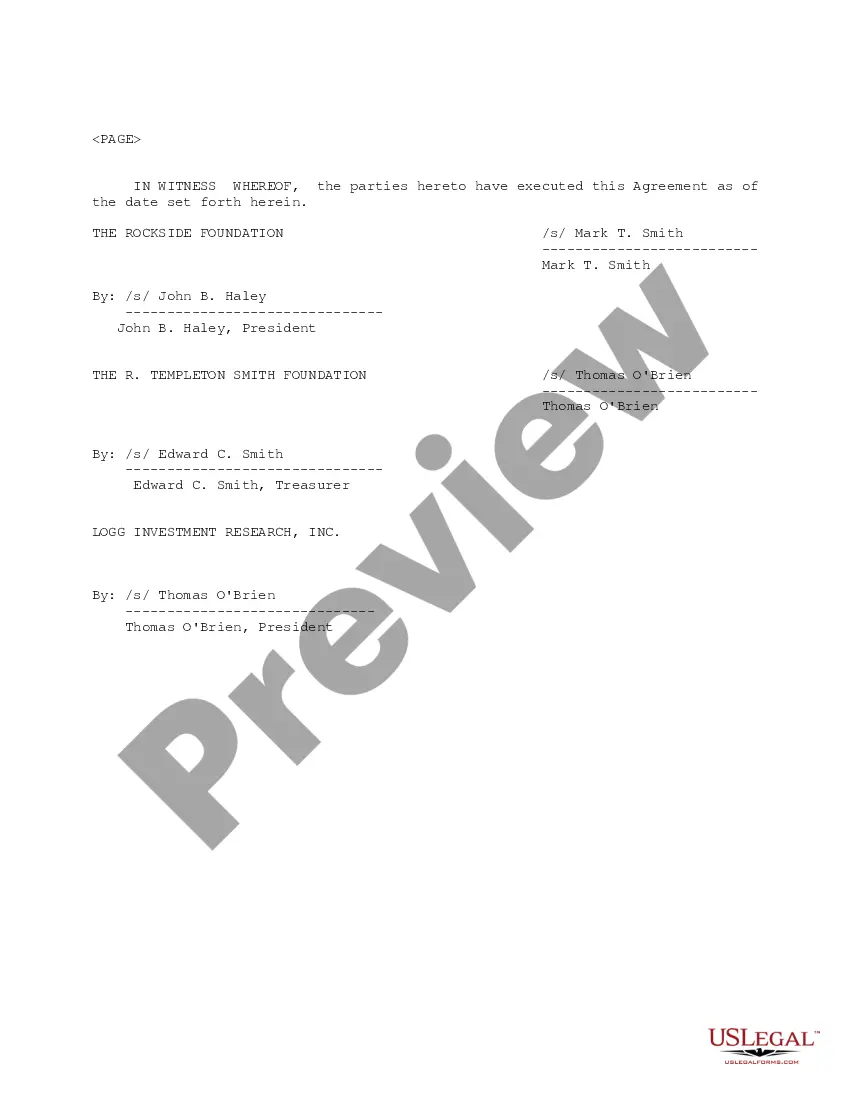

Oklahoma Withdrawal Agreement

Description

How to fill out Withdrawal Agreement?

US Legal Forms - among the most significant libraries of legal varieties in the States - provides a wide array of legal record web templates it is possible to obtain or produce. Using the internet site, you can get thousands of varieties for company and individual functions, sorted by categories, claims, or key phrases.You will find the most recent types of varieties much like the Oklahoma Withdrawal Agreement within minutes.

If you already have a registration, log in and obtain Oklahoma Withdrawal Agreement from the US Legal Forms collection. The Acquire button will appear on each and every type you perspective. You have accessibility to all in the past downloaded varieties in the My Forms tab of your respective accounts.

If you want to use US Legal Forms the very first time, allow me to share easy recommendations to get you started out:

- Ensure you have selected the correct type for your city/region. Click on the Preview button to check the form`s information. Read the type information to actually have chosen the appropriate type.

- In the event the type doesn`t satisfy your demands, take advantage of the Search area on top of the display to find the one that does.

- In case you are happy with the form, verify your option by visiting the Purchase now button. Then, select the prices prepare you favor and offer your references to sign up on an accounts.

- Approach the transaction. Make use of your Visa or Mastercard or PayPal accounts to perform the transaction.

- Choose the structure and obtain the form on your system.

- Make changes. Load, edit and produce and indicator the downloaded Oklahoma Withdrawal Agreement.

Every web template you put into your bank account lacks an expiration particular date and is the one you have for a long time. So, if you wish to obtain or produce one more copy, just go to the My Forms segment and click on in the type you will need.

Gain access to the Oklahoma Withdrawal Agreement with US Legal Forms, the most extensive collection of legal record web templates. Use thousands of skilled and state-specific web templates that fulfill your company or individual needs and demands.

Form popularity

FAQ

Foreign corporation registered in Oklahoma: To withdraw your foreign Corporation in Oklahoma, you must complete and submit Certificate of Withdrawal form by mail, in person or by fax to the Oklahoma Secretary of State, with the filing fee.

Upon termination of employment, a client may withdraw the accumulated contributions remitted to their account. A client may request a withdrawal packet by phone or via the internet. Completed forms will not be accepted before client's last day on the job.

Once an investor turns 60, up to 60% of the corpus in Tier I accounts can be withdrawn as a lump sum. The remaining 40% has to be used to buy annuity products that will be used to pay post-retirement pension. However, in case the pension corpus is less than Rs. 2,00,000, it can be withdrawn 100% as lumpsum.

These funds are invested by OPERS with the expectation you will one day be eligible to receive a monthly lifetime retirement benefit. While working for an OPERS employer, you may not take a withdrawal or loan from the contributions paid to OPERS.

Generally, you'll need to complete some paperwork, and describe why you need early access to your retirement funds. Unless you're 59 1/2 or older, the IRS will tax your traditional 401(k) withdrawal at your ordinary income rate (based on your tax bracket) plus a 10 percent penalty.

In order to change your direct deposit, you must have it on file with OPERS no later than the 5th day of the month your benefits are to deposit. For example, for the deposit on August 31st, you must have the form submitted to OPERS before August 5th. Call the OPERS office to request a Direct Deposit Authorization form.