Oklahoma Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd.

Description

How to fill out Form Of Security Agreement Between Everest And Jennings International, Ltd., Everest And Jennings, Inc., And BIL, Ltd.?

Are you within a situation where you need to have documents for possibly company or specific reasons almost every day time? There are a variety of legal record themes available online, but discovering types you can rely on isn`t easy. US Legal Forms delivers a huge number of form themes, much like the Oklahoma Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd., which are written to meet state and federal requirements.

When you are currently informed about US Legal Forms web site and have your account, just log in. After that, it is possible to acquire the Oklahoma Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd. web template.

If you do not have an profile and need to begin to use US Legal Forms, abide by these steps:

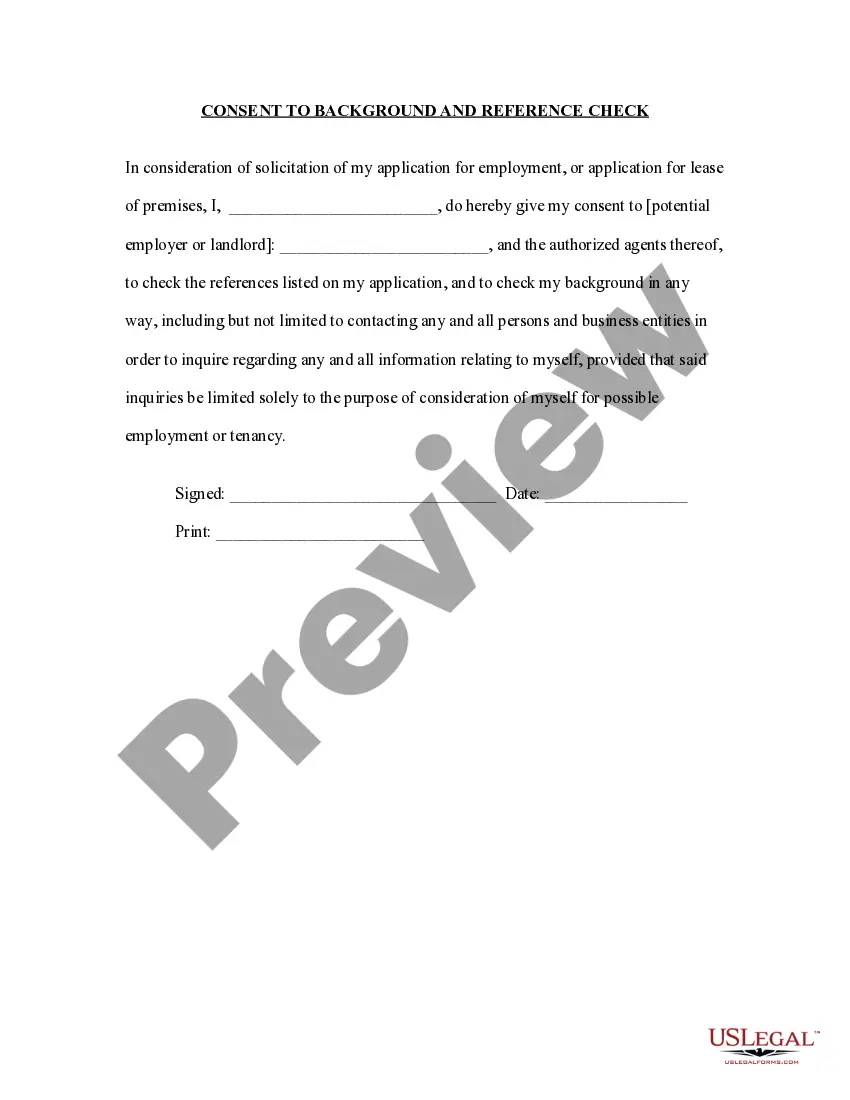

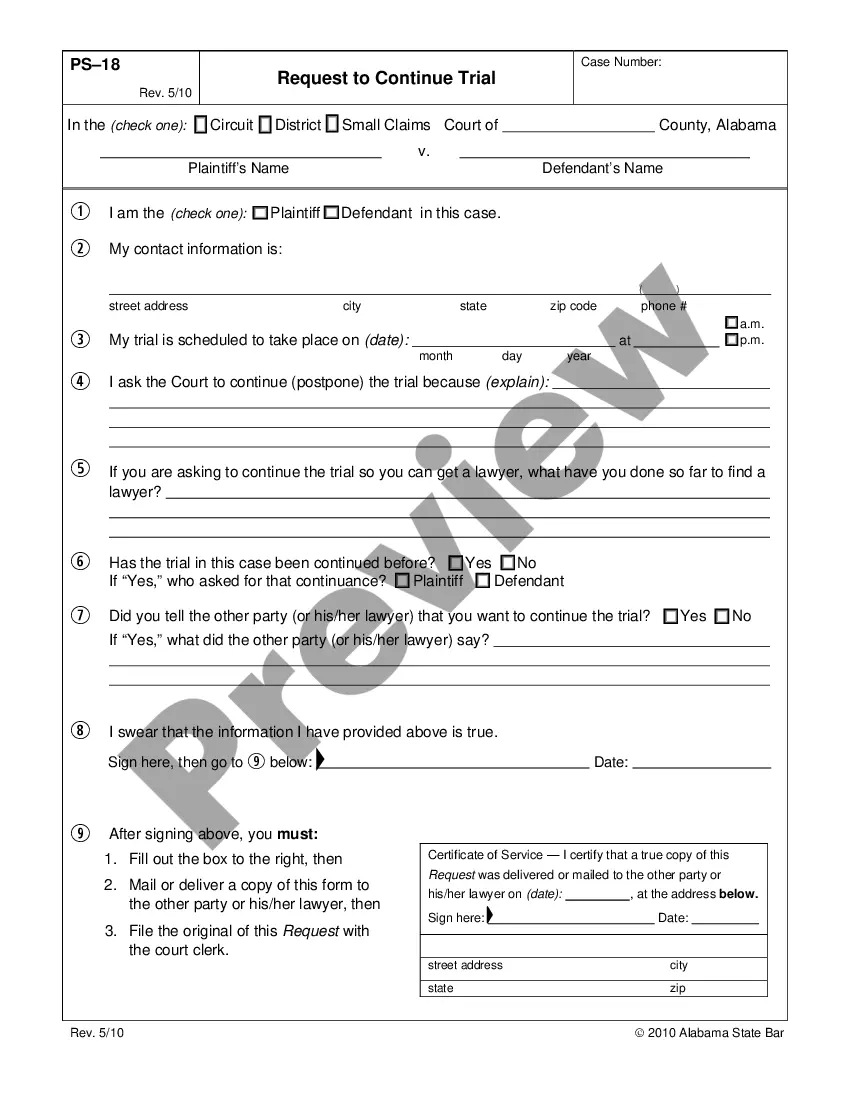

- Discover the form you want and ensure it is for the right town/state.

- Take advantage of the Preview button to examine the form.

- Look at the information to ensure that you have chosen the right form.

- In case the form isn`t what you are looking for, utilize the Lookup area to get the form that meets your needs and requirements.

- If you obtain the right form, click Buy now.

- Select the costs strategy you need, fill out the specified info to make your money, and pay for the order with your PayPal or Visa or Mastercard.

- Choose a practical document file format and acquire your duplicate.

Get all of the record themes you possess purchased in the My Forms menu. You can aquire a more duplicate of Oklahoma Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd. anytime, if required. Just click the needed form to acquire or print the record web template.

Use US Legal Forms, probably the most considerable collection of legal varieties, to save lots of time and avoid faults. The assistance delivers skillfully created legal record themes that can be used for an array of reasons. Generate your account on US Legal Forms and commence making your lifestyle easier.