Oklahoma VETS-100 Report

Description

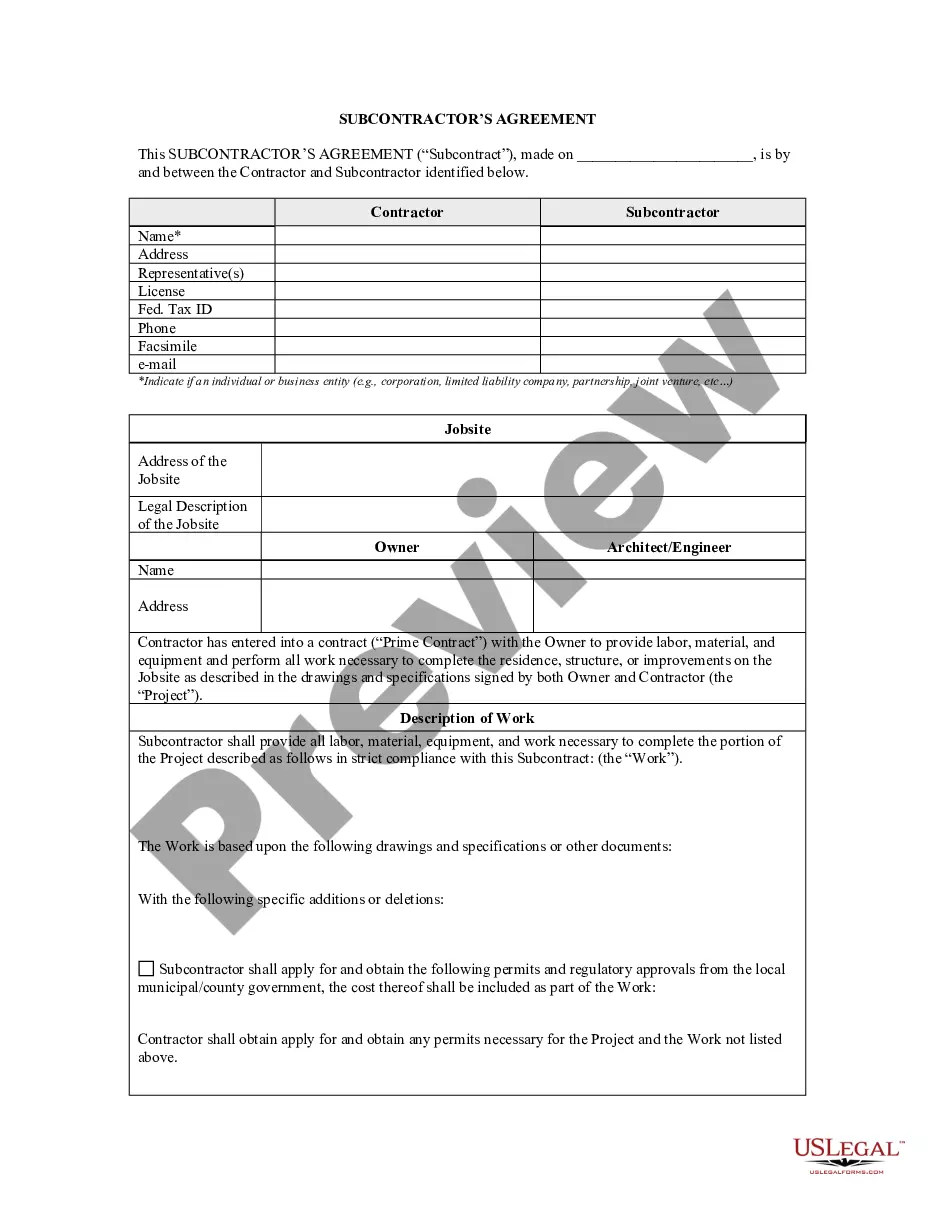

How to fill out VETS-100 Report?

If you wish to finalize, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's user-friendly and efficient search to find the documents you need.

Many templates for business and personal purposes are categorized by areas and states, or keywords.

Step 4. Once you have found the form you seek, click the Purchase now button. Choose the payment plan you prefer and enter your information to register for an account.

Step 5. Process the purchase. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to locate the Oklahoma VETS-100 Report with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and hit the Download button to retrieve the Oklahoma VETS-100 Report.

- You may also access forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for your correct region/state.

- Step 2. Use the Preview option to review the form’s details. Do not forget to read the description.

- Step 3. If you are not satisfied with the type, utilize the Search area at the top of the screen to look for other versions of the legal form template.

Form popularity

FAQ

The Oklahoma VETS-100 Report is mandatory for federal contractors and subcontractors who meet specific criteria. If your company has contracts worth at least $150,000 and employs veterans, you must file this report annually. This requirement helps ensure compliance with federal laws aimed at promoting employment opportunities for veterans. For an easy solution to complete the Oklahoma VETS-100 Report, consider using US Legal Forms, which offers streamlined resources and guidance.

David Smith, R-Arpelar, said his measure, House Bill 1271, would allow approximately 56,600 Oklahoman veterans, who are at least 60 percent disabled, to drive private vehicles on the state's turnpike network without paying any tolls.

Oklahoma 100% Disabled Veteran Property Tax Exemption: Oklahoma offers a 100% property tax exemption for eligible disabled Veterans. This exemption is for the full fair cash value of the homestead....ECP provides:Resume assistance.Civilian job search assistance.Interview coaching.Career advice.Education advice.

Oklahoma 100% Disabled Veteran Property Tax Exemption: Oklahoma offers a 100% property tax exemption for eligible disabled Veterans. This exemption is for the full fair cash value of the homestead....ECP provides:Resume assistance.Civilian job search assistance.Interview coaching.Career advice.Education advice.

With the 100 percent combined disability rating, you do not have any restrictions on work activity. As such, if you meet the 100 percent rating for your service-connected condition, and you are still able to work, then you may do so.

David Smith, R-Arpelar, said his measure, House Bill 1271, would allow approximately 56,600 Oklahoman veterans, who are at least 60 percent disabled, to drive private vehicles on the state's turnpike network without paying any tolls.

Disability benefits you receive from the Department of Veterans Affairs (VA) aren't taxable. You don't need to include them as income on your tax return. Tax-free disability benefits include: disability compensation and pension payments for disabilities paid either to veterans or their families.

Summary: Oklahoma offers special benefits for Service members, Veterans and their Families including 100% Veteran disability tax exemption, employment assistance, Veteran's employment preference, tuition assistance for eligible Veterans and Family members, special vehicle license plates, as well as hunting and fishing

All honorably discharged veterans who are currently Oklahoma residents shall be allowed free admission to all state-owned or stateoperated parks and museums.

Oklahoma 100% Disabled Veteran Sales Tax Exemption: 100% tax exemption for sales tax including city and county sales tax, will be exempt.