This form is when the Lessor ratifies the Lease and grants, leases, and lets all of Lessor's undivided mineral interest in the Lands to Lessee on the same terms and conditions as provided for in the Lease, and adopts and confirms the Lease as if Lessor was an original party to and named as a Lessor in the Lease.

Oklahoma Ratification of Oil, Gas, and Mineral Lease by Mineral Owner

Description

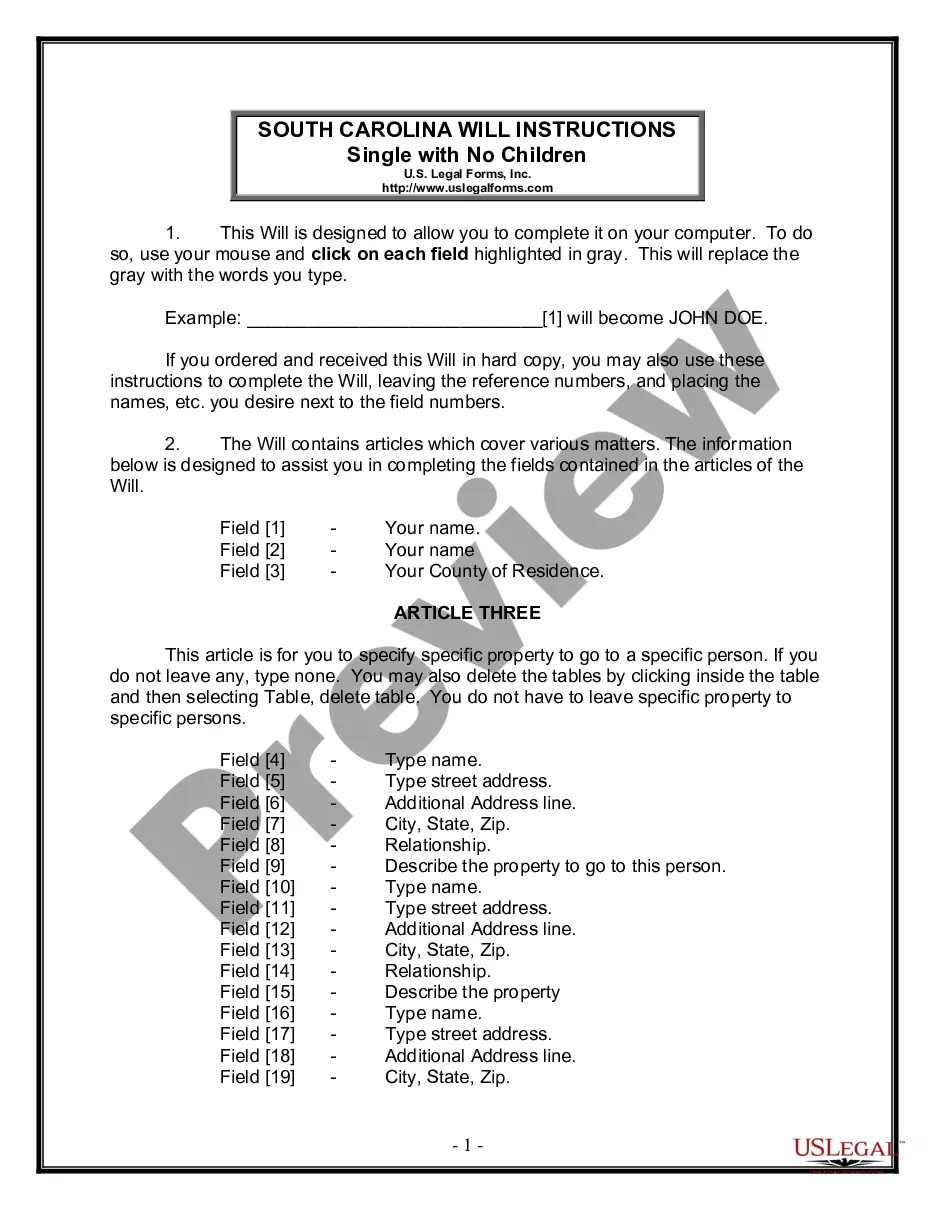

How to fill out Ratification Of Oil, Gas, And Mineral Lease By Mineral Owner?

If you have to comprehensive, obtain, or produce authorized record themes, use US Legal Forms, the biggest assortment of authorized kinds, that can be found on-line. Make use of the site`s simple and easy handy lookup to obtain the papers you need. Various themes for company and individual functions are categorized by types and suggests, or keywords and phrases. Use US Legal Forms to obtain the Oklahoma Ratification of Oil, Gas, and Mineral Lease by Mineral Owner with a handful of clicks.

In case you are already a US Legal Forms customer, log in to your accounts and click on the Obtain button to get the Oklahoma Ratification of Oil, Gas, and Mineral Lease by Mineral Owner. You can also gain access to kinds you previously downloaded inside the My Forms tab of the accounts.

If you are using US Legal Forms initially, follow the instructions beneath:

- Step 1. Be sure you have selected the shape to the appropriate area/land.

- Step 2. Use the Review solution to check out the form`s content. Never forget about to learn the description.

- Step 3. In case you are not happy together with the kind, utilize the Search area towards the top of the screen to locate other types in the authorized kind web template.

- Step 4. After you have discovered the shape you need, click on the Get now button. Pick the costs program you like and add your accreditations to sign up for the accounts.

- Step 5. Process the purchase. You can utilize your charge card or PayPal accounts to perform the purchase.

- Step 6. Choose the file format in the authorized kind and obtain it on the device.

- Step 7. Comprehensive, revise and produce or indicator the Oklahoma Ratification of Oil, Gas, and Mineral Lease by Mineral Owner.

Every single authorized record web template you purchase is your own property forever. You might have acces to each kind you downloaded in your acccount. Select the My Forms section and select a kind to produce or obtain again.

Remain competitive and obtain, and produce the Oklahoma Ratification of Oil, Gas, and Mineral Lease by Mineral Owner with US Legal Forms. There are many specialist and status-specific kinds you may use for your personal company or individual requires.

Form popularity

FAQ

To ?ratify? a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

Statutory ?Pugh? Clause: The Commission has no jurisdiction to release any portion of your lease. [* Named after a Louisiana lawyer, Lawrence G. Pugh, who drafted an oil and gas lease clause calculated to prevent the holding of non-pooled acreage.]

The point of a retained-acreage provision is to be able to seek a new opportunity to lease unworked land to a different lessee, one who might do something productive with it. A Pugh clause is a negotiated provision in favor of the lessor. Pugh clauses modify pooling/unitization rights.

What is the Pugh Clause and what does it accomplish? In general terms, the Pugh Clause provides that production from a unitized or pooled area located on or including a portion of the leased lands will not be sufficient to extend the primary term for the entire leasehold.

A Pugh Clause terminates the lease as to the portions of the land that are not included in a unit if the lessee does not conduct independent operations. Therefore, the Pugh Clause requires the lessee to develop areas of the lease that are not included in a unit.

The only way to determine mineral rights ownership in Oklahoma is to do a title search at the courthouse where the property is located. To do this, you must review all deeds and other legal conveyances pertaining to the subject tract back to 1907. Mineral ownership information is not available online from any website.

Without any royalty income it comes down to what buyers think the future income might be. For non-producing properties, the Mineral Rights Value in Oklahoma could be anywhere from a few hundred dollars per acre to $5,000+/acre. It really depends on which county your property is located in.

Oklahoma has no inheritance tax. Capital gains tax must be paid on any sale of mineral rights and income generated from royalty streams. However, if the mineral rights have not been severed from the property, the county may not charge taxes beyond property taxes.