Oklahoma Subscription Agreement

Description

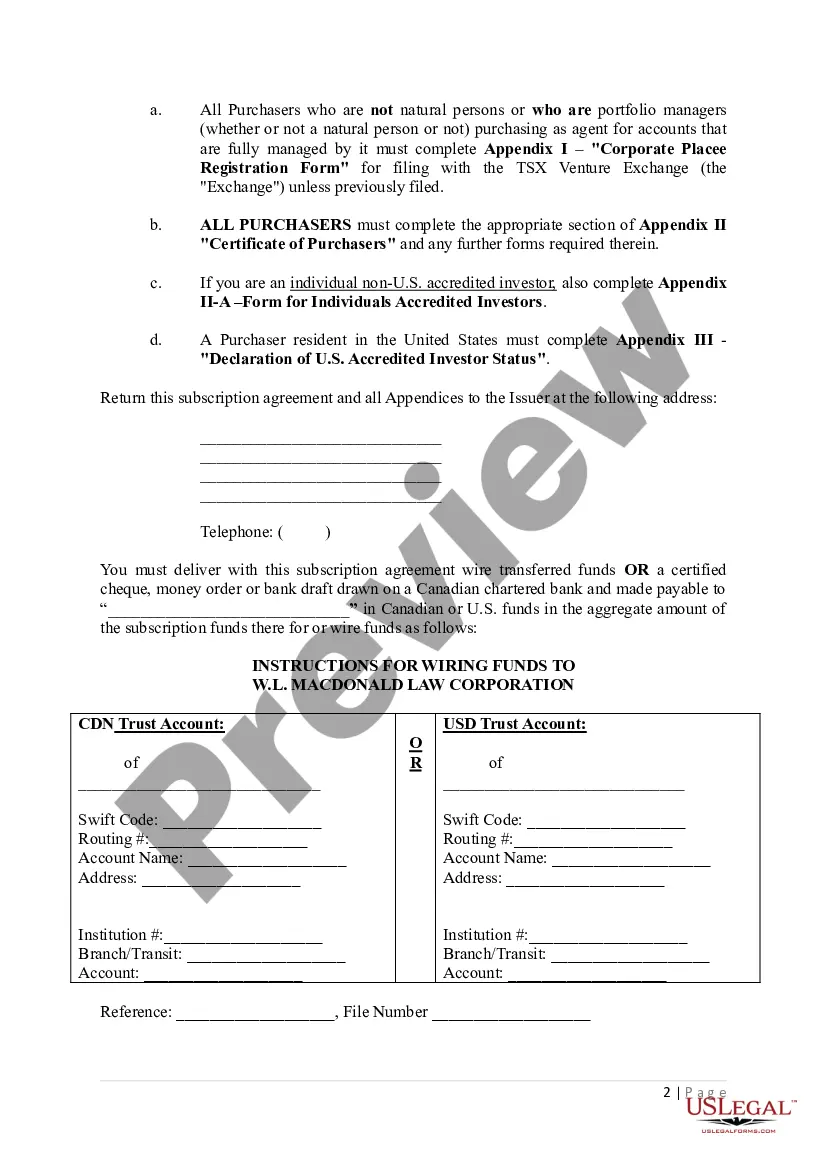

How to fill out Subscription Agreement?

US Legal Forms - one of several most significant libraries of authorized varieties in the USA - gives a wide range of authorized papers layouts you may obtain or print. Using the site, you can get thousands of varieties for organization and personal purposes, sorted by types, suggests, or keywords and phrases.You will discover the newest models of varieties just like the Oklahoma Subscription Agreement within minutes.

If you have a subscription, log in and obtain Oklahoma Subscription Agreement in the US Legal Forms collection. The Download switch will show up on every kind you look at. You have accessibility to all earlier delivered electronically varieties within the My Forms tab of the accounts.

If you want to use US Legal Forms the very first time, allow me to share easy directions to get you started off:

- Make sure you have picked the correct kind for the area/area. Select the Review switch to analyze the form`s information. Browse the kind outline to ensure that you have selected the correct kind.

- In case the kind does not satisfy your specifications, make use of the Research area near the top of the monitor to find the one which does.

- Should you be happy with the form, affirm your selection by simply clicking the Get now switch. Then, choose the rates strategy you want and offer your credentials to register to have an accounts.

- Approach the financial transaction. Use your credit card or PayPal accounts to complete the financial transaction.

- Choose the formatting and obtain the form on your system.

- Make modifications. Fill out, modify and print and indication the delivered electronically Oklahoma Subscription Agreement.

Each and every template you included with your bank account lacks an expiry date and is also your own property forever. So, if you wish to obtain or print yet another copy, just go to the My Forms segment and then click about the kind you will need.

Obtain access to the Oklahoma Subscription Agreement with US Legal Forms, one of the most comprehensive collection of authorized papers layouts. Use thousands of specialist and express-distinct layouts that meet up with your company or personal needs and specifications.

Form popularity

FAQ

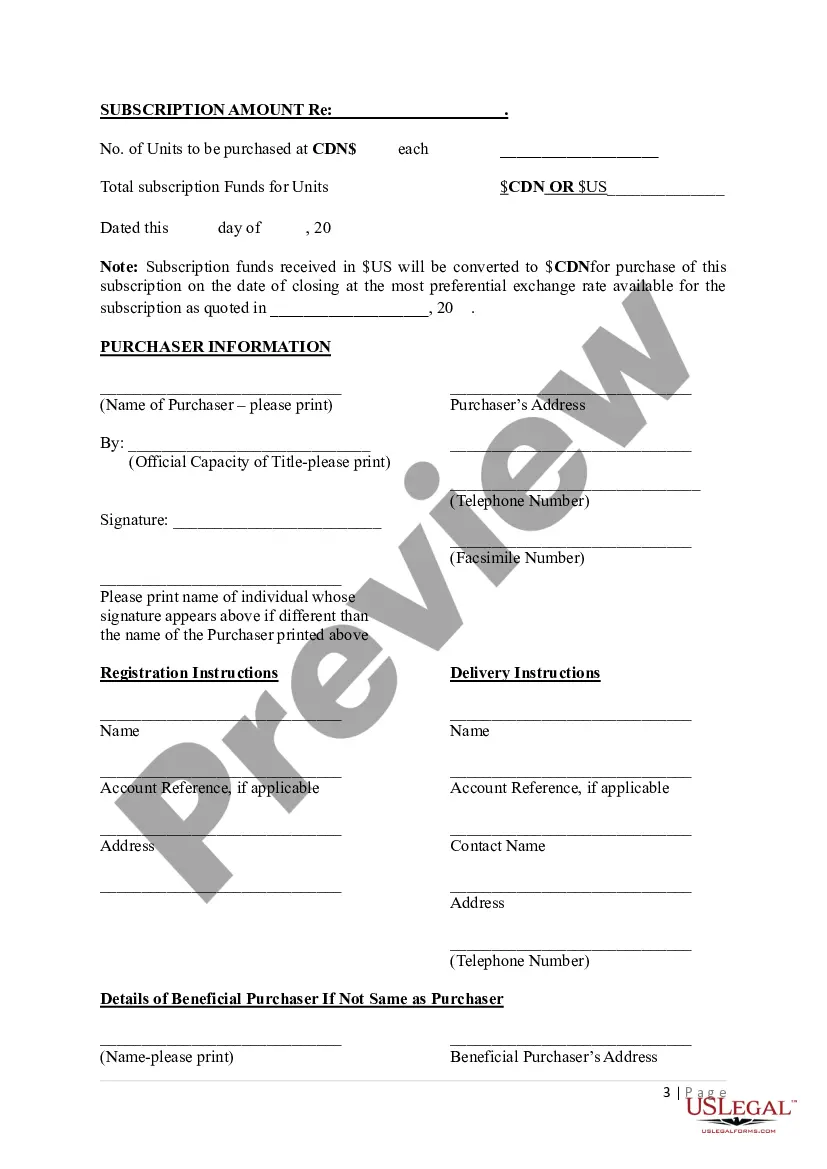

Hear this out loud PauseAlso known as a subscription agreement. The purchase agreement is the principal agreement between the issuer and the investor, or between the issuer and the initial purchasers, in a private placement of debt or equity securities.

Hear this out loud PauseA subscription contract can be defined as regular or continuous use of a certain service or product by paying a certain amount. In this type of contract, the buyer has the right to demand a product or service from the other party for a certain period or continuously by paying a certain amount.

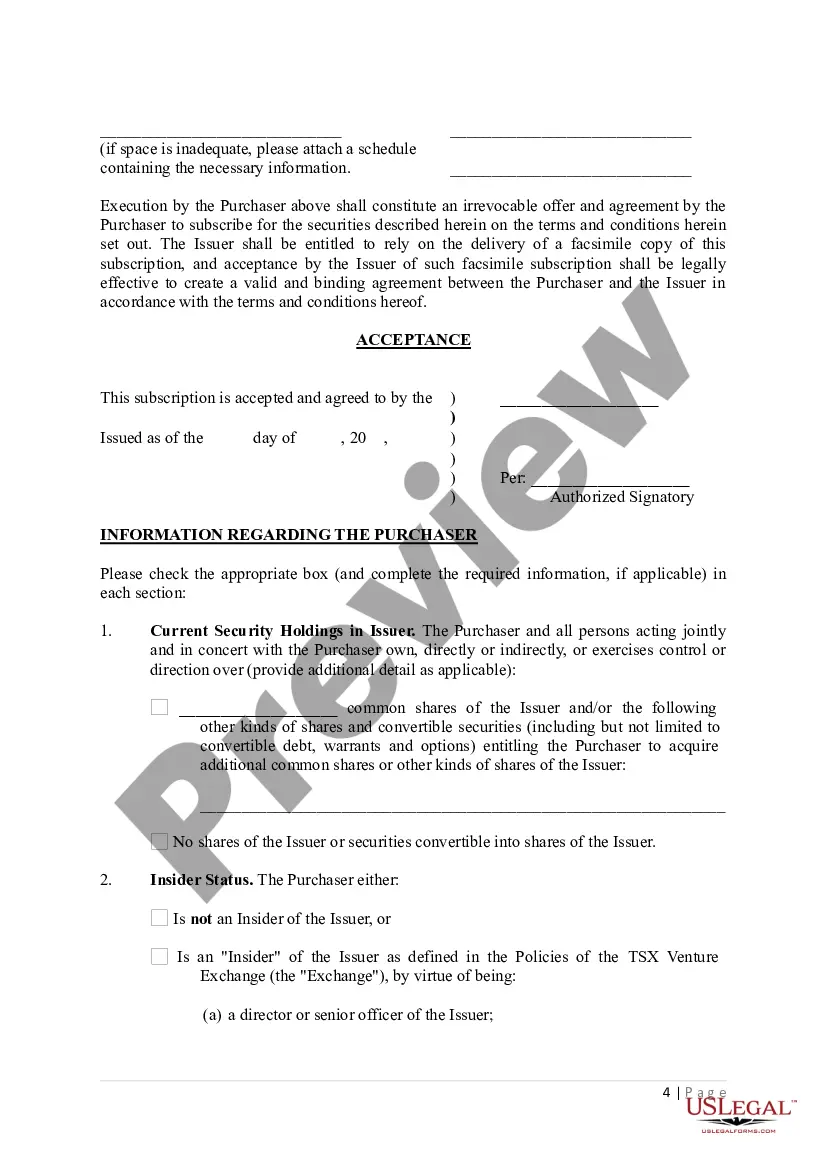

The Operating Agreement outlines how the governing body will operate. The Subscription Agreement is the legally binding agreement between the investor and the Issuer.

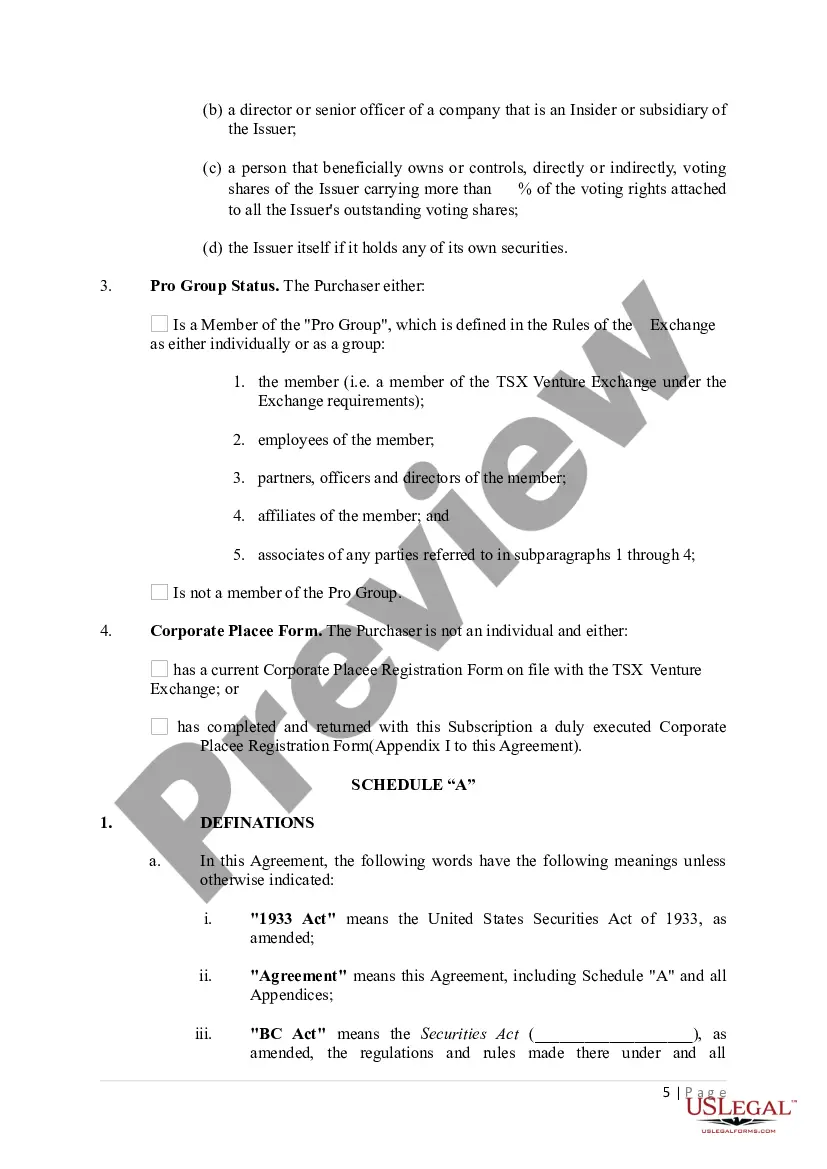

A share purchase agreement differs from a share subscription agreement because a share purchase agreement has a seller that is not the business itself. In a subscription agreement, the business agrees to sell shares to a subscriber.

There are two key documents that set out the terms and the structure of an LLC, the Operating Agreement and the Subscription Agreement. Note that investors do not buy shares in an LLC ? they buy an interest, which determines their percentage ownership and is documented in the Subscription Agreement.

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

A Share Subscription Agreement is a legally binding contract between a company and an investor or subscriber. It outlines the terms and conditions under which the investor agrees to purchase newly issued company shares.

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

Hear this out loud PauseThe Operating Agreement outlines how the governing body will operate. The Subscription Agreement is the legally binding agreement between the investor and the Issuer.