Oklahoma Geophysical Exploration Agreement Between Mineral Owner and Operator, with Option to Purchase Oil and Gas Lease

Description

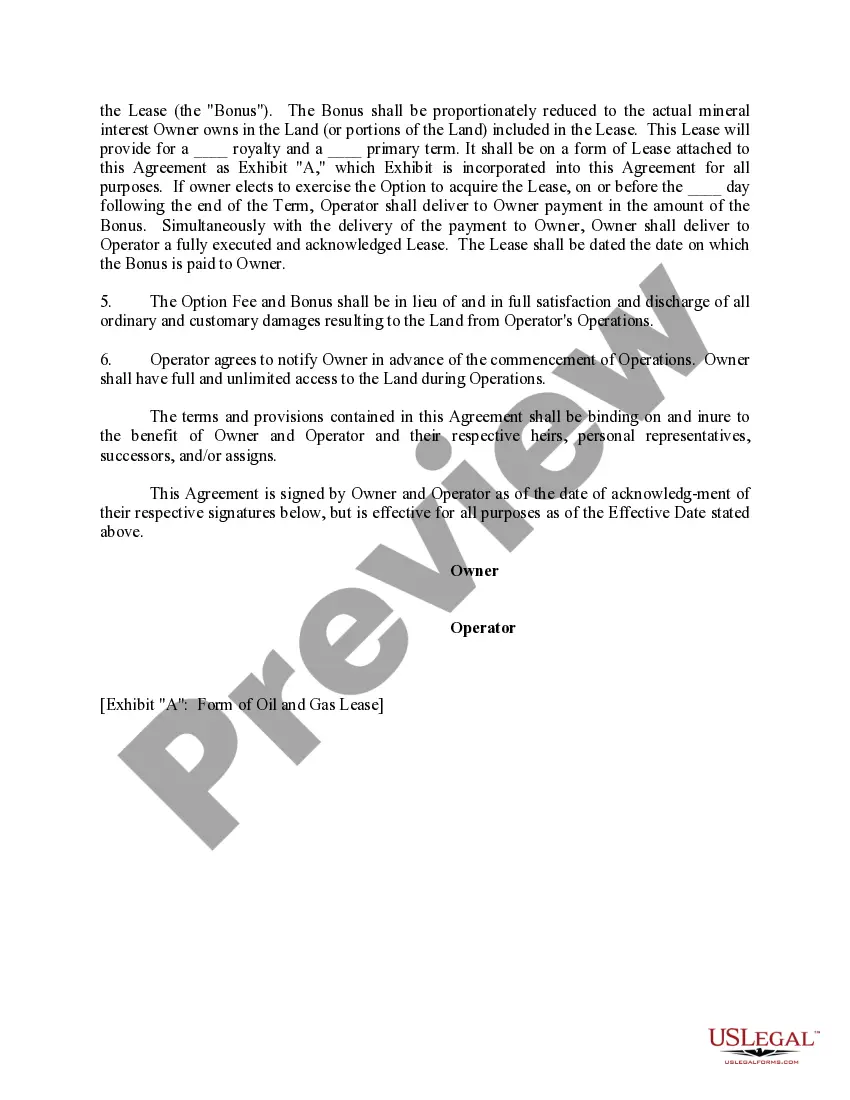

How to fill out Geophysical Exploration Agreement Between Mineral Owner And Operator, With Option To Purchase Oil And Gas Lease?

US Legal Forms - one of several greatest libraries of authorized varieties in the United States - offers an array of authorized file templates you may acquire or produce. Utilizing the website, you can get 1000s of varieties for organization and personal purposes, categorized by types, claims, or search phrases.You can get the most recent models of varieties such as the Oklahoma Geophysical Exploration Agreement Between Mineral Owner and Operator, with Option to Purchase Oil and Gas Lease in seconds.

If you have a registration, log in and acquire Oklahoma Geophysical Exploration Agreement Between Mineral Owner and Operator, with Option to Purchase Oil and Gas Lease through the US Legal Forms catalogue. The Obtain option will show up on every form you view. You gain access to all previously downloaded varieties inside the My Forms tab of the profile.

If you wish to use US Legal Forms the very first time, here are basic recommendations to help you get started:

- Ensure you have selected the proper form for the metropolis/state. Click the Preview option to examine the form`s information. Browse the form description to actually have chosen the correct form.

- In the event the form does not suit your demands, utilize the Research industry towards the top of the display screen to get the one which does.

- Should you be happy with the shape, validate your option by clicking on the Purchase now option. Then, choose the costs prepare you prefer and give your qualifications to sign up for the profile.

- Procedure the purchase. Utilize your bank card or PayPal profile to perform the purchase.

- Find the file format and acquire the shape on the device.

- Make alterations. Complete, revise and produce and sign the downloaded Oklahoma Geophysical Exploration Agreement Between Mineral Owner and Operator, with Option to Purchase Oil and Gas Lease.

Each design you included with your account lacks an expiry time and is also your own eternally. So, if you would like acquire or produce one more duplicate, just go to the My Forms portion and then click on the form you will need.

Gain access to the Oklahoma Geophysical Exploration Agreement Between Mineral Owner and Operator, with Option to Purchase Oil and Gas Lease with US Legal Forms, probably the most comprehensive catalogue of authorized file templates. Use 1000s of expert and express-specific templates that meet your small business or personal requirements and demands.

Form popularity

FAQ

Below are seven of the most important things that you should do to be successful as you work on oil and gas deals with companies. Don't Focus on Price Only. ... Practice Patience. Patience is a virtue, especially when it comes to making a deal in the oil and gas business. ... Never show your hand. ... Delete The Warranty Clause.

The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations. Types of Leases: There are different types of oil and gas leases, and they affect royalty calculations differently.

Negotiating an oil and gas lease will require some research upfront. If you're a landowner interested in working with an oil and gas company, you should explore their history and experience. You'll want to work with a reputable company that works in your best interests, holds a high standard, and maintains insurance.

These basic lease terms ? bonus, royalty, term, delay rental (if any) and shut-in royalty --are typically the "deal terms" negotiated between the Lessor and Lessee. The Lessor typically wants the highest bonus, delay rental and royalty fraction he can get, and the shortest primary term. The Lessee wants the opposite.

Ingly, when you see the words ?Paid-Up Lease,? this normally means that you will receive an upfront bonus for which the oil and gas company does not have to do anything during the initial or primary term of the lease.

Ingly, when you see the words ?Paid-Up Lease,? this normally means that you will receive an upfront bonus for which the oil and gas company does not have to do anything during the initial or primary term of the lease.

Oklahoma has no inheritance tax. Capital gains tax must be paid on any sale of mineral rights and income generated from royalty streams. However, if the mineral rights have not been severed from the property, the county may not charge taxes beyond property taxes.

Royalty Rates: The royalty agreement or rate is a percentage of total revenue gotten from the sale of oil and gas, and it's always outlined in the lease agreement. The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations.