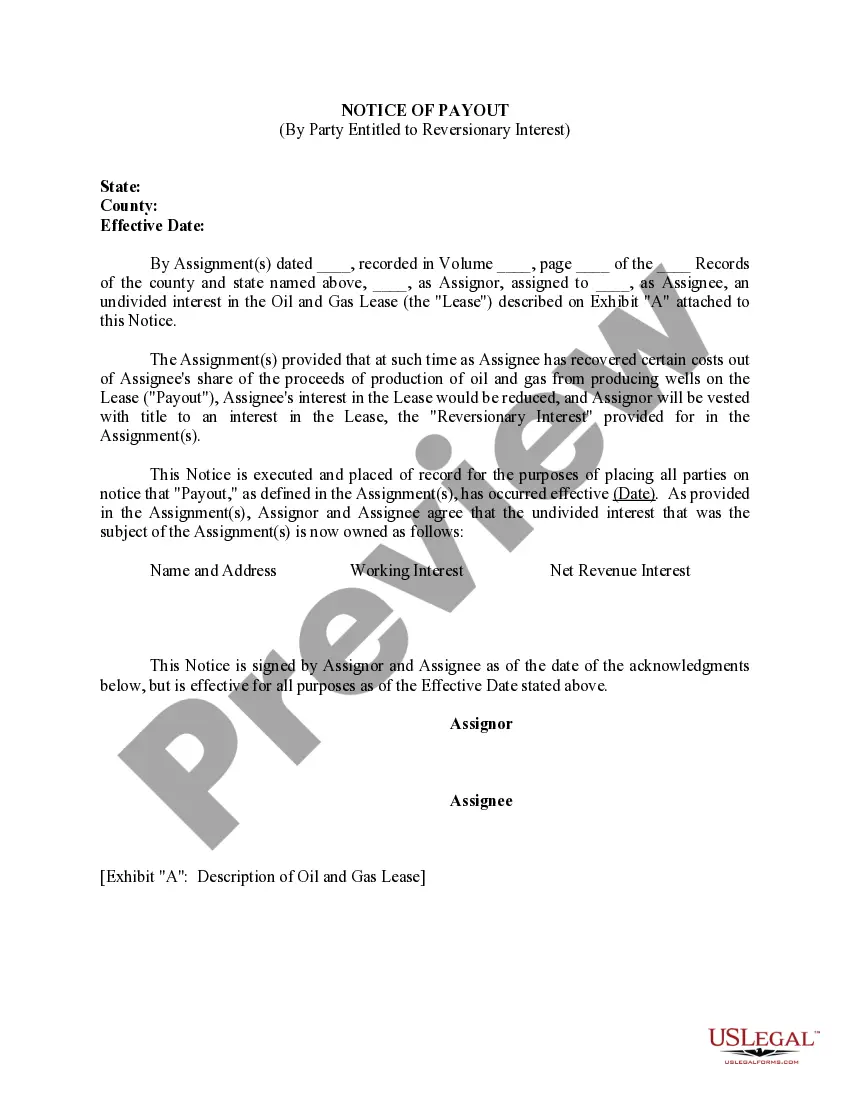

Oklahoma Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest

Description

How to fill out Notice Of Payout, Election To Convert Interest To Party With Right To Convert An Overriding Royalty Interest To A Working Interest?

If you want to comprehensive, obtain, or print out legitimate record layouts, use US Legal Forms, the largest selection of legitimate kinds, that can be found on the Internet. Make use of the site`s simple and practical research to get the files you will need. A variety of layouts for company and person functions are categorized by types and suggests, or keywords. Use US Legal Forms to get the Oklahoma Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest in just a few clicks.

Should you be previously a US Legal Forms customer, log in in your bank account and click the Download option to get the Oklahoma Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest. You can also accessibility kinds you in the past downloaded from the My Forms tab of your respective bank account.

If you use US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have selected the form for that right town/region.

- Step 2. Make use of the Review method to look over the form`s content material. Never neglect to read through the description.

- Step 3. Should you be unsatisfied using the kind, utilize the Lookup field near the top of the display to find other versions of your legitimate kind design.

- Step 4. When you have found the form you will need, click the Purchase now option. Opt for the costs plan you favor and add your accreditations to register for an bank account.

- Step 5. Method the deal. You can utilize your bank card or PayPal bank account to accomplish the deal.

- Step 6. Pick the file format of your legitimate kind and obtain it on the system.

- Step 7. Comprehensive, modify and print out or indicator the Oklahoma Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest.

Every legitimate record design you buy is your own eternally. You have acces to every kind you downloaded in your acccount. Go through the My Forms segment and choose a kind to print out or obtain once more.

Be competitive and obtain, and print out the Oklahoma Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest with US Legal Forms. There are many specialist and express-distinct kinds you may use for your company or person needs.

Form popularity

FAQ

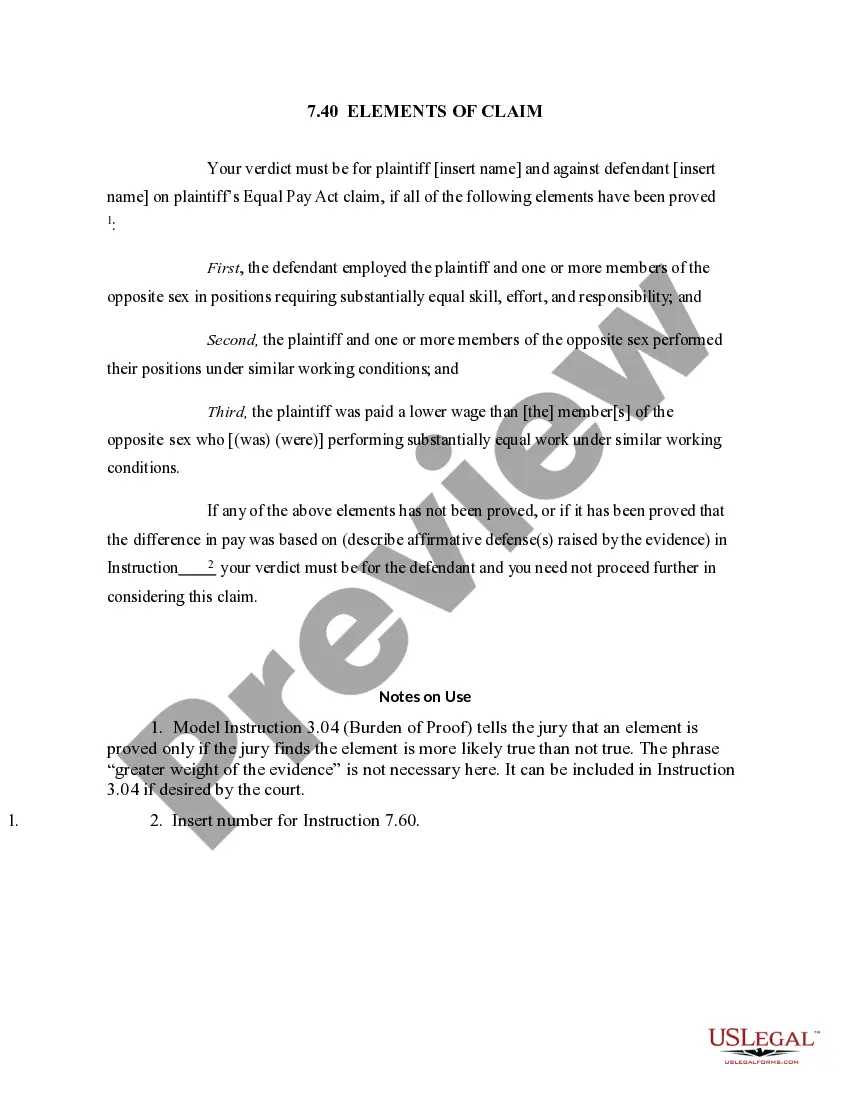

An Overriding Royalty Interest IORRI), commonly referred to as an override, is a fractional, undivided interest granting the right to receive proceeds from the sale of oil and gas. It is not an interest in the minerals themselves, but rather in the proceeds of the sale of oil and gas.

Several factors determine the value of an overriding royalty interest in a working lease. They include: Location ? A mineral interest in high producing shale basins will be more valuable. Producing Wells ? Producing wells are valued higher than non-producing wells.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

?To pay Lessor for gas (including casinghead gas) and all other substance covered hereby, a royalty of 3/16 of the proceeds realized by Lessee from the sale thereof.? This simply means the operator will pay a royalty of 3/16 of revenue generated from production on the property.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

To summarize, Blanchard Royalties refer to the practice of the pooling or communitization of royalty interests such that each royalty owner would get their proportionate share in 1/8th of all production from any wells drilled within the unit.

However, unlike royalty and working interests, an overriding royalty interest cannot be fractionalized unlike royalty and working interests. The ORRI is a non-possessory, undivided right to a share of the oil and gas production, but it excludes the production costs of the mineral lease.

An attorney can create a deed or assignment that conveys the mineral rights to the new owners. The original deed will need to be recorded in the county where the minerals are located. If there are producing wells on the property, each operator will need to be notified of the change in ownership.