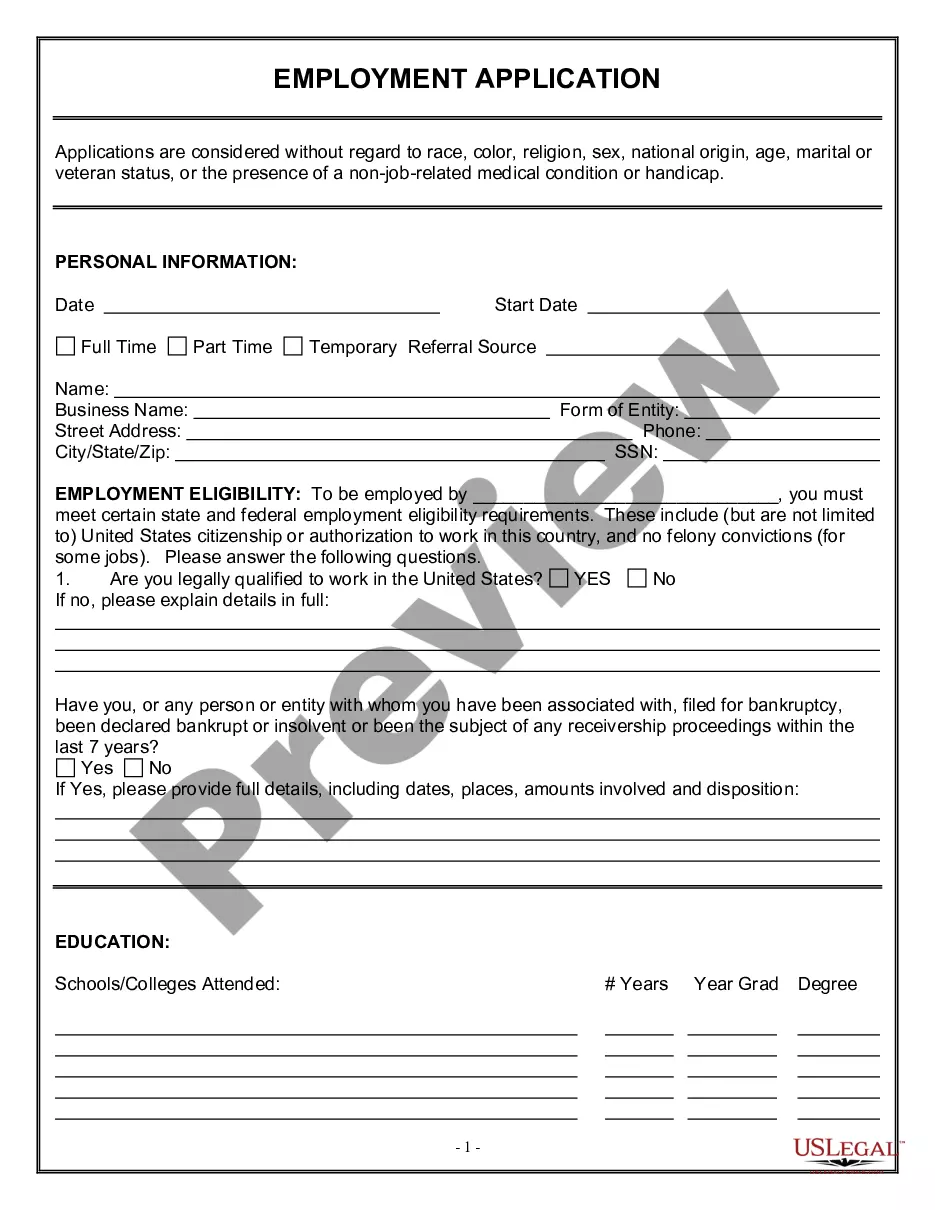

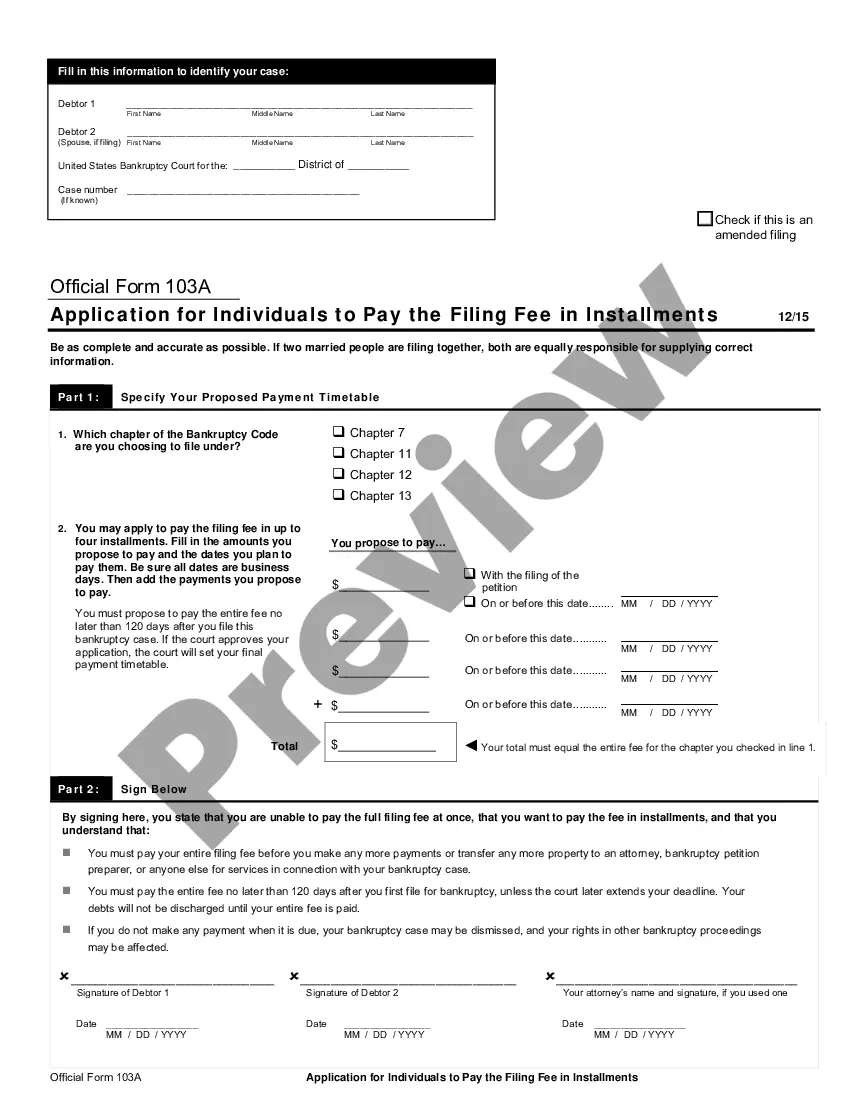

- Document Preparation: Gather personal information for both individuals, including legal names, addresses, and detailed descriptions of the property.

- Select a Beneficiary: Decide who will inherit the property. This person can be a relative, friend, or organization.

- Complete the TOD Deed Form: Fill out the form specific to your state. This form may be available online or through an attorney.

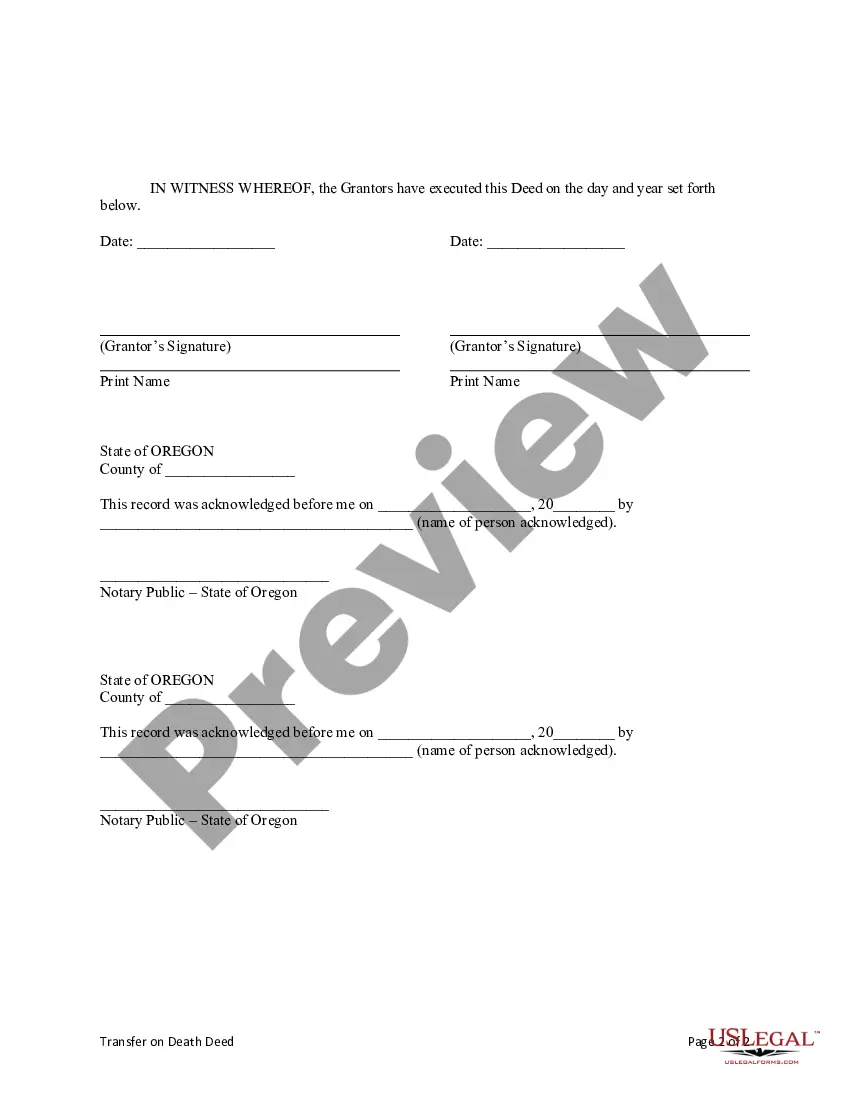

- Signature and Notarization: Both property owners must sign the deed in the presence of a notary public to make it legally binding.

- Record the Deed: File the signed deed with the local county recorders office to make it effective. There may be a filing fee involved.

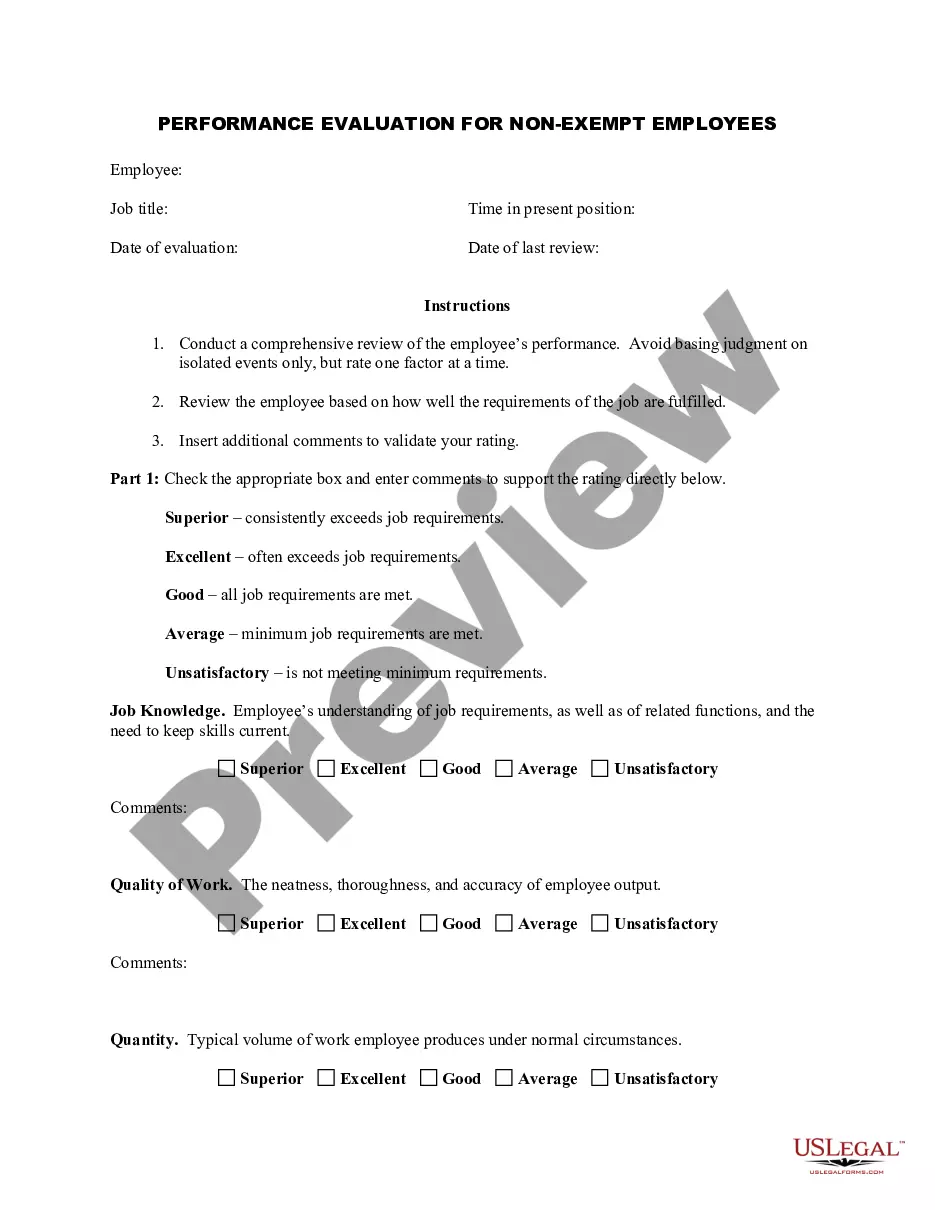

Risk Analysis of Using a Transfer on Death Deed

While beneficial, transfer on death deeds come with risks:

- Potential disputes among beneficiaries, especially if not clearly defined or if there are multiple beneficiaries.

- Changes in circumstances (e.g., the beneficiary predeceases the owner) necessitating updates to the deed that if ignored can lead to legal complications.

- Lack of flexibility compared to a trust, as a TOD deed is effective only upon death and offers no benefits during the owner's lifetime.

Pros & Cons of Transfer on Death Deeds

Pros:

- Avoids the time-consuming and expensive probate process.

- Simplifies the transfer of property upon death.

- Can be revoked or changed as long as the property owner is alive.

Cons:

- Does not provide asset protection or tax benefits during the owner's life.

- May lead to complications if the beneficiary has legal or financial issues.

- Doesn't cover all types of properties; some estate laws might restrict the use of TOD deeds.

Best Practices in Drafting a TOD Deed

- Ensure all information is accurate and the deed conforms to state law requirements to avoid legal challenges.

- Consult with an estate planning attorney to tailor the deed according to your specific circumstances and needs.

- Regularly review and update the deed, especially after major life events like marriage, divorce, or the birth of a child.

Common Mistakes & How to Avoid Them

- Not Notarizing the Deed: Always ensure the deed is properly notarized, as failing to do so can invalidate the document.

- Failing to Record the Deed: Always file the deed with the appropriate county office to ensure it is recognized legally upon death.

- Ignoring Changes in Laws: Stay informed about changes in estate and property laws in your state that might affect TOD deeds.

How to fill out Oregon Transfer On Death Deed From Two (2) Individuals Or Husband And Wife To An Individual With Provision For Appointment Of Alternative Beneficiary.?

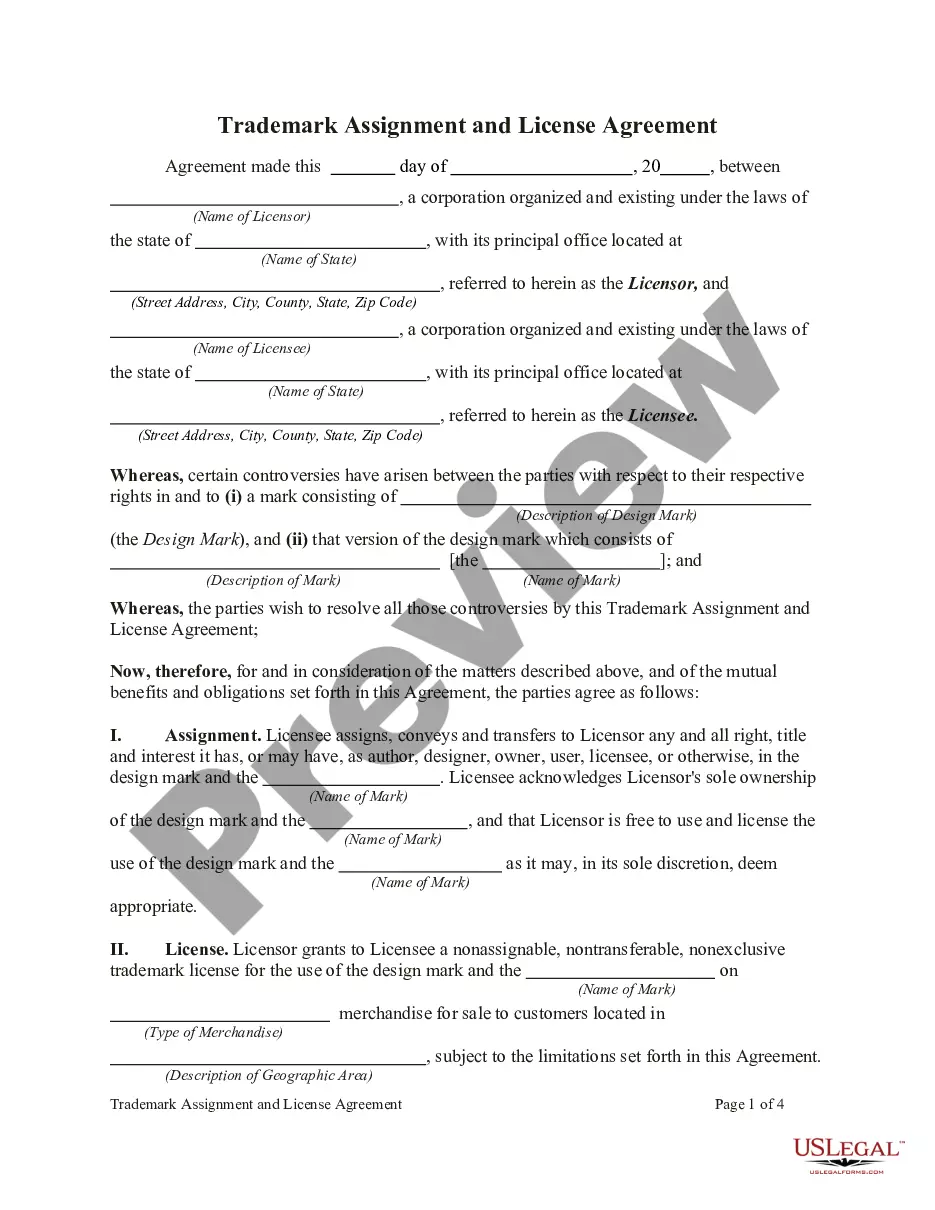

In terms of completing Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary., you almost certainly visualize an extensive procedure that requires choosing a appropriate sample among countless very similar ones and then being forced to pay out an attorney to fill it out for you. Generally, that’s a sluggish and expensive choice. Use US Legal Forms and pick out the state-specific document within clicks.

In case you have a subscription, just log in and click Download to have the Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary. sample.

If you don’t have an account yet but need one, follow the point-by-point guideline below:

- Make sure the document you’re downloading applies in your state (or the state it’s needed in).

- Do it by reading the form’s description and through clicking the Preview function (if accessible) to find out the form’s information.

- Click on Buy Now button.

- Find the appropriate plan for your financial budget.

- Sign up to an account and select how you would like to pay: by PayPal or by card.

- Download the file in .pdf or .docx file format.

- Get the document on your device or in your My Forms folder.

Skilled attorneys work on drawing up our samples to ensure that after downloading, you don't have to worry about editing and enhancing content material outside of your individual info or your business’s information. Sign up for US Legal Forms and get your Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary. document now.

Form popularity

FAQ

Get a Deed Form or Prepare Your Own. You can buy a state-specific TOD deed form for your state or type up your own document. Name the Beneficiary. Describe the Property. Sign the Deed. Record the Deed.

Effective January 1, 2012, Oregon law provides for a new form of deed known as a transfer on death (TOD) deed. These deeds allow an owner of real property to designate a beneficiary who will obtain title to that real property when the owner dies, without having to go through probate (subject to some exceptions).

When a joint owner dies, the process is relatively simple you just need to inform the Land Registry of the death. You should complete a 'Deceased joint proprietor' form on the government's website and then send the form to the Land Registry, with an official copy of the death certificate.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

Once you obtain a transfer-on-death deed, complete the form to name a beneficiary. The transfer deed will ask you to name the person(s) you wish to inherit your property. You can name multiple people as the beneficiary, as well as an organization. List the beneficiary's complete name and avoid titles.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

All you need to do is fill out a simple form, provided by the bank, naming the person you want to inherit the money in the account at your death. As long as you are alive, the person you named to inherit the money in a payable-on-death (POD) account has no rights to it.

A transfer on death (TOD) account automatically transfers its assets to a named beneficiary when the holder dies For example, if you have a savings account with $100,000 in it and name your son as its beneficiary, that account would transfer to him upon your death.