This due diligence questionnaire is to enable a company to discharge its responsibilities under the private placement and limited offering exemptions and that, as issuer and/or any of its sales personnel, a company will rely upon the information and representations and warranties contained in this questionnaire.

Oklahoma Investor Suitability Questionnaire

Description

How to fill out Investor Suitability Questionnaire?

Choosing the best legitimate record design could be a have a problem. Needless to say, there are tons of web templates available online, but how can you find the legitimate kind you want? Make use of the US Legal Forms site. The support offers 1000s of web templates, such as the Oklahoma Investor Suitability Questionnaire, that can be used for company and private requirements. Each of the types are checked by pros and fulfill state and federal needs.

In case you are currently registered, log in to your account and then click the Download button to obtain the Oklahoma Investor Suitability Questionnaire. Utilize your account to search from the legitimate types you might have purchased previously. Proceed to the My Forms tab of your respective account and obtain one more duplicate from the record you want.

In case you are a brand new consumer of US Legal Forms, listed here are simple instructions so that you can stick to:

- Initially, make certain you have chosen the right kind for your personal metropolis/state. It is possible to look through the form using the Review button and look at the form explanation to guarantee this is basically the right one for you.

- In case the kind fails to fulfill your preferences, make use of the Seach discipline to find the right kind.

- Once you are positive that the form is acceptable, go through the Get now button to obtain the kind.

- Pick the costs strategy you need and enter the needed information and facts. Build your account and pay for an order utilizing your PayPal account or Visa or Mastercard.

- Pick the file structure and download the legitimate record design to your product.

- Full, edit and print and indication the acquired Oklahoma Investor Suitability Questionnaire.

US Legal Forms will be the greatest local library of legitimate types for which you will find various record web templates. Make use of the company to download appropriately-manufactured files that stick to status needs.

Form popularity

FAQ

The mission of the Oklahoma Securities Commission is investor protection through the administration and enforcement of the Oklahoma Uniform Securities Act of 2004 (OUSA of 2004) , an act prohibiting fraud in securities transactions and requiring the registration of broker-dealers, agents, investment advisers and

The Registered Investment Advisor (RIA) registration process generally takes between 45-90 days from the time you initially engage a consulting firm to begin the process to when the filing has been officially confirmed by the applicable regulator.

A quick Google search for RIA will reveal that many people misuse the term, instead referring to a professional designation for individuals who provide investment advice. An individual cannot be an RIA; however, the individual could have her own RIA firm.

Becoming a Financial Advisor in OklahomaGet Your Education. Pursue the right degree.Step 2: Register Your Firm in Oklahoma.Step 3: Get Your Registered Investment Adviser License in Oklahoma by Taking the Required Exam.Step 4: Ongoing Renewal and Update Requirements in Oklahoma.

RIAs must pass the Series 65 exam. RIAs must register with the SEC or state authorities, depending on the amount of money they manage. Applying to become an RIA includes filing a Form ADV, which includes a disclosure document that is also distributed to all clients.

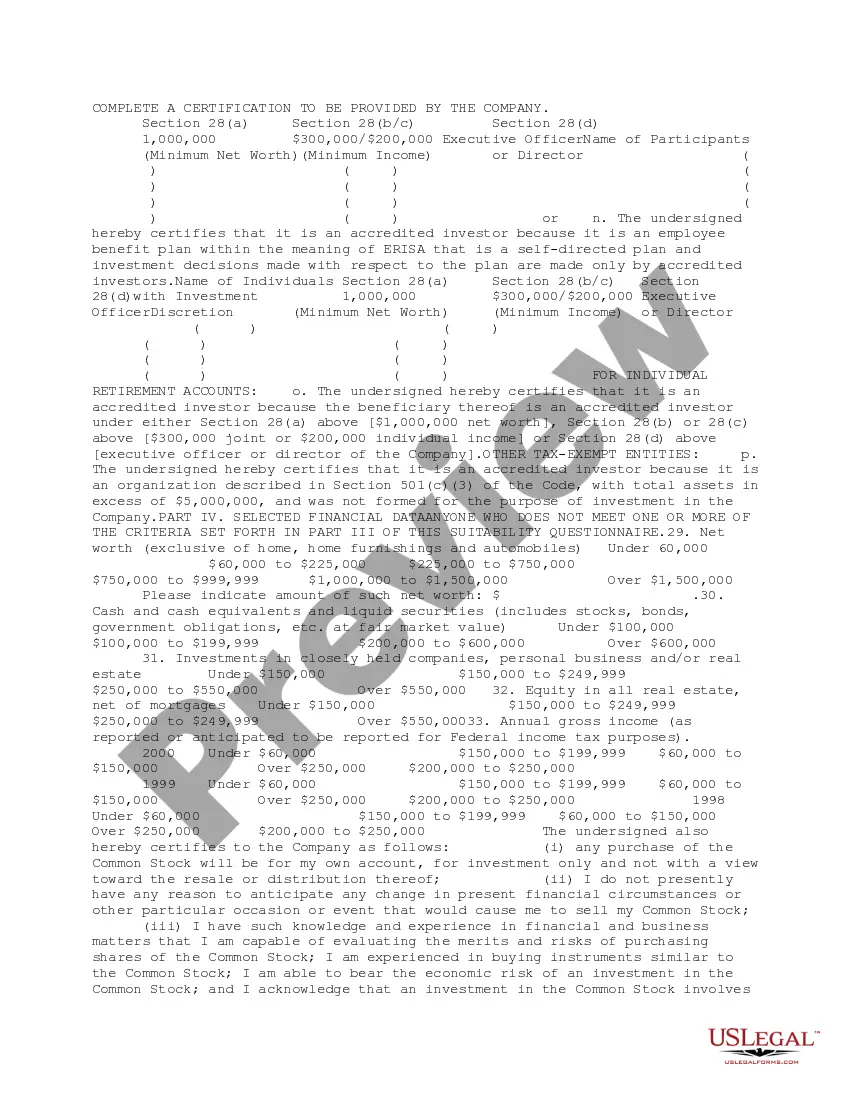

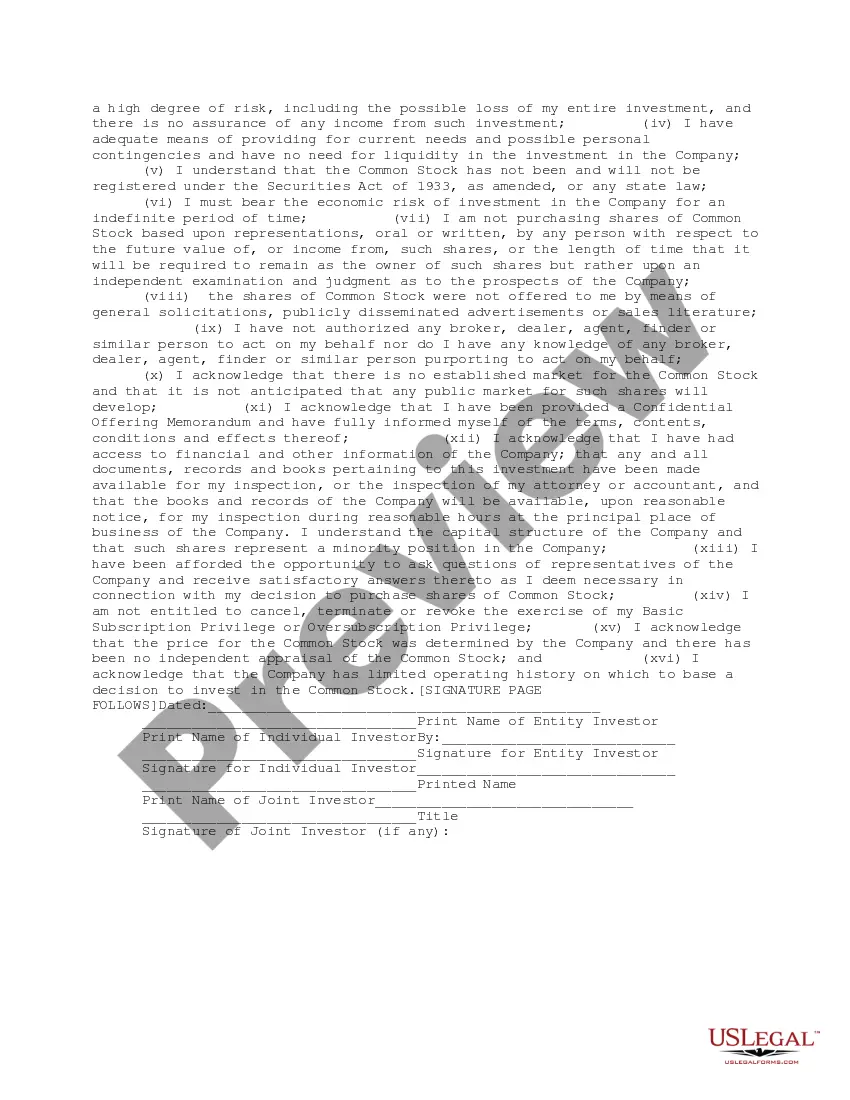

The Purpose of this Questionnaire is to solicit certain information regarding your financial status to determine whether you are an Accredited Investor, as defined under applicable federal and state securities laws, and otherwise meet the suitability criteria established by the Company for purchasing Shares.

Backgroundhave between $25 million and $100 million under management and are required to be registered in 15 or more states;advise one or more investment companies registered under the Investment Company Act of 1940; or.qualify for an exemption under Section 203A-2 of the Investment Advisers Act of 1940.

The mission of the SEC is to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation .

When has a State-registered adviser is considered to have taken custody of client funds? $500 of prepaid advisory fees (or more), 6 months or more in advance of rendering services, then the adviser is considered to have taken custody of client funds under NASAA's interpretation.

To open a margin account, the customer must sign a margin agreement, pledging the securities in the account as collateral for the loan. Other names for the margin agreement are the hypothecation agreement or the customer's agreement.