Oklahoma Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries

Description

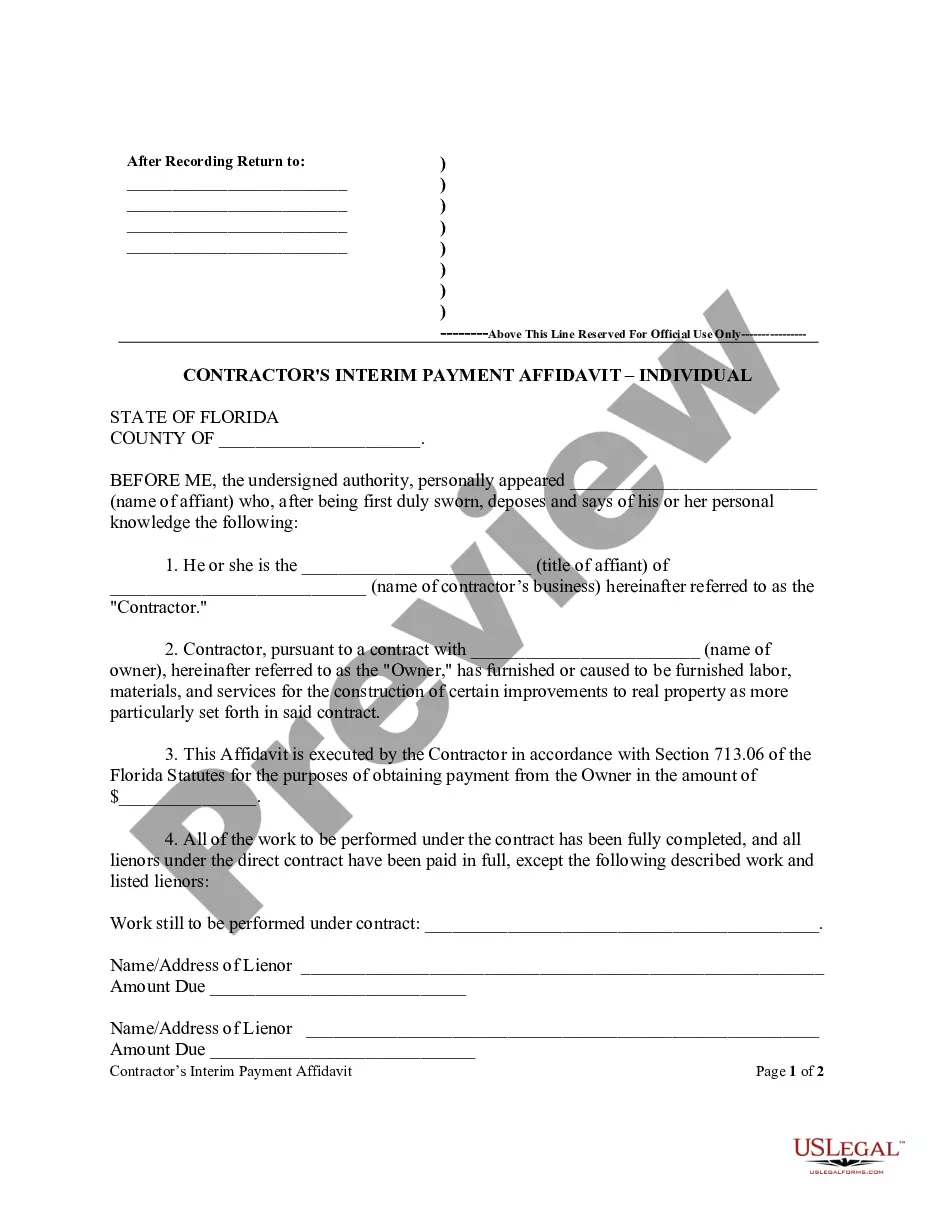

How to fill out Trustee's Deed And Assignment For Distribution By Trustee To Testamentary Trust Beneficiaries?

If you have to total, down load, or produce legal record web templates, use US Legal Forms, the biggest selection of legal kinds, that can be found on the Internet. Take advantage of the site`s simple and easy practical research to discover the documents you require. Various web templates for business and person purposes are sorted by types and suggests, or keywords and phrases. Use US Legal Forms to discover the Oklahoma Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries with a few click throughs.

Should you be previously a US Legal Forms consumer, log in to your accounts and click on the Download button to obtain the Oklahoma Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries. You may also access kinds you previously delivered electronically from the My Forms tab of the accounts.

If you use US Legal Forms the first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the shape for your correct city/country.

- Step 2. Utilize the Review option to look over the form`s information. Never neglect to read through the outline.

- Step 3. Should you be unsatisfied together with the type, take advantage of the Look for field on top of the display screen to find other types in the legal type template.

- Step 4. After you have discovered the shape you require, go through the Get now button. Opt for the prices strategy you prefer and include your qualifications to register for an accounts.

- Step 5. Procedure the deal. You may use your bank card or PayPal accounts to finish the deal.

- Step 6. Pick the file format in the legal type and down load it on your own gadget.

- Step 7. Full, edit and produce or indicator the Oklahoma Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries.

Every legal record template you acquire is the one you have permanently. You have acces to each type you delivered electronically in your acccount. Click on the My Forms portion and pick a type to produce or down load again.

Compete and down load, and produce the Oklahoma Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries with US Legal Forms. There are thousands of skilled and status-particular kinds you may use for your business or person demands.

Form popularity

FAQ

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

A trustee deed?sometimes called a deed of trust or a trust deed?is a legal document created when someone purchases real estate in a trust deed state, such as California (check your local laws to see what is required in your state). A trust deed is used in place of a mortgage.

Any income/losses and capital gains/ losses earned in the in-trust account will be taxed in the trust unless the income or capital gains are paid or made payable to the beneficiaries. Income taxed in the trust is taxable at the highest marginal tax rate.

The transferee must have been a beneficiary of the trust when the property was acquired and became an asset of the trust (i.e. the relevant time). There must be no consideration for the transfer and the transfer of property from trustee to beneficiary must not be part of a sale or other arrangement.

To summarize, a trustee must provide notice to heirs and beneficiaries of a trust when the trust, or a portion of it, becomes irrevocable, or when there has been a change of trustee of an irrevocable trust. The trustee has 60 days to serve that notice and it must conform to the requirements of the probate code.

Bank accounts, retirement accounts, and life insurance will automatically transfer an inheritance if beneficiaries are designated. Listing beneficiaries on these accounts can be the easiest and quickest way to transfer those assets outside probate court.

You can name your own testamentary trust as your beneficiary by including it on the beneficiary form in the following format. You cannot name someone else's testamentary trust.

Outright distributions, in which the beneficiaries receive the assets outright, generally in a lump sum, and without restrictions. Staggered distributions, in which assets remain in a trust and are distributed over time, or based on the beneficiaries' ages or specific dates or events.