This form is a due diligence checklist that outlines information pertinent to five percent shareholders in a business transaction.

Oklahoma Five Percent Shareholder Checklist

Description

How to fill out Five Percent Shareholder Checklist?

Are you presently in a situation where you need documents for possible organizational or personal activities nearly every day.

There are numerous legal document templates accessible online, but finding forms you can rely on is not simple.

US Legal Forms offers thousands of form templates, such as the Oklahoma Five Percent Shareholder Checklist, which can be downloaded to comply with federal and state regulations.

Once you find the appropriate form, click Purchase now.

Choose the payment plan you prefer, enter the required information to create your account, and complete the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply sign in.

- Then, you can download the Oklahoma Five Percent Shareholder Checklist template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

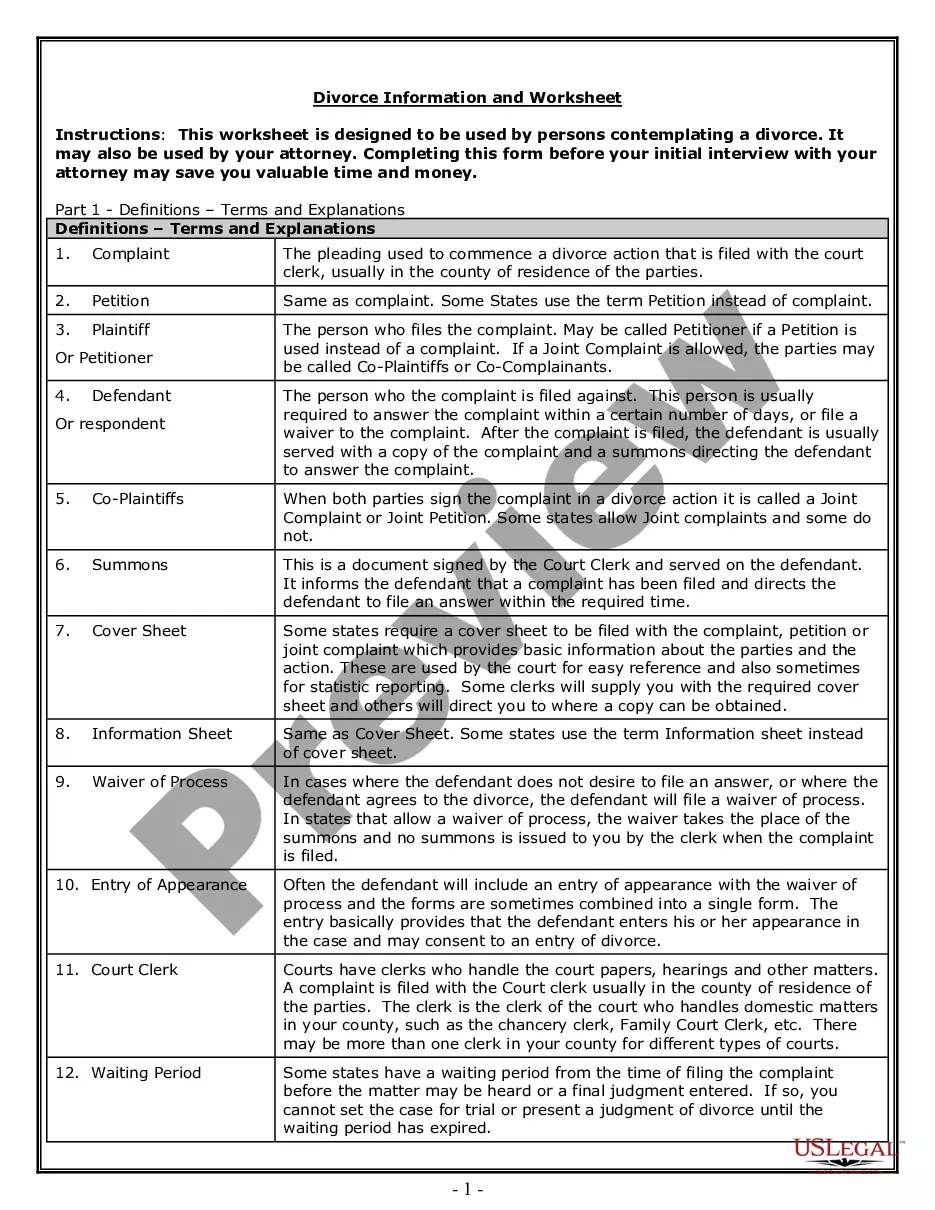

- Utilize the Preview option to review the document.

- Check the description to confirm you have selected the right form.

- If the form is not what you are looking for, use the Search feature to find a form that meets your needs.

Form popularity

FAQ

What to Think about When You Begin Writing a Shareholder Agreement.Name Your Shareholders.Specify the Responsibilities of Shareholders.The Voting Rights of Your Shareholders.Decisions Your Corporation Might Face.Changing the Original Shareholder Agreement.Determine How Stock can be Sold or Transferred.More items...

Drafting a Successful Shareholders' AgreementDrafting a successful shareholders' agreement.Understand your client's business.Don't overcomplicate decision making.Decide how to deal with stalemates.You need an exit.Think through all the possible outcomes for your exit mechanism it needs to work.

You can find out the names of the shareholders of a public company through several resources. If you wish to find out the names of large shareholders of a public company that has filed with the SEC, you can find this information by searching EDGAR, the SEC's Electronic Data Gathering, Analysis, and Retrieval System.

For each share class, the register must also list shareholders by name, in alphabetical order, and each party's last known physical address. Some shareholder registers go as far as to detail all issues of shares to each individual shareholder in the last 10 years, along with the date of any and all transfers of shares.

Introduction.Step 1: Decide on the issues the agreement should cover.Step 2: Identify the interests of shareholders.Step 3: Identify shareholder value.Step 4: Identify who will make decisions - shareholders or directors.Step 5: Decide how voting power of shareholders should add up.Further information and documents.

The Share Purchase Agreement needs to be signed by both the purchaser and seller of the shares. Before you put pen on paper, you want to review all the details and provisions for accuracy and your comfort level. It is not necessary to get the agreement notarized.

A shareholder agreement will include the rights and obligations of each shareholder, how the shares of the company are sold, how the company will run, and how decisions will be made.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the

A Shareholders Agreement is a contract concluded between shareholders to a company that formalizes the relationship and governs the duties and responsibilities between all stakeholders to the company.