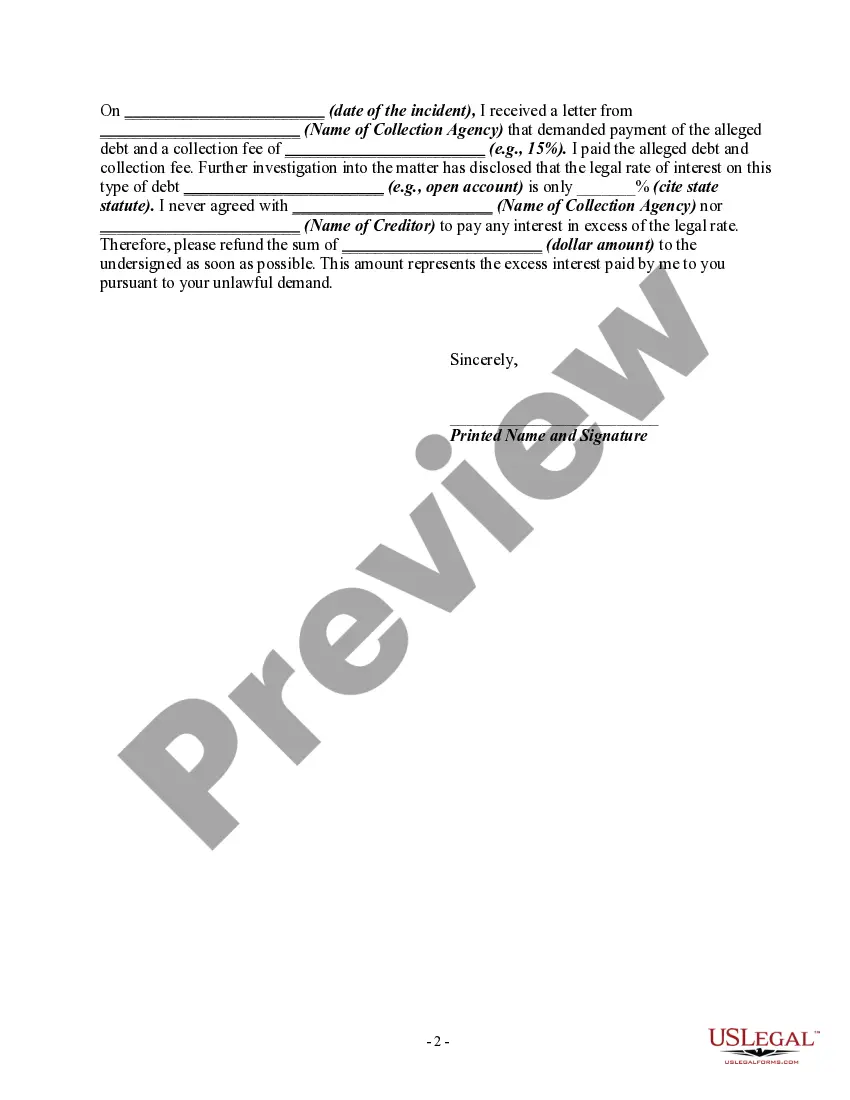

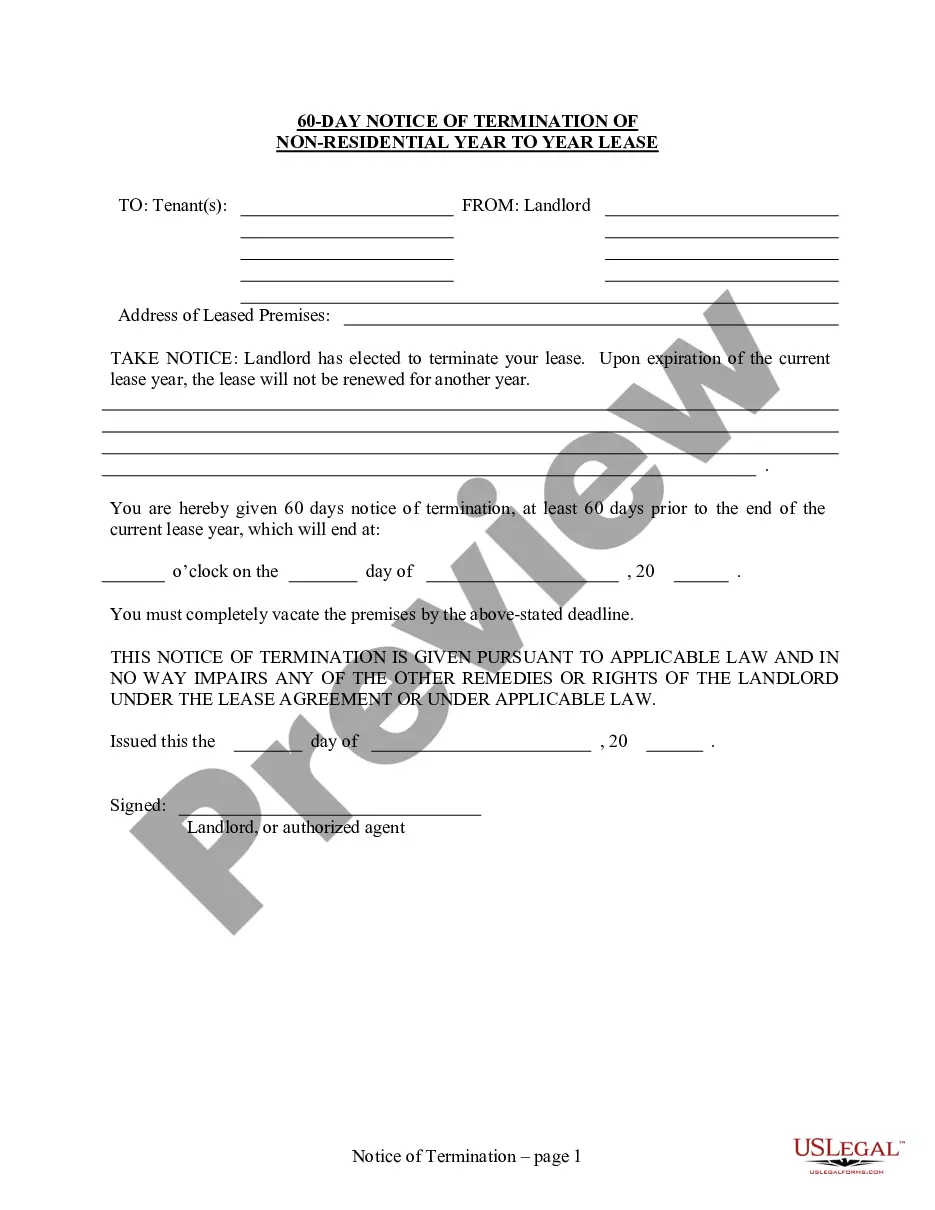

You are able to devote hours on-line looking for the lawful file design that suits the federal and state specifications you will need. US Legal Forms offers 1000s of lawful forms that are reviewed by specialists. It is possible to down load or print out the Oklahoma Letter Informing Debt Collector of Unfair Practices in Collection Activities - Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law from the support.

If you already have a US Legal Forms account, you may log in and then click the Down load switch. Next, you may complete, edit, print out, or sign the Oklahoma Letter Informing Debt Collector of Unfair Practices in Collection Activities - Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law. Every lawful file design you acquire is yours for a long time. To get yet another duplicate of the purchased form, visit the My Forms tab and then click the related switch.

If you work with the US Legal Forms web site the very first time, follow the easy recommendations listed below:

- First, ensure that you have selected the best file design to the region/city of your choice. Read the form information to ensure you have selected the correct form. If offered, utilize the Preview switch to look from the file design as well.

- If you want to discover yet another version from the form, utilize the Search area to obtain the design that meets your requirements and specifications.

- Once you have located the design you need, just click Buy now to proceed.

- Choose the costs program you need, enter your qualifications, and sign up for an account on US Legal Forms.

- Comprehensive the financial transaction. You should use your bank card or PayPal account to pay for the lawful form.

- Choose the format from the file and down load it to the product.

- Make alterations to the file if needed. You are able to complete, edit and sign and print out Oklahoma Letter Informing Debt Collector of Unfair Practices in Collection Activities - Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law.

Down load and print out 1000s of file layouts utilizing the US Legal Forms Internet site, that offers the most important selection of lawful forms. Use specialist and express-particular layouts to deal with your small business or specific demands.

The Fair Debt Collection Practices Act (FDCPA), effective inAn institution is not a debt collector under the FDCPA when it collects:.6 pagesMissing: Oklahoma ?Informing

The Fair Debt Collection Practices Act (FDCPA), effective inAn institution is not a debt collector under the FDCPA when it collects:. (2) identify collection practices of creditors and debt collectors experienced byauthorized by the agreement creating the debt or permitted by law; and.One of the most common complaints about debt collectors is that they harass people over debts that are either no longer owed, ... The law: Collectors are not allowed to call repeatedly just to harass you. However, there is no specific number of calls specified in the FDCPA ... The FDCPA also prohibits debt collectors from collecting any amount unless it is "expressly authorized by the agreement creating the debt or permitted by law." ... Under the CARES Act, a servicer of federally backed mortgage loan mayand that bar debt collectors from bringing collection lawsuits. Send a Demand Letter When Debt Collectors Violate the FDCPA · You have a collector calling you regarding a debt you do not owe. · The statute of ... Debtor/defendant to assert affirmative Fair Debt Collection Practices Actand not a debt collector, the attorneys filing the collection actions are debt. You may owe a debt, but you still have rights. And debt collectors have to obey the law. If You Owe Money Creditors don't want to bring in a debt collection ... Both the State Act and FDCPA cover debt collection activities against consumersA number of misleading or deceptive tactics by debt collectors are ...