Delaware Neutral Assessors Report

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

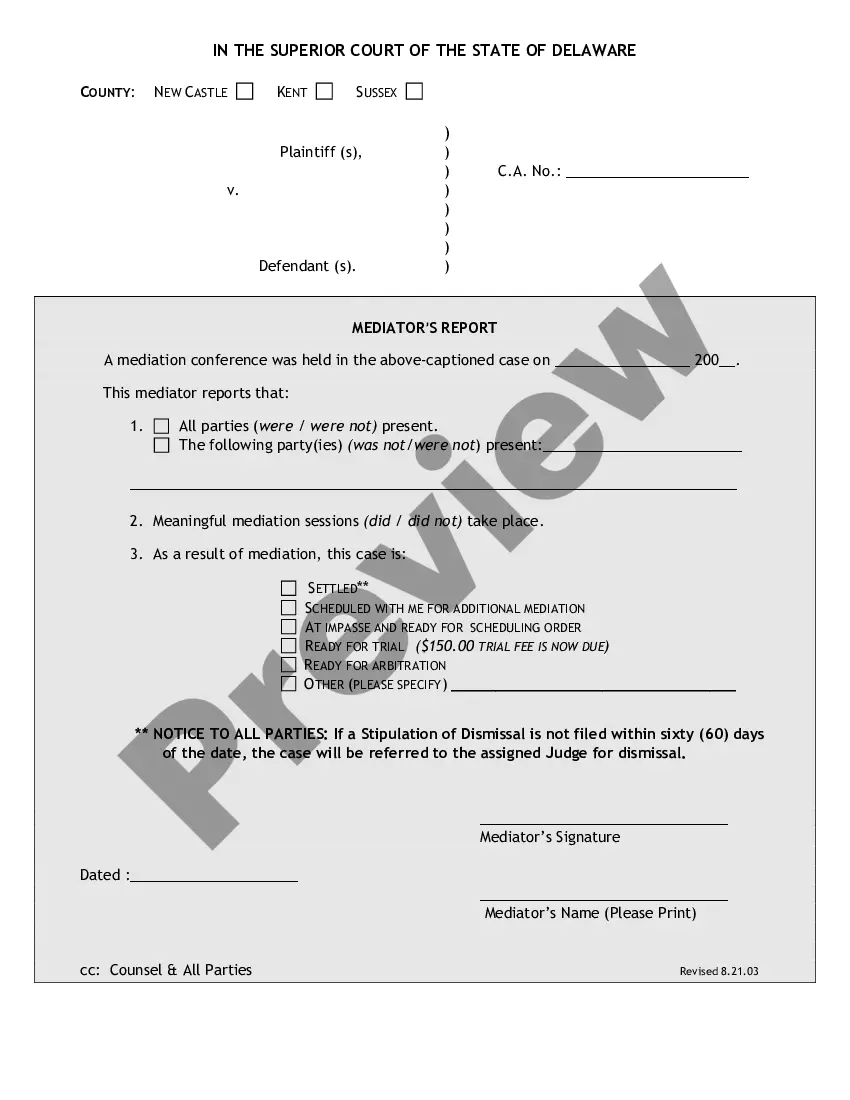

How to fill out Delaware Neutral Assessors Report?

The larger quantity of documents you generate - the more anxious you become.

You can discover a vast array of Delaware Neutral Assessor's Report templates online, however, you are unsure which ones to trust.

Eliminate the trouble of making the search for examples simpler by using US Legal Forms.

Provide the required details to create your account and complete your purchase with PayPal or a credit card. Choose a preferred document format and download your template. Access all templates you obtain in the My documents section. Simply navigate there to prepare a new copy of the Delaware Neutral Assessor's Report. Even with professionally prepared documents, it's crucial to consider consulting a local attorney to review the completed form to ensure your record is filled out correctly. Achieve more for less with US Legal Forms!

- If you possess a US Legal Forms subscription, Log In to your account, and you will find the Download button on the Delaware Neutral Assessor's Report’s page.

- If you are a new user of our platform, follow these steps to register.

- Ensure the Delaware Neutral Assessor's Report is applicable in your jurisdiction.

- Verify your choice by reviewing the description or utilizing the Preview feature if available for the selected document.

- Click Buy Now to begin the sign-up process and select a payment plan that fits your requirements.

Form popularity

FAQ

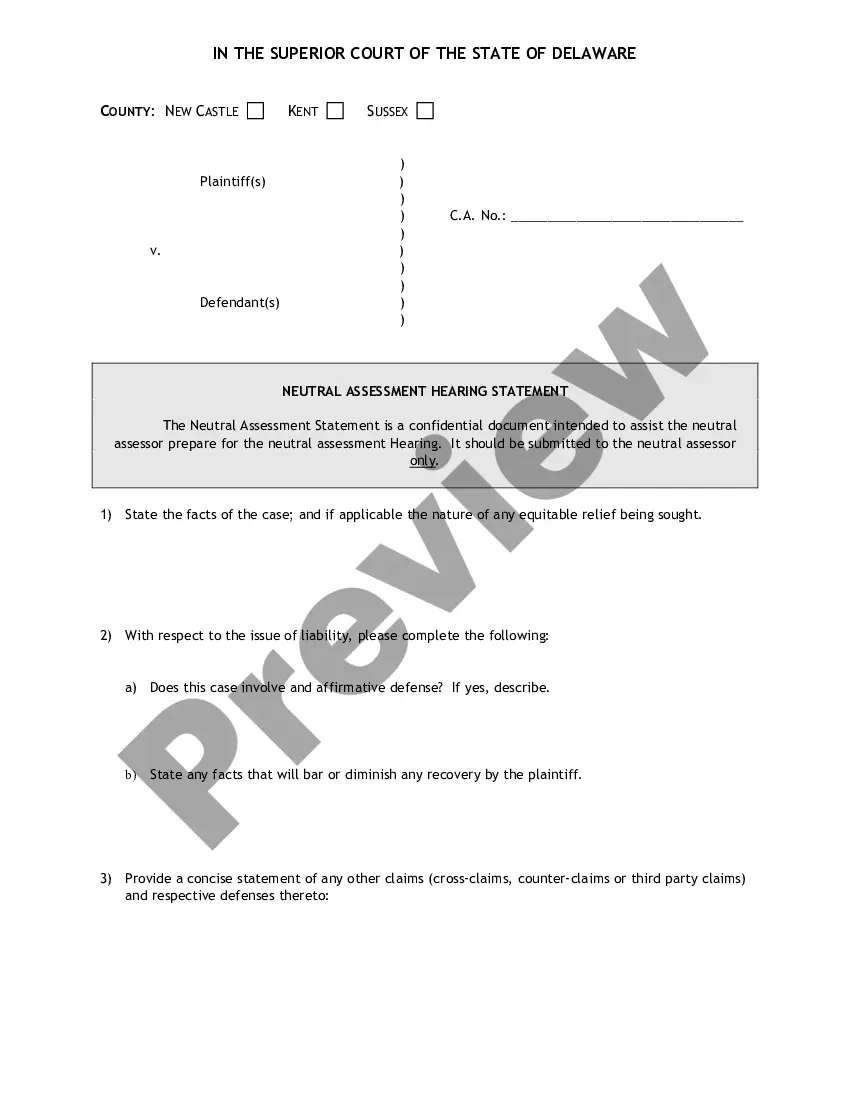

Property taxes in Delaware are assessed based on the fair market value of the property, determined by the local assessors. The process includes evaluating various factors such as property improvements and neighborhood trends. Utilizing the Delaware Neutral Assessors Report can provide clarity and transparency during this assessment process. Being informed allows property owners to challenge assessments if needed.

In Delaware, seniors may be eligible for property tax exemptions and credits starting at age 65. These benefits aim to ease the financial burden for older homeowners. To understand how to qualify for these exemptions, consider reviewing the Delaware Neutral Assessors Report for detailed eligibility criteria. This assessment can empower seniors to navigate their property tax landscape effectively.

Generally, a higher property assessment can lead to higher taxes. However, tax rates also play a significant role in determining your overall tax liability. The Delaware Neutral Assessors Report helps property owners understand how assessments affect taxes, providing clear data on market value changes. Being proactive with this information can help you make informed financial decisions.

Reassessments in Delaware occur at varying intervals based on local practices, generally every five to ten years. Each county may have its own schedule for conducting these evaluations. Using the Delaware Neutral Assessors Report allows you to access valuable insights into your property’s value during these assessments. You can prepare for possible changes well in advance.

Delaware typically reassesses property taxes every few years. This process ensures that property values reflect current market conditions. The Delaware Neutral Assessors Report plays a crucial role in providing accurate assessments, helping property owners understand changes that may affect their taxes. Staying informed about these reassessments can benefit you greatly.

Failing to file your annual report in Delaware can lead to significant consequences, including fines and the potential dissolution of your business entity. The state views timely reporting as a critical responsibility, and neglecting it could affect your business's legal standing. To avoid such issues, consider utilizing tools and resources, including a Delaware Neutral Assessors Report, which can help you maintain compliance and facilitate your filings.

Rule 59 in the Delaware Superior Court governs the process for obtaining new trials and modifying judgments. It allows parties to file motions for new trials based on specific grounds, such as legal errors or new evidence. This rule is vital for ensuring that all parties have the opportunity to present a fair case. A Delaware Neutral Assessors Report may help gather the facts necessary for an effective argument under Rule 59.

Yes, filing an annual report for your LLC in Delaware is mandatory. This report provides essential information about your business and ensures compliance with state regulations. Failure to file can result in penalties and legal issues. To simplify this process, consider referencing a Delaware Neutral Assessors Report, which can help clarify your LLC's standing and responsibilities.

In Delaware, Rule 59 E allows parties to seek alteration or amendment of a judgment under specific circumstances. This rule helps address errors or new evidence that might impact the outcome of a case. Filing this motion requires adherence to strict deadlines, so it’s vital to consult legal resources. A Delaware Neutral Assessors Report might enhance your argument by providing impartial insights.

A Rule 59 E motion enables a party to request that a court alter or amend its judgment. This motion must be filed within a set timeframe after the judgment is entered. It is critical to present clear reasons for the request to show that justice requires a different outcome. Utilizing a Delaware Neutral Assessors Report may provide valuable evidence to support your motion.